QUOTE(Phoenix_KL @ Dec 10 2025, 01:47 AM)

money not spent in country? give mykasih?

this why usd always high, countries keep giving loan to usa.

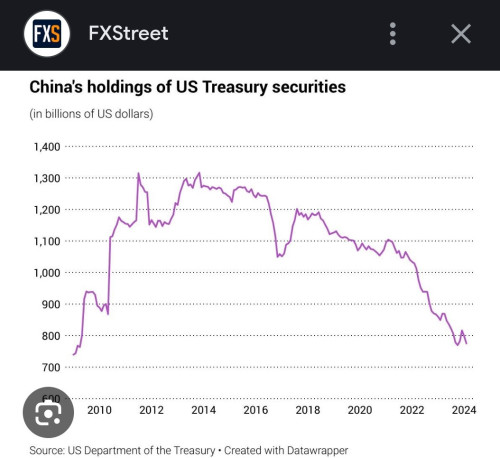

Yes, China has historically used its massive trade surplus (earning lots of US dollars) to buy bonds

, primarily U.S. Treasury bonds, as a safe, high-yielding investment for its foreign reserves, though its holdings have fluctuated and shifted in recent years. China accumulated vast dollar reserves from exporting more to the U.S. than it imported, and investing these dollars in safe U.S. debt was a key strategy for its central bank.

https://www.investopedia.com/articles/inves...asury-bonds.asp

AI Overview

The US dollar maintains a consistently high value primarily because of its role as the world's dominant reserve currency and the perception of the United States as a stable and reliable economic power. Other countries, including their central banks and private investors, buy U.S. debt (Treasury securities) as a secure investment and to facilitate global trade.

this why usd always high, countries keep giving loan to usa.

Yes, China has historically used its massive trade surplus (earning lots of US dollars) to buy bonds

, primarily U.S. Treasury bonds, as a safe, high-yielding investment for its foreign reserves, though its holdings have fluctuated and shifted in recent years. China accumulated vast dollar reserves from exporting more to the U.S. than it imported, and investing these dollars in safe U.S. debt was a key strategy for its central bank.

https://www.investopedia.com/articles/inves...asury-bonds.asp

AI Overview

The US dollar maintains a consistently high value primarily because of its role as the world's dominant reserve currency and the perception of the United States as a stable and reliable economic power. Other countries, including their central banks and private investors, buy U.S. debt (Treasury securities) as a secure investment and to facilitate global trade.

Dec 10 2025, 03:09 AM

Dec 10 2025, 03:09 AM

Quote

Quote 0.0111sec

0.0111sec

0.70

0.70

6 queries

6 queries

GZIP Disabled

GZIP Disabled