QUOTE(party @ Nov 14 2025, 11:14 PM)

just avoid tambadana.

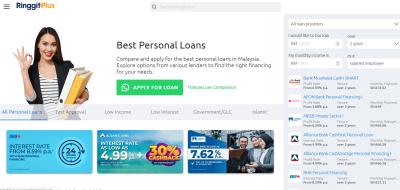

go ringgitplus and check which bank loan u want to apply. if u have no prior loan before, hope u at least have CC. actually if u have no CC, just apply cash from the CC. it will be faster.

If CC also dont have, check out RHB, Alliance, HLB or direct apply with MBB if u have acc with MBB for higher chance of approval.

all this can be done online via ringgitplus or direct the bank website itself.

I tried with AEON bank right after open this thread but get rejected saying "unable to proceed your application ...." without given any reason and that's about it. May be I will try the banks that you mention but what is CC ?? Yeah I have Maybank acc but guess I didn't meet their "at least RM3,5K monthly income" condition so I decide not to waste time.

QUOTE(netmatrix @ Nov 15 2025, 08:42 AM)

In order to qualify for tng loan, you need to use their investment product like GO+. The more money you have inside the more you can loan. If you do not have it, the loans are not available.

Thanks for the helpful info, wondering why they didn't explain the reason when they reject an application.

QUOTE(cuddlybubblyteddy @ Nov 15 2025, 09:01 AM)

You can forget about tambadana for rm5k

For new customer, you will only get most likely rm500-rm1000

You need to build your profile with them, be good payer on time or pay early, then can get up to rm10k (it take 6 months)

For emergency use, tambadana is good option, albeit like /k said, interest is legal ah long.

Alright understood.

TQ to ALL for yours time. Much appreciated.

Nov 13 2025, 03:58 PM, updated 2 months ago

Nov 13 2025, 03:58 PM, updated 2 months ago

Quote

Quote

0.0184sec

0.0184sec

0.63

0.63

6 queries

6 queries

GZIP Disabled

GZIP Disabled