QUOTE(chupapi_munyayo @ Jul 28 2025, 12:34 PM)

E Pass.

QUOTE(gnc88 @ Jul 28 2025, 12:41 PM)

Paya Lebar very happening. Our back office operation is at SingPost/PLQ.. be prepared to spend more on makan unless u buy chap fan from MRT as most, if not all, are foodcourt, F&B outlets etc.

$600 is cheap if it's per room/per pax.. my family 3-bedder in west was rented at $2.8K (6-pax capacity). Electricity ownself pay. That also cause whole unit rented out as leceh to find 6 separate tenants.

I always thought hawker is the same as food court no? Unless food court is like a more atas version of hawker lol. I was researching and a meal can be had for 3-4 SGD in most hawker places.

Yeah, rental is definitely the one thing that is pricey in SG. Payar Lebar and surrounding MRT areas (Aljunied, Eunos, etc.) seems to be still okay-ish in rental (single room below 1000 SGD) since it is not CBD area from what I gather.

QUOTE(Lescotesco @ Jul 28 2025, 03:27 PM)

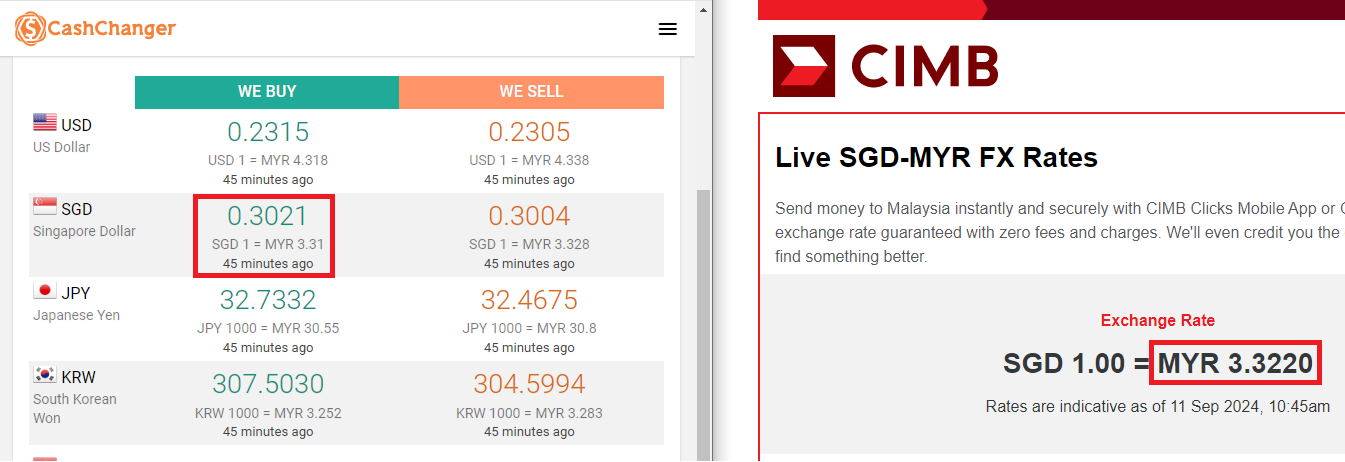

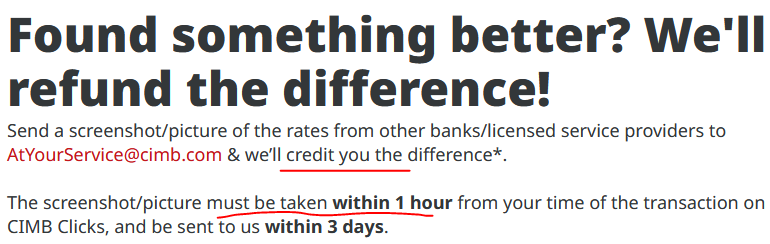

CIMB rate is better, but u need cimb my and cimb sg for it work. the good thing is u can open both online without going to any branch.

i never withdraw cash in sg for a year already i think. most accept paynow, paywave but some old hawker still prefer cash only la.

mine is 2.5k for 1 bedroom (another room is locked so we got the whole unit with 1 bedroom only) in marrymount, near to bishan.

it is expensive but the good thing is we can run around naked in the house haha.

When I did online comparison I thought WISE was better actually? The live conversion seems to favour WISE more than CIMB, unless I'm missing what you are seeing?

Paynow is something like our DuitNow system correct? Is there a TnG equivalent there? Is it GrabPay or DBS Paylah?

If the other room is locked means practically the whole house is yours, no need to share bathroom haha.

Jul 28 2025, 06:41 PM

Jul 28 2025, 06:41 PM

Quote

Quote

0.0153sec

0.0153sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled