QUOTE(PAChamp @ Jul 11 2025, 01:05 PM)

My experience with unit trust also dissapointing. Took out money from EPF to buy unit trust but covid came wipe out all profit and fund was in the red few years. Only after covid got some <10% gain. If money left in EPF, got few years dividend >20%. Regret. My savings in other unit trusts also loss. PNB very safe ah? 4% is good enough in this day and age. Don't lose money cukup.

Can't comment much on UT, because some ppl win some ppl lose. I got one senior manager who retired with huge balance in UT. She earned alot as she bought those equity fund mark to KLCI mainly, start invest constantly when that time KLCI was 700points ++ when she retired was 1200++, she constantly invest all these years and beat the epf. But uncle won't do that now due to no confidence at all to current gov, if najib still in house I will be aggressive, lol.

PNB if not mistaken also conservative for their fix fund, they kumpul money to buy gov bond which is very safe, then pay out the div. Those equity with price fluctuation, uncle won't touch

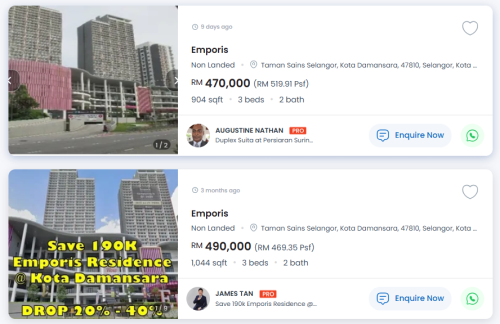

Good point, as long don't lose money will be deemed as good investment. Uncle just don't understand why youth nowadays so keen to "invest" in condo then call themselves as "investor", and must buy one expensive cup of ice coffee and hold in hand when sharing their story, lol, maybe like that only can show he is successful . But what uncle see is holding negative asset and stay afloat with own blood😅.

Jul 11 2025, 12:48 PM

Jul 11 2025, 12:48 PM

Quote

Quote

0.0145sec

0.0145sec

0.66

0.66

5 queries

5 queries

GZIP Disabled

GZIP Disabled