Outline ·

[ Standard ] ·

Linear+

Malaysian retirement logic very flawed

|

MGM

|

Jun 8 2025, 08:05 AM Jun 8 2025, 08:05 AM

|

|

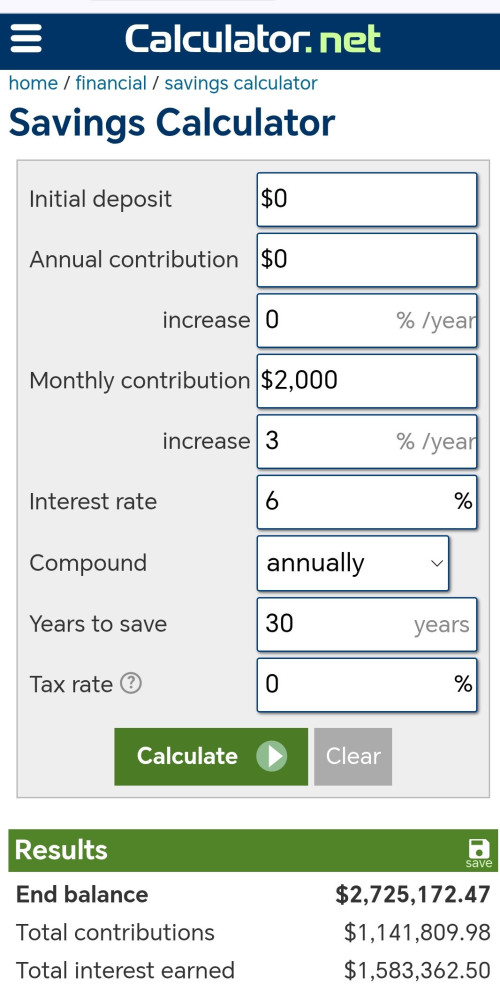

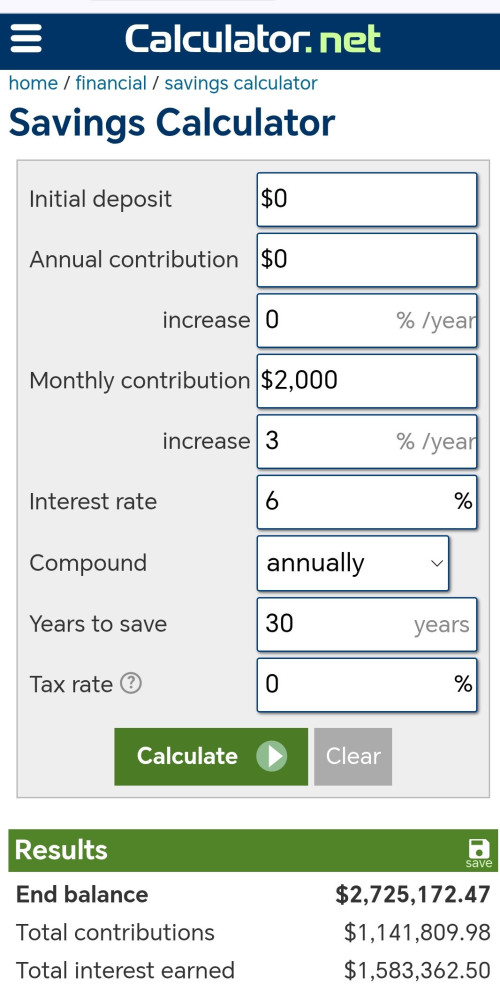

QUOTE(MalcomShorten @ Jun 8 2025, 12:01 AM) Many Malaysian talk about retiring with millions in the bank. When ask about how much they can save a month, a lot says around RM2k to 5k, which is a respectable amount. However, their so call saving doesn't factor in those large 1 off purchase like oversea trip per year or the latest gadget, which could easily eat up quite a portion of the savings. Imagine you save RM5k every month and till year end you got RM60k saved for the year but in between you've spend RM20k on oversea trips and luxury purchases, how to hit the million ringgit retirement target then? If retirement fund then put in EPF lah. With limited withdrawal n if save extra 2k every month u can have a better retirement. Say u start the below plan at 30yo with 3% yearly pay increment, after 30 years u will have extra 2.7 million, on top your employment epf. May be less since I exclude tax rate.  This post has been edited by MGM: Jun 8 2025, 08:16 AM This post has been edited by MGM: Jun 8 2025, 08:16 AM |

|

|

|

|

|

soul78

|

Jun 8 2025, 08:18 AM Jun 8 2025, 08:18 AM

|

|

mao.. save.. just save...

but kturds mao travel pulak... save 20K but spend 40K travelling...

in the end... say 5mil unachievable.. even when saving 20K... topkekk

|

|

|

|

|

|

kiddokitt

|

Jun 8 2025, 08:22 AM Jun 8 2025, 08:22 AM

|

|

QUOTE(Najibaik @ Jun 8 2025, 01:13 AM) dude i go japan with my gf 2 weeks also need 26k ad phuket maybe 2k enuf Wow! I cannot. Here I am still debating with myself whether to go to spend 2D1N in Port Dickson next week with a hotel room rate of RM350 and y’all splashing out 26k overseas. This is my B40 life. |

|

|

|

|

|

sexysarah1992

|

Jun 8 2025, 08:31 AM Jun 8 2025, 08:31 AM

|

|

QUOTE(MalcomShorten @ Jun 8 2025, 12:01 AM) Many Malaysian talk about retiring with millions in the bank. When ask about how much they can save a month, a lot says around RM2k to 5k, which is a respectable amount. However, their so call saving doesn't factor in those large 1 off purchase like oversea trip per year or the latest gadget, which could easily eat up quite a portion of the savings. Imagine you save RM5k every month and till year end you got RM60k saved for the year but in between you've spend RM20k on oversea trips and luxury purchases, how to hit the million ringgit retirement target then? Passive income. U want to be rich u dont save , u invest |

|

|

|

|

|

sexysarah1992

|

Jun 8 2025, 08:32 AM Jun 8 2025, 08:32 AM

|

|

QUOTE(MalcomShorten @ Jun 8 2025, 12:01 AM) Many Malaysian talk about retiring with millions in the bank. When ask about how much they can save a month, a lot says around RM2k to 5k, which is a respectable amount. However, their so call saving doesn't factor in those large 1 off purchase like oversea trip per year or the latest gadget, which could easily eat up quite a portion of the savings. Imagine you save RM5k every month and till year end you got RM60k saved for the year but in between you've spend RM20k on oversea trips and luxury purchases, how to hit the million ringgit retirement target then? Passive income. U want to be rich u dont save , u invest |

|

|

|

|

|

p4n6

|

Jun 8 2025, 08:42 AM Jun 8 2025, 08:42 AM

|

|

People maybe have allocation for travelling, park under one saving pot.

Tak kan you only eat and live essentials and no spending for rest of live, prepare for retirement only.

It should be the other way around, after retirement should be live on essential.

Alot of people don’t think will spend after retirement but in the end no chance … not to mention inflation, cost to travel or buy certain things went up significantly…

This post has been edited by p4n6: Jun 8 2025, 08:43 AM

|

|

|

|

|

|

icemanfx

|

Jun 8 2025, 08:43 AM Jun 8 2025, 08:43 AM

|

|

According to wealth reports, only about 4% of adults in this country have over USD 100k net worth. Implied over 96% of opinion on investment and retirement is unworthy.

This post has been edited by icemanfx: Jun 8 2025, 10:10 AM

|

|

|

|

|

|

killdavid

|

Jun 8 2025, 08:46 AM Jun 8 2025, 08:46 AM

|

|

QUOTE(poooky @ Jun 8 2025, 07:17 AM) I dunno lah. Unker saved as much at he could around 60% in his youth every paycheck, using budget CCP phones, buying the cheapest cpu at the time, only buy bata and padini during sale days crowd with everyone, only eat zap fan when koliks wented different place at lunch, drive same 20 yr old car and later mrt when built, never buy Starbucks, stay home on weekends, no vacations and you know what unker has to show for it decades later? EPF not even rm100k, still can't afford own home. Nothing but lost hopes and dreams and regret. Now unker is old and bitter. Now unker just yolo. If died, last it be quick and painless. So now unker say to just yolo. Unless earning high income, a typical comfortable retirement is unlikely these days. From young till old, consistent saving still epf less than 100k. You work at McD whole life issit ? Withdraw epf issit? Saved all your money in savings account issit ? |

|

|

|

|

|

AfraidIGotBan

|

Jun 8 2025, 09:16 AM Jun 8 2025, 09:16 AM

|

Getting Started

|

QUOTE(knwong @ Jun 7 2025, 04:13 PM) What oversea trip spend 20k? A lavish one. For example, purposely take flight to jepang just for the sake of makan kaisendon, or recently went to reyjavik with wife because she promised her fellow kepohchi betinas wanna take hot dip. kosong hand pergi, whatever also buy there. Burn my pocket, burns!!! |

|

|

|

|

|

nelson969

|

Jun 8 2025, 09:16 AM Jun 8 2025, 09:16 AM

|

|

QUOTE(knwong @ Jun 8 2025, 12:13 AM) What oversea trip spend 20k? A lot ppl spend 20k anywhere they go , if china different story most likely rm10k , even lavish spending also rm15k Never heard these ppl spend below 8k |

|

|

|

|

|

Mr.Robert

|

Jun 8 2025, 09:19 AM Jun 8 2025, 09:19 AM

|

Getting Started

|

QUOTE(MalcomShorten @ Jun 8 2025, 12:01 AM) Many Malaysian talk about retiring with millions in the bank. When ask about how much they can save a month, a lot says around RM2k to 5k, which is a respectable amount. However, their so call saving doesn't factor in those large 1 off purchase like oversea trip per year or the latest gadget, which could easily eat up quite a portion of the savings. Imagine you save RM5k every month and till year end you got RM60k saved for the year but in between you've spend RM20k on oversea trips and luxury purchases, how to hit the million ringgit retirement target then? Hi kid, you’re meant to work till you are expired. No such thing as retirement anymore araso. Welcome to the world of capitalism  |

|

|

|

|

|

N9484640

|

Jun 8 2025, 09:20 AM Jun 8 2025, 09:20 AM

|

|

QUOTE(MalcomShorten @ Jun 8 2025, 12:01 AM) Many Malaysian talk about retiring with millions in the bank. When ask about how much they can save a month, a lot says around RM2k to 5k, which is a respectable amount. However, their so call saving doesn't factor in those large 1 off purchase like oversea trip per year or the latest gadget, which could easily eat up quite a portion of the savings. Imagine you save RM5k every month and till year end you got RM60k saved for the year but in between you've spend RM20k on oversea trips and luxury purchases, how to hit the million ringgit retirement target then? people save for their retirements with their compulsory EPF contributions |

|

|

|

|

|

SUSHasukiiXrd

|

Jun 8 2025, 09:20 AM Jun 8 2025, 09:20 AM

|

Getting Started

|

QUOTE(sexysarah1992 @ Jun 8 2025, 08:32 AM) Passive income. U want to be rich u dont save , u invest this |

|

|

|

|

|

shuin1986

|

Jun 8 2025, 09:22 AM Jun 8 2025, 09:22 AM

|

Getting Started

|

QUOTE(MalcomShorten @ Jun 8 2025, 12:01 AM) Imagine you save RM5k every month and till year end you got RM60k saved for the year but in between you've spend RM20k on oversea trips and luxury purchases. U got no bonus? If monthly can save rm5k, bonus should easily covered the trip |

|

|

|

|

|

gundamsp01

|

Jun 8 2025, 09:24 AM Jun 8 2025, 09:24 AM

|

|

luckily i can save/invest around 8-10k a month by living below my means, excluding epf. Millions by the time i want to retire? yes.

|

|

|

|

|

|

Stigonboard

|

Jun 8 2025, 09:32 AM Jun 8 2025, 09:32 AM

|

|

QUOTE(Najibaik @ Jun 8 2025, 01:13 AM) dude i go japan with my gf 2 weeks also need 26k ad phuket maybe 2k enuf This is why i always find it funny if someone claiming to be careful about money, skimping so much, use cheap cars and say ppl that buy expensive cars is sohai and then each year blow rm20-30k just like that .. At least my expensive cars protect me from harsh road conditions, better occupant safety EVERYDAY and by the time my loan finish i still earn some back But you are suffer your back and mental by buying cheap cars, dicing with your own live EVERYDAY and by the time you back from holiday you only have your memories and social media pictures to brag |

|

|

|

|

|

TheEvilMan

|

Jun 8 2025, 09:36 AM Jun 8 2025, 09:36 AM

|

|

QUOTE(MalcomShorten @ Jun 8 2025, 12:01 AM) Many Malaysian talk about retiring with millions in the bank. When ask about how much they can save a month, a lot says around RM2k to 5k, which is a respectable amount. However, their so call saving doesn't factor in those large 1 off purchase like oversea trip per year or the latest gadget, which could easily eat up quite a portion of the savings. Imagine you save RM5k every month and till year end you got RM60k saved for the year but in between you've spend RM20k on oversea trips and luxury purchases, how to hit the million ringgit retirement target then? U watching influenza soc med izzit, ppl who are m40 and can really save do not travel or buy anything not useful one, those who die die must buy fit ur description, they do not have a million in account, they have flex only |

|

|

|

|

|

TheEvilMan

|

Jun 8 2025, 09:38 AM Jun 8 2025, 09:38 AM

|

|

QUOTE(Stigonboard @ Jun 8 2025, 09:32 AM) This is why i always find it funny if someone claiming to be careful about money, skimping so much, use cheap cars and say ppl that buy expensive cars is sohai and then each year blow rm20-30k just like that .. At least my expensive cars protect me from harsh road conditions, better occupant safety EVERYDAY and by the time my loan finish i still earn some back But you are suffer your back and mental by buying cheap cars, dicing with your own live EVERYDAY and by the time you back from holiday you only have your memories and social media pictures to brag Car and travel are same for me, its more for bragging, u accidient cos u lousy driver nia At least my expensive house keep me away from robbers and very comfy to live in, oh wai |

|

|

|

|

|

samftrmd

|

Jun 8 2025, 09:55 AM Jun 8 2025, 09:55 AM

|

|

QUOTE(damnkids01 @ Jun 8 2025, 12:25 AM) You guys have saving? |

|

|

|

|

|

ClessRV

|

Jun 8 2025, 10:09 AM Jun 8 2025, 10:09 AM

|

|

if follow current trend, some 2-3% of those who have millions or hundreds of thousand in retirement will be scammed, so I assume those who travel overseas are the scammers?

joking aside, if current generation retire later in life, i highly hoping they are those who are very financially responsible, either because of all the knowledge today or inflation will catch up and 1 mil will only be like 100k

|

|

|

|

|

Jun 8 2025, 08:05 AM

Jun 8 2025, 08:05 AM

Quote

Quote

0.0170sec

0.0170sec

0.83

0.83

5 queries

5 queries

GZIP Disabled

GZIP Disabled