Outline ·

[ Standard ] ·

Linear+

EPF weighs £1.4bil sale of UK private hospitals

|

TSsoul78

|

Jun 4 2025, 09:11 PM, updated 7 months ago Jun 4 2025, 09:11 PM, updated 7 months ago

|

|

The hospitals, which an EPF-led consortium bought for about £700 million in 2013, are operated by Spire Healthcare Group Plc. KUALA LUMPUR: EPF is preparing to sell a portfolio of UK private hospitals that are valued at about £1.4 billion (US$1.9 billion). The fund has appointed broker Knight Frank to offer the 12 properties for sale, people with knowledge of the process said. Representatives for EPF and Knight Frank declined to comment. Can read more in sos below...   sos: https://www.freemalaysiatoday.com/category/...ivate-hospitals |

|

|

|

|

|

teehk_tee

|

Jun 4 2025, 09:12 PM Jun 4 2025, 09:12 PM

|

|

So means dividend 10% next yr?

|

|

|

|

|

|

fongsk

|

Jun 4 2025, 09:26 PM Jun 4 2025, 09:26 PM

|

New Member

|

I wonder WHY they want to divest this strategic income garner, almost like MAHB case. Something that we do not know?

|

|

|

|

|

|

fongsk

|

Jun 4 2025, 09:28 PM Jun 4 2025, 09:28 PM

|

New Member

|

QUOTE(teehk_tee @ Jun 4 2025, 09:12 PM) So means dividend 10% next yr? Hope long long la…if sale, our dividends will be even lower in the coming future as a constant source of income generator is lost. Does the gov need so much fund from EPF, that we must sell off? https://www.nst.com.my/business/corporate/2...n%20fund%20said. |

|

|

|

|

|

potatolala

|

Jun 4 2025, 09:30 PM Jun 4 2025, 09:30 PM

|

Getting Started

|

Just invest in snp500.

A solid 8% every year won’t be hard

|

|

|

|

|

|

Slowpokeking

|

Jun 4 2025, 09:38 PM Jun 4 2025, 09:38 PM

|

New Member

|

Good.

Another isinar please.

|

|

|

|

|

|

max_cavalera

|

Jun 4 2025, 09:40 PM Jun 4 2025, 09:40 PM

|

|

Power epf

Making good moneh from good yinvestment

|

|

|

|

|

|

kelvinfixx

|

Jun 4 2025, 09:40 PM Jun 4 2025, 09:40 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 09:28 PM) Hope long long la…if sale, our dividends will be even lower in the coming future as a constant source of income generator is lost. Does the gov need so much fund from EPF, that we must sell off? https://www.nst.com.my/business/corporate/2...n%20fund%20said. You are wrong, money can reinvest and generate better dividend. |

|

|

|

|

|

nelson969

|

Jun 4 2025, 09:43 PM Jun 4 2025, 09:43 PM

|

|

QUOTE(teehk_tee @ Jun 4 2025, 09:12 PM) So means dividend 10% next yr? never, at least would be last year, always mind set 5% |

|

|

|

|

|

TSsoul78

|

Jun 4 2025, 09:44 PM Jun 4 2025, 09:44 PM

|

|

No point putting more investments into UK moving forward...

UK is already moving to WARtime stance... and getting ready for WAR in 2027.

EPF from a risk perspective also why wanna risk more exposure on EU/UK knowing tension is getting worst month after month...

|

|

|

|

|

|

DarkAeon

|

Jun 4 2025, 09:45 PM Jun 4 2025, 09:45 PM

|

|

QUOTE(kelvinfixx @ Jun 4 2025, 09:40 PM) You are wrong, money can reinvest and generate better dividend. reinvest can also lose money. then dividen no more high  |

|

|

|

|

|

knwong

|

Jun 4 2025, 09:45 PM Jun 4 2025, 09:45 PM

|

|

Hold for 12 years and double the return. Not bad. Good job!

|

|

|

|

|

|

bill11

|

Jun 4 2025, 09:49 PM Jun 4 2025, 09:49 PM

|

|

just buy over one of the insurance company here. Better the insurance premium benefit back EPF than let the money flow back to SG.

|

|

|

|

|

|

TSsoul78

|

Jun 4 2025, 09:58 PM Jun 4 2025, 09:58 PM

|

|

EPF should invest into BITcoin...

since now if anyone buys SNP500, they are indirectly having exposure to keriptos liao.. via COINBASE...

|

|

|

|

|

|

fongsk

|

Jun 4 2025, 10:13 PM Jun 4 2025, 10:13 PM

|

New Member

|

QUOTE(kelvinfixx @ Jun 4 2025, 09:40 PM) You are wrong, money can reinvest and generate better dividend. Well, chances are will be re-invested in Malaysia, given PKX ‘advice’ last year. Read the article…. 38% of our investment in shares pervades generate 44% of income vs 62% domestic KLSE giving us 56%. And our forex gai. Is like 1 bn. This post has been edited by fongsk: Jun 4 2025, 10:13 PM |

|

|

|

|

|

fongsk

|

Jun 4 2025, 10:16 PM Jun 4 2025, 10:16 PM

|

New Member

|

QUOTE(DarkAeon @ Jun 4 2025, 09:45 PM) reinvest can also lose money. then dividen no more high  Dow is back to almost its level pre tariff days, I think. KLSE is still dwindling at 1500 level, with international investor fleeing the bourse last week again, if I am not mistaken. And our growth has been expected to slow down in 2H. The last set of KLSE companies performances are not indicative of good performance. If we can get 5% dividend for 2025, be glad. |

|

|

|

|

|

fongsk

|

Jun 4 2025, 10:18 PM Jun 4 2025, 10:18 PM

|

New Member

|

QUOTE(soul78 @ Jun 4 2025, 09:44 PM) No point putting more investments into UK moving forward... UK is already moving to WARtime stance... and getting ready for WAR in 2027. EPF from a risk perspective also why wanna risk more exposure on EU/UK knowing tension is getting worst month after month... The article Mentioned that healthcare is one of the active segment that is expected to be profitable and have investors coming in…. |

|

|

|

|

|

lordgamer3

|

Jun 4 2025, 10:23 PM Jun 4 2025, 10:23 PM

|

|

Better sell hospitals in UK and reinvest janji proceed not for afterlife and brainwash funds.

|

|

|

|

|

|

Zhik

|

Jun 4 2025, 10:25 PM Jun 4 2025, 10:25 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 09:26 PM) I wonder WHY they want to divest this strategic income garner, almost like MAHB case. Something that we do not know? well last time, if u read the timeline. It is inevitable to save the fund |

|

|

|

|

|

SUSfuzzy

|

Jun 4 2025, 10:25 PM Jun 4 2025, 10:25 PM

|

|

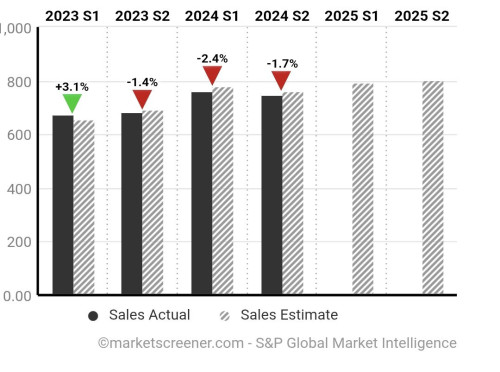

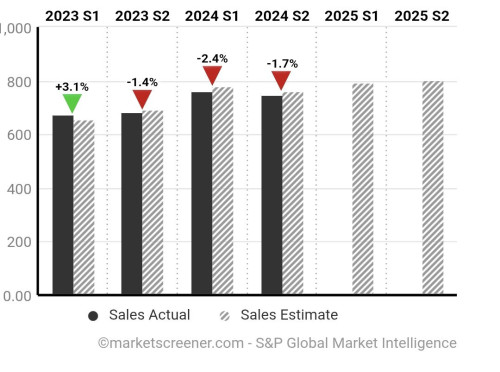

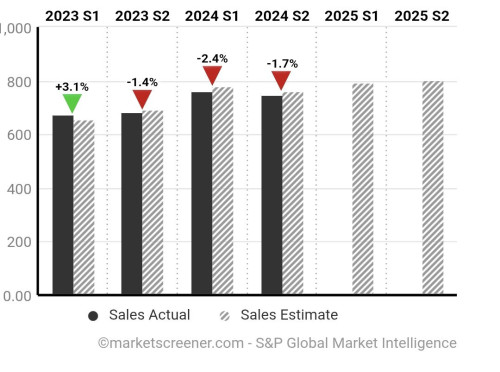

QUOTE(fongsk @ Jun 4 2025, 10:18 PM) The article Mentioned that healthcare is one of the active segment that is expected to be profitable and have investors coming in….  Revenue has fell for 3 quarters straight. This is good sign ke? |

|

|

|

|

|

TSsoul78

|

Jun 4 2025, 10:27 PM Jun 4 2025, 10:27 PM

|

|

When war time comes...  |

|

|

|

|

|

SUSfuzzy

|

Jun 4 2025, 10:28 PM Jun 4 2025, 10:28 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 10:13 PM) Well, chances are will be re-invested in Malaysia, given PKX ‘advice’ last year. Read the article…. 38% of our investment in shares pervades generate 44% of income vs 62% domestic KLSE giving us 56%. And our forex gai. Is like 1 bn. That's because domestic investment includes government securities, loans and bonds, etc.. So fixed income stuff plus equities. While overseas is pure equities, that is why the returns are more moderated given equities was on a bull run last year. EPF cannot invest 100% into equities, else last quarter they would be 20% or so down post Trump election. Then you will complain why they can't manage. |

|

|

|

|

|

9m2w

|

Jun 4 2025, 10:38 PM Jun 4 2025, 10:38 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 10:13 PM) Well, chances are will be re-invested in Malaysia, given PKX ‘advice’ last year. Read the article…. 38% of our investment in shares pervades generate 44% of income vs 62% domestic KLSE giving us 56%. And our forex gai. Is like 1 bn. 38% is EPF peak overseas investment holdings. The previous high was 37% before being pared down in 2022 to fund withdrawals |

|

|

|

|

|

fongsk

|

Jun 4 2025, 10:49 PM Jun 4 2025, 10:49 PM

|

New Member

|

QUOTE(Zhik @ Jun 4 2025, 10:25 PM) well last time, if u read the timeline. It is inevitable to save the fund But why? It is a constant income generator. |

|

|

|

|

|

fongsk

|

Jun 4 2025, 10:51 PM Jun 4 2025, 10:51 PM

|

New Member

|

QUOTE(fuzzy @ Jun 4 2025, 10:25 PM)  Revenue has fell for 3 quarters straight. This is good sign ke? I don’t know but what I see is a healthy revenue stream at that. |

|

|

|

|

|

fongsk

|

Jun 4 2025, 10:52 PM Jun 4 2025, 10:52 PM

|

New Member

|

QUOTE(fuzzy @ Jun 4 2025, 10:28 PM) That's because domestic investment includes government securities, loans and bonds, etc.. So fixed income stuff plus equities. While overseas is pure equities, that is why the returns are more moderated given equities was on a bull run last year. EPF cannot invest 100% into equities, else last quarter they would be 20% or so down post Trump election. Then you will complain why they can't manage. Agree but I do expect that more shd be allocated overseas for better returns vs local bourse which is almost lifeless now. |

|

|

|

|

|

9m2w

|

Jun 4 2025, 10:57 PM Jun 4 2025, 10:57 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 10:51 PM) I don’t know but what I see is a healthy revenue stream at that. So it's a coin toss between slow and steady dividend returns, May not outperform the other foreign assets out there with the slowing revenue growth Or selling high And based on what your article said the NHS turning to private health care more and more as their public health care creaks under the pressure Another coin toss. Is this a bubble since UK govt can afford to only pay so much for so long in this economy There's a reason this TS share this and hint it isn't epf related |

|

|

|

|

|

vexus

|

Jun 4 2025, 10:59 PM Jun 4 2025, 10:59 PM

|

|

to cover LTAT lubang?

|

|

|

|

|

|

SUSfuzzy

|

Jun 4 2025, 11:00 PM Jun 4 2025, 11:00 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 10:52 PM) Agree but I do expect that more shd be allocated overseas for better returns vs local bourse which is almost lifeless now. Can not because BMX no rike. |

|

|

|

|

|

fongsk

|

Jun 4 2025, 11:01 PM Jun 4 2025, 11:01 PM

|

New Member

|

QUOTE(9m2w @ Jun 4 2025, 10:57 PM) So it's a coin toss between slow and steady dividend returns, May not outperform the other foreign assets out there with the slowing revenue growth Or selling high And based on what your article said the NHS turning to private health care more and more as their public health care creaks under the pressure Another coin toss. Is this a bubble since UK govt can afford to only pay so much for so long in this economy There's a reason this TS share this and hint it isn't epf related Ok, understand. To me, at such stage of supposedly world economic turbulence caused by trumpnomics , it is better to stay and be prudent. Maybe I have less appetite for risks, than EPF I suppose. I suppose the EPF managers are better informed than me with their experience and background. I am no financial expert. |

|

|

|

|

|

Boomwick

|

Jun 4 2025, 11:36 PM Jun 4 2025, 11:36 PM

|

|

Because sozai ukraine go and bomb kao russia planes with drones, and the market now will factor in european nuclear war into it.. will turn into a massive wasteland..

|

|

|

|

|

|

soulknight

|

Jun 4 2025, 11:44 PM Jun 4 2025, 11:44 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 09:26 PM) I wonder WHY they want to divest this strategic income garner, almost like MAHB case. Something that we do not know? to cover cost of someone planned kota development. |

|

|

|

|

|

fongsk

|

Jun 5 2025, 05:34 AM Jun 5 2025, 05:34 AM

|

New Member

|

QUOTE(soulknight @ Jun 4 2025, 11:44 PM) to cover cost of someone planned kota development. Possible also. |

|

|

|

|

|

Syie9^_^

|

Jun 5 2025, 03:17 PM Jun 5 2025, 03:17 PM

|

|

UK got NHS. Private Hospital will last?  its better repatriate the funds and fix Malaysia health care |

|

|

|

|

|

blmse92

|

Jun 5 2025, 03:28 PM Jun 5 2025, 03:28 PM

|

|

we must trust the fund manager in the higher ups in EPF office. our 1 trillions MYR funds is in their hands. careful yo and good luck

owai

|

|

|

|

|

|

Mixxomon

|

Jun 5 2025, 03:43 PM Jun 5 2025, 03:43 PM

|

Getting Started

|

QUOTE(Syie9^_^ @ Jun 5 2025, 03:17 PM) UK got NHS. Private Hospital will last?  its better repatriate the funds and fix Malaysia health care That's like saying Malaysia got KKM RM1, why go private hospital. But private hospital here flourishing. Their NHS is a shithole. At the same time, private also not exactly affordable. This post has been edited by Mixxomon: Jun 5 2025, 03:44 PM |

|

|

|

|

|

Syie9^_^

|

Jun 5 2025, 04:08 PM Jun 5 2025, 04:08 PM

|

|

QUOTE(Mixxomon @ Jun 5 2025, 05:13 PM) That's like saying Malaysia got KKM RM1, why go private hospital. But private hospital here flourishing. Their NHS is a shithole. At the same time, private also not exactly affordable. similar story, just different locality.   |

|

|

|

|

|

Jenn77

|

Jun 5 2025, 04:14 PM Jun 5 2025, 04:14 PM

|

|

QUOTE(soul78 @ Jun 4 2025, 09:44 PM) No point putting more investments into UK moving forward... UK is already moving to WARtime stance... and getting ready for WAR in 2027. EPF from a risk perspective also why wanna risk more exposure on EU/UK knowing tension is getting worst month after month... I concur. Been reading about the WAR preparations and the bad economy alarms in EU/UK. Perhaps its a wise move for EPF to not invest there.. |

|

|

|

|

Jun 4 2025, 09:11 PM, updated 7 months ago

Jun 4 2025, 09:11 PM, updated 7 months ago

Quote

Quote

0.0202sec

0.0202sec

0.91

0.91

5 queries

5 queries

GZIP Disabled

GZIP Disabled