Outline ·

[ Standard ] ·

Linear+

EPF weighs £1.4bil sale of UK private hospitals

|

SUSfuzzy

|

Jun 4 2025, 10:25 PM Jun 4 2025, 10:25 PM

|

|

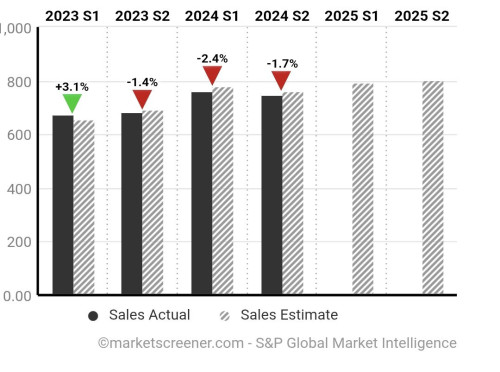

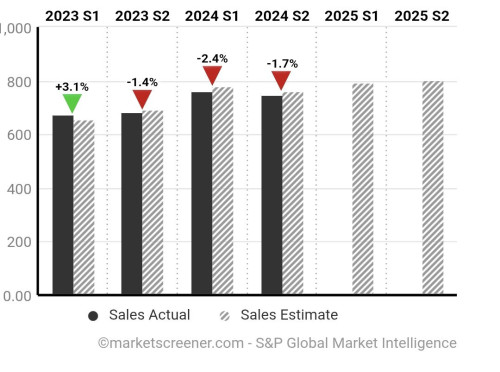

QUOTE(fongsk @ Jun 4 2025, 10:18 PM) The article Mentioned that healthcare is one of the active segment that is expected to be profitable and have investors coming in….  Revenue has fell for 3 quarters straight. This is good sign ke? |

|

|

|

|

|

SUSfuzzy

|

Jun 4 2025, 10:28 PM Jun 4 2025, 10:28 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 10:13 PM) Well, chances are will be re-invested in Malaysia, given PKX ‘advice’ last year. Read the article…. 38% of our investment in shares pervades generate 44% of income vs 62% domestic KLSE giving us 56%. And our forex gai. Is like 1 bn. That's because domestic investment includes government securities, loans and bonds, etc.. So fixed income stuff plus equities. While overseas is pure equities, that is why the returns are more moderated given equities was on a bull run last year. EPF cannot invest 100% into equities, else last quarter they would be 20% or so down post Trump election. Then you will complain why they can't manage. |

|

|

|

|

|

SUSfuzzy

|

Jun 4 2025, 11:00 PM Jun 4 2025, 11:00 PM

|

|

QUOTE(fongsk @ Jun 4 2025, 10:52 PM) Agree but I do expect that more shd be allocated overseas for better returns vs local bourse which is almost lifeless now. Can not because BMX no rike. |

|

|

|

|

Jun 4 2025, 10:25 PM

Jun 4 2025, 10:25 PM

Quote

Quote 0.0143sec

0.0143sec

1.05

1.05

6 queries

6 queries

GZIP Disabled

GZIP Disabled