QUOTE(coconutxyz @ Jun 7 2025, 03:08 PM)

Self billed only required for few categories, cannot simply issue also

If I call a bangla plumber.. or even local plumber (freelance), or local wireman, there is no need self bill e-inv? Sometimes they issue regular resit, or if not, I just get them sign payment received, stated their details and contact. So no need self billed e-invoice?

If I'm correct, this e-invoice is actually pointless because it's them who under report their income.

QUOTE(sansaboy @ Jun 7 2025, 02:43 PM)

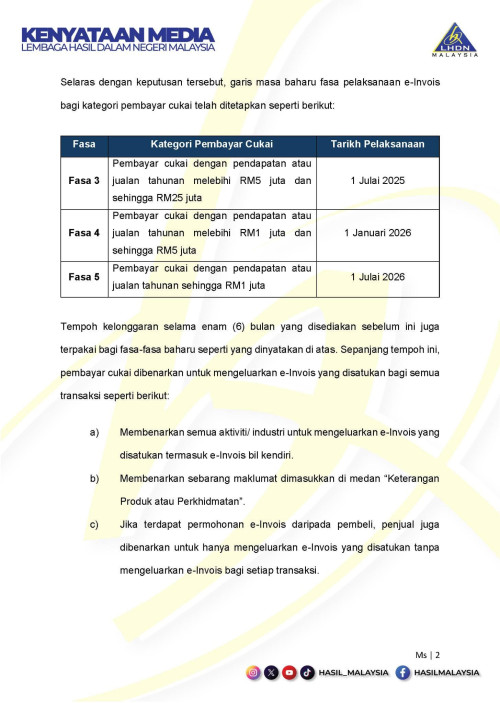

Here we go again ,our famous u turn culture kick in

The whole point of e invoice is the enforcement target those company sme , revenue below 1 million or 500k

Those are the typical company who always under report their income and enjoy the subsidized to the max,few examples:

Aircon contractor, wire man, cctv installer, small renovation contractor, small tyre shop, workshop, small hand phone accessories shop.

And yes they are using cheap ron 95 to travel around doing business.

And under report their income every year

Most company with more than 1 million revenue, normally are sdn bhd setup ,with proper book audit yearly.

You enforce e invoice on them,

There is nothing to see inside their book,no differences

But when you enforce e invoice inside these contractor ?

Yes suddenly you see their business are so good alr compare to previously few years

At first I ready popcorn to see how this freelancer or contractor facing e invoice

But our lovely government delay the show again

How disappointed

Delay delay then elections come, sure delay again?

Right, so I can be doing air-cond business and under report my income, buyer also don't issue self-billed invoice, since for these kind of things, does not fall under self-billed e-invoice part, and I also can always say I'm below rm1m.

Like my friend always say, to which I also agree, people who pay tax is the one they want to be strict towards and want to monitor/control more. Meanwhile, the real ones who under report, still enjoy under reporting.

This post has been edited by Natsukashii: Jun 8 2025, 06:41 PM

May 24 2025, 07:08 PM, updated 7 months ago

May 24 2025, 07:08 PM, updated 7 months ago

Quote

Quote

0.0383sec

0.0383sec

0.74

0.74

5 queries

5 queries

GZIP Disabled

GZIP Disabled