QUOTE(latipbogiba @ Jan 28 2025, 11:29 AM)

i imagine the scenario of pensioner is like,

morning go kebun kejap sejam dua. petang lepak dengan kawan yang belum mati. malam lepak surau.

1.5k paying nothing tak cukup?

old people dont eat much. entertainment pun tak layan sangat

QUOTE(zerorating @ Jan 28 2025, 11:30 AM)

but then again you got of tons of money, but you cant eat much, you are lacking of energy, no mood to travel. not much point either.

also you can spend the whole fund as fallback, why must limited to interest only?

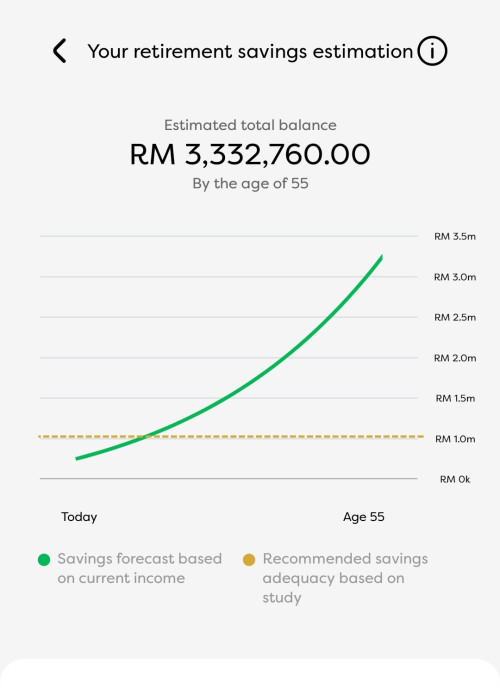

Ayam target retire at 55 also, target 3 million epf and other savings.

5% dividend will net around 12k per month for spending

Of course priority is different, when retire:

1) I want to be able to belanja my grand kids

2) pigi holiday bring family

3) travel sana sini look see got what interesting

4) drive BMW or Merc

1.5k not enough lor

And when retire at 55, I plan to work at non stress job. Like drive grab, volunteer cleaner, etc etc. Because mind still need to use, if no use later become senile

Jan 28 2025, 11:10 AM, updated 11 months ago

Jan 28 2025, 11:10 AM, updated 11 months ago

Quote

Quote

0.0286sec

0.0286sec

0.89

0.89

5 queries

5 queries

GZIP Disabled

GZIP Disabled