I have been living in walk up flat almost my whole life.

In recent months, my father fall on his head and had a minor surgery. His memory is very much weaken and is too weak to walk. My mother is very old as well, although still considered strong at her age, she needs more time to climb the staires. Thus, I wish to buy a lift apartment to live with them. My salary is around 3400 basic before deductions, my monthly after deductions total is around 3600 to 3800 plus 750 rental income.

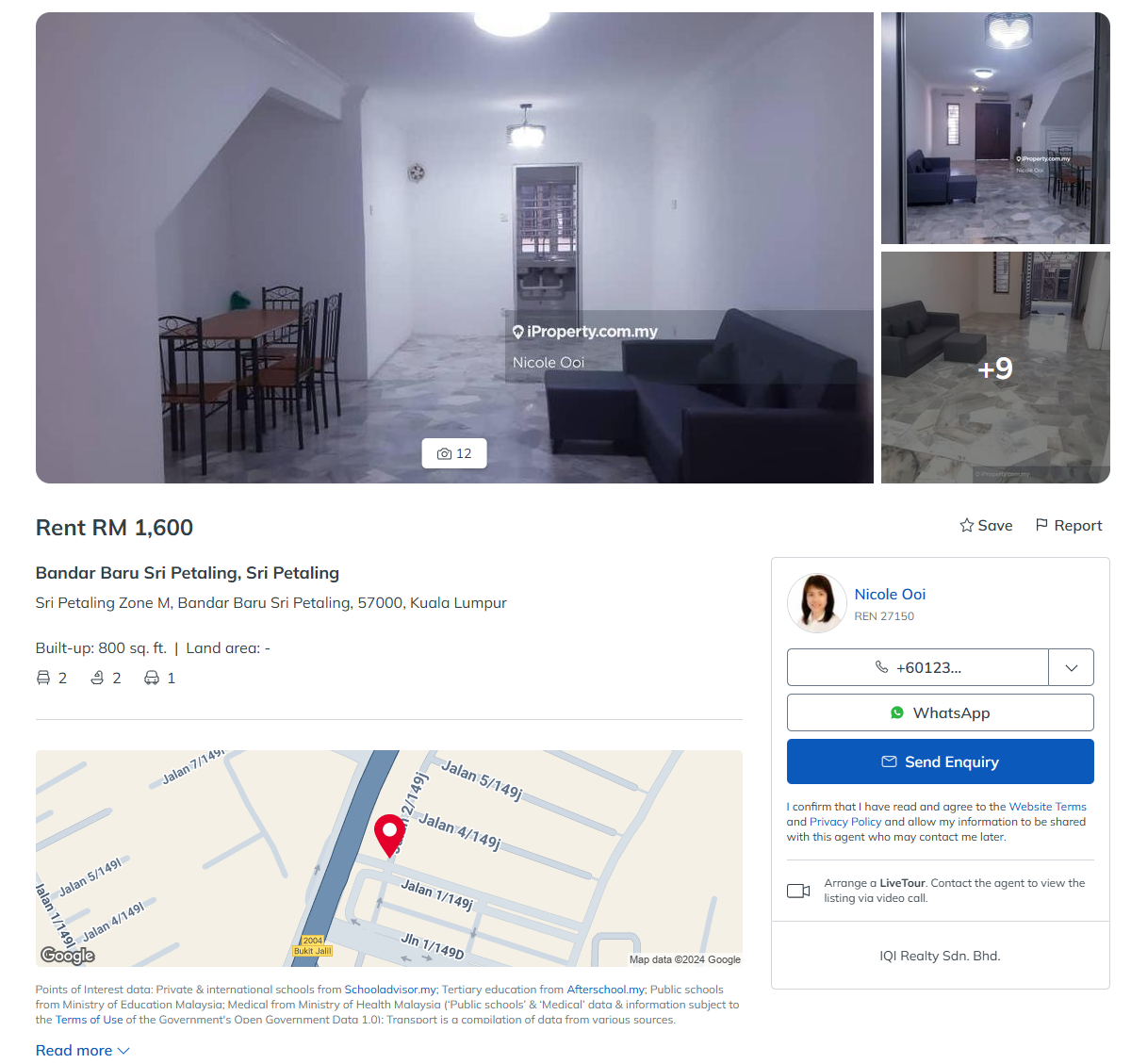

My family is living in a walk up flat in Sri Endah worth around 160k to 200k, and I have another one in Sri Kembangan worth around 200k above. I plan to sell that one, and get a loan to buy a 3 rooms lift apartment in KL with good convenience such as market, shops just on the ground floor, less than 1 hour drive to government hospital, train station. After we move in, we would be renting out the one we are living in then.

Another option is to sell both houses, get a dual key, and rent out the studio unit. But doing so, might need to rent outside during the transaction period.

I have a few questions, should I engage an agent to help me do all these transactions and loan application or DIY? What will be the price difference? I can't afford to gamble on this, so I am more toward completed unit. Is this way more expensive? Is it near impossible for my income?

Buy lift apartment for my parents.

Dec 7 2024, 10:48 AM, updated 12 months ago

Dec 7 2024, 10:48 AM, updated 12 months ago

Quote

Quote

0.0266sec

0.0266sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled