Outline ·

[ Standard ] ·

Linear+

Cost of making a Will

|

ycs

|

May 24 2024, 03:24 PM May 24 2024, 03:24 PM

|

|

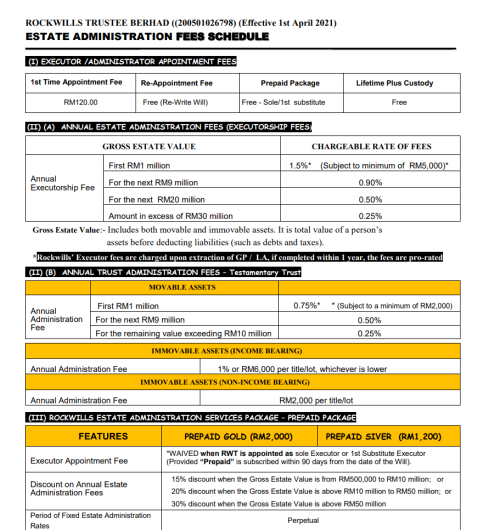

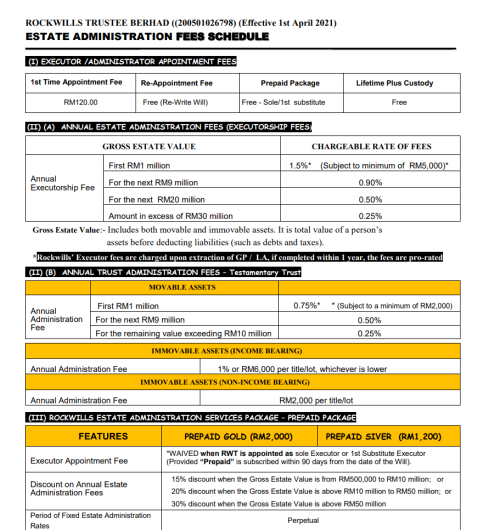

QUOTE(gashout @ May 24 2024, 12:30 PM) They end up being the executor?? Conflict of interest dah. If so, better find a normal lawyer to do will better that doesn't have this clause. i think the issue is if you appoint a 3rd party like rockwills as executor and they charge 1.5% of total assets 'market value' as their annual fee and they take their sweet time to get GP for you, delay until few years, how? if executor is also beneficiary, then executor wont delay getting GP https://www.rockwillsonline.com.my/document...es_schedule.pdf |

|

|

|

|

|

ycs

|

May 28 2024, 11:13 PM May 28 2024, 11:13 PM

|

|

QUOTE(benzxzx @ May 28 2024, 10:09 AM) bro will is will, and only take effect upon your passing. adding name means essentially you transfer the ownership of property, if you add one name meaning transfer half share of yours to the other half, and yeah you can only do it during your lifetime. let me know your property details, I am able to give a quote for such transfer service, MOT but if its not to spouses, or children, then bear in mind there might be stamp duty imposed, so your cost goes up since you're a lawyer, is it cheaper to transfer property to children via a will or to transfer to children when still alive? |

|

|

|

|

|

ycs

|

May 28 2024, 11:28 PM May 28 2024, 11:28 PM

|

|

QUOTE(benzxzx @ May 28 2024, 11:21 PM) yes i sure am. for sure will is cheaper as we dont have inheritance tax here so if you pass on your child basically get to inherit the prop for free, just need to pay nominal stamp duty and obtain the grant of probate, whereas for transfer during lifetime, there will be imposition of stamp duty, which is calculated based on value of your prop and divide by half since kasih sayang transfer got partial waiver. thanks for confirming; thats what i thought as well  |

|

|

|

|

May 24 2024, 03:24 PM

May 24 2024, 03:24 PM

Quote

Quote 0.0162sec

0.0162sec

0.30

0.30

6 queries

6 queries

GZIP Disabled

GZIP Disabled