PruBSN insurance naik harga

|

|

May 7 2024, 06:55 AM, updated 2y ago May 7 2024, 06:55 AM, updated 2y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

177 posts Joined: May 2022 |

|

|

|

|

|

|

May 7 2024, 06:57 AM May 7 2024, 06:57 AM

Show posts by this member only | Post

#2

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

|

|

|

May 7 2024, 06:59 AM May 7 2024, 06:59 AM

Show posts by this member only | Post

#3

|

Junior Member

433 posts Joined: Jul 2010 |

if premium increase, the package value increase too or not?

|

|

|

May 7 2024, 07:04 AM May 7 2024, 07:04 AM

Show posts by this member only | Post

#4

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

QUOTE(WinkyJr @ May 7 2024, 06:59 AM) no lol, it is a defend twosocks liked this post

|

|

|

May 7 2024, 07:09 AM May 7 2024, 07:09 AM

Show posts by this member only | Post

#5

|

Junior Member

433 posts Joined: Jul 2010 |

QUOTE(Pain4UrsinZ @ May 7 2024, 07:04 AM) so what is the point for the increase? need more money to increase the profit so their tops can get/maintain double digit bonuses? Quang1819 liked this post

|

|

|

May 7 2024, 07:22 AM May 7 2024, 07:22 AM

Show posts by this member only | Post

#6

|

Senior Member

818 posts Joined: Jan 2003 |

|

|

|

|

|

|

May 7 2024, 07:25 AM May 7 2024, 07:25 AM

Show posts by this member only | Post

#7

|

Junior Member

421 posts Joined: Feb 2022 |

Have not receive anything from my agent.

|

|

|

May 7 2024, 07:25 AM May 7 2024, 07:25 AM

Show posts by this member only | IPv6 | Post

#8

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

Insurance premium keep increasing yet salary still maintain. Healthcare getting more expensive. Yet government don’t really regulate and control the price. People from private sector suffering while government servants always get tongkat. Gov servants can get free healthcare by using GL and no need to think much about savings for the future. While private sectors need to pay more tax and subsidies-free. Now have to pay high insurance premium because of no choice. If admit to ward or surgeries, need to pay quite expensive even at government hospital.

|

|

|

May 7 2024, 07:26 AM May 7 2024, 07:26 AM

Show posts by this member only | Post

#9

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(WinkyJr @ May 7 2024, 08:09 AM) so what is the point for the increase? need more money to increase the profit so their tops can get/maintain double digit bonuses? Medical inflation. You look at how much private hospitals are charging nowadays. They can’t suka-suka increase as they need BNM approval. If BNM approved, they must have good justification. thesoothsayer liked this post

|

|

|

May 7 2024, 07:27 AM May 7 2024, 07:27 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(POYOZER @ May 7 2024, 08:25 AM) Insurance premium keep increasing yet salary still maintain. Healthcare getting more expensive. Yet government don’t really regulate and control the price. People from private sector suffering while government servants always get tongkat. Gov servants can get free healthcare by using GL and no need to think much about savings for the future. While private sectors need to pay more tax and subsidies-free. Now have to pay high insurance premium because of no choice. If admit to ward or surgeries, need to pay quite expensive even at government hospital. Government servants get free healthcare when they visit private hospitals? If you say government hospitals, non-government servants go also not expensive |

|

|

May 7 2024, 07:30 AM May 7 2024, 07:30 AM

Show posts by this member only | IPv6 | Post

#11

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

QUOTE(30624770 @ May 7 2024, 07:27 AM) Government servants get free healthcare when they visit private hospitals? If you say government hospitals, non-government servants go also not expensive Free at government hospital.Non-gov servants still need to pay and sometimes can reach thousands at government hospital for surgeries. Not all can afford even at discounted price. If admit to IJN then sure more expensive. |

|

|

May 7 2024, 07:33 AM May 7 2024, 07:33 AM

Show posts by this member only | IPv6 | Post

#12

|

Junior Member

396 posts Joined: Mar 2005 |

My Prudential increased 3-4 times already in the span of 12 years.

|

|

|

May 7 2024, 07:34 AM May 7 2024, 07:34 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(POYOZER @ May 7 2024, 08:30 AM) Free at government hospital. It’s still much cheaper than private hospitals. People who buy insurance won’t go government hospitals. If they go government hospitals, I think the insurance companies will be even more happy as it will be cheaper. Non-gov servants still need to pay and sometimes can reach thousands at government hospital for surgeries. Not all can afford even at discounted price. If admit to IJN then sure more expensive. The free healthcare for government servants are not sustainable in the long run. Sooner or later, they can’t subsidise anymore which is why government since Najib time has been trying to get more people to buy insurance. |

|

|

|

|

|

May 7 2024, 07:37 AM May 7 2024, 07:37 AM

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

|

|

|

May 7 2024, 07:37 AM May 7 2024, 07:37 AM

Show posts by this member only | IPv6 | Post

#15

|

Junior Member

979 posts Joined: Jan 2022 |

QUOTE(POYOZER @ May 7 2024, 07:25 AM) Insurance premium keep increasing yet salary still maintain. Healthcare getting more expensive. Yet government don’t really regulate and control the price. People from private sector suffering while government servants always get tongkat. Gov servants can get free healthcare by using GL and no need to think much about savings for the future. While private sectors need to pay more tax and subsidies-free. Now have to pay high insurance premium because of no choice. If admit to ward or surgeries, need to pay quite expensive even at government hospital. Give me example of expensive at govt hospital? I got relative admitted due to stroke. When go to the counter they say no need pay anything. My other relative did a heart bypass and go to the counter it was rm 250 for entire ops and stayIt’s only expensive if you are foreigner which is fair because you are not a citizen and don’t deserve citizen perks So tell me again which govt hospital is expensive |

|

|

May 7 2024, 07:39 AM May 7 2024, 07:39 AM

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

QUOTE(POYOZER @ May 7 2024, 07:25 AM) Insurance premium keep increasing yet salary still maintain. Healthcare getting more expensive. Yet government don’t really regulate and control the price. People from private sector suffering while government servants always get tongkat. Gov servants can get free healthcare by using GL and no need to think much about savings for the future. While private sectors need to pay more tax and subsidies-free. Now have to pay high insurance premium because of no choice. If admit to ward or surgeries, need to pay quite expensive even at government hospital. i dont see difference between non vs gov servant, only the room is different. |

|

|

May 7 2024, 07:42 AM May 7 2024, 07:42 AM

Show posts by this member only | IPv6 | Post

#17

|

Junior Member

535 posts Joined: May 2005 |

QUOTE(30624770 @ May 7 2024, 07:26 AM) Medical inflation. You look at how much private hospitals are charging nowadays. They can’t suka-suka increase as they need BNM approval. If BNM approved, they must have good justification. Correct, and this matter involves multiple parties/stakeholders, govt, MoH, insurance, bnm.... It will take time to resolve the issue. |

|

|

May 7 2024, 07:46 AM May 7 2024, 07:46 AM

Show posts by this member only | IPv6 | Post

#18

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

QUOTE(Roadwarrior1337 @ May 7 2024, 07:37 AM) Give me example of expensive at govt hospital? I got relative admitted due to stroke. When go to the counter they say no need pay anything. My other relative did a heart bypass and go to the counter it was rm 250 for entire ops and stay I’ve paid thousands before for surgery for my relative.It’s only expensive if you are foreigner which is fair because you are not a citizen and don’t deserve citizen perks So tell me again which govt hospital is expensive |

|

|

May 7 2024, 07:56 AM May 7 2024, 07:56 AM

Show posts by this member only | IPv6 | Post

#19

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Pain4UrsinZ @ May 7 2024, 08:37 AM) it is a guarantee profit business for them , when inflation or more people claim insurance, they will increase your premium Insurance companies are still business and they need to be profitable. If not how are they going to pay out the claims and all related costs. The rising insurance costs are more due to medical inflation at private hospitals. |

|

|

May 7 2024, 07:57 AM May 7 2024, 07:57 AM

Show posts by this member only | IPv6 | Post

#20

|

Junior Member

269 posts Joined: Oct 2021 |

|

|

|

May 7 2024, 07:58 AM May 7 2024, 07:58 AM

Show posts by this member only | IPv6 | Post

#21

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

|

|

|

May 7 2024, 07:59 AM May 7 2024, 07:59 AM

Show posts by this member only | IPv6 | Post

#22

|

Senior Member

1,400 posts Joined: May 2006 From: Penang island |

|

|

|

May 7 2024, 08:00 AM May 7 2024, 08:00 AM

Show posts by this member only | IPv6 | Post

#23

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(POYOZER @ May 7 2024, 08:58 AM) Putrajaya hospital got private wing. So are you sure it’s not the private wing?https://www.hpj.gov.my/portalv11/index.php/en/fpp-bi |

|

|

May 7 2024, 08:00 AM May 7 2024, 08:00 AM

Show posts by this member only | IPv6 | Post

#24

|

Senior Member

1,400 posts Joined: May 2006 From: Penang island |

|

|

|

May 7 2024, 08:02 AM May 7 2024, 08:02 AM

Show posts by this member only | IPv6 | Post

#25

|

Senior Member

1,400 posts Joined: May 2006 From: Penang island |

QUOTE(POYOZER @ May 7 2024, 07:25 AM) Insurance premium keep increasing yet salary still maintain. Healthcare getting more expensive. Yet government don’t really regulate and control the price. People from private sector suffering while government servants always get tongkat. Gov servants can get free healthcare by using GL and no need to think much about savings for the future. While private sectors need to pay more tax and subsidies-free. Now have to pay high insurance premium because of no choice. If admit to ward or surgeries, need to pay quite expensive even at government hospital. Hospital kerajaan MalaysiaCharge you : Rm 5 saje |

|

|

May 7 2024, 08:04 AM May 7 2024, 08:04 AM

Show posts by this member only | IPv6 | Post

#26

|

Senior Member

1,400 posts Joined: May 2006 From: Penang island |

QUOTE(POYOZER @ May 7 2024, 07:25 AM) Insurance premium keep increasing yet salary still maintain. Healthcare getting more expensive. Yet government don’t really regulate and control the price. People from private sector suffering while government servants always get tongkat. Gov servants can get free healthcare by using GL and no need to think much about savings for the future. While private sectors need to pay more tax and subsidies-free. Now have to pay high insurance premium because of no choice. If admit to ward or surgeries, need to pay quite expensive even at government hospital. Private MNC do take group insurance for their few thousand staffs.. |

|

|

May 7 2024, 08:04 AM May 7 2024, 08:04 AM

Show posts by this member only | IPv6 | Post

#27

|

Senior Member

1,410 posts Joined: Dec 2009 From: Everywhere |

Banyak nya kenaikan.

|

|

|

May 7 2024, 08:05 AM May 7 2024, 08:05 AM

Show posts by this member only | IPv6 | Post

#28

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

|

|

|

May 7 2024, 08:09 AM May 7 2024, 08:09 AM

Show posts by this member only | IPv6 | Post

#29

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

QUOTE(adamtayy @ May 7 2024, 08:04 AM) When you left that company and if you don’t have personal insurance, what will happen if something happened? That time sure not covered and if you want to take personal insurance, premium sure more expensive due to age factor. |

|

|

May 7 2024, 08:09 AM May 7 2024, 08:09 AM

Show posts by this member only | IPv6 | Post

#30

|

Senior Member

1,400 posts Joined: May 2006 From: Penang island |

|

|

|

May 7 2024, 08:10 AM May 7 2024, 08:10 AM

Show posts by this member only | IPv6 | Post

#31

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

|

|

|

May 7 2024, 08:11 AM May 7 2024, 08:11 AM

Show posts by this member only | IPv6 | Post

#32

|

Senior Member

1,400 posts Joined: May 2006 From: Penang island |

QUOTE(POYOZER @ May 7 2024, 08:09 AM) When you left that company and if you don’t have personal insurance, what will happen if something happened? That time sure not covered and if you want to take personal insurance, premium sure more expensive due to age factor. B4 you leave any companyGo, attend 10 interviews Get hired & then resign.. Get it??? |

|

|

May 7 2024, 08:12 AM May 7 2024, 08:12 AM

Show posts by this member only | IPv6 | Post

#33

|

Senior Member

1,400 posts Joined: May 2006 From: Penang island |

|

|

|

May 7 2024, 08:13 AM May 7 2024, 08:13 AM

Show posts by this member only | IPv6 | Post

#34

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

|

|

|

May 7 2024, 08:15 AM May 7 2024, 08:15 AM

Show posts by this member only | IPv6 | Post

#35

|

Senior Member

1,400 posts Joined: May 2006 From: Penang island |

|

|

|

May 7 2024, 08:16 AM May 7 2024, 08:16 AM

Show posts by this member only | IPv6 | Post

#36

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(POYOZER @ May 7 2024, 09:13 AM) A lot of youngsters don’t think like that because they always think their company cover them but they forgot that most people need insurance when they are older especially after retirement. If you take insurance when you’re older, the premiums are usually a lot more expensive. Some insurance companies will not even do your biz. |

|

|

May 7 2024, 08:20 AM May 7 2024, 08:20 AM

Show posts by this member only | IPv6 | Post

#37

|

Junior Member

763 posts Joined: Jan 2003 |

|

|

|

May 7 2024, 08:20 AM May 7 2024, 08:20 AM

Show posts by this member only | IPv6 | Post

#38

|

Junior Member

51 posts Joined: Jan 2009 |

i read before this many hospitals dont like this insurance company..hard to claim..they was popular because many insurance agent especially malay promoting their plan..

|

|

|

May 7 2024, 08:25 AM May 7 2024, 08:25 AM

Show posts by this member only | IPv6 | Post

#39

|

Senior Member

3,582 posts Joined: Oct 2007 From: everywhere in sabah |

that prubsn is increase in how long?

because the rest of the insurance industry already increase multiple times in the past 2 years |

|

|

May 7 2024, 08:26 AM May 7 2024, 08:26 AM

Show posts by this member only | IPv6 | Post

#40

|

Senior Member

3,582 posts Joined: Oct 2007 From: everywhere in sabah |

|

|

|

May 7 2024, 08:27 AM May 7 2024, 08:27 AM

|

Newbie

7 posts Joined: Feb 2011 |

|

|

|

May 7 2024, 08:28 AM May 7 2024, 08:28 AM

Show posts by this member only | IPv6 | Post

#42

|

Senior Member

3,567 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(30624770 @ May 7 2024, 08:16 AM) A lot of youngsters don’t think like that because they always think their company cover them but they forgot that most people need insurance when they are older especially after retirement. If you take insurance when you’re older, the premiums are usually a lot more expensive. Some insurance companies will not even do your biz. Actually I’ve been thinking when everyone say how expensive it is when we subscribe insurance when we are older - how expensive are we looking at?I’ve been paying the premium since 20 years ago and I’ve never claim any hospitalization before. Only twice but those are covered under company. All those $$ could have been saved and if the premium at older age is more expensive, just wonder how expensive could it be? |

|

|

May 7 2024, 08:31 AM May 7 2024, 08:31 AM

Show posts by this member only | IPv6 | Post

#43

|

Junior Member

763 posts Joined: Jan 2003 |

QUOTE(knwong @ May 7 2024, 08:28 AM) Actually I’ve been thinking when everyone say how expensive it is when we subscribe insurance when we are older - how expensive are we looking at? I don't know the numbers but I suspect it's based on a set pay table already. So even if we start earlier or later eventually will pay the same at the same age. Excluding any loading etc. I’ve been paying the premium since 20 years ago and I’ve never claim any hospitalization before. Only twice but those are covered under company. All those $$ could have been saved and if the premium at older age is more expensive, just wonder how expensive could it be? Just the main thing is as we age, there is a risk of loading, exclusion or rejection die to our health deteriorated. |

|

|

May 7 2024, 08:35 AM May 7 2024, 08:35 AM

Show posts by this member only | IPv6 | Post

#44

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

They are just telling you

"You are getting riskier and not so profitable to be insured. If you still want the 'protection' you need to continue pay up" Insurance is a risk calculated business where the insurance company always wins. How else they can publish full colored centerspread page in newspaper of their agents achievements. If at current age, you feel the squeeze to pay, wait till you get older or retired, that is when you realized you already spend a fortune on insurance and they decided not to insure you anymore or increase the premium beyond your capability, in a way forcing you to willingly surrender the policy. Do the calculations and adjust accordingly today. This post has been edited by Capt. Marble: May 7 2024, 08:36 AM |

|

|

May 7 2024, 08:37 AM May 7 2024, 08:37 AM

Show posts by this member only | IPv6 | Post

#45

|

Junior Member

77 posts Joined: Jun 2019 |

insurance companies: pay cash if don't like us.

|

|

|

May 7 2024, 08:43 AM May 7 2024, 08:43 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Capt. Marble @ May 7 2024, 09:35 AM) They are just telling you If you are capable of self-insured, then go ahead and take the risks."You are getting riskier and not so profitable to be insured. If you still want the 'protection' you need to continue pay up" Insurance is a risk calculated business where the insurance company always wins. How else they can publish full colored centerspread page in newspaper of their agents achievements. If at current age, you feel the squeeze to pay, wait till you get older or retired, that is when you realized you already spend a fortune on insurance and they decided not to insure you anymore or increase the premium beyond your capability, in a way forcing you to willingly surrender the policy. Do the calculations and adjust accordingly today. Like you say, insurance is risk calculated biz. Your own life is also a risk calculated. So, it's up to individual to decide themselves. Fact is even millionaires buy insurance when they can easily self-insured? |

|

|

May 7 2024, 08:45 AM May 7 2024, 08:45 AM

Show posts by this member only | IPv6 | Post

#47

|

Senior Member

6,056 posts Joined: Jan 2003 From: Suldanessellar |

This is Medical Inflation. All medical fees price increase so your medical insurance price also ikut the inflation.

All insurance company also have to increase their medical premium |

|

|

May 7 2024, 08:45 AM May 7 2024, 08:45 AM

Show posts by this member only | IPv6 | Post

#48

|

Senior Member

1,818 posts Joined: Jan 2005 From: Kuala Lumpur |

|

|

|

May 7 2024, 08:49 AM May 7 2024, 08:49 AM

Show posts by this member only | IPv6 | Post

#49

|

Junior Member

266 posts Joined: May 2012 |

Ok to raise price but the company pls warn your agents not to flaunt wealth on the expense of clients. Got overseas trip star producer every year, big cars, raya open house at 5 star hotel for all agents. This like saying we take client money so we can live in luxury. Recently pru keep investing in starbucks although all analysts advise against it, is it a wise decision when it fell 50%?!

This post has been edited by daidragon12: May 7 2024, 08:50 AM |

|

|

May 7 2024, 08:49 AM May 7 2024, 08:49 AM

Show posts by this member only | IPv6 | Post

#50

|

Senior Member

1,410 posts Joined: Dec 2009 From: Everywhere |

My friend has Rare Disease.

He wants sign up for insurance but the insurance companies refuse to do business with him. Same goes to the people that have Rare Disease in support group he joined. So the only option he has is getting access to gov hospital only |

|

|

May 7 2024, 08:50 AM May 7 2024, 08:50 AM

Show posts by this member only | IPv6 | Post

#51

|

Senior Member

1,767 posts Joined: Jan 2019 |

|

|

|

May 7 2024, 08:50 AM May 7 2024, 08:50 AM

|

Senior Member

1,923 posts Joined: Feb 2016 |

QUOTE(knwong @ May 7 2024, 08:28 AM) Actually I’ve been thinking when everyone say how expensive it is when we subscribe insurance when we are older - how expensive are we looking at? Mine for your reference. Age 54, my premium with 300 B&B at 13k+ paI’ve been paying the premium since 20 years ago and I’ve never claim any hospitalization before. Only twice but those are covered under company. All those $$ could have been saved and if the premium at older age is more expensive, just wonder how expensive could it be? Latest sustainability revision as at 1 Mar 2024 Note: from 3k pa in my early 30s (no add-on) This post has been edited by jojolicia: May 7 2024, 08:57 AM |

|

|

May 7 2024, 08:53 AM May 7 2024, 08:53 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(knwong @ May 7 2024, 09:28 AM) Actually I’ve been thinking when everyone say how expensive it is when we subscribe insurance when we are older - how expensive are we looking at? I don't think its apple-to-apple comparison as each individual health condition is different. What I know is if you take up insurance at older age, the requirements are stricter as my friend needed to go for medical test. Another friend who tried to take up insurance was rejected after medical test.I’ve been paying the premium since 20 years ago and I’ve never claim any hospitalization before. Only twice but those are covered under company. All those $$ could have been saved and if the premium at older age is more expensive, just wonder how expensive could it be? What I know is I took my insurance since my 20s and today my premium is about 30% lower than my friend who took his insurance much later even after my policy was repriced twice. But like I say, it's not apple-to-apple comparison as I don't know what is his medical condition. Insurance is to insure yourself against any potential risk. It is something you hope you never need to use. So, a lot of people think that just because they don't use since they bought insurance, the premium paid is wasted but that is a wrong thinking as even though we never claim, they are still insuring you against any risks. From what I hear, the insurance penetration rate in Malaysia is still low especially among the B40s and the government is encouraging more people to take up insurance. That's why there are schemes like MySalam being introduced. The current cheap government hospitals are no longer sustainable which is why a lot of government hospitals already have private wings. Sooner or later, we will have to kiss goodbye to RM1 fees at government hospitals. This post has been edited by 30624770: May 7 2024, 08:54 AM |

|

|

May 7 2024, 08:58 AM May 7 2024, 08:58 AM

Show posts by this member only | IPv6 | Post

#54

|

Senior Member

1,767 posts Joined: Jan 2019 |

QUOTE(cms @ May 7 2024, 08:31 AM) I don't know the numbers but I suspect it's based on a set pay table already. So even if we start earlier or later eventually will pay the same at the same age. Excluding any loading etc. Just the main thing is as we age, there is a risk of loading, exclusion or rejection die to our health deteriorated. QUOTE(knwong @ May 7 2024, 08:28 AM) Actually I’ve been thinking when everyone say how expensive it is when we subscribe insurance when we are older - how expensive are we looking at? A lot of ppl are unclear that premiums and insurance charges are actually dif item in insurance terms.I’ve been paying the premium since 20 years ago and I’ve never claim any hospitalization before. Only twice but those are covered under company. All those $$ could have been saved and if the premium at older age is more expensive, just wonder how expensive could it be? It’s actually very similar to our prepaid plan, you pay your monthly/yearly premiums (like top up) to reload some cash value (credit) into your account and keep it active. Then every year or so they’ll deduct credits from your account as insurance charges. The main killer figures here is the insurance charges after you’re age 70, those can easily grow to 5 digits and beyond, and it’s meant to tell you you’re too costly to remain insured and may be it’s time to terminate your policy, cash out whatever cash value left and bare your life/medical at your own cost. Actually there isn’t much additional cost taking insurance at older age (like in your 40-50s), all be it you’re less likely to be fully healthy to get the best terms (no diabetes, no HBP etc) and you didn’t enjoy the compounding effect of building up annual interest with your cash value since your young age (anyway their interests also sucky nowadays). My mom took up a medical policy in her late 50s and the monthly premiums is RM500++. This post has been edited by msacras: May 7 2024, 09:03 AM |

|

|

May 7 2024, 08:59 AM May 7 2024, 08:59 AM

Show posts by this member only | IPv6 | Post

#55

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

QUOTE(30624770 @ May 7 2024, 08:43 AM) If you are capable of self-insured, then go ahead and take the risks. That's why I mentioned if you feel the squeeze today to pay, don't bother to continue because it will only get worst and eventually will give up the policy. Just need to do proper calculation and evaluation. Like you say, insurance is risk calculated biz. Your own life is also a risk calculated. So, it's up to individual to decide themselves. Fact is even millionaires buy insurance when they can easily self-insured? I am sure a lot millionaire insured themselves because they can afford to. The ones that are complaining here obviously is hitting their ceiling of affordability. This post has been edited by Capt. Marble: May 7 2024, 09:05 AM |

|

|

May 7 2024, 09:02 AM May 7 2024, 09:02 AM

Show posts by this member only | IPv6 | Post

#56

|

Junior Member

979 posts Joined: Jan 2022 |

|

|

|

May 7 2024, 09:03 AM May 7 2024, 09:03 AM

|

Senior Member

1,923 posts Joined: Feb 2016 |

QUOTE(WinkyJr @ May 7 2024, 07:09 AM) so what is the point for the increase? need more money to increase the profit so their tops can get/maintain double digit bonuses? In short, pool fund depleted, COI increase, your premium rollover cannot sustain.Either you top up to meet your cover period or it just lapsed upon -ve. In short, you don't expect paying 5k pa, last 20 years to sustain for the next 20 years. It can never This post has been edited by jojolicia: May 7 2024, 09:06 AM WinkyJr liked this post

|

|

|

May 7 2024, 09:03 AM May 7 2024, 09:03 AM

Show posts by this member only | IPv6 | Post

#58

|

Junior Member

671 posts Joined: May 2019 |

Insurans not for BiForty

This post has been edited by The.Lucas.DaY: May 7 2024, 09:04 AM |

|

|

May 7 2024, 09:05 AM May 7 2024, 09:05 AM

|

Senior Member

1,923 posts Joined: Feb 2016 |

DP

This post has been edited by jojolicia: May 7 2024, 09:06 AM |

|

|

May 7 2024, 09:08 AM May 7 2024, 09:08 AM

Show posts by this member only | IPv6 | Post

#60

|

Junior Member

144 posts Joined: Jun 2014 From: Kuala Lumpur |

so for example, i've been sub for insurance in the span of 10 years and premium keep increasing lets say 3-4x. At the same time, i never utilize cause health is in good form. It means ayam rugi lor, right?

|

|

|

May 7 2024, 09:09 AM May 7 2024, 09:09 AM

Show posts by this member only | IPv6 | Post

#61

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Capt. Marble @ May 7 2024, 09:59 AM) That's why I mentioned if you feel the squeeze today to pay, don't bother to continue because it will only get worst and eventually will give up the policy. Just need to do proper calculation and evaluation. Like I say before, a lot of millionaires buy insurance too even though they can self insured. Why?I am sure a lot millionaire insured themselves because they can afford to. The ones that are complaining here obviously is hitting their ceiling of affordability. How many percentage of people need to give up their insurance in old age. From my friends and families, I have not encountered anyone who need to give up even after retirement. If you say paying for insurance is a burden, what makes you think people will be disciplined enough to save and self insured? How many people can do that and are able to calculate risk to self insured enough? Unless, your plan is to go government hospital when you’re old age, then it’s a different story altogether but be wary that our current cheap government hospital cost are not sustainable. That’s why government are encouraging people especially B40s to buy insurance. |

|

|

May 7 2024, 09:36 AM May 7 2024, 09:36 AM

Show posts by this member only | IPv6 | Post

#62

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

QUOTE(30624770 @ May 7 2024, 09:09 AM) Like I say before, a lot of millionaires buy insurance too even though they can self insured. Why? - Like I say before, a lot of millionaires buy insurance too even though they can self insured. Why?How many percentage of people need to give up their insurance in old age. From my friends and families, I have not encountered anyone who need to give up even after retirement. If you say paying for insurance is a burden, what makes you think people will be disciplined enough to save and self insured? How many people can do that and are able to calculate risk to self insured enough? Unless, your plan is to go government hospital when you’re old age, then it’s a different story altogether but be wary that our current cheap government hospital cost are not sustainable. That’s why government are encouraging people especially B40s to buy insurance. It's because they can afford to pay. Affordability is the issue here. You might be comfortable with the premium today but if it increases beyond ones expectations, he /she might not be able to afford it. By looking at the main post, she already started to complain about the increase in the premium of her insurance. Of course she wants to continue to be insured but if it goes too high, do you think she will be able to pay the increments? It all boils down to affordability. People should be given a full picture of how things will be when signing up for insurance. Obviously she did not expect the rise to be so much. - How many percentage of people need to give up their insurance in old age. From my friends and families, I have not encountered anyone who need to give up even after retirement. After paying for 23 years, I gave up mine. So now you know one person that gave up their policy. 2 policies actually. I was originally told after paying for 20 years, it would continue to self paid for itself until it eventually matured but after the 20th year, I called up and I was told otherwise, stating the increment of medical bills. I continue to pay diligently until the premium starts to increase exponentially, twice per year. I did a calculation and found out that it will eventually reach beyond what I am willing to pay after I retired and decided to stop it. Since I started the policy, I have paid more than half the insured sum itself by the time I decided to surrender the policy. - If you say paying for insurance is a burden, what makes you think people will be disciplined enough to save and self insured? How many people can do that and are able to calculate risk to self insured enough? Of course not a lot is capable and discipline enough to save and self insured. All I am saying is people needs to be given the right information and projection of increment that they are supposed to expect from signing up a policy. You can clearly see from the main post itself, she was not expecting such increments in the premium. Project and show them the entire cost of insurance throughout the tenure and reason with them if they are ok to go through the entire thing. No point if the person is comfortable at the beginning and ended up surrendering the policy half way through because he didn't know it will be up so much. Just give them the full picture at the beginning and adjust accordingly to their affordability level. This post has been edited by Capt. Marble: May 7 2024, 10:02 AM POYOZER liked this post

|

|

|

May 7 2024, 09:37 AM May 7 2024, 09:37 AM

|

Senior Member

3,838 posts Joined: Oct 2011 |

|

|

|

May 7 2024, 09:39 AM May 7 2024, 09:39 AM

Show posts by this member only | IPv6 | Post

#64

|

Senior Member

1,013 posts Joined: Sep 2014 |

|

|

|

May 7 2024, 09:41 AM May 7 2024, 09:41 AM

|

All Stars

15,192 posts Joined: Oct 2004 |

not fair at all

ppl misused the medical and we kena |

|

|

May 7 2024, 09:51 AM May 7 2024, 09:51 AM

Show posts by this member only | IPv6 | Post

#66

|

Junior Member

763 posts Joined: Jan 2003 |

My GE policy also like revised 2-3 times from pandemic onwards.

It's also reported by BNM's report. Inflation is very real. |

|

|

May 7 2024, 09:57 AM May 7 2024, 09:57 AM

Show posts by this member only | IPv6 | Post

#67

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Capt. Marble @ May 7 2024, 10:36 AM) - Like I say before, a lot of millionaires buy insurance too even though they can self insured. Why? There’s no way insurance companies are able to predict 100% correct what will happen in the future. Their pricing and underwriters can only underwrite a policy based on current conditions and some predictions of what inflation is going to be in the future. However, medical inflation in Malaysia has gone way above what they anticipated and the pandemic makes it worse.It's because they can afford to pay. Affordability is the issue here. You might be comfortable with the premium today but if it increases beyond ones expectations, he /she might not be able to afford it. By looking at the main post, she already started to complain about the increase in the premium of her insurance. Of course she wants to continue to be insured but if it goes too high, do you think she will be able to pay the increments? It all boils down to affordability. People should be given a full picture of how things will be when signing up for insurance. Obviously she did not expect the rise to be so much. - How many percentage of people need to give up their insurance in old age. From my friends and families, I have not encountered anyone who need to give up even after retirement. After paying for 23 years, I gave up mine. So now you know one person that gave up their policy. 2 policies actually. I was originally told after paying for 20 years, it would continue to self paid for itself until it eventually matured but after the 20th year, I called up and I was told otherwise, stating the increment of medical bills. I continue to pay diligently until the premium starts to increase exponentially, twice per year. I did a calculation and found out that it will eventually reach beyond what I am willing to pay after I retired and decided to stop it. Since I started the policy, I have paid more than half the insured sum itself by the time I decided to surrender the policy. - If you say paying for insurance is a burden, what makes you think people will be disciplined enough to save and self insured? How many people can do that and are able to calculate risk to self insured enough? Of course not a lot is capable and discipline enough to save and self insured. All I am saying is people needs to be given the right information and projection of increment that they are supposed to expect from signing up a policy. You can clearly see from the main post itself, she was not expecting such increments in the premium. Project and show them the entire cost of insurance throughout the tenure and reason with them if they are ok to go through the entire thing. No point if the person is comfortable at the beginning and ended up surrendering the policy half way through because he didn't know it will be up so much. Just give them the full picture at the beginning and adjust accordingly to their affordability level. Like I say before, unless you can self insured or plan to only go government hospitals, then go ahead and give up your insurance. There’s no right or wrong here. Most repricing will still give you an option to retain the current premium but then you will have to sacrifice some coverage. At the end of the day, it’s again the problem of our salaries has not increased in tandem with inflation which affects everything and not just insurance. Insurance is worse affected because medical inflation is a lot worse than our inflation rate. That’s why a lot of hospitals have changed their policies as nowadays a lot of minor surgeries don’t require hospitalisation anymore due to pressure from insurance companies. This post has been edited by 30624770: May 7 2024, 09:59 AM |

|

|

May 7 2024, 09:58 AM May 7 2024, 09:58 AM

|

Junior Member

938 posts Joined: Jul 2005 |

insurance was always a kok trap... and now the trap is springing up... got monei, just put it in your investments and savings and you can tap from there if you ever need monei for your medical ... you think 5k is expensive?.... what about 7k next 3 years... then 10k next 3 years... since you've already paid so much for so long... you will feel compelled to continue even with that kind of price... monei that you've put in, better put into improviing the livestyle and food and stay healthy is much more worth it... POYOZER liked this post

|

|

|

May 7 2024, 10:02 AM May 7 2024, 10:02 AM

Show posts by this member only | IPv6 | Post

#69

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(jack2 @ May 7 2024, 10:41 AM) That’s why nowadays it’s not so easy to claim medical card like last time anymore. Hospitals are more reluctant to admit people unless they are really needed. Last time, small matters also masuk hospital and people enjoy it like vacation. Minor surgery, they will discharge you within the same day if you don’t show any bad symptoms |

|

|

May 7 2024, 10:05 AM May 7 2024, 10:05 AM

Show posts by this member only | IPv6 | Post

#70

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(soul78 @ May 7 2024, 10:58 AM) insurance was always a kok trap... You sure what you save will be enough? If insurance companies with all their experts also can’t predict medical inflation, what makes you think you can save enough to cover you medical needs in the future? Unless your plan is government hospitals, then it’s a different story lah.and now the trap is springing up... got monei, just put it in your investments and savings and you can tap from there if you ever need monei for your medical ... you think 5k is expensive?.... what about 7k next 3 years... then 10k next 3 years... since you've already paid so much for so long... you will feel compelled to continue even with that kind of price... monei that you've put in, better put into improviing the livestyle and food and stay healthy is much more worth it... |

|

|

May 7 2024, 10:12 AM May 7 2024, 10:12 AM

|

Senior Member

2,119 posts Joined: Apr 2013 |

holy cow

|

|

|

May 7 2024, 10:14 AM May 7 2024, 10:14 AM

Show posts by this member only | IPv6 | Post

#72

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

QUOTE(30624770 @ May 7 2024, 09:57 AM) There’s no way insurance companies are able to predict 100% correct what will happen in the future. Their pricing and underwriters can only underwrite a policy based on current conditions and some predictions of what inflation is going to be in the future. However, medical inflation in Malaysia has gone way above what they anticipated and the pandemic makes it worse. Fair statement. There is no way the prediction will be 100% accurate. What really ticked me off was the "pay for 20 years then it will pay for itself" which turned out to be unfulfilled coupled with the exponential increment after that and when I was asking for options and alternatives to retain the insurance but without the such high increment in premium, there were no options at all other than surrendering and sign up for a new policy. If only I knew what was I getting into before I signed up and get locked in, I would have done things differently. It's not like a loan for cars which last 5-9 years or house which might go up to 30 years, this one turned out to be an endless increase forever until the day I die or surrender the policy.Like I say before, unless you can self insured or plan to only go government hospitals, then go ahead and give up your insurance. There’s no right or wrong here. Most repricing will still give you an option to retain the current premium but then you will have to sacrifice some coverage. At the end of the day, it’s again the problem of our salaries has not increased in tandem with inflation which affects everything and not just insurance. Insurance is worse affected because medical inflation is a lot worse than our inflation rate. That’s why a lot of hospitals have changed their policies as nowadays a lot of minor surgeries don’t require hospitalisation anymore due to pressure from insurance companies. This post has been edited by Capt. Marble: May 7 2024, 10:23 AM |

|

|

May 7 2024, 10:20 AM May 7 2024, 10:20 AM

Show posts by this member only | IPv6 | Post

#73

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Capt. Marble @ May 7 2024, 11:14 AM) Fair statement. There is no way the prediction will be 100% accurate. What really ticked me off was the "pay for 20 years then it will pay for itself" which turned out to be unfulfilled coupled with the exponential increment after that and when I was asking for options and alternatives to retain the insurance but without the such high increment in premium, there were no options at all other than surrendering and sign up for a new policy. If only I knew what was I getting into before I signed up and get locked in, I would have done things differently. It's not like a loan for cars which last 5-9 years or house which might go up to 30 years, this one is turned out to be an endless increase forever until the day I die or surrender the policy. Like I say before, it can’t be predicted. You ask any underwriter or actuarial people in 2018 to take into consideration a worldwide pandemic and they will probably laughed at you as it’s probably their 1 in 100 scenarios only such things happened.What my actuarial friend told me is you need to review your insurance every few years as things change and sometimes what was underwritten 20 years ago are not relevant anymore and you really buta-buta paying for useless things. If really, you see after reviewing that it’s not sustainable in the future, it’s sometimes better to terminate and take up a new policy. Capt. Marble liked this post

|

|

|

May 7 2024, 10:23 AM May 7 2024, 10:23 AM

|

Senior Member

2,119 posts Joined: Apr 2013 |

QUOTE(Capt. Marble @ May 7 2024, 10:14 AM) Fair statement. There is no way the prediction will be 100% accurate. What really ticked me off was the "pay for 20 years then it will pay for itself" which turned out to be unfulfilled coupled with the exponential increment after that and when I was asking for options and alternatives to retain the insurance but without the such high increment in premium, there were no options at all other than surrendering and sign up for a new policy. If only I knew what was I getting into before I signed up and get locked in, I would have done things differently. It's not like a loan for cars which last 5-9 years or house which might go up to 30 years, this one is turned out to be an endless increase forever until the day I die or surrender the policy. new insurance need to pay until it expires Capt. Marble liked this post

|

|

|

May 7 2024, 10:32 AM May 7 2024, 10:32 AM

Show posts by this member only | IPv6 | Post

#75

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

QUOTE(30624770 @ May 7 2024, 10:20 AM) Like I say before, it can’t be predicted. You ask any underwriter or actuarial people in 2018 to take into consideration a worldwide pandemic and they will probably laughed at you as it’s probably their 1 in 100 scenarios only such things happened. Yup that's why I surrendered mine. 23 years of premium payment down the drain with 0 claim. What was claimed to be best plan for me 20 over years ago is now totally useless.What my actuarial friend told me is you need to review your insurance every few years as things change and sometimes what was underwritten 20 years ago are not relevant anymore and you really buta-buta paying for useless things. If really, you see after reviewing that it’s not sustainable in the future, it’s sometimes better to terminate and take up a new policy. This post has been edited by Capt. Marble: May 7 2024, 10:33 AM |

|

|

May 7 2024, 10:41 AM May 7 2024, 10:41 AM

Show posts by this member only | IPv6 | Post

#76

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Capt. Marble @ May 7 2024, 11:32 AM) Yup that's why I surrendered mine. 23 years of premium payment down the drain with 0 claim. What was claimed to be best plan for me 20 over years ago is now totally useless. That’s a wrong mentality when it comes to insurance. A lot of people think like you and say all the money can be better spent as I never claimed a single sen. However, do you really want to claim? Without claiming a single sen is actually a good thing. Insurance is about protecting you from potential risk. It’s really about what if scenario only and you cannot really say it’s useless as it provided you coverage for 23 years. |

|

|

May 7 2024, 10:51 AM May 7 2024, 10:51 AM

Show posts by this member only | IPv6 | Post

#77

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

QUOTE(30624770 @ May 7 2024, 10:41 AM) That’s a wrong mentality when it comes to insurance. A lot of people think like you and say all the money can be better spent as I never claimed a single sen. However, do you really want to claim? Without claiming a single sen is actually a good thing. Insurance is about protecting you from potential risk. It’s really about what if scenario only and you cannot really say it’s useless as it provided you coverage for 23 years. Yup it's good to be protected and I wanted to continue the policy but that wasn't an option because I was priced out of what I am willing to pay for it. That was what happened to me. |

|

|

May 7 2024, 11:03 AM May 7 2024, 11:03 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Capt. Marble @ May 7 2024, 11:51 AM) Yup it's good to be protected and I wanted to continue the policy but that wasn't an option because I was priced out of what I am willing to pay for it. That was what happened to me. That's why I say you should probably take up a new policy that you can afford. That's what my actuarial friends advise. Always review your policy every few years and if you find its unsustainable, get a new policy which is more within your affordability instead of going self-insured. Capt. Marble liked this post

|

|

|

May 7 2024, 11:08 AM May 7 2024, 11:08 AM

|

Senior Member

7,617 posts Joined: Mar 2009 |

QUOTE(30624770 @ May 7 2024, 10:41 AM) That’s a wrong mentality when it comes to insurance. A lot of people think like you and say all the money can be better spent as I never claimed a single sen. However, do you really want to claim? Without claiming a single sen is actually a good thing. Insurance is about protecting you from potential risk. It’s really about what if scenario only and you cannot really say it’s useless as it provided you coverage for 23 years. A lot of ppl think like this, but hindsight is 20/20. If its the other way around eg: they got admitted, etc.. they would be thinking, thank goodness I bought insuranceEven for a simple dengue case, if u admitted to private hospital can cost 5 figures already. If cancer the cost teruk. My friend only 34 years old got breast cancer, need to go surgery and chemo, imagine u 34 how much saving u have to treat cancer? This post has been edited by annoymous1234: May 7 2024, 11:13 AM |

|

|

May 7 2024, 11:16 AM May 7 2024, 11:16 AM

Show posts by this member only | IPv6 | Post

#80

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(annoymous1234 @ May 7 2024, 12:08 PM) A lot of ppl think like this, but hindsight is 20/20. If its the other way around eg: they got admitted, etc.. they would be thinking, thank goodness I bought insurance Exactly. You don’t need to claim your insurance is actually a blessing and should be happy about it instead of thinking it’s a waste of money.Even for a simple dengue case, if u admitted to private hospital can cost 5 figures already. If cancer the cost teruk. My friend only 34 years old got breast cancer, need to go surgery and chemo, imagine u 34 how much saving u have to treat cancer? |

|

|

May 7 2024, 11:17 AM May 7 2024, 11:17 AM

|

Senior Member

1,230 posts Joined: Nov 2017 |

My medical insurance increased by 30% monthly.

There is an option to maintain current or agree to increase. Asked my agent what happens if maintain and her reply, - No reduce in benefit - will shorten sustainability of policy with insurance charge pricing then i asked 'sustainability' means what? how much shorten? no answer. |

|

|

May 7 2024, 11:29 AM May 7 2024, 11:29 AM

Show posts by this member only | IPv6 | Post

#82

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

QUOTE(annoymous1234 @ May 7 2024, 11:08 AM) A lot of ppl think like this, but hindsight is 20/20. If its the other way around eg: they got admitted, etc.. they would be thinking, thank goodness I bought insurance Even for a simple dengue case, if u admitted to private hospital can cost 5 figures already. If cancer the cost teruk. My friend only 34 years old got breast cancer, need to go surgery and chemo, imagine u 34 how much saving u have to treat cancer? QUOTE(30624770 @ May 7 2024, 11:16 AM) Exactly. You don’t need to claim your insurance is actually a blessing and should be happy about it instead of thinking it’s a waste of money. Yes it's good. That's why I bought it in the first place and stick to it for 23 years. But the premium eventually increased beyond what I expect it to, that's why I stop and have to surrender the policy. If the price is maintain or with a 5-10 increment each time, it would have been fine but no, it's way more than that. If it happens before, what is the percentage of increment will I be charged in the future? That's what bugged me and figure out at one point I will just have to give it up prematurely, so I minus well just give it up now. Just look at the main post increment. Hers is a 25% increase. This post has been edited by Capt. Marble: May 7 2024, 12:12 PM |

|

|

May 7 2024, 12:00 PM May 7 2024, 12:00 PM

|

Junior Member

4 posts Joined: Mar 2019 |

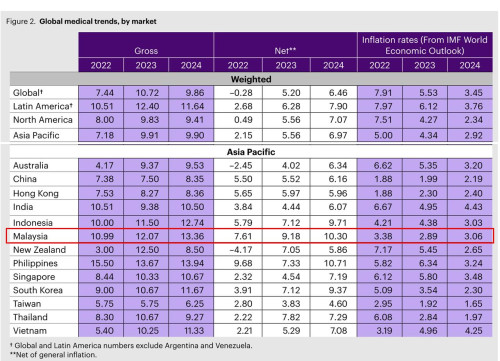

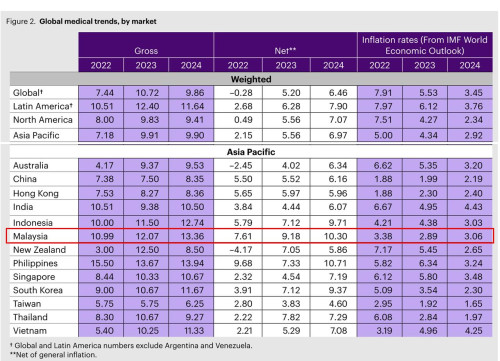

No choice.

Malaysia has the highest rate of increase in medical costs in Asia-pac in 2023. Second highest for 2024. A key reason cited by the study is our Ringgit laosai: https://www.wtwco.com/en-za/insights/2023/1...l-trends-survey  |

|

|

May 7 2024, 12:02 PM May 7 2024, 12:02 PM

Show posts by this member only | IPv6 | Post

#84

|

Senior Member

3,848 posts Joined: Dec 2009 From: Ampang |

Gomen hospital kan ada

|

|

|

May 7 2024, 12:08 PM May 7 2024, 12:08 PM

|

Junior Member

938 posts Joined: Jul 2005 |

Depopz is already happening now.... insurance company feel the pain... so price must increase...

if your leg is already in the shiet... does it even matter to hose clean the other leg not in the shiet?... you know what you've done to your body when you have made the decision to take it!... Go ask insurance company how many pepolz are falling ill and die nowadays compared to precovid!... |

|

|

May 7 2024, 12:08 PM May 7 2024, 12:08 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

and prubsn already increase their product price last few months no?

fucuk la said medical cost increase, but coverage is the same, you think people like pay more but the value offered are the same (probably worse because people said harder to claim now). |

|

|

May 7 2024, 12:13 PM May 7 2024, 12:13 PM

Show posts by this member only | IPv6 | Post

#87

|

Junior Member

763 posts Joined: Jan 2003 |

QUOTE(Capt. Marble @ May 7 2024, 11:29 AM) Yes it's good. That's why I bought it in the first place and stick to it for 23 years. But the premium eventually increased beyond what I expect it to, that's why I stop and have to surrender the policy. Why didn't downgrade to copay or coinsurance kind of medical card? The savings like quite substantial leh.If the price is maintain or with a 5-10 increment each time, it would have been fine but no, it's way more than that. If it happens before, what is the percentage of increment will I be charged in the future? That's what bugged me and figure out at one point I will just have to give it up prematurely, so I minus well just give it up now. |

|

|

May 7 2024, 12:15 PM May 7 2024, 12:15 PM

Show posts by this member only | IPv6 | Post

#88

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

QUOTE(cms @ May 7 2024, 12:13 PM) Why didn't downgrade to copay or coinsurance kind of medical card? The savings like quite substantial leh. There were no downgrade options given to me from my policy, basically asking me to continue pay or surrender the policy. Unlike car insurance which comes with NCB discount, this one tobalik.This post has been edited by Capt. Marble: May 7 2024, 12:18 PM |

|

|

May 7 2024, 12:24 PM May 7 2024, 12:24 PM

Show posts by this member only | IPv6 | Post

#89

|

Junior Member

763 posts Joined: Jan 2003 |

|

|

|

May 7 2024, 12:28 PM May 7 2024, 12:28 PM

Show posts by this member only | IPv6 | Post

#90

|

Senior Member

4,034 posts Joined: Dec 2019 |

like this, i won't be looking at renewing.

this will be 1st and last year taking medical-related insurance. |

|

|

May 7 2024, 12:29 PM May 7 2024, 12:29 PM

Show posts by this member only | IPv6 | Post

#91

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

|

|

|

May 7 2024, 12:33 PM May 7 2024, 12:33 PM

|

Junior Member

269 posts Joined: Oct 2021 |

|

|

|

May 7 2024, 12:36 PM May 7 2024, 12:36 PM

Show posts by this member only | IPv6 | Post

#93

|

Senior Member

4,034 posts Joined: Dec 2019 |

QUOTE(30624770 @ May 7 2024, 12:33 PM) i never believe in buying insurance.the whole premise is rotten. other then denying outright fraud, there shouldn't be condition at all. either cover any outcome or don't sell at all. to me, the industry exists simply to fatten the players. i already told my wife long before; if aedical emergency happens and it requires a load some of own money, just let me die, don't waste money that otherwise can be spent on the children's future and hers. This post has been edited by Oltromen Ripot: May 7 2024, 12:38 PM |

|

|

May 7 2024, 12:41 PM May 7 2024, 12:41 PM

Show posts by this member only | IPv6 | Post

#94

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Oltromen Ripot @ May 7 2024, 01:36 PM) i never believe in buying insurance. What happened if it’s your wife or children who need medical?the whole premise is rotten. other then denying outright fraud, there shouldn't be condition at all. either cover any outcome or don't sell at all. to me, the industry exists simply to fatten the players. i already told my wife long before; if aedical emergency happens and it requires a load some of own money, just let me die, don't waste money that otherwise can be spent on the children's future and hers. |

|

|

May 7 2024, 12:42 PM May 7 2024, 12:42 PM

Show posts by this member only | IPv6 | Post

#95

|

Senior Member

4,034 posts Joined: Dec 2019 |

|

|

|

May 7 2024, 12:43 PM May 7 2024, 12:43 PM

Show posts by this member only | IPv6 | Post

#96

|

Junior Member

269 posts Joined: Oct 2021 |

|

|

|

May 7 2024, 01:34 PM May 7 2024, 01:34 PM

Show posts by this member only | IPv6 | Post

#97

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

QUOTE(Roblox Malaya @ May 7 2024, 12:00 PM) No choice. Ini semua salah government because didn’t put much effort to protect our currency. Besides that, R&D still not good enough and have to import drugs and medical equipments from other countries.Malaysia has the highest rate of increase in medical costs in Asia-pac in 2023. Second highest for 2024. A key reason cited by the study is our Ringgit laosai: https://www.wtwco.com/en-za/insights/2023/1...l-trends-survey  |

|

|

May 7 2024, 01:35 PM May 7 2024, 01:35 PM

|

Junior Member

4 posts Joined: Mar 2019 |

QUOTE(POYOZER @ May 7 2024, 01:34 PM) Ini semua salah government because didn’t put much effort to protect our currency. Besides that, R&D still not good enough and have to import drugs and medical equipments from other countries. I guess lack of new doctors now also a factor driving up existing doctors pay and reducing competition. |

|

|

May 7 2024, 02:17 PM May 7 2024, 02:17 PM

Show posts by this member only | IPv6 | Post

#99

|

Newbie

14 posts Joined: Oct 2014 From: Bandar Damai dan Indah |

Kerajaan Gagal

|

|

|

May 7 2024, 02:20 PM May 7 2024, 02:20 PM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(POYOZER @ May 7 2024, 02:34 PM) Ini semua salah government because didn’t put much effort to protect our currency. Besides that, R&D still not good enough and have to import drugs and medical equipments from other countries. You tell me how to protect?Raise interest rates until match or higher than US? |

|

|

May 7 2024, 03:00 PM May 7 2024, 03:00 PM

Show posts by this member only | IPv6 | Post

#101

|

Senior Member

3,653 posts Joined: Jan 2003 From: London, Hong Kong, Subang Jaya & Cyberjaya |

QUOTE(30624770 @ May 7 2024, 02:20 PM) Encourage FDI and also local R&D. Not halau those who got talents by increasing tax and removing subsidies for T20. If continues, for sure many who got talents will migrate to other countries for better life and opportunity. No benefits to stay here for high-tier M40 and low-tier T20. Kena punish more instead of benefits. |

|

|

May 7 2024, 05:38 PM May 7 2024, 05:38 PM

|

Junior Member

421 posts Joined: Feb 2022 |

|

|

|

Nov 5 2024, 01:28 AM Nov 5 2024, 01:28 AM

|

Newbie

0 posts Joined: Nov 2018 |

QUOTE(alexandersuk @ May 7 2024, 06:55 AM) My insurance currently increase again!!! Last year they already increase my monthly sebanyak RM54, this year dorg naikkan lagi sampai RM91, which is almost RM100!!! Gila!!! Pastu bila nak claim susah betul nak approve!!! Btw, it's BSN Prudential TakafulThis post has been edited by Audrey Hepburn: Nov 5 2024, 01:29 AM |

| Change to: |  0.0351sec 0.0351sec

1.08 1.08

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 04:06 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote