» Click to show Spoiler - click again to hide... «

QUOTE(ky118 @ Apr 30 2024, 03:38 PM)

I plan to sell my condo and would like to calculate the breakeven price and the minimum selling price in order not to make a loss.

Condo price: RM405,000

Down payment: RM63,000

Loan amount: RM342,000

Monthly loan installment: RM1650

Monthly loan installment period until today: 12 years

Monthly loan installment payment until today: RM237,600 (RM1650 x 12 x 12)

Misc expenses like legal fees, stamp duty, renovation, maintenance fees, insurance, assessment: RM93,200

Rental income: RM20,000

Is my breakeven price RM373,800?

Appreciate your comments. Thanks!

QUOTE(ky118 @ Apr 30 2024, 06:36 PM)

The outstanding loan is about RM250,000. So my cost price is 250,000 + 373,800 + legal fees?

QUOTE(Cavatzu @ May 1 2024, 09:29 AM)

If we want to go really technical, you can add in an opportunity cost of fd interest if you had not bought anything and just saved your money passively.

If this threshold is met then congratulations you had an actual property investment. If not, then it’s just poorperly.

TL;DR: RM63K (Downpayment) + RM237.6K (Total Paid to Bank So Far) + RM93.2K (Misc Expenses) + RM xxx (any other Transaction Fees to sell your property i.e. agents commission, legal fees, taxes) - RM20K (Rental Income) + Outstanding Loan Settlement (RM250K) = your minimum Breakeven Price (~RM623K)

But I like to be a bit more specific in calculating the opportunity cost so I'll further add RM 88,452.62 loss of potential EPF dividend gained to the total cost, bringing the breakeven price to ~RM711.5K. Selling anything below this number means you're making a loss.

Nerds part if anyone's interested to read the calculation & the reasons to high outstanding loan balance. (can skip, but I had fun writing it so might as well post it instead of deleting it  )Opportunity Cost Calculation

)Opportunity Cost Calculation» Click to show Spoiler - click again to hide... «

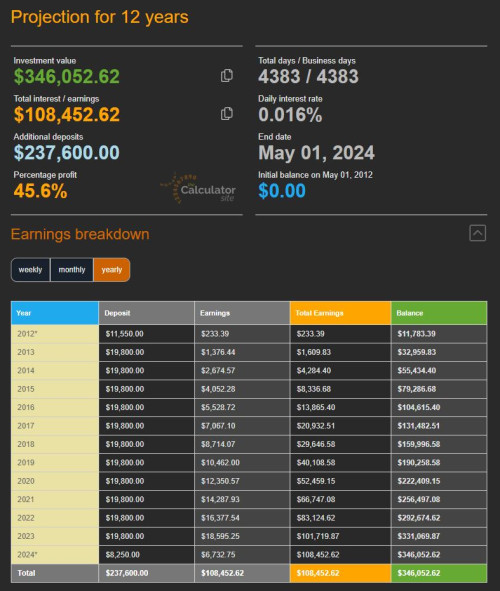

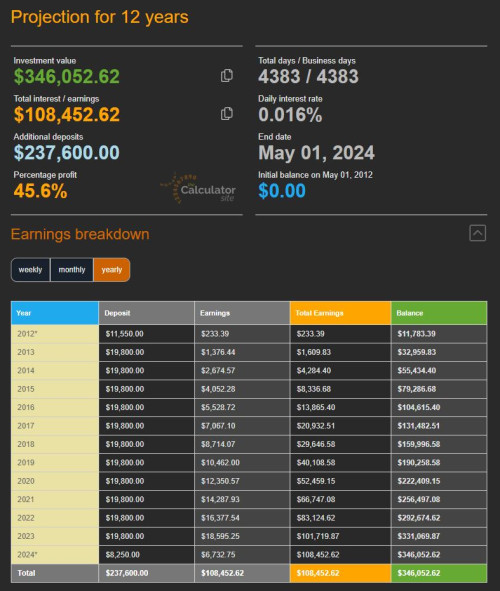

For sake of simplicity, I'm going to assume that the Opportunity Cost will be calculated where - if you had opted to deposit additional monies into your EPF account 12 years ago, you wouldn't have had the property nor rental income of RM20k. So, using 10-years average EPF historical conventional dividend rate as the benchmark since 2014 - 2023 , we'll get ~5.95%/annum of dividends return

- Deposits; RM1650 per month, totalling to RM237,600 by Y12

- Interests Earned: Vary; totalling to RM108,452.62 factoring in the effects of compounding interest

- Loss of Rental Income (since we don't have property): -RM20,000

TOTAL EARNINGS (OPPORTUNITY COST): 88,452.62 the calculation

the calculation:

To be honest I can go even more crazy - because assuming you didn't buy the property, you wouldn't have incurred all the Misc fees of RM93.2K nor having to pay RM60k+ for downpayments, and these can also be compounded via EPF/other investment vehicles, but let's leave that for another day before I ended up writing an essay

» Click to show Spoiler - click again to hide... «

In case if you wonder why after paying RM237k throughout 12 years, the outstanding loan balance is still a hefty ~RM250k (vs. RM342K loan starting balance, with only -92k principal paid....)

You only mentioned few facts about your Loan parameters where (1) that you paid RM237,600 so far and (2) loan balance is around RM250k after 12 years today; but didn't provide specifics about your loan parameters

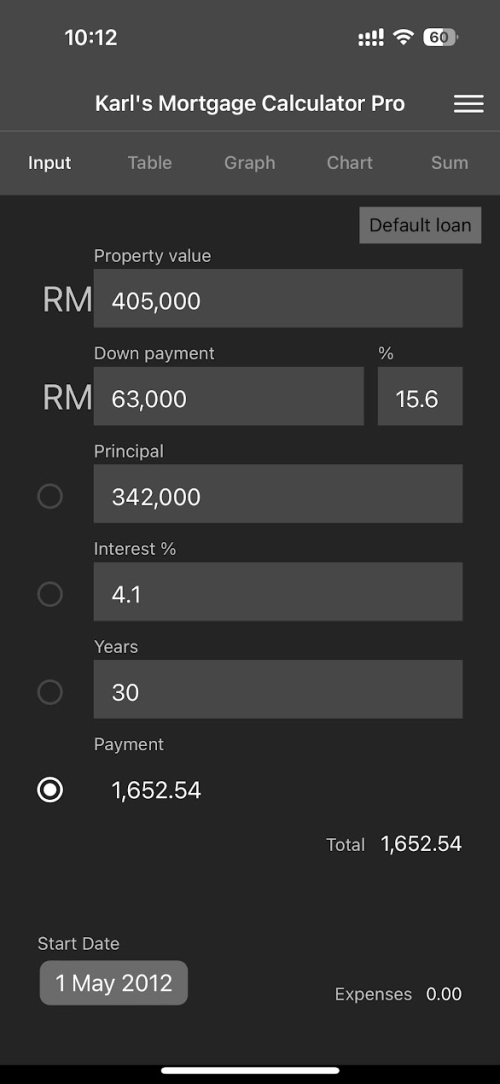

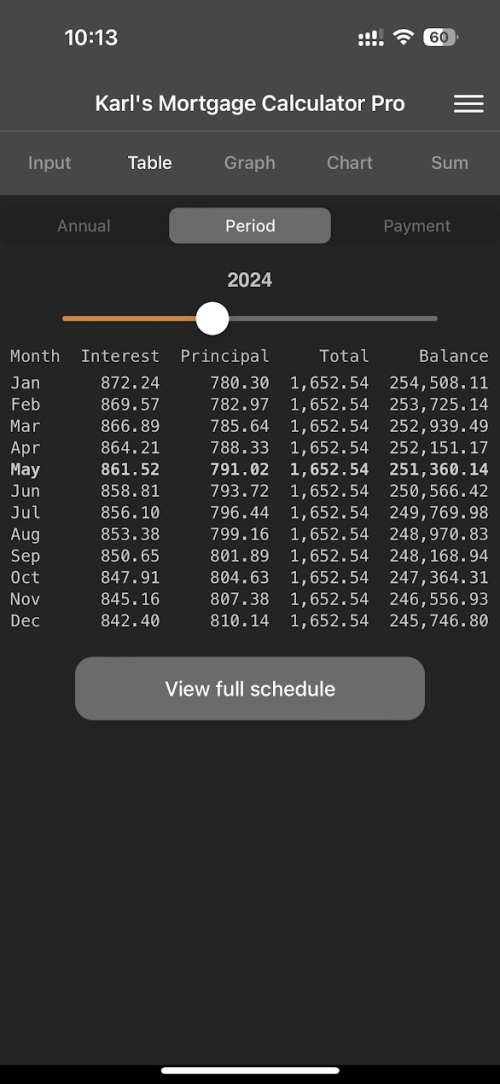

So for calculation's sake and to simulate numbers, I'm assuming it's a 30-years loan with fixed monthly payment of RM1650+/- (total inclusive interest and principal) at fixed ~4.1% interest rate

Assuming:-

QUOTE

Property value: 405,000

Down payment: 63,000 (15.6%)

Principal: 342,000

Interest: 4.1%

Payment: 1,652.54

Start date: May 2012

End date: April 2042

Term: 30 years

That means to date, with monthly payment of RM1,652.54, you have paid approximately:

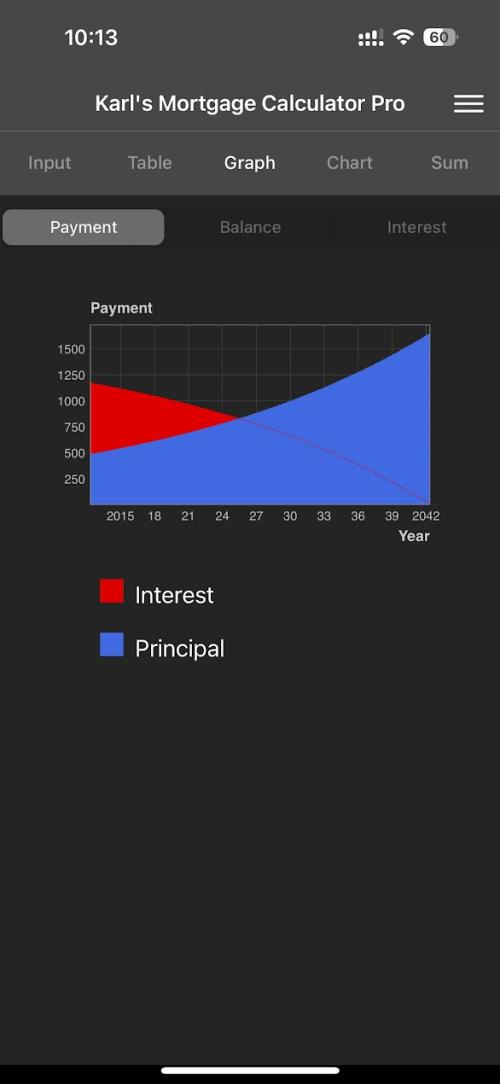

- RM89,848.83 in Principals

- RM148,116.67 in Interest Fees

- Which leaves you with ~RM252,151.17 Outstanding Loan Principal Balance as of 30 April 2024, assuming loan starts since 1 May 2012

» Click to show Spoiler - click again to hide... «

That means in the approx. RM237,600 (~RM1650 x 12 x 12) payment that you have made until today, ~62% went towards serving interest and ~38% serves principal repayment.

The amortisation schedule will favour banks mostly for Fixed Total Payment schedule, where the ratio of the contribution to be spent towards

Principal vs. Interests will differ throughout the loan tenure.

Disclaimer: Calculation for illustrative purposes, not property agent or financial advisor, please do your own due diligence checks.

EDIT: the 250k got buried in my long essay, corrected my TLDR formula

This post has been edited by polarzbearz: May 1 2024, 09:09 PM

This post has been edited by polarzbearz: May 1 2024, 09:09 PM

Apr 30 2024, 03:38 PM, updated 2y ago

Apr 30 2024, 03:38 PM, updated 2y ago

Quote

Quote

0.0195sec

0.0195sec

0.29

0.29

6 queries

6 queries

GZIP Disabled

GZIP Disabled