Outline ·

[ Standard ] ·

Linear+

House Loan Semi Flexi, Thinking dump my saving in house loan

|

viktorherald

|

Feb 4 2025, 08:48 PM Feb 4 2025, 08:48 PM

|

Getting Started

|

QUOTE(jenern84 @ Feb 3 2025, 09:46 PM) If I am not mistaken, if you pay online without notifying the bank, the paid amount will be considered as advance payment, not reducing your principle. One way to test it is directly make large advance payment like 20k, and see does it reduce your outstanding by said amount |

|

|

|

|

|

pisces88

|

Feb 4 2025, 11:32 PM Feb 4 2025, 11:32 PM

|

|

maybank mcm dun need

|

|

|

|

|

|

poweredbydiscuz

|

Feb 5 2025, 07:51 AM Feb 5 2025, 07:51 AM

|

|

QUOTE(viktorherald @ Feb 4 2025, 08:48 PM) One way to test it is directly make large advance payment like 20k, and see does it reduce your outstanding by said amount A simple call to the bank will do. |

|

|

|

|

|

shakku

|

Feb 5 2025, 11:02 AM Feb 5 2025, 11:02 AM

|

|

Few scenarios that are good to dump into flexi loan.

- you have savings, but have no idea where to park it. Parking in home mortgage helps to reduce daily interest

- You want to improve monthly cashflow, each 50k dump is equivalent to 250 monthly free up.

Else, it's better just dump the savings to higher interest rate 5-6% that will generate more value after 30 years.

|

|

|

|

|

|

RadenMasIV

|

Feb 7 2025, 11:39 AM Feb 7 2025, 11:39 AM

|

Getting Started

|

QUOTE(viktorherald @ Feb 4 2025, 08:48 PM) One way to test it is directly make large advance payment like 20k, and see does it reduce your outstanding by said amount Yes for my maybank semi flexi outstanding is reduce. End of this month I will pay my monthly normal payment. Hope less go the interest and more to principal reduction. |

|

|

|

|

|

TSshyan90's

|

Feb 7 2025, 12:43 PM Feb 7 2025, 12:43 PM

|

|

QUOTE(RadenMasIV @ Feb 7 2025, 11:39 AM) Yes for my maybank semi flexi outstanding is reduce. End of this month I will pay my monthly normal payment. Hope less go the interest and more to principal reduction. You can agak agak calculate your January interest is betul or not... example 100k balance @ 4.05% 100000x1.0405 = 104050 4050/365 = 11.09 11.09 x calendar day (31) = 343.79 (January 2025 interest) BTW, what is your interest rate for maybank? This post has been edited by shyan90's: Feb 7 2025, 12:56 PM |

|

|

|

|

|

pakjat

|

Feb 9 2025, 06:59 AM Feb 9 2025, 06:59 AM

|

New Member

|

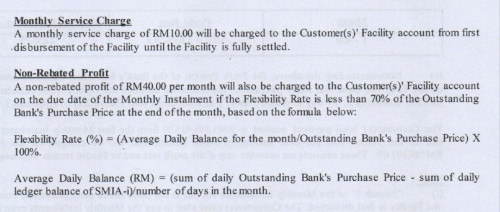

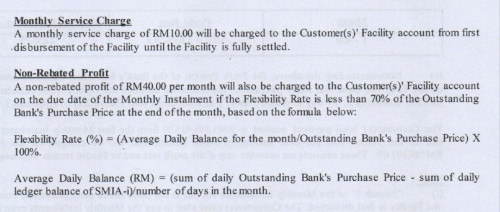

my cimb full flexi financing started in may 2023. current profit rate is 4.65%. little by little i dump in the linked current account. till today it's only 21 months (1yr 9mth). from amortization table, principal payment suppose to be rm624. but for this month, the principal payment is rm954. which equivalent to 131 months (10yr 11mth) . not so sure if this is the most effective way. just that it is very liquid to withdraw. only rm10/mth service charge for current account. and i did this only for my own stay house. from what i understand I'll get charged rm40/mth if current account has more than 70% of financing outstanding balance.  This post has been edited by pakjat: Feb 9 2025, 07:07 AM This post has been edited by pakjat: Feb 9 2025, 07:07 AM |

|

|

|

|

|

genesic

|

Feb 9 2025, 08:04 AM Feb 9 2025, 08:04 AM

|

|

QUOTE(jenern84 @ Feb 3 2025, 10:46 PM) If I am not mistaken, if you pay online without notifying the bank, the paid amount will be considered as advance payment, not reducing your principle. depends, based on my exp, my semi flexi OCBC will consider advance payment to reduce the principal. while CIMB semi flex is the real CB. you would need give instruction on the advance payment to reduce principal. otherwise they will put into special account where this sum is just sitting there doing nothing. |

|

|

|

|

|

genesic

|

Feb 9 2025, 08:07 AM Feb 9 2025, 08:07 AM

|

|

QUOTE(shakku @ Feb 5 2025, 12:02 PM) Few scenarios that are good to dump into flexi loan. - you have savings, but have no idea where to park it. Parking in home mortgage helps to reduce daily interest - You want to improve monthly cashflow, each 50k dump is equivalent to 250 monthly free up. Else, it's better just dump the savings to higher interest rate 5-6% that will generate more value after 30 years. i add in one scenario which is good to dump, - when this is your 2nd house loan and you have plan for next purchase, you clear this one and your next purchase will eligible for 90% loan.  |

|

|

|

|

|

unknown_2

|

Feb 13 2025, 03:34 PM Feb 13 2025, 03:34 PM

|

|

QUOTE(funnybone @ Feb 4 2025, 12:26 PM) Just need clarification on this. I did a semi flexi for one house. Lower the interest or the monthly instalment? The bank informed that the monthly instalment will be automatically reduced (but after a 6 mth cycle for recount). Interest should remain the same. BNM hav not adjusted BR since Q1 2023. when BNM raise BR, usually overnight u'll see your mortgage bank adjusted their rate & your payment overnight. however, if BNM slash BR, usually bank will take their sweet time, might even only lower their rate months later. |

|

|

|

|

|

funnybone

|

Feb 13 2025, 04:12 PM Feb 13 2025, 04:12 PM

|

|

QUOTE(unknown_2 @ Feb 13 2025, 03:34 PM) BNM hav not adjusted BR since Q1 2023. when BNM raise BR, usually overnight u'll see your mortgage bank adjusted their rate & your payment overnight. however, if BNM slash BR, usually bank will take their sweet time, might even only lower their rate months later. Understand about the BLR. But what I meant is for a semi flexi loan, I can gradually park money into the loan account but the interest would not change, only will reduce the monthly payment. That is what happening to one of my housing loan. Just seeking clarifications if the understanding is aligned. This post has been edited by funnybone: Feb 13 2025, 04:13 PM |

|

|

|

|

|

lioncarlsberg

|

Apr 13 2025, 10:11 AM Apr 13 2025, 10:11 AM

|

|

QUOTE(funnybone @ Feb 13 2025, 04:12 PM) Understand about the BLR. But what I meant is for a semi flexi loan, I can gradually park money into the loan account but the interest would not change, only will reduce the monthly payment. That is what happening to one of my housing loan. Just seeking clarifications if the understanding is aligned. This statement does not seem correct. If you correctly perform a payment for principal reduction, then your remaining outstanding loan should reduce and therefore the portion of your instalment charged for the interest should reduce . The monthly payment (or instalment) should remain the same. You are still obligated to pay your instalments on time. |

|

|

|

|

|

funnybone

|

Apr 14 2025, 02:52 PM Apr 14 2025, 02:52 PM

|

|

QUOTE(lioncarlsberg @ Apr 13 2025, 10:11 AM) This statement does not seem correct. If you correctly perform a payment for principal reduction, then your remaining outstanding loan should reduce and therefore the portion of your instalment charged for the interest should reduce . The monthly payment (or instalment) should remain the same. You are still obligated to pay your instalments on time. Actually to clarify, I parked the extra sum to the loan account but did not issue an instruction to the bank to offset from the principal amount. And yes, the remaining outstanding still reduce and the instalment amount reduced as well (monthly payment). However, I still continue to pay a higher instalment amount to reduce the principal loan faster. That is what I was told....hope this is as what supposedly to happen. Quite confused when the loan officer explained this. |

|

|

|

|

|

Gaia34

|

Apr 14 2025, 04:50 PM Apr 14 2025, 04:50 PM

|

|

QUOTE(funnybone @ Apr 14 2025, 03:52 PM) Actually to clarify, I parked the extra sum to the loan account but did not issue an instruction to the bank to offset from the principal amount. And yes, the remaining outstanding still reduce and the instalment amount reduced as well (monthly payment). However, I still continue to pay a higher instalment amount to reduce the principal loan faster. That is what I was told....hope this is as what supposedly to happen. Quite confused when the loan officer explained this. May i know what bank? |

|

|

|

|

|

jojolicia

|

Apr 14 2025, 05:04 PM Apr 14 2025, 05:04 PM

|

|

QUOTE(lioncarlsberg @ Apr 13 2025, 10:11 AM) This statement does not seem correct. If you correctly perform a payment for principal reduction, then your remaining outstanding loan should reduce and therefore the portion of your instalment charged for the interest should reduce . The monthly payment (or instalment) should remain the same. You are still obligated to pay your instalments on time. Free time, I kepoh a bit This is correct. The incurred interest is reduced, monthly installment amount remains the same. Meaning a bigger portion of that month installment amount goes to principal reduction (after interest). Objective. 1. Reduce total incurred interest which is your finance cost 2. A reduced repayment tenure and a principal reduction are the 2 underlying factors to your total interest incurred. This post has been edited by jojolicia: Apr 14 2025, 05:18 PM |

|

|

|

|

|

funnybone

|

Apr 14 2025, 05:53 PM Apr 14 2025, 05:53 PM

|

|

QUOTE(Gaia34 @ Apr 14 2025, 04:50 PM) Maybank |

|

|

|

|

|

N9484640

|

Apr 14 2025, 07:05 PM Apr 14 2025, 07:05 PM

|

|

QUOTE(funnybone @ Apr 14 2025, 02:52 PM) Actually to clarify, I parked the extra sum to the loan account but did not issue an instruction to the bank to offset from the principal amount. And yes, the remaining outstanding still reduce and the instalment amount reduced as well (monthly payment). However, I still continue to pay a higher instalment amount to reduce the principal loan faster. That is what I was told....hope this is as what supposedly to happen. Quite confused when the loan officer explained this. QUOTE(funnybone @ Feb 13 2025, 04:12 PM) Understand about the BLR. But what I meant is for a semi flexi loan, I can gradually park money into the loan account but the interest would not change, only will reduce the monthly payment. That is what happening to one of my housing loan. Just seeking clarifications if the understanding is aligned. this seems to me is an advance payment which does not reduce your principle amount and therefore does not reduce the interest advance payment really doesnt do anything monthly installment amount should not reduce, if reduce means its taking your previous extra payment as an advance This post has been edited by N9484640: Apr 14 2025, 07:06 PM |

|

|

|

|

|

Gaia34

|

Apr 14 2025, 07:43 PM Apr 14 2025, 07:43 PM

|

|

QUOTE(funnybone @ Apr 14 2025, 06:53 PM) My loan is with MBB as well, the mortgage officer told me that even if i put a large amount into my account, the monthly installment will remain the same, just that the bigger portion will go to reducing your principal. |

|

|

|

|

|

TSshyan90's

|

Apr 14 2025, 11:54 PM Apr 14 2025, 11:54 PM

|

|

QUOTE(Gaia34 @ Apr 14 2025, 07:43 PM) My loan is with MBB as well, the mortgage officer told me that even if i put a large amount into my account, the monthly installment will remain the same, just that the bigger portion will go to reducing your principal. This is correct. But it actually what we want, reduce interest. |

|

|

|

|

|

jomonista

|

Apr 15 2025, 01:33 AM Apr 15 2025, 01:33 AM

|

Getting Started

|

Maybank islamic semi flexi, this is what my banker told me

[24/07/2024, 15:43] N***: 1st option:

U can pay extra to save the interest, example if loan released 500k, let say u pay 400k into loan acc. Then bank only charge u interest based on 100k

This 400k still in your loan acc and if u want withdraw still can withdraw via online or branch, withdrawal fee RM25 per transaction.

2nd option:

After u transfer the 400k into loan acc, fill in the service request form and hv to walk in any branch, to inform branch to off set the payment(direct pay to the bank), if u off set the payment u cannot withdraw anymore

[24/07/2024, 15:45] m*******: Is there benefit on 2nd option?

[24/07/2024, 15:45] N***: Actually both also same. Just 1st option u still got a flexibility for your cash flow

Option 2 is direct pay to the bank, u can settle the loan faster

|

|

|

|

|

Feb 4 2025, 08:48 PM

Feb 4 2025, 08:48 PM

Quote

Quote

0.0282sec

0.0282sec

0.29

0.29

6 queries

6 queries

GZIP Disabled

GZIP Disabled