QUOTE(fongsk26 @ Apr 19 2024, 10:45 PM)

I read somewhere that they can do batch invoicing at the end of the day. So they do not have to give real time invoice.

I am in China now and their system is simple. Even hawkers can issue invoice for tax purposes. Maybe the gov is adopting the same systems.

Batch invoicing still need someone to record every single sales/purchase, else the total will not be accurate, only estimated.

Very hard for nenek kuih muih to do, especially with many low value cash sales.

Unless they use App with prefilled info, just scan QR for every sale.

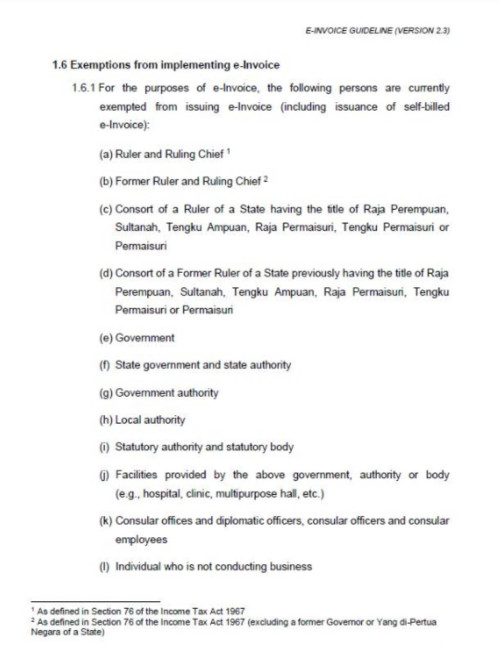

Gov does not have E-invoice app so far, only a clumsy portal that's not even up last checked. haih.

QUOTE(Zaryl @ Apr 19 2024, 10:46 PM)

i do rent my 2nd house for 2 years now. but got rental agreement & LHDN stamp duty lah. I do declare my rental income in eFiling every year without fail.

still need to provide monthly myInvois ka? i do keep excel ledger though to keep track on rental income, house maintenance and whatnot

jilake madanon!

According to gov, yes, need to key in all the details and monthly amount, but MyInvois portal not ready and no mobile app.

I read their guide, got lots of details, hopefully no need re-enter for every transaction, that would be ridiculous.

QUOTE(fongsk26 @ Apr 19 2024, 10:47 PM)

They have not even decided if your expense claims from mileage claims, entertainment claims etc need invoicing. This is what I understand from watching online explanations about the my invoices.

The user guide says need to "self issue invoice", haih.

Problem is, if people not honest, put bigger or smaller amount, how can they tell?

How many million gov auditors needed to check?

QUOTE(jayakumarsc2 @ Apr 19 2024, 10:53 PM)

when they make everything too hard and too dependent on some online portal that run by incompetents

then black market will grow

people will stick to cash, you can already see people starting to switch back to cash rather than QR

people will keep cash, even switch to foreign currency

LHDN should focus on big players , taukays, not try to push SME to e-invoice.

But gov says even cash need issue e-invoice, but if both buyer and seller berpakat, how to check? lol

Cash in cash out no invoice langsung, only can check if their bank accounts suddenly very fat.

But fat account can also transfer to Tax haven or diversify, very hard to audit.

QUOTE(jack2 @ Apr 19 2024, 11:41 PM)

e-invoice is to prevent ppl "ahem ahem" tax

Small time biz and nenek sell kuih maybe can prevent, but big time tax evader VERY hard to prevent, they long time transferred all profits to tax haven, no audit trail.

This will only make poor people's life harder, rich people keep pay little to no tax.

Apr 19 2024, 08:28 PM, updated 2y ago

Apr 19 2024, 08:28 PM, updated 2y ago

Quote

Quote

0.0588sec

0.0588sec

1.19

1.19

5 queries

5 queries

GZIP Disabled

GZIP Disabled