Outline ·

[ Standard ] ·

Linear+

US Option trader, 0DTE to 2month DTE

|

TStkwfriend

|

Apr 16 2024, 01:10 PM, updated 3 months ago Apr 16 2024, 01:10 PM, updated 3 months ago

|

|

is anyone here trade options

I would like to group up for options discussion,

Myself, most of the time day traders for options,

strategy I use Buy call/put, vertical, and butterfly. for selling the majority vertical for a few days to few weeks.

not sure can post trade for discussion ?

|

|

|

|

|

|

lamode

|

Apr 16 2024, 02:27 PM Apr 16 2024, 02:27 PM

|

|

QUOTE(tkwfriend @ Apr 16 2024, 01:10 PM) is anyone here trade options I would like to group up for options discussion, Myself, most of the time day traders for options, strategy I use Buy call/put, vertical, and butterfly. for selling the majority vertical for a few days to few weeks. not sure can post trade for discussion ? i'm swing trading options on US index. there used to be an active telegram group about options, but pretty much inactive liao since 2022 crash.  |

|

|

|

|

|

TStkwfriend

|

Apr 16 2024, 11:40 PM Apr 16 2024, 11:40 PM

|

|

QUOTE(lamode @ Apr 16 2024, 02:27 PM) i'm swing trading options on US index. there used to be an active telegram group about options, but pretty much inactive liao since 2022 crash.  is it, I always been active, 2022 was one of the best year. time to accumulate back people be more active |

|

|

|

|

|

TStkwfriend

|

Apr 18 2024, 01:06 AM Apr 18 2024, 01:06 AM

|

|

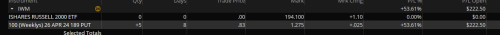

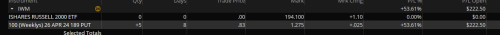

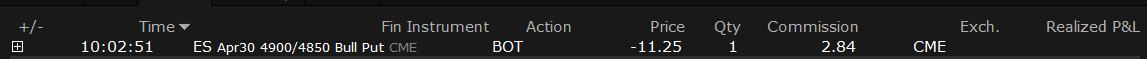

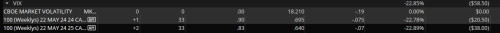

got in some position myself for current and new position

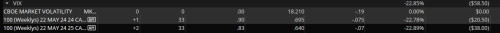

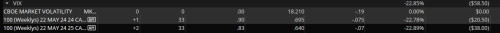

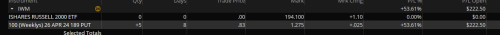

VIX 22 may 2024 25C 0.78 current

spy 23d april 495P 1.68 new

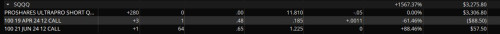

SQQQ 21jun 12C premium 0.65 current few week back

iwm 26april 189P 0.90 new

This post has been edited by tkwfriend: Apr 18 2024, 01:06 AM

|

|

|

|

|

|

danmooncake

|

Apr 18 2024, 04:08 AM Apr 18 2024, 04:08 AM

|

|

I hardly buy but mostly sell naked/spread puts or covered calls. Recently the 0DTE been pretty profitable but could be dangerous during volatile times. This week plays: Short QQQ APR 18 421P 1.00 Short DIA APR 19 375P 2.00 Let see how it goes, 2 more days to go.  |

|

|

|

|

|

Ramjade

|

Apr 18 2024, 10:27 AM Apr 18 2024, 10:27 AM

|

|

I am options seller too. Mainly doing covered/naked puts and covered calls.

|

|

|

|

|

|

lamode

|

Apr 18 2024, 11:59 AM Apr 18 2024, 11:59 AM

|

|

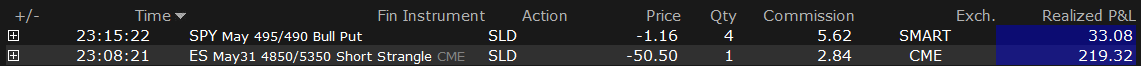

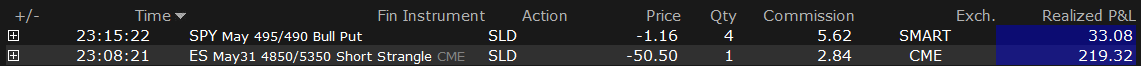

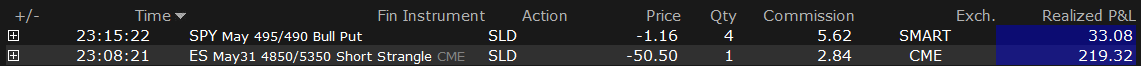

from last night... | Action | Quantity | Fin Instrument | Price | Time | | BOT | 1 | SPY May 495/490 Bull Put | -1.4 | 0:33:03 | | BOT | 3 | SPY May 495/490 Bull Put | -1.23 | 23:27:21 | | BOT | 1 | ES May31 4850/5350 Short Strangle CME | -55 | 22:22:30 |

|

|

|

|

|

|

TStkwfriend

|

Apr 18 2024, 02:53 PM Apr 18 2024, 02:53 PM

|

|

QUOTE(danmooncake @ Apr 18 2024, 04:08 AM) I hardly buy but mostly sell naked/spread puts or covered calls. Recently the 0DTE been pretty profitable but could be dangerous during volatile times. This week plays: Short QQQ APR 18 421P 1.00 Short DIA APR 19 375P 2.00 Let see how it goes, 2 more days to go.  For selling options I am building a system to screen the entire options, usually, I choose those with good returns with low risk Buying I had built my indicator in tradingview, usually, I use 1min and 5min time frames. as time approaches May 7/8 more interesting will happen. |

|

|

|

|

|

TStkwfriend

|

Apr 18 2024, 02:57 PM Apr 18 2024, 02:57 PM

|

|

QUOTE(Ramjade @ Apr 18 2024, 10:27 AM) I am options seller too. Mainly doing covered/naked puts and covered calls. This strategy is a good strategy, how do you usually find the option to do it? My target per week is about USD1k to 1.5k which so will still do, but I more focus on buying lol |

|

|

|

|

|

TStkwfriend

|

Apr 18 2024, 03:03 PM Apr 18 2024, 03:03 PM

|

|

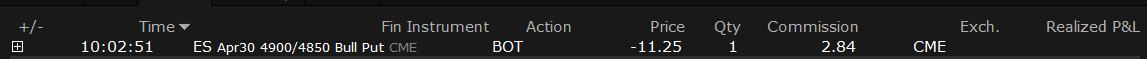

IWM after clsoing

SPY   after market Myself I love VIX a lot, because it can bring you super HIGH, always about time I will buy some as it goes. This post has been edited by tkwfriend: Apr 18 2024, 03:06 PM |

|

|

|

|

|

Ramjade

|

Apr 18 2024, 03:11 PM Apr 18 2024, 03:11 PM

|

|

QUOTE(tkwfriend @ Apr 18 2024, 02:57 PM) This strategy is a good strategy, how do you usually find the option to do it? My target per week is about USD1k to 1.5k which so will still do, but I more focus on buying lol My is USD300-450/week. Good week can earn usd1k+. For me USD20-30/week/counter enough. My usual list Nvidia Costco Mcd Accenture Snowflake Visa Linde Unp Palo alto I don't stray from the path. This post has been edited by Ramjade: Apr 18 2024, 03:13 PM |

|

|

|

|

|

TStkwfriend

|

Apr 18 2024, 03:21 PM Apr 18 2024, 03:21 PM

|

|

QUOTE(Ramjade @ Apr 18 2024, 03:11 PM) My is USD300-450/week. Good week can earn usd1k+. For me USD20-30/week/counter enough. My usual list Nvidia Costco Mcd Accenture Snowflake Visa Linde Unp Palo alto I don't stray from the path. seem capital intensive, I have not trade many in your list before other than nvida, snowflake |

|

|

|

|

|

lamode

|

Apr 18 2024, 04:45 PM Apr 18 2024, 04:45 PM

|

|

tkwfriend u trading with TDA?

how's the liquidity and bid ask spreads on VIX option compare SPY?

not sure if its because of timing, as of now, there is almost zero vol on nearest dte and the spreads are damn wide.

This post has been edited by lamode: Apr 18 2024, 04:48 PM

|

|

|

|

|

|

TStkwfriend

|

Apr 18 2024, 05:44 PM Apr 18 2024, 05:44 PM

|

|

QUOTE(lamode @ Apr 18 2024, 04:45 PM) tkwfriend u trading with TDA? how's the liquidity and bid ask spreads on VIX option compare SPY? not sure if its because of timing, as of now, there is almost zero vol on the nearest dte and the spreads are damn wide. in my many years of experience in VIX I seldom go close to 1 week expire, as many big hedging funds buy 1 month to 3 months range, further is 6 month. i had few round encounter that VIX without any volume and suddenly just come in, if you know something bad going to happen to S&P 500, I had profited from buying VIX that I bought 4th march 2024 for 44% for strike price 16. was initially loss by 70% of the premium as expecting something going to happen. liquidity and spreads at the moment still has the gap, as it coming I am expecting to have smaller gap when come to May 2024. and wider gap end of May 2024 |

|

|

|

|

|

TStkwfriend

|

Apr 18 2024, 10:37 PM Apr 18 2024, 10:37 PM

|

|

QUOTE(tkwfriend @ Apr 18 2024, 03:03 PM)  IWM after clsoing

SPY   after market Myself I love VIX a lot, because it can bring you super HIGH, always about time I will buy some as it goes. close spy, for 29% profit iwm 51% |

|

|

|

|

|

lamode

|

Apr 18 2024, 11:16 PM Apr 18 2024, 11:16 PM

|

|

QUOTE(tkwfriend @ Apr 18 2024, 10:37 PM) close spy, for 29% profit iwm 51% closed too.. your broker is TDA?  |

|

|

|

|

|

TStkwfriend

|

Apr 18 2024, 11:28 PM Apr 18 2024, 11:28 PM

|

|

QUOTE(lamode @ Apr 18 2024, 11:16 PM) closed too.. your broker is TDA?  currently is Schwab, as they bought over td back in 2019 Anyway nice profit there. |

|

|

|

|

|

lamode

|

Apr 19 2024, 10:05 AM Apr 19 2024, 10:05 AM

|

|

futures crashing now...  |

|

|

|

|

|

TStkwfriend

|

Apr 19 2024, 06:20 PM Apr 19 2024, 06:20 PM

|

|

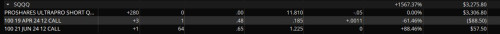

QUOTE(lamode @ Apr 19 2024, 10:05 AM) futures crashing now...  notice you like to do future spread, I am still on my SQQQ which arrive 107% on options vix doing so so looking to reenter again for iwm, spy and qqq, and maybe additional call on SQQQ |

|

|

|

|

|

lamode

|

Apr 19 2024, 07:04 PM Apr 19 2024, 07:04 PM

|

|

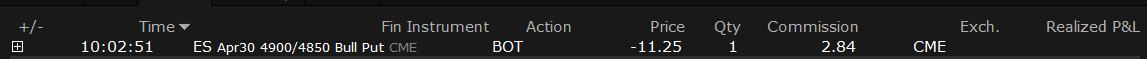

QUOTE(tkwfriend @ Apr 19 2024, 06:20 PM) notice you like to do future spread, I am still on my SQQQ which arrive 107% on options vix doing so so looking to reenter again for iwm, spy and qqq, and maybe additional call on SQQQ I tp liao. Got do SPY and QQQ ETFs also. I had to do future options this morning, it was out of trading hours for ETFs, sometimes to save a bit of comm... 1 ES = 5 SPY options. Not always manage to save though as liquidity is better in SPY. |

|

|

|

|

Apr 16 2024, 01:10 PM, updated 3 months ago

Apr 16 2024, 01:10 PM, updated 3 months ago

Quote

Quote

0.0223sec

0.0223sec

0.57

0.57

6 queries

6 queries

GZIP Disabled

GZIP Disabled