QUOTE(tkwfriend @ Apr 19 2024, 06:20 PM)

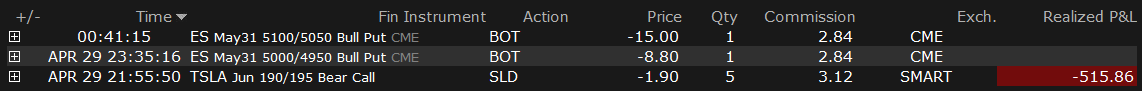

notice you like to do future spread,

I am still on my SQQQ which arrive 107% on options

vix doing so so

looking to reenter again for iwm, spy and qqq, and maybe additional call on SQQQ

SQQQ...and Options together are like juggling dynamite sticks but can also turn into bars of gold at the end of the juggling act as long you don't drop them or any of them explodes. I am still on my SQQQ which arrive 107% on options

vix doing so so

looking to reenter again for iwm, spy and qqq, and maybe additional call on SQQQ

This post has been edited by danmooncake: Apr 19 2024, 08:50 PM

Apr 19 2024, 08:49 PM

Apr 19 2024, 08:49 PM

Quote

Quote

0.0193sec

0.0193sec

0.92

0.92

6 queries

6 queries

GZIP Disabled

GZIP Disabled