lets say I buy Item from overseas online store which is a small boutique from UK ship to malaysia

and they dont know about the 10% malaysia tax

when the product enters malaysia, kastam will hold the product i bought, contact me to pay the 10% tax? then can do online payment ke to imigration or must go office

https://says.com/my/lifestyle/lvg-10-tax?ut...RxLgLwNUC7-ij3M

QUOTE

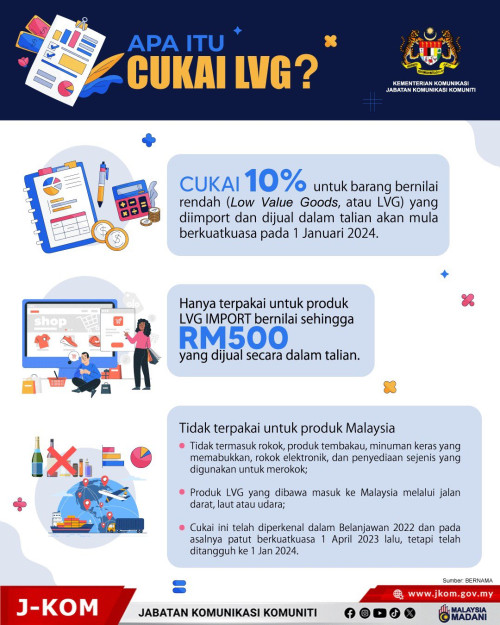

Meanwhile, sellers will need to register with RMCD

Who needs to register?

According to the department's announcement, any seller — whether in Malaysia or overseas — selling goods under RM500 that are brought into Malaysia by land, sea, or air, with a total sales value of LVG exceeding RM500,000 within 12 months, needs to register as a Registered Seller.

Registration for such sellers has been open since 1 January 2023.

The new sales tax on LVG is meant to encourage Malaysians to purchase more locally made products and to level the playing field between foreign and local sellers, who are currently subject to a 5% to 10% sales tax on items sold.

Who needs to register?

According to the department's announcement, any seller — whether in Malaysia or overseas — selling goods under RM500 that are brought into Malaysia by land, sea, or air, with a total sales value of LVG exceeding RM500,000 within 12 months, needs to register as a Registered Seller.

Registration for such sellers has been open since 1 January 2023.

The new sales tax on LVG is meant to encourage Malaysians to purchase more locally made products and to level the playing field between foreign and local sellers, who are currently subject to a 5% to 10% sales tax on items sold.

This post has been edited by Raddus: Dec 18 2023, 04:49 PM

Dec 18 2023, 04:48 PM, updated 2y ago

Dec 18 2023, 04:48 PM, updated 2y ago

Quote

Quote

0.0232sec

0.0232sec

0.44

0.44

5 queries

5 queries

GZIP Disabled

GZIP Disabled