Outline ·

[ Standard ] ·

Linear+

Banking GXBank - First Malaysian Digital Bank (by Grab), UNLIMITED 1% cashback+3% p.a. interest!

|

jacklsw86

|

Feb 22 2024, 11:09 AM Feb 22 2024, 11:09 AM

|

|

QUOTE(leanman @ Feb 22 2024, 09:47 AM) You are right, i was blinded by the 3%, which in fact it was for per annum. Unless the CC has other CB higher than 1%, as said once all these CB cards used up, it is feasible to use the GX card If you just look at getting back money, sure cash back looks better. But usage/function wise you don't compare like that. Cash back you get 1%, but you have spent 99% Daily interest 3% pa, one day your money will grow +0.03/365 |

|

|

|

|

|

jacklsw86

|

Feb 29 2024, 04:22 PM Feb 29 2024, 04:22 PM

|

|

Don't delete GXBank app if you intend to use it again some time soon. Will need to call CS to allow you to log in again and wait 12/24 hours before use.

|

|

|

|

|

|

jacklsw86

|

Mar 1 2024, 10:37 AM Mar 1 2024, 10:37 AM

|

|

QUOTE(blahbleh @ Feb 29 2024, 05:37 PM) My mistake is I uninstalled it and redownload again and it prompted that. Don't do that. If you've done that, I'm afraid you might need to call the CS. Yeah, back in last year I deposited RM 100 to get the free RM20 sign up, then withdraw all and delete the app thinking that I won't use GXbank again. Then I feel GXbank is useful to keep emergency fund and get some returns to when I added back the GXbank app again, I need to call CS to allow me to log in. |

|

|

|

|

|

jacklsw86

|

Mar 1 2024, 11:26 AM Mar 1 2024, 11:26 AM

|

|

Got enough spare time to get the free money why not?  Also their benefits managed to pull me back to use them haha |

|

|

|

|

|

jacklsw86

|

May 27 2024, 02:35 PM May 27 2024, 02:35 PM

|

|

QUOTE(ronnie @ May 27 2024, 01:21 PM) RM671 to earn 6% is better than RM671 earns 3%. Correct, right ? Some of us aim to maximize earnings from the same amount of money, that all. if you feel your time is better at other things. nothing wrong also. Thanks to those researching the small details and share the info. I'm a lazy person can just follow and try haha |

|

|

|

|

|

jacklsw86

|

Jun 18 2024, 02:37 PM Jun 18 2024, 02:37 PM

|

|

QUOTE(greyshadow @ Jun 18 2024, 10:22 AM) Just got offered a 0% BT from my bank, can get around RM30k 0% interest for 6 months. Thinking of parking it in GX to get the 3% interest, then just take out RM5k monthly from the pocket for repayment, basically it's free money, no?  anyone did something similar? Yes there is a Ezycash 0% promo with no upfront charge by Maybank which can be used to store money to generate extra income in GXBank. For 0% BT you better ask the bank. Normally they only credit the money in your other bank's credit card, not into your savings account |

|

|

|

|

|

jacklsw86

|

Sep 6 2024, 12:13 PM Sep 6 2024, 12:13 PM

|

|

Digital banks in Msia reached climax already, starting Oct 2024 all dying

Boost bank will be last digital bank standing as they started late

|

|

|

|

|

|

jacklsw86

|

Nov 18 2024, 02:59 PM Nov 18 2024, 02:59 PM

|

|

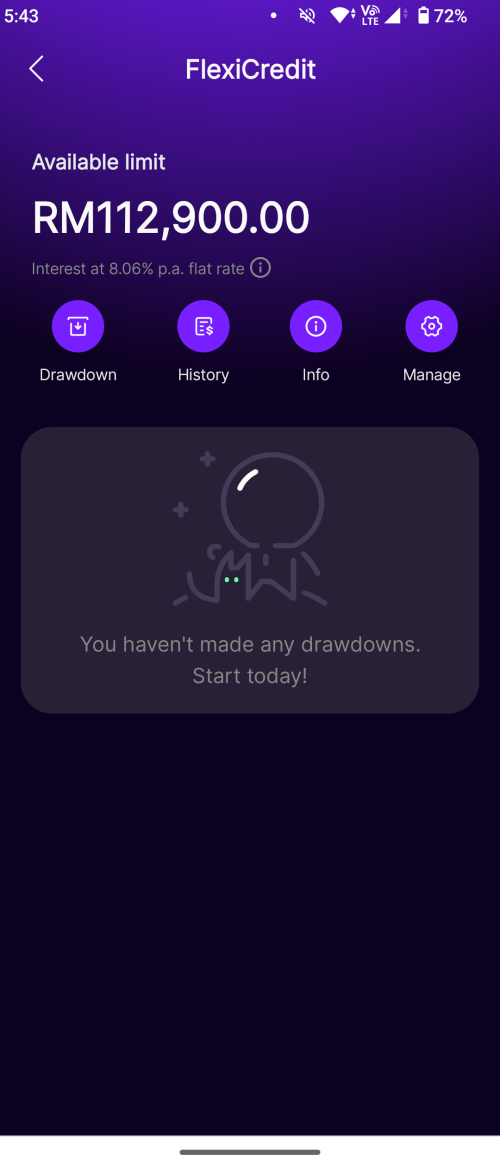

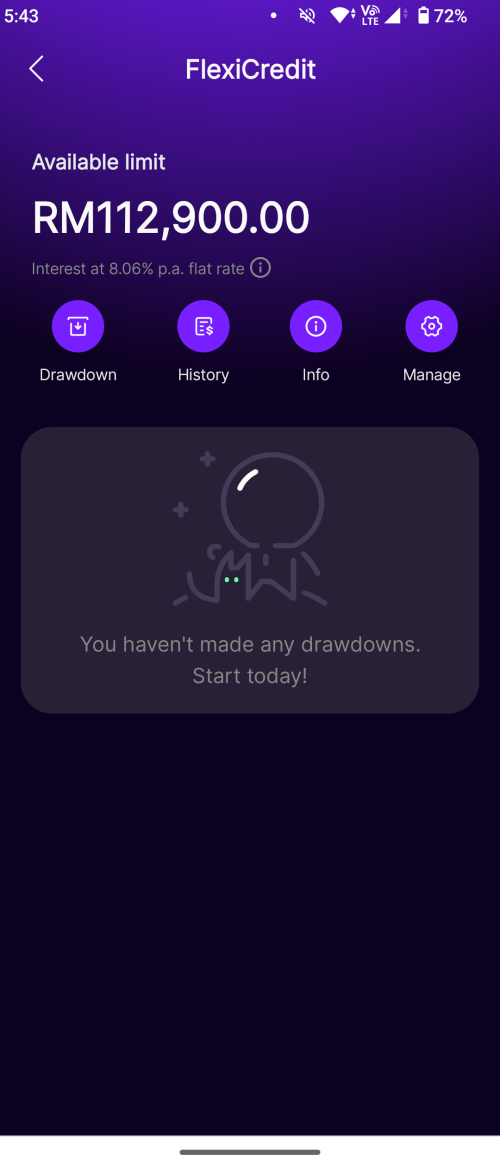

QUOTE(Mr Gray @ Nov 15 2024, 05:45 PM)  Lol 8.06% interest rate for Flexi Credit. Like Ah Long already. I better cash out from hong leong credit card for any short ter cash need. HLB always have 0% BT promo. Eventually all fintech companies become digital ah long |

|

|

|

|

Feb 22 2024, 11:09 AM

Feb 22 2024, 11:09 AM

Quote

Quote

0.0255sec

0.0255sec

1.51

1.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled