QUOTE(xiaojohn @ Oct 14 2023, 04:55 PM)

it is not....actually...

in fact, government adjust the tax base on their spending needs (which is budget)....not base on statistical bell shape distribution....

so we still keep this old tax structure until today....so sad...

everytime government want to lure MNC here by giving tax break - unker will shake my head for sure....government do not realised the real situation, or maybe they are inccapbale to do anything on it...because of 3R

well, many countries already added spending taxes and wealth transfer taxes, which Malaysia didn't really move into yet. we still love our SST, when it should be GST to be introduced.

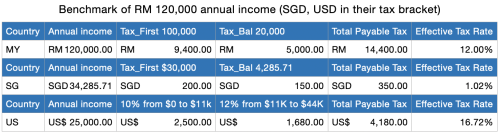

the current tax brackets in Malaysia is already too lopsided... i would have preferred everyone to pay tax, even 1% at the below 1K salary level. If intro GST, then maybe can leave the other brackets intact.

wealth tax I don't agree... cos then I will kena for all my working life effort of accumulating wealth. haha.

3R? malaysia is pretty much doomed... But I will still tell everyone that Malaysia is a great place to be your base of retirement. If want to work and earn a good and honest living, go elsewhere.

Oct 14 2023, 01:29 PM

Oct 14 2023, 01:29 PM

Quote

Quote

0.0338sec

0.0338sec

0.72

0.72

6 queries

6 queries

GZIP Disabled

GZIP Disabled