QUOTE(razr_sped @ Oct 4 2023, 04:31 PM)

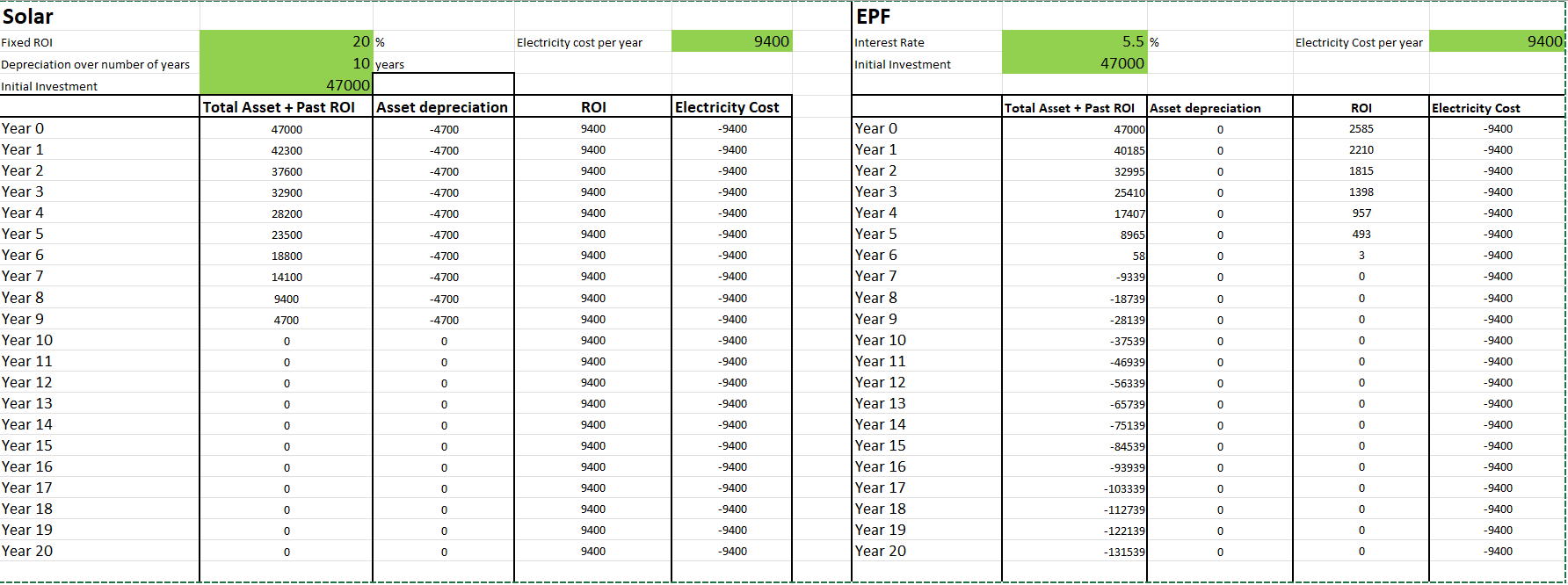

this is a little over-simplified with the assumption of 47k upfront, for most solar user it will be usually EPP of 2-5yrs card dependent.

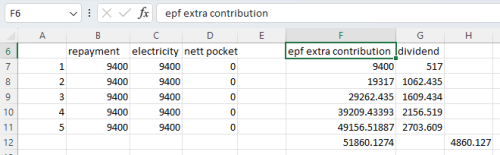

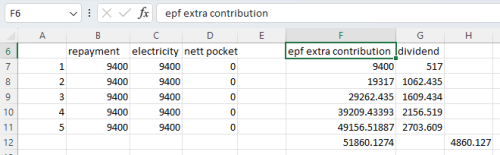

using the same logic to gradually increase the capital over the same period, you will not get 2.5k. Furthermore using epf as benchmark the dividend given also depends on when the funds goes into epf pool so it is even much lesser when partial capital funds are being inputed over the same 2-5yr period.

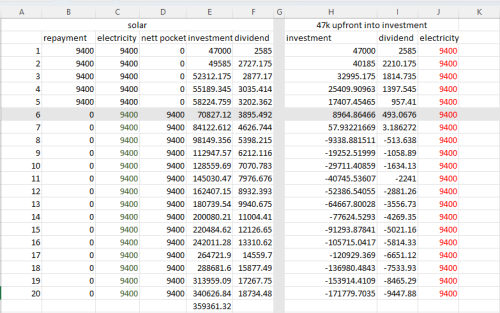

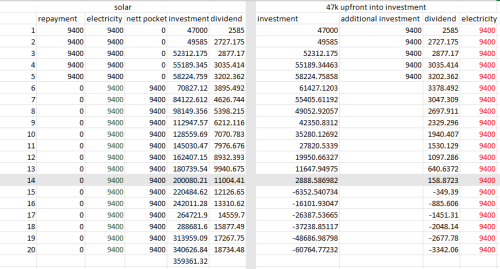

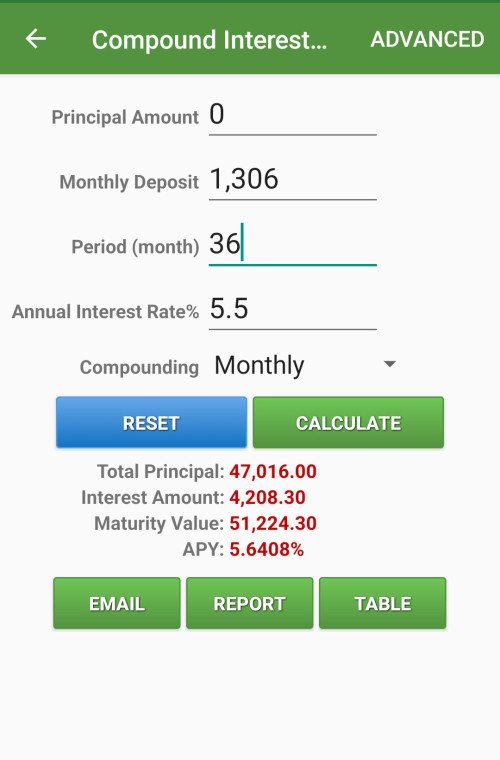

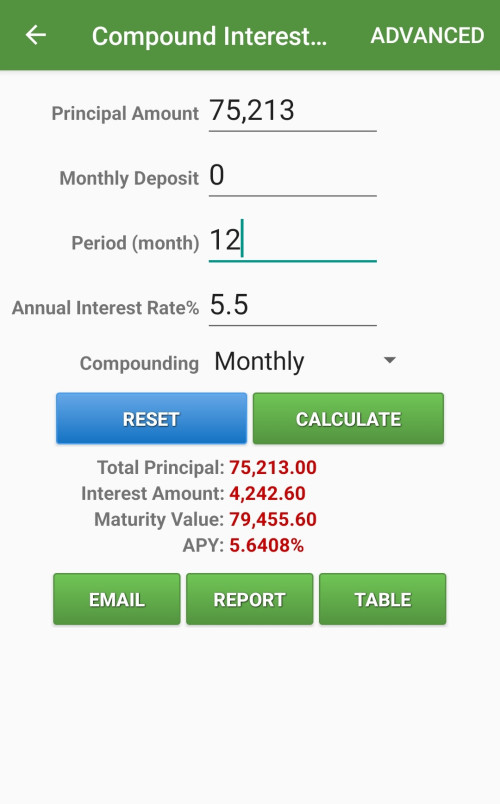

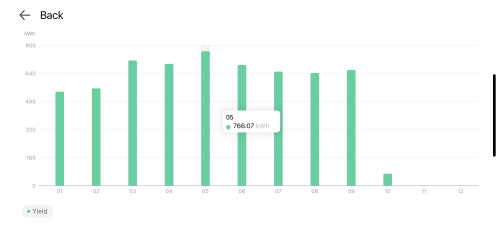

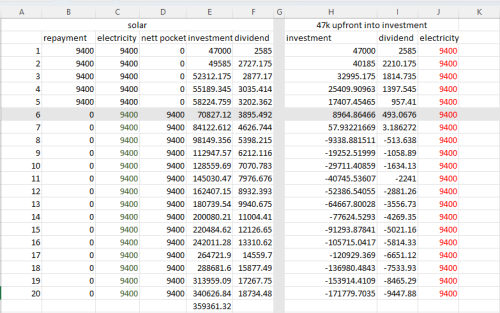

so using same way of the first 5yr where the amount is contributed to investment instrument with 5.5% (i shouldnt use epf cos that cant be taken out till 55yo) by the end of the 5yrs, it will be a little ahead with 4.8k, but then for the next 10yrs with the expectation of 15 years cycle, i could still put this extra which i dont pay to tnb now.

i'm also not using the invested fund to pay tnb as calculation, meaning one will need even more disposable income to sustain the ROI.

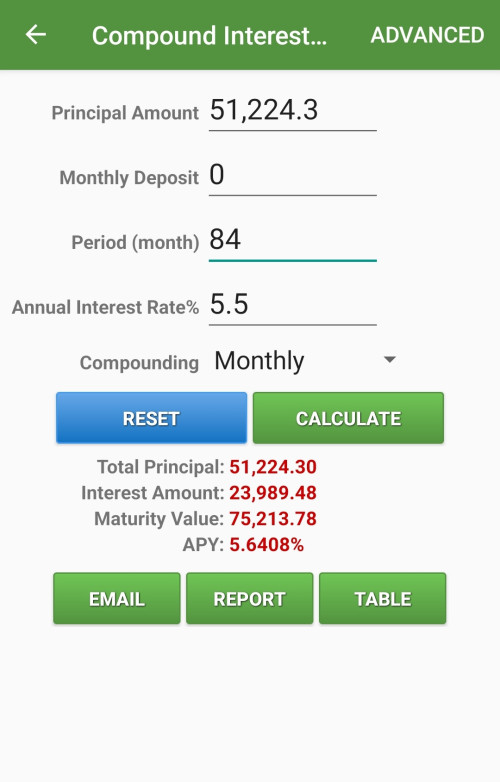

and if i have 47k upfront, then same result as yours with year 6 running out of fund if i dont put into solar.

this is of course provided after completing the EPP repayment the extra that i dont pay EPP/tnb is also put into investment instrument for the total course.

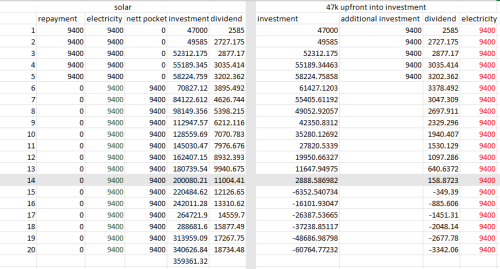

to put the field even, for the first 5yrs i'll also put in the same amount per the EPP as i should have that extra disposable income (as otherwise i wouldnt be able to pay the EPP); which by yr14 i would run out of funds.

QUOTE

so using same way of the first 5yr where the amount is contributed to investment instrument with 5.5% (i shouldnt use epf cos that cant be taken out till 55yo) by the end of the 5yrs, it will be a little ahead with 4.8k, but then for the next 10yrs with the expectation of 15 years cycle, i could still put this extra which i dont pay to tnb now.

i'm also not using the invested fund to pay tnb as calculation, meaning one will need even more disposable income to sustain the ROI.

If you don't take invested fund to pay TNB as if you take from another source , it means the amount of capital used is higher , which means it no longer is 47k but 47k + extra money to pay TNB bill.

I'm trying to make it apple and apples as much as possible, you have 47K money and 9.4k electricity expense every year. Which would come up at the top?

This post has been edited by Drian: Oct 5 2023, 12:18 PM

Oct 3 2023, 12:22 PM

Oct 3 2023, 12:22 PM

Quote

Quote

0.0934sec

0.0934sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled