QUOTE(Angelpoli @ Aug 25 2024, 10:21 PM)

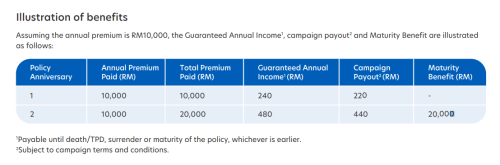

Example, u put 10k u get 4.6% for 10k first year.

Then 2nd year u top up another 10k then u get another 4.6% for 10k(first year) + 10k(2nd year top up). Maturity at end of 2nd year where u get to withdraw everything u put in plus the 4.6% interest. I think quite straight forward.

If really can get 2.4% + 2.2% = 4.6% return pa x 2 years

with free life and TPD insurance thrown in.

This is really the best "FD", i would want to buy the MAX of it.

i bought RM1000 just to get hold of a Policy,

the campaign 2.2% extra is no where stated in there

so i emailed my Policy number to Prudential ask if my policy qualified for that 4.6% pa

this the reply from Prudential...

"......The product is giving 2.4 guarantee annual payout but currently under campaign additional of 2.20 percent.

If you entitle under the campaign yes, it would be 4.6 percent meanwhile under normal purchase product it only would be 2.4 percent. Total premium paid is guaranteed after the policy is matured............."

and he pointed out the clause..

The Organisers shall have the right to decide in respect of all matters and disputes concerning this

Campaign in accordance with treating Eligible Customers fairly, including substituting the Campaign

Payout(s) with other form of gifts/rewards of equivalent value.

you try call Prudential or UOB see what info you can get........

read the T&C ourselves, it seems there is quota for that..

quota sudah penuh tak dapat 4.6% how?

buy 2 policies how? only 1st Policy entitled for 4.6%

they dont know the asnwer.

this is the reply from Prudential

"....You may contact uob to confim the offer and maximum is RM 50,000.00 per life tranche----"

i only bought RM1000, still he was not able to tell me yes, you can buy more until max RM50k.

This post has been edited by guy3288: Aug 25 2024, 11:32 PM

May 24 2023, 10:58 PM, updated 2y ago

May 24 2023, 10:58 PM, updated 2y ago

Quote

Quote

0.0303sec

0.0303sec

1.28

1.28

6 queries

6 queries

GZIP Disabled

GZIP Disabled