Any members here part of AHAM Capital or have invested with them?

AHAM Capital, (Formally Affin Hwang Asset Management)

AHAM Capital, (Formally Affin Hwang Asset Management)

|

|

Mar 22 2023, 05:00 PM, updated 3y ago Mar 22 2023, 05:00 PM, updated 3y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

123 posts Joined: Mar 2013 |

Any members here part of AHAM Capital or have invested with them?

|

|

|

|

|

|

Mar 22 2023, 05:03 PM Mar 22 2023, 05:03 PM

Show posts by this member only | Post

#2

|

Senior Member

3,158 posts Joined: Oct 2013 |

Yes, PRS

|

|

|

Mar 22 2023, 05:31 PM Mar 22 2023, 05:31 PM

Show posts by this member only | IPv6 | Post

#3

|

Senior Member

4,499 posts Joined: Mar 2014 |

Yes, client. |

|

|

Mar 22 2023, 05:39 PM Mar 22 2023, 05:39 PM

Show posts by this member only | Post

#4

|

All Stars

48,521 posts Joined: Sep 2014 From: REality |

QUOTE(eggplants @ Mar 22 2023, 05:00 PM) Any problem?Or u want to know some of their products lolabunny123 and MUM liked this post

|

|

|

Mar 22 2023, 08:14 PM Mar 22 2023, 08:14 PM

Show posts by this member only | IPv6 | Post

#5

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Mar 22 2023, 08:41 PM Mar 22 2023, 08:41 PM

Show posts by this member only | IPv6 | Post

#6

|

Senior Member

1,773 posts Joined: Dec 2013 |

Versa

|

|

|

|

|

|

Mar 22 2023, 09:45 PM Mar 22 2023, 09:45 PM

Show posts by this member only | IPv6 | Post

#7

|

Senior Member

1,616 posts Joined: Jul 2016 |

Are u referring to some bond series specifically? Otherwise not much of issue.

The bond currently suspended from trading but still accruing interest. Waiting to see what is their next step. All bonds have this kind of risk. |

|

|

Mar 23 2023, 03:32 AM Mar 23 2023, 03:32 AM

Show posts by this member only | IPv6 | Post

#8

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(Cookie101 @ Mar 22 2023, 09:45 PM) Are u referring to some bond series specifically? Otherwise not much of issue. When the bond series suspended by AHAM it still has a nominal value of at least 30% value coupled with 15% of portfolio in cash hence it still have value of close to 50% The bond currently suspended from trading but still accruing interest. Waiting to see what is their next step. All bonds have this kind of risk. The next step is to claim back the nominal value from FINMA and CS only will only process the bond value either through swap or payoff from CS which only happens once the merger is completed by September |

|

|

Mar 23 2023, 12:37 PM Mar 23 2023, 12:37 PM

Show posts by this member only | Post

#9

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Mar 23 2023, 03:32 AM) When the bond series suspended by AHAM it still has a nominal value of at least 30% value coupled with 15% of portfolio in cash hence it still have value of close to 50% Referring to the item in bold, how do you derive this values?The next step is to claim back the nominal value from FINMA and CS only will only process the bond value either through swap or payoff from CS which only happens once the merger is completed by September FINMA has indicated that the bond value for AT1 is write down to ZERO. Did FINMA say that the AT1 holders will get something?? https://www.ft.com/content/3f405e6d-d4a3-46...ba-3ec9cf4f7054 |

|

|

Mar 23 2023, 12:55 PM Mar 23 2023, 12:55 PM

Show posts by this member only | IPv6 | Post

#10

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Mar 23 2023, 12:37 PM) Referring to the item in bold, how do you derive this values? 30% is based on the last traded value from AHAM and they have stated in the press statement that the fund has 15% in cash FINMA has indicated that the bond value for AT1 is write down to ZERO. Did FINMA say that the AT1 holders will get something?? https://www.ft.com/content/3f405e6d-d4a3-46...ba-3ec9cf4f7054 FINMA only indicated the value is Zero meaning the losses is being write down but the bonds are still having a nominal value because it is not completely zero because the write down is only the losses but not the value of the paper 🤦♀️ At the end of the day it is up to CS to decide what course of action being taken on whether bond swaps, new bonds issuance or equity swap with the blessing of SNB |

|

|

Mar 23 2023, 02:10 PM Mar 23 2023, 02:10 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Mar 23 2023, 12:55 PM) 30% is based on the last traded value from AHAM and they have stated in the press statement that the fund has 15% in cash Press statement, do you have a link? Their communique didn't mention anything about that.FINMA only indicated the value is Zero meaning the losses is being write down but the bonds are still having a nominal value because it is not completely zero because the write down is only the losses but not the value of the paper 🤦♀️ At the end of the day it is up to CS to decide what course of action being taken on whether bond swaps, new bonds issuance or equity swap with the blessing of SNB I am skeptical about what you mention, paper loss, as it seems its a total loss based on most major financial media reportings. In any case, its academic now, will see how it plays out. |

|

|

Mar 23 2023, 04:27 PM Mar 23 2023, 04:27 PM

Show posts by this member only | IPv6 | Post

#12

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Mar 23 2023, 02:10 PM) Press statement, do you have a link? Their communique didn't mention anything about that. https://www.theedgemarkets.com/node/659947I am skeptical about what you mention, paper loss, as it seems its a total loss based on most major financial media reportings. In any case, its academic now, will see how it plays out. You need to check Bloomberg because the value is still there before suspension It is still not total loss because it is not a realised loss until they totally liquidate completely 🤦♀️ FINMA is actually forcing some party to carry losses and that party will have to decide what to do with it whether to write down or not hence why UBS is asking for liquidity guarantee or backstop in order to hold losses UBS already requested 9billion earlier from SNB to cover at least 60% but it is still pending Sometimes you need to take media reporting me with pinch of a salt as they tend overblown it 🤦♀️ Just wait for UBS statement on what they do next within this 6 months upon merger |

|

|

Mar 23 2023, 04:47 PM Mar 23 2023, 04:47 PM

|

Junior Member

123 posts Joined: Mar 2013 |

|

|

|

|

|

|

Mar 23 2023, 04:58 PM Mar 23 2023, 04:58 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Mar 23 2023, 04:27 PM) https://www.theedgemarkets.com/node/659947 Not everyone has visibility but its not wrong to ask and take it the wrong way.You need to check Bloomberg because the value is still there before suspension It is still not total loss because it is not a realised loss until they totally liquidate completely 🤦♀️ FINMA is actually forcing some party to carry losses and that party will have to decide what to do with it whether to write down or not hence why UBS is asking for liquidity guarantee or backstop in order to hold losses UBS already requested 9billion earlier from SNB to cover at least 60% but it is still pending Sometimes you need to take media reporting me with pinch of a salt as they tend overblown it 🤦♀️ Just wait for UBS statement on what they do next within this 6 months upon merger The factsheet at at 28 Feb 23 for both series 2 and 4 states 95.6%(AT1)/4.4%(Cash) and 95.7%(AT1)/4.3%(cash) respectively. Still highly doubtful that AT1 investors will get anything (even though paper value suggest otherwise), if it is open and shut, folks like Lazard, Pimco, Artemis won't be launching a suit over the shotgun marriage made by FINMA and UBS. Definitely, exciting times. |

|

|

Mar 23 2023, 05:17 PM Mar 23 2023, 05:17 PM

Show posts by this member only | IPv6 | Post

#15

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Mar 23 2023, 04:58 PM) Not everyone has visibility but its not wrong to ask and take it the wrong way. The fund fact sheet was taken by end of Feb hence there is lagged of 15 days on what did AHAM hence they might have liquidate some of the bonds which they are able to cut the losses and shore up the cash pile to 15%The factsheet at at 28 Feb 23 for both series 2 and 4 states 95.6%(AT1)/4.4%(Cash) and 95.7%(AT1)/4.3%(cash) respectively. Still highly doubtful that AT1 investors will get anything (even though paper value suggest otherwise), if it is open and shut, folks like Lazard, Pimco, Artemis won't be launching a suit over the shotgun marriage made by FINMA and UBS. Definitely, exciting times. PimCo is launching suit because they are holding most of the AT1s by CS and the suit is alleged because there is clause between them and it was breach of certain clause that triggers the suit Just wait for next month meeting from FINMA and SNB to see the actual scale because I got a gut feeling now they are liquidating some of the gold reserves to shore the liquidity in this crisis This wouldn’t have happen if the other SNB would have extend another line of credit to CS and now they are bearing a billion in losses just on the equities holding 🤦♀️ This post has been edited by xander2k8: Mar 23 2023, 05:18 PM aurora97 liked this post

|

|

|

Mar 23 2023, 06:59 PM Mar 23 2023, 06:59 PM

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(eggplants @ Mar 23 2023, 04:47 PM) Would like to know anyone have used them and their experience dealing with them. Is there minimum amount of capital for using them? Aham is a large Malaysian asset manager offering many types of products. So the minimum amount is dependant on the product you are investing in.Lowest I think would be their PRS fund with minimum of RM100 as initial investment. Their unit trust is RM1000. Highest would be if you buy a wholesale bond with them. That would be like minimum USD200,000 for a USD wholesale bond. This post has been edited by Cubalagi: Mar 23 2023, 06:59 PM |

|

|

Mar 23 2023, 08:00 PM Mar 23 2023, 08:00 PM

Show posts by this member only | IPv6 | Post

#17

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(eggplants @ Mar 23 2023, 04:47 PM) Would like to know anyone have used them and their experience dealing with them. Is there minimum amount of capital for using them? So far so good as their CS is quite efficient in getting back to you if you have any enquires in the morning and by afternoon will sort it out easily Minimum is at RM10 for MMF to certain UTs at 100 to 250k minimum for wholesale bond Downside if no promo or vouchers be prepared to pay high SC 🤦♀️ |

|

|

Mar 23 2023, 09:39 PM Mar 23 2023, 09:39 PM

Show posts by this member only | IPv6 | Post

#18

|

Junior Member

184 posts Joined: Sep 2006 |

QUOTE(aurora97 @ Mar 23 2023, 04:58 PM) Swiss regulator defends $17bn wipeout of AT1 bonds in Credit Suisse dealQUOTE The additional tier 1 (AT1) bonds in question contained explicit contractual language that they would be “completely written down in a ‘viability event’ in particular if extraordinary government support is granted”, Finma said. This allowed the regulator to prioritise equity holders ahead of AT1 holders. QUOTE “[The] instruments in Switzerland are designed in such a way that they are written down or converted into [equity] before the equity capital of the bank concerned is completely used up or written down,” it said, pointing out that the bonds were designed for the use of sophisticated institutional investors because of their risky hybrid nature. » Click to show Spoiler - click again to hide... « |

|

|

Apr 3 2023, 06:33 AM Apr 3 2023, 06:33 AM

|

Junior Member

263 posts Joined: Aug 2017 |

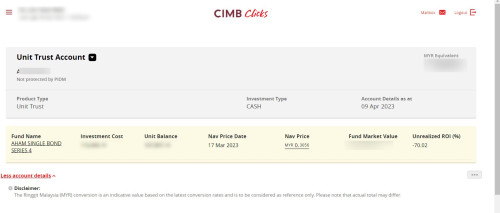

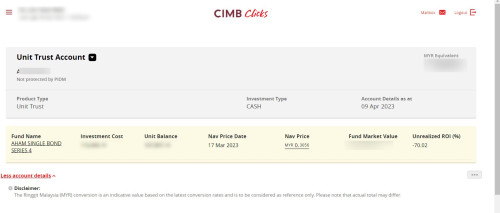

bought AHAM single bond series 4 through CIMB

|

|

|

Apr 3 2023, 07:54 AM Apr 3 2023, 07:54 AM

Show posts by this member only | IPv6 | Post

#20

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 3 2023, 11:12 AM Apr 3 2023, 11:12 AM

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

Apr 3 2023, 11:28 AM Apr 3 2023, 11:28 AM

Show posts by this member only | IPv6 | Post

#22

|

Senior Member

4,499 posts Joined: Mar 2014 |

|

|

|

Apr 3 2023, 11:53 AM Apr 3 2023, 11:53 AM

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

Apr 3 2023, 12:12 PM Apr 3 2023, 12:12 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Mar 23 2023, 03:32 AM) When the bond series suspended by AHAM it still has a nominal value of at least 30% value coupled with 15% of portfolio in cash hence it still have value of close to 50% what about AHAM Single bond series 2 and 4 ?The next step is to claim back the nominal value from FINMA and CS only will only process the bond value either through swap or payoff from CS which only happens once the merger is completed by September |

|

|

Apr 3 2023, 02:53 PM Apr 3 2023, 02:53 PM

Show posts by this member only | IPv6 | Post

#25

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 10 2023, 03:56 AM Apr 10 2023, 03:56 AM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 3 2023, 02:53 PM) Despite of Credit Suisse Bond writing down to "ZERO" (NO VALUE AT ALL), below info of AHAM SINGLE BOND SERIES 4(Product Highlights Sheet) and Screenshot of CIMB Clicks web (UT Account section)Following info extract from one of AHAMs document: Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF KEY PRODUCT FEATURES: Investment Strategy: The Fund will be investing directly into a single-credit bond. The remaining NAV of the Fund will be in money market instruments, deposits, derivatives, and/or any other form of investments as may be determined by the Manager from time to time that is in line with the Fund’s objective. The Fund may invest in foreign market. Asset Allocation • A minimum of 60% of the Fund’s NAV to be invested in bond; and • A maximum of 40% of the Fund’s NAV to be invested in money market instrument and/or deposits.. Following screenshot from CIMB Clicks: As per app last NAV Price was 0.3056 @ 17 MAC 2023, with Unrealized ROI (%) -70.02  I still see numbers under FUND MARKET VALUE |

|

|

Apr 10 2023, 10:43 AM Apr 10 2023, 10:43 AM

Show posts by this member only | IPv6 | Post

#27

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 10 2023, 03:56 AM) Despite of Credit Suisse Bond writing down to "ZERO" (NO VALUE AT ALL), below info of AHAM SINGLE BOND SERIES 4(Product Highlights Sheet) and Screenshot of CIMB Clicks web (UT Account section) Which means you just lose 70% which they allocate to AT1 bonds while 30% is still in MMF or liquid depositsFollowing info extract from one of AHAMs document: Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF KEY PRODUCT FEATURES: Investment Strategy: The Fund will be investing directly into a single-credit bond. The remaining NAV of the Fund will be in money market instruments, deposits, derivatives, and/or any other form of investments as may be determined by the Manager from time to time that is in line with the Fund’s objective. The Fund may invest in foreign market. Asset Allocation • A minimum of 60% of the Fund’s NAV to be invested in bond; and • A maximum of 40% of the Fund’s NAV to be invested in money market instrument and/or deposits.. Following screenshot from CIMB Clicks: As per app last NAV Price was 0.3056 @ 17 MAC 2023, with Unrealized ROI (%) -70.02  I still see numbers under FUND MARKET VALUE |

|

|

Apr 11 2023, 05:31 AM Apr 11 2023, 05:31 AM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 10 2023, 10:43 AM) Which means you just lose 70% which they allocate to AT1 bonds while 30% is still in MMF or liquid deposits Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? |

|

|

Apr 11 2023, 05:41 AM Apr 11 2023, 05:41 AM

Show posts by this member only | IPv6 | Post

#29

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(csbong87 @ Apr 11 2023, 05:31 AM) Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? Just asking, ....do you still hv documented evidence of communication or instruction to liquidate that fund when nav was still at 0.80? |

|

|

Apr 11 2023, 11:53 AM Apr 11 2023, 11:53 AM

Show posts by this member only | IPv6 | Post

#30

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 05:31 AM) Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? Did you have any written standing instruction as proof of execution?Verbal would be very hard to proof He has the right to blame AHAM because he can instruct but execution by the fund house itself This is why never ever buy from 3rd party particularly banks because it is out their hands unlike buying direct from the fund house where you locked in the projected price |

|

|

Apr 11 2023, 12:03 PM Apr 11 2023, 12:03 PM

Show posts by this member only | IPv6 | Post

#31

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(csbong87 @ Apr 11 2023, 05:31 AM) Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? You make the complaint to the bank official channel first. Go check cimb website for how to complaint. The bank will be obligated to respond.Draft your complaint properly. Maybe get a lawyer friend to help draft it. Get ready supporting documents. Other than not following instructions, was there also misseling? A lot of bankers get away with misselling financial products without properly informing client of the risk. If not happy with the Bank response then can go to BNM, SC and or Financial Ombudsman for further action. |

|

|

Apr 11 2023, 02:26 PM Apr 11 2023, 02:26 PM

|

Junior Member

263 posts Joined: Aug 2017 |

Replying to respondents of the forum members. I have file a complaint via CIMB's CRU unit regarding this and certain Rules and ACT that the banker did not follow.

A meeting was made on 27/03/2023 with representative from AHAM, Regional Director, Investment Specialist and Branch Manager of CIMB, but non unable to reply when questioned the rights of liquidating and baring the cost of loses. |

|

|

Apr 11 2023, 02:37 PM Apr 11 2023, 02:37 PM

Show posts by this member only | IPv6 | Post

#33

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(csbong87 @ Apr 11 2023, 02:26 PM) Replying to respondents of the forum members. I have file a complaint via CIMB's CRU unit regarding this and certain Rules and ACT that the banker did not follow. They just kept quite when asked? Or they gives answers which you think is not answering it?A meeting was made on 27/03/2023 with representative from AHAM, Regional Director, Investment Specialist and Branch Manager of CIMB, but non unable to reply when questioned the rights of liquidating and baring the cost of loses. Dud you question them again? |

|

|

Apr 11 2023, 02:50 PM Apr 11 2023, 02:50 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(MUM @ Apr 11 2023, 02:37 PM) They just kept quite when asked? Or they gives answers which you think is not answering it? Pending CIMB's CRU unit to reply my E-Mail. Kept quite when asked during the meeting regarding rights of liquidating and who's going to bare the loses.Dud you question them again? |

|

|

Apr 11 2023, 02:59 PM Apr 11 2023, 02:59 PM

Show posts by this member only | IPv6 | Post

#35

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 02:26 PM) Replying to respondents of the forum members. I have file a complaint via CIMB's CRU unit regarding this and certain Rules and ACT that the banker did not follow. Ask for follow up come Sept A meeting was made on 27/03/2023 with representative from AHAM, Regional Director, Investment Specialist and Branch Manager of CIMB, but non unable to reply when questioned the rights of liquidating and baring the cost of loses. QUOTE(csbong87 @ Apr 11 2023, 02:50 PM) Pending CIMB's CRU unit to reply my E-Mail. Kept quite when asked during the meeting regarding rights of liquidating and who's going to bare the loses. You should check the prospectus and see whether you got any loopholes or your rights as the deed holders to question them bankSuggest find some one in the legal field who does legal banking for advise on the prospectus itself Seems the meeting itself was show to shift the blame to AHAM but the banker himself know that he is the wrong for not executing your standing instructions AHAM can’t answer you that much unless the Investment Board or fund manager who can give you a better answer on the liquidation Only Stashaway can answer with the similar situation with KWEB debacle last year 🤦♀️ |

|

|

Apr 11 2023, 03:52 PM Apr 11 2023, 03:52 PM

|

Senior Member

577 posts Joined: Aug 2005 |

their ETF products are also suspended & no longer traded

|

|

|

Apr 11 2023, 04:06 PM Apr 11 2023, 04:06 PM

Show posts by this member only | IPv6 | Post

#37

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 11 2023, 04:55 PM Apr 11 2023, 04:55 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 11 2023, 02:59 PM) Ask for follow up come Sept Below paragraph extracted from AHAMs PRODUCT HIGHLIGHT SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4):You should check the prospectus and see whether you got any loopholes or your rights as the deed holders to question them bank Suggest find some one in the legal field who does legal banking for advise on the prospectus itself Seems the meeting itself was show to shift the blame to AHAM but the banker himself know that he is the wrong for not executing your standing instructions AHAM can’t answer you that much unless the Investment Board or fund manager who can give you a better answer on the liquidation Only Stashaway can answer with the similar situation with KWEB debacle last year 🤦♀️ "5. What are the possible outcomes of my investment? This Fund is a wholesale bond fund that invests primarily in a single-credit bond. The performance of the Fund would be dependent on the bond that the Fund invests in. The Fund’s performance is reliant on the Manager’s expertise in managing the Fund to meet its objective. Unlike fixed deposits which generally provide a guarantee on capital invested and carry specific rate of return, the Fund’s investment into the bond does not provide a guarantee on capital contributed nor does it guarantee a fixed rate of return." The Fund endeavours to distribute income, if any, on an annual basis. However, the amount of income available for distribution may fluctuate from year to year. Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF Different from what our CIMB's bank manager says regarding on capital guarantee. |

|

|

Apr 11 2023, 05:10 PM Apr 11 2023, 05:10 PM

Show posts by this member only | IPv6 | Post

#39

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 04:55 PM) Below paragraph extracted from AHAMs PRODUCT HIGHLIGHT SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4): Standard fund disclaimer hence it is already proven that the fault is not in AHAM hands"5. What are the possible outcomes of my investment? This Fund is a wholesale bond fund that invests primarily in a single-credit bond. The performance of the Fund would be dependent on the bond that the Fund invests in. The Fund’s performance is reliant on the Manager’s expertise in managing the Fund to meet its objective. Unlike fixed deposits which generally provide a guarantee on capital invested and carry specific rate of return, the Fund’s investment into the bond does not provide a guarantee on capital contributed nor does it guarantee a fixed rate of return." The Fund endeavours to distribute income, if any, on an annual basis. However, the amount of income available for distribution may fluctuate from year to year. Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF Different from what our CIMB's bank manager says regarding on capital guarantee. Do you have any written or actual recorded verbal communication on capital guarantee as you can file a civil claim against the bank manager and CIMB for product disclosure return misleading and confusing to customers? Most likely you have file via tribunal 1st and if the tribunal is not able to make a decision satisfactory to both parties then you drag to civil court claim Make them feel the pain for product and putting customer negligence on handling of your funds and only worth it if you are talking of losses more than tm100k which I am sure it is even higher |

|

|

Apr 11 2023, 05:16 PM Apr 11 2023, 05:16 PM

Show posts by this member only | IPv6 | Post

#40

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(csbong87 @ Apr 11 2023, 04:55 PM) Below paragraph extracted from AHAMs PRODUCT HIGHLIGHT SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4): Did cimb represent to you a capital guarantee?"5. What are the possible outcomes of my investment? This Fund is a wholesale bond fund that invests primarily in a single-credit bond. The performance of the Fund would be dependent on the bond that the Fund invests in. The Fund’s performance is reliant on the Manager’s expertise in managing the Fund to meet its objective. Unlike fixed deposits which generally provide a guarantee on capital invested and carry specific rate of return, the Fund’s investment into the bond does not provide a guarantee on capital contributed nor does it guarantee a fixed rate of return." The Fund endeavours to distribute income, if any, on an annual basis. However, the amount of income available for distribution may fluctuate from year to year. Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF Different from what our CIMB's bank manager says regarding on capital guarantee. This post has been edited by Cubalagi: Apr 11 2023, 05:17 PM |

|

|

Apr 11 2023, 05:57 PM Apr 11 2023, 05:57 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 11 2023, 05:10 PM) Standard fund disclaimer hence it is already proven that the fault is not in AHAM hands No written or recorded verbal communication on our CIMB's bank manager says that bond principal is guaranteed.Do you have any written or actual recorded verbal communication on capital guarantee as you can file a civil claim against the bank manager and CIMB for product disclosure return misleading and confusing to customers? Most likely you have file via tribunal 1st and if the tribunal is not able to make a decision satisfactory to both parties then you drag to civil court claim Make them feel the pain for product and putting customer negligence on handling of your funds and only worth it if you are talking of losses more than tm100k which I am sure it is even higher |

|

|

Apr 12 2023, 07:31 AM Apr 12 2023, 07:31 AM

|

Junior Member

263 posts Joined: Aug 2017 |

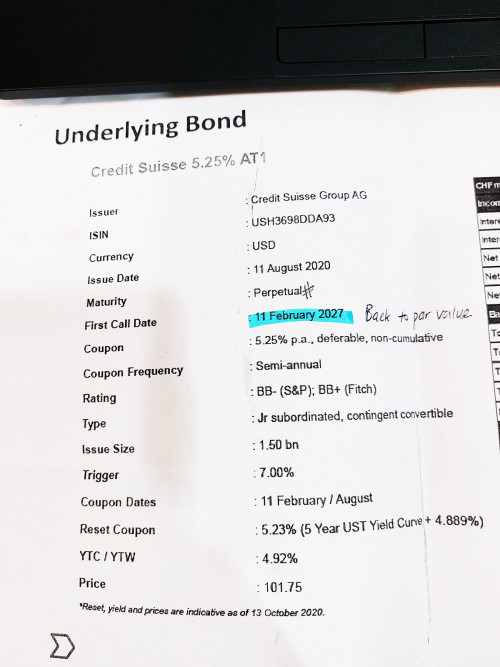

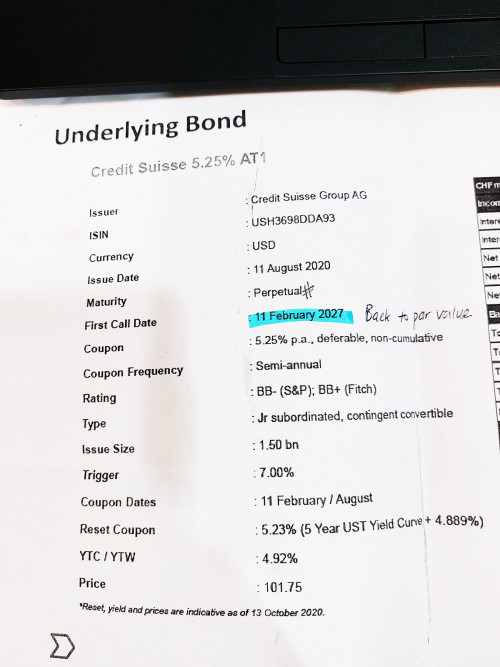

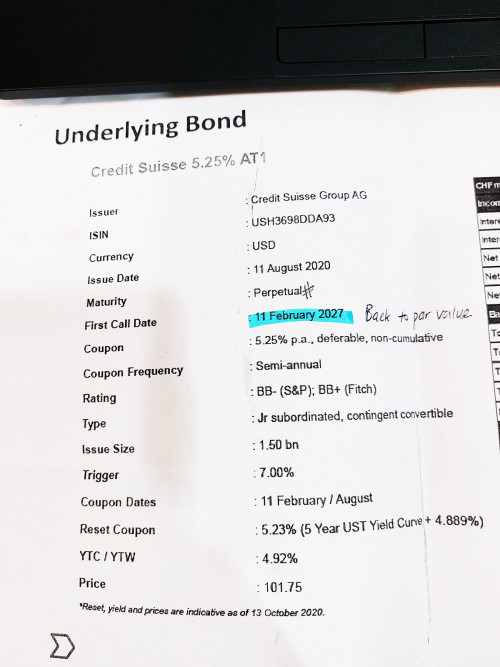

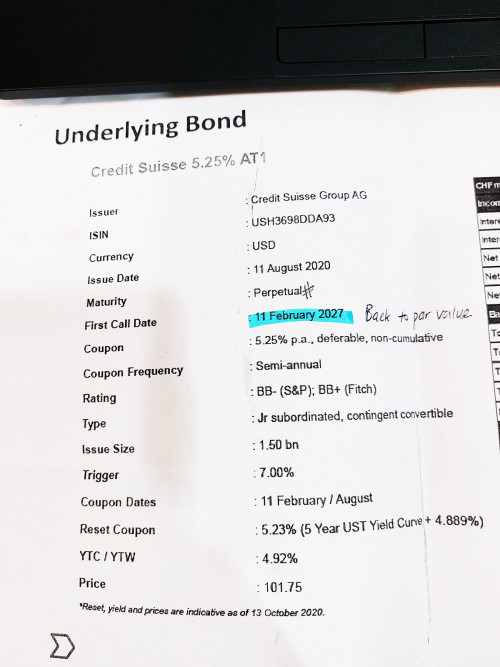

QUOTE(Cubalagi @ Apr 11 2023, 05:16 PM) Given only the below document, but did not disclose AHAM's side on capital not guaranteed as stated in it's PRODUCT HIGHLIGHTS SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4) This post has been edited by csbong87: Apr 12 2023, 07:36 AM |

|

|

Apr 12 2023, 07:48 AM Apr 12 2023, 07:48 AM

Show posts by this member only | IPv6 | Post

#43

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(csbong87 @ Apr 12 2023, 07:31 AM) Given only the below document, but did not disclose AHAM's side on capital not guaranteed as stated in it's PRODUCT HIGHLIGHTS SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4) Sorry, just kay poh and just for talking kok only. Do you mean the word "back to par value" written on that paper? I think this is none admissive legally, as there is no company chop, no name of person writing it, etc etc. And also it did highlight Feb 2027, ...so have to wait till then to be back to value? |

|

|

Apr 12 2023, 09:18 AM Apr 12 2023, 09:18 AM

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(csbong87 @ Apr 12 2023, 07:31 AM) Given only the below document, but did not disclose AHAM's side on capital not guaranteed as stated in it's PRODUCT HIGHLIGHTS SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4) So the bank did not share with you the Aham prodict disclsoure sheet? I think you should still complaint on the basis of misleading sales practice as you were not made fully aware of the risk of the product, in addition to the not following instructions to liquidate. Right now follow up on the banks response. After that, if unsatisfactory, get ready to escalate to the relevant authorities. |

|

|

Apr 12 2023, 11:44 AM Apr 12 2023, 11:44 AM

Show posts by this member only | IPv6 | Post

#45

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 05:57 PM) No written or recorded verbal communication on our CIMB's bank manager says that bond principal is guaranteed. Then you can file an internal dispute with CIMB via CRU If not next steps report BNM if CIMB cannot give satisfactory answer There is so much you can do and a learn lesson to be learn never buy any financial products from a 3rd party and buy it as directly as possible to avoid such thing whenever bad things happened |

|

|

Apr 12 2023, 11:49 AM Apr 12 2023, 11:49 AM

Show posts by this member only | IPv6 | Post

#46

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 12 2023, 07:31 AM) Given only the below document, but did not disclose AHAM's side on capital not guaranteed as stated in it's PRODUCT HIGHLIGHTS SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4) Wah before you bought it you never check the rating itself it is already red flagged as it shown on your sheet 🤦♀️ QUOTE(Cubalagi @ Apr 12 2023, 09:18 AM) So the bank did not share with you the Aham prodict disclsoure sheet? Not possible now because the proof of product mislead 🤦♀️I think you should still complaint on the basis of misleading sales practice as you were not made fully aware of the risk of the product, in addition to the not following instructions to liquidate. Right now follow up on the banks response. After that, if unsatisfactory, get ready to escalate to the relevant authorities. The CIMB officer itself confuse him to submit the bond based on what he is shown and practice from this discussions The red flagged itself was the bond rating which in hindsight it should be check and verified before buying it especially those in B range rating which can be very confusing itself |

|

|

Apr 12 2023, 12:09 PM Apr 12 2023, 12:09 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(MUM @ Apr 12 2023, 07:48 AM) Sorry, just kay poh and just for talking kok only. Ya, because it's a bank and it's CIMB and it's what the bank manager said to us.Do you mean the word "back to par value" written on that paper? I think this is none admissive legally, as there is no company chop, no name of person writing it, etc etc. And also it did highlight Feb 2027, ...so have to wait till then to be back to value? MUM liked this post

|

|

|

Apr 12 2023, 12:24 PM Apr 12 2023, 12:24 PM

Show posts by this member only | IPv6 | Post

#48

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 14 2023, 07:13 AM Apr 14 2023, 07:13 AM

|

Junior Member

263 posts Joined: Aug 2017 |

CommodoreAmiga liked this post

|

|

|

Apr 14 2023, 07:36 AM Apr 14 2023, 07:36 AM

Show posts by this member only | IPv6 | Post

#50

|

All Stars

14,931 posts Joined: Mar 2015 |

What to do if you suspect a mis-selling has occurred? https://www.sidrec.com.my/publications/guid...ssion-malaysia/ Attached thumbnail(s)

Cubalagi liked this post

|

|

|

Apr 14 2023, 10:10 AM Apr 14 2023, 10:10 AM

Show posts by this member only | IPv6 | Post

#51

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

Apr 14 2023, 12:44 PM Apr 14 2023, 12:44 PM

Show posts by this member only | IPv6 | Post

#52

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 14 2023, 10:10 AM) Pressure AHAM to join the lawsuit Even if Swiss Parliament votes against the merger no point because the regulator have the final say 🤦♀️ csbong87 liked this post

|

|

|

Apr 17 2023, 03:08 PM Apr 17 2023, 03:08 PM

|

Junior Member

263 posts Joined: Aug 2017 |

Alerting forum members whose friends or relative that has purchased AHAM SINGLE BOND SERIES 2 AND 4 through CIMB to kindly leave a contact info, we are forming a WhatsApp group to keep each other updates relating to this recent bond write off to zero. Thanks. Cubalagi liked this post

|

|

|

Apr 17 2023, 03:47 PM Apr 17 2023, 03:47 PM

Show posts by this member only | IPv6 | Post

#54

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(csbong87 @ Apr 17 2023, 03:08 PM) Alerting forum members whose friends or relative that has purchased AHAM SINGLE BOND SERIES 2 AND 4 through CIMB to kindly leave a contact info, we are forming a WhatsApp group to keep each other updates relating to this recent bond write off to zero. Thanks. Many Japanese holders with this CS bondhttps://www.bloomberg.com/news/articles/202...peout#xj4y7vzkg This post has been edited by Cubalagi: Apr 17 2023, 03:48 PM csbong87 liked this post

|

|

|

Apr 17 2023, 04:58 PM Apr 17 2023, 04:58 PM

|

Junior Member

263 posts Joined: Aug 2017 |

https://chng.it/DmjfcnLDDg 4 have signed. Let’s get to 5! This post has been edited by csbong87: Apr 17 2023, 04:58 PM csbong87 liked this post

|

|

|

Apr 21 2023, 05:11 PM Apr 21 2023, 05:11 PM

Show posts by this member only | IPv6 | Post

#56

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 17 2023, 03:08 PM) Alerting forum members whose friends or relative that has purchased AHAM SINGLE BOND SERIES 2 AND 4 through CIMB to kindly leave a contact info, we are forming a WhatsApp group to keep each other updates relating to this recent bond write off to zero. Thanks. Finally lawsuit is in already suing the regulators https://www.reuters.com/business/finance/cr...-ft-2023-04-21/ |

|

|

Apr 23 2023, 04:51 PM Apr 23 2023, 04:51 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 21 2023, 05:11 PM) Finally lawsuit is in already suing the regulators AHAM filing lawsuit ?https://www.reuters.com/business/finance/cr...-ft-2023-04-21/ |

|

|

Apr 23 2023, 04:56 PM Apr 23 2023, 04:56 PM

Show posts by this member only | IPv6 | Post

#58

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 23 2023, 05:02 PM Apr 23 2023, 05:02 PM

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

Apr 23 2023, 05:13 PM Apr 23 2023, 05:13 PM

Show posts by this member only | IPv6 | Post

#60

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 23 2023, 05:02 PM) You should pose the question to them 🤦♀️Firstly are they direct holders of the AT1 bonds or through are other means and if they are is the bonds still in their holdings or has been sold and written off as losses as you and I won’t know unless they have disclosed it publicly Filing this lawsuit is not just about the money 🤦♀️ It is whether you have the legal expertise to fight this in Swiss courts which is why those big foreign institutions like in US and Japan are banding to fight it in those courts |

|

|

Apr 23 2023, 05:18 PM Apr 23 2023, 05:18 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 23 2023, 05:13 PM) You should pose the question to them 🤦♀️ so what is CIMB Malaysia and AHAM doing ? waiting the news to spread like fire to the whole nation ?Firstly are they direct holders of the AT1 bonds or through are other means and if they are is the bonds still in their holdings or has been sold and written off as losses as you and I won’t know unless they have disclosed it publicly Filing this lawsuit is not just about the money 🤦♀️ It is whether you have the legal expertise to fight this in Swiss courts which is why those big foreign institutions like in US and Japan are banding to fight it in those courts |

|

|

Apr 23 2023, 06:32 PM Apr 23 2023, 06:32 PM

|

Junior Member

263 posts Joined: Aug 2017 |

Extract from CC FINAL TERM SHEET (ISIN: USH3698DDA93)

USD 1,500,000,000 5.250% PERPETUAL TIER 1 CONTINGENT WRITE-DOWN CAPITAL NOTES (THE “NOTES”) FINAL TERM SHEET Joint Lead Managers: Banco Bilbao Vizcaya Argentaria, S.A. Natixis Securities Americas LLC UniCredit Bank AG Santander Investment Securities Inc. Scotia Capital (USA) Inc. Wells Fargo Securities, LLC Co-Managers: ABN AMRO Securities (USA) LLC CIBC World Markets Corp. ING Financial Markets LLC NatWest Markets Securities Inc. Rabo Securities USA, Inc SG Americas Securities, LLC TD Securities (USA) LLC Banco de Sabadell, S.A. BMO Capital Markets Corp. BNY Mellon Capital Markets, LLC CaixaBank, S.A. Capital One Securities, Inc. Citigroup Global Markets Inc. Citizens Capital Markets, Inc. Danske Bank A/S Deutsche Bank Securities Inc. HSBC Securities (USA) Inc. Landesbank Baden-Württemberg Lloyds Bank Corporate Markets Wertpapierhandelsbank GmbH Morgan Stanley & Co. LLC Nordea Bank Abp RBC Capital Markets, LLC Standard Chartered Bank |

|

|

Apr 23 2023, 06:53 PM Apr 23 2023, 06:53 PM

Show posts by this member only | IPv6 | Post

#63

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 24 2023, 01:15 AM Apr 24 2023, 01:15 AM

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

Apr 24 2023, 02:18 AM Apr 24 2023, 02:18 AM

Show posts by this member only | IPv6 | Post

#65

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 24 2023, 07:50 AM Apr 24 2023, 07:50 AM

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

Apr 24 2023, 03:32 PM Apr 24 2023, 03:32 PM

Show posts by this member only | IPv6 | Post

#67

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 24 2023, 07:12 PM Apr 24 2023, 07:12 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(MUM @ Apr 14 2023, 07:36 AM) What to do if you suspect a mis-selling has occurred? There is pro and con taking your case to SIDREC. They have jurisdiction over claims not exceeding RM 250K. If your investment say is RM 1 Million and you win the case, the UTMC will only be obliged to pay you RM 250K. https://www.sidrec.com.my/publications/guid...ssion-malaysia/ SIDREC is less formal and more sympathetic to investors. Hence, if say the amount you are claiming is within the ball park of RM 250K, it may be viable to file a claim or if you are willing to take some losses, example you invested RM 300K, you will forgo the RM 50K. A court process will definitively be the most preferred route, that is... if you have the financial clout to fight both CIMB and AHAM's lawyers. Unless it's a class action suit (i.e. all the unit holders of the fund band together and fight), its unlikely an individual will be able to sustain the momentum of the suit. Do seek professional advice on this, each route will have its pro and con, it will require time and resources, and sheer f will and commitment to see it through. This post has been edited by aurora97: Apr 24 2023, 07:13 PM |

|

|

Apr 24 2023, 07:15 PM Apr 24 2023, 07:15 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

|

|

|

Apr 24 2023, 07:25 PM Apr 24 2023, 07:25 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Apr 23 2023, 06:53 PM) Then you should pose the question the fund house 🤦♀️ Not true, indeed they are merely distributing the fund, however they still have to market and sell it. If the bank had sold the product as though it was a fixed deposit, this may give rise a claim (example Singapore and HK Mini Bond incident, i think some investors got back their money because of representations made by the bank).CIMB will easily absolve its responsibility because they are only just fund distributor The problem is the quality or the evidence adduced by the complainant. In this case, the person mentioned all were communicated "verbally". Likelihood, the complainant will get his / her complaint stomped bloody by a wall of terms and conditions, which ironically includes the fact that you should read the offering documents before completing the application form and coupled with the fact that only Sophisticated investors can purchase such products. So it seems whatever argument the complainant has, it's shaky at best and ability to move the needle is negligible. |

|

|

Apr 24 2023, 07:54 PM Apr 24 2023, 07:54 PM

Show posts by this member only | IPv6 | Post

#71

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Apr 24 2023, 07:25 PM) Not true, indeed they are merely distributing the fund, however they still have to market and sell it. If the bank had sold the product as though it was a fixed deposit, this may give rise a claim (example Singapore and HK Mini Bond incident, i think some investors got back their money because of representations made by the bank). I said before to TS that he has to prove misrepresentation from the manager but so far none hence not viable to bring it up to the authoritiesThe problem is the quality or the evidence adduced by the complainant. In this case, the person mentioned all were communicated "verbally". Likelihood, the complainant will get his / her complaint stomped bloody by a wall of terms and conditions, which ironically includes the fact that you should read the offering documents before completing the application form and coupled with the fact that only Sophisticated investors can purchase such products. So it seems whatever argument the complainant has, it's shaky at best and ability to move the needle is negligible. |

|

|

Apr 24 2023, 07:56 PM Apr 24 2023, 07:56 PM

Show posts by this member only | IPv6 | Post

#72

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Apr 24 2023, 07:15 PM) Unlikely to be either, it will be the trustee of the fund to initiate the suit. The trustee is the legal owner of the fund. Yes trustee is the legal owner but they won’t sue because they would need legal instructions from the fund itself hence the trustee won’t act but the fund house itself because the power of decision and execution lies in them not the trustee 🤦♀️ |

|

|

Apr 24 2023, 08:48 PM Apr 24 2023, 08:48 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Apr 24 2023, 07:56 PM) Yes trustee is the legal owner but they won’t sue because they would need legal instructions from the fund itself hence the trustee won’t act but the fund house itself because the power of decision and execution lies in them not the trustee 🤦♀️ In terms of investment but when it comes to protecting rights of unit holders the demarcation in the deed is clear. The trustee has a fiduciary duty towards the fund. |

|

|

Apr 24 2023, 08:52 PM Apr 24 2023, 08:52 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Apr 24 2023, 07:54 PM) I said before to TS that he has to prove misrepresentation from the manager but so far none hence not viable to bring it up to the authorities There is no misrepresentation by the fund manager because what the fund manager intends to say is embedded in the offering document. Save where there is material omission/incorrect representation and the likes in the offering document.The fund was sold by an IUTA to its customer. Also, IUTA enjoys a nominee structure, meaning to say the fund manager has no knowledge who the end customer is. This fund would have been sold by the IUTA's own relationship managers and the customer had relied on the representation from the IUTA. |

|

|

Apr 24 2023, 09:06 PM Apr 24 2023, 09:06 PM

Show posts by this member only | IPv6 | Post

#75

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Apr 24 2023, 08:52 PM) There is no misrepresentation by the fund manager because what the fund manager intends to say is embedded in the offering document. Save where there is material omission/incorrect representation and the likes in the offering document. That is why the CIMB manager is misrepresenting not the fund house manager 🤦♀️The fund was sold by an IUTA to its customer. Also, IUTA enjoys a nominee structure, meaning to say the fund manager has no knowledge who the end customer is. This fund would have been sold by the IUTA's own relationship managers and the customer had relied on the representation from the IUTA. |

|

|

Apr 24 2023, 09:08 PM Apr 24 2023, 09:08 PM

Show posts by this member only | IPv6 | Post

#76

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Apr 24 2023, 08:48 PM) In terms of investment but when it comes to protecting rights of unit holders the demarcation in the deed is clear. The trustee has a fiduciary duty towards the fund. What fiduciary duty when it is reported that the fund house is giving instructions to the trustee to take action rather than the trustee The trustee duty is only to hold and protect the fund but not on fund execution particularly in buying and selling assets or holdings 🤦♀️ |

|

|

Apr 24 2023, 09:11 PM Apr 24 2023, 09:11 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Apr 24 2023, 09:06 PM) The term is used loosely here, there is a distinction between CIMB's RM and the fund house manager. In which case, the fault more likely lies with the former, which is the point I am driving at. |

|

|

Apr 24 2023, 09:14 PM Apr 24 2023, 09:14 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Apr 24 2023, 09:08 PM) What fiduciary duty when it is reported that the fund house is giving instructions to the trustee to take action rather than the trustee Indeed trustee takes instruction from the fund manager and pays a fee for the services rendered because the trustee does not have fund management knowledge / expertise. The trustee duty is only to hold and protect the fund but not on fund execution particularly in buying and selling assets or holdings 🤦♀️ As you have mentioned, the trustee is only to "hold and to protect the fund" what constitutes the fund is obviously the assets and the unit holders that are within it. |

|

|

Apr 24 2023, 09:26 PM Apr 24 2023, 09:26 PM

|

Junior Member

263 posts Joined: Aug 2017 |

when we want to liquidate the investment but the CIMB bank manager says to wait write up from AHAM but too late as FINMA already trigger write down. Who should bare losses ?

|

|

|

Apr 24 2023, 09:50 PM Apr 24 2023, 09:50 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(csbong87 @ Apr 24 2023, 09:26 PM) when we want to liquidate the investment but the CIMB bank manager says to wait write up from AHAM but too late as FINMA already trigger write down. Who should bare losses ? First and foremost, to disclaim, this isn't legal advice. It's just for discussion purpose. Please consult a professional, if needed.All things being equal, if the contents of the Offering Document (in this case an Information Memorandum) are as disclosed and transpired, the investor to bear the losses. Then again, this isn't your usual cup of tea, as alleged by you, there is element of misrepresentation and government intervention. Unless there are other developments, the situation you encounter now remains as "status quo". |

|

|

Apr 24 2023, 09:59 PM Apr 24 2023, 09:59 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(aurora97 @ Apr 24 2023, 09:50 PM) First and foremost, to disclaim, this isn't legal advice. It's just for discussion purpose. Please consult a professional, if needed. CIMB bank manager promise and say wont write down to zero, when we called him on the phone to liquidate that evening was 60 cents already.All things being equal, if the contents of the Offering Document (in this case an Information Memorandum) are as disclosed and transpired, the investor to bear the losses. Then again, this isn't your usual cup of tea, as alleged by you, there is element of misrepresentation and government intervention. Unless there are other developments, the situation you encounter now remains as "status quo". |

|

|

Apr 24 2023, 10:17 PM Apr 24 2023, 10:17 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(csbong87 @ Apr 24 2023, 09:59 PM) CIMB bank manager promise and say wont write down to zero, when we called him on the phone to liquidate that evening was 60 cents already. Put it this way, if I don't see money in the bank, as the adage goes "money talks, bullshit walks".Good luck in your recovery or claim, I will be watching this closely. |

|

|

Apr 24 2023, 10:22 PM Apr 24 2023, 10:22 PM

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

Apr 25 2023, 04:10 AM Apr 25 2023, 04:10 AM

Show posts by this member only | IPv6 | Post

#84

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Apr 24 2023, 09:11 PM) The term is used loosely here, there is a distinction between CIMB's RM and the fund house manager. In which case, the fault more likely lies with the former, which is the point I am driving at. Already mentioned earlier that is the CIMB Manager not the fund house manager as you didn’t read through 🤦♀️QUOTE(aurora97 @ Apr 24 2023, 09:14 PM) Indeed trustee takes instruction from the fund manager and pays a fee for the services rendered because the trustee does not have fund management knowledge / expertise. The only action the trustee can take against the fund house is they deviate against the asset allocation stated deed nothing else 🤦♀️As you have mentioned, the trustee is only to "hold and to protect the fund" what constitutes the fund is obviously the assets and the unit holders that are within it. QUOTE(csbong87 @ Apr 24 2023, 09:26 PM) when we want to liquidate the investment but the CIMB bank manager says to wait write up from AHAM but too late as FINMA already trigger write down. Who should bare losses ? You will have the bare losses no matter and they only thing they can recovered whatever left in the cash with any goodwill exit payment that is voluntarily top up by the fund house which is very low possibility QUOTE(csbong87 @ Apr 24 2023, 09:59 PM) CIMB bank manager promise and say wont write down to zero, when we called him on the phone to liquidate that evening was 60 cents already. In way he is right because the fund won’t write down to 0 but can bear losses 🤦♀️That is why I stay away from UT a lot because you don’t have control with whatever decisions especially exit hence why when you invest in anything always plan your exit strategy if things go wrong |

|

|

Apr 25 2023, 05:39 AM Apr 25 2023, 05:39 AM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 25 2023, 04:10 AM) Already mentioned earlier that is the CIMB Manager not the fund house manager as you didn’t read through 🤦♀️ It' a bond and purchase through CIMB Bank Malaysia and its bank manager guarantees customers that the principal is guaranteed. Unless if CIMB bank manager has follow proper procedures in selling (letting know customers that the bond can be written down to zero) than we might have second taught. Is misselling here that what Im trying to say as we are victims to the CIMB bank manager, and CIMB Malaysia must be responsible towards it's customers.The only action the trustee can take against the fund house is they deviate against the asset allocation stated deed nothing else 🤦♀️ You will have the bare losses no matter and they only thing they can recovered whatever left in the cash with any goodwill exit payment that is voluntarily top up by the fund house which is very low possibility In way he is right because the fund won’t write down to 0 but can bear losses 🤦♀️ That is why I stay away from UT a lot because you don’t have control with whatever decisions especially exit hence why when you invest in anything always plan your exit strategy if things go wrong This post has been edited by csbong87: Apr 25 2023, 05:49 AM |

|

|

Apr 25 2023, 07:15 AM Apr 25 2023, 07:15 AM

Show posts by this member only | IPv6 | Post

#86

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 25 2023, 05:39 AM) It' a bond and purchase through CIMB Bank Malaysia and its bank manager guarantees customers that the principal is guaranteed. Unless if CIMB bank manager has follow proper procedures in selling (letting know customers that the bond can be written down to zero) than we might have second taught. Is misselling here that what Im trying to say as we are victims to the CIMB bank manager, and CIMB Malaysia must be responsible towards it's customers. Unless you have written legal binding guarantee from the bank manager you are not a victims in their eyes as they are doing their jobs 🤦♀️1stly you got sucked into just by the bank manager as he has no right and power to guarantee as no one can guaranteed the principal other than issuer themselves 🤦♀️ This is a good lesson for you to learn that if you don’t understand don’t buy and don’t be greedy and get sucked into as there is nothing life is guaranteed other than taxes and death 🤦♀️ |

|

|

Apr 25 2023, 08:37 AM Apr 25 2023, 08:37 AM

Show posts by this member only | IPv6 | Post

#87

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 25 2023, 07:15 AM) Unless you have written legal binding guarantee from the bank manager you are not a victims in their eyes as they are doing their jobs 🤦♀️ Its a bond, and its CIMB Malaysia. Its called cheating as what AHAM and the bank manager present its different. Not any customer btw, is Preferred.1stly you got sucked into just by the bank manager as he has no right and power to guarantee as no one can guaranteed the principal other than issuer themselves 🤦♀️ This is a good lesson for you to learn that if you don’t understand don’t buy and don’t be greedy and get sucked into as there is nothing life is guaranteed other than taxes and death 🤦♀️ |

|

|

Apr 25 2023, 12:39 PM Apr 25 2023, 12:39 PM

Show posts by this member only | IPv6 | Post

#88

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 25 2023, 08:37 AM) Its a bond, and its CIMB Malaysia. Its called cheating as what AHAM and the bank manager present its different. Not any customer btw, is Preferred. Doesn’t matter if it is bond or CIMB or whatever status you are 🤦♀️ in their eyes they are doing the job just that you are unlucky lamb I don’t know whether you dumb or ignorant because you could have say no but you greed tempt you in just because you say yes because it is a bond and the manager tempt you and say principal guaranteed when he does not have the right or power to do it 🤦♀️ take it as a lesson and move otherwise you will be still bitter as you got no control even to sue 🤦♀️ |

|

|

Apr 25 2023, 03:14 PM Apr 25 2023, 03:14 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 25 2023, 12:39 PM) Doesn’t matter if it is bond or CIMB or whatever status you are 🤦♀️ in their eyes they are doing the job just that you are unlucky lamb Again it's a bond, a bank CIMB and principal guaranteed as told by the bank manager.I don’t know whether you dumb or ignorant because you could have say no but you greed tempt you in just because you say yes because it is a bond and the manager tempt you and say principal guaranteed when he does not have the right or power to do it 🤦♀️ take it as a lesson and move otherwise you will be still bitter as you got no control even to sue 🤦♀️ |

|

|

Apr 25 2023, 03:21 PM Apr 25 2023, 03:21 PM

Show posts by this member only | IPv6 | Post

#90

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 25 2023, 03:14 PM) Doesn’t matter if it is bond because bond is just lending paper to them while you are buying those papers 🤦♀️Like I said CIMB and the bank manager cannot guaranteed because they do not issue the bonds 🤦♀️ Only Credit Suisse can tell you whether it is principal is guaranteed because they are issuers of those papers 🤦♀️ seems like you are still in lala land thinking bond are guarantee while it is not 🤦♀️ as you have not learnt the lesson |

|

|

Apr 25 2023, 03:32 PM Apr 25 2023, 03:32 PM

Show posts by this member only | IPv6 | Post

#91

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(csbong87 @ Apr 25 2023, 05:39 AM) It' a bond and purchase through CIMB Bank Malaysia and its bank manager guarantees customers that the principal is guaranteed. Unless if CIMB bank manager has follow proper procedures in selling (letting know customers that the bond can be written down to zero) than we might have second taught. Is misselling here that what Im trying to say as we are victims to the CIMB bank manager, and CIMB Malaysia must be responsible towards it's customers. A lot of these Branch Managers and RMs are just simply pushing all forms of products without fully explaining the risks. Last few years, I have heard of uncles and aunties being sold equity linked Glove stocks, China tech stocks. All kena burn.About time some people make these bankers accountable. This post has been edited by Cubalagi: Apr 25 2023, 03:32 PM |

|

|

Apr 25 2023, 03:37 PM Apr 25 2023, 03:37 PM

Show posts by this member only | IPv6 | Post

#92

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(Cubalagi @ Apr 25 2023, 03:32 PM) A lot of these Branch Managers and RMs are just simply pushing all forms of products without fully explaining the risks. Last few years, I have heard of uncles and aunties being sold equity linked Glove stocks, China tech stocks. All kena burn. Must be SI products 🤦♀️ they won’t be accountable so as long as the regulator’s doesn’t take any action 🤦♀️ hence why such product is still in the markets for those financial illiterates About time some people make these bankers accountable. Only you can see action on Leverage and Inverse products as one have to fulfill the conditions of Sophisticated Investor in order for them to purchase those products |

|

|

Apr 25 2023, 05:53 PM Apr 25 2023, 05:53 PM

Show posts by this member only | IPv6 | Post

#93

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(Cubalagi @ Apr 25 2023, 03:32 PM) A lot of these Branch Managers and RMs are just simply pushing all forms of products without fully explaining the risks. Last few years, I have heard of uncles and aunties being sold equity linked Glove stocks, China tech stocks. All kena burn. Ya, that particular CIMB branch has senior citizens some amounting to a million in this bond.About time some people make these bankers accountable. |

|

|

May 7 2023, 06:33 PM May 7 2023, 06:33 PM

|

Junior Member

263 posts Joined: Aug 2017 |

Quinn Emanuel said it is working with the following firms:

-- US – Wollmuth Maher & Deutsch; -- UK – Keidan Harrison; -- Singapore – Engelin Teh; -- Gulf Cooperation Council – Global Advocacy and Legal Counsel; and -- Switzerland – Geissbühler Weber & Partners. https://www.wealthbriefing.com/html/article...84#.ZFd-W3ZBy3B |

|

|

May 10 2023, 09:17 PM May 10 2023, 09:17 PM

Show posts by this member only | IPv6 | Post

#95

|

Junior Member

184 posts Joined: Sep 2006 |

QUOTE(csbong87 @ May 7 2023, 06:33 PM) Quinn Emanuel said it is working with the following firms: AHAM Capital joins global litigation to challenge Credit Suisse AT1 write-downs-- US – Wollmuth Maher & Deutsch; -- UK – Keidan Harrison; -- Singapore – Engelin Teh; -- Gulf Cooperation Council – Global Advocacy and Legal Counsel; and -- Switzerland – Geissbühler Weber & Partners. https://www.wealthbriefing.com/html/article...84#.ZFd-W3ZBy3B Good luck! |

|

|

May 12 2023, 08:03 PM May 12 2023, 08:03 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(plc255 @ May 10 2023, 09:17 PM) Just curious which are the banks in Malaysia which is also selling CS's bond other than CIMB ? |

|

|

May 13 2023, 03:55 AM May 13 2023, 03:55 AM

Show posts by this member only | IPv6 | Post

#97

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ May 12 2023, 08:03 PM) I don’t think directly there is for any Malaysian Banks Even CIMB is not directly selling the CS bonds 🤦♀️ they are selling the bond fund that is from AHAM which manages and buying the bonds itself |

|

|

May 13 2023, 04:30 PM May 13 2023, 04:30 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Rain or shine. Bankers and lawyers walk home with your money.

https://www.freemalaysiatoday.com/category/...t-him-rm500000/ |

|

|

May 13 2023, 04:35 PM May 13 2023, 04:35 PM

Show posts by this member only | IPv6 | Post

#99

|

Junior Member

184 posts Joined: Sep 2006 |

QUOTE(TOS @ May 13 2023, 04:30 PM) Rain or shine. Bankers and lawyers walk home with your money. The 2 bond funds that got wiped was around RM70 ~ RM100m, depending on how you count it....https://www.freemalaysiatoday.com/category/...t-him-rm500000/ It had me wondering for a while that it cant be all just insti buying this, but rather must be some individual and surely some unfortunate one were losing more than others... also a mere rm10k entry point surely quite some people kena... Guess the news is slowly coming out... Cross selling fund or insurance to FD uncle is surely quite profitable to the bankers..... |

|

|

May 13 2023, 08:46 PM May 13 2023, 08:46 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(plc255 @ May 13 2023, 04:35 PM) The 2 bond funds that got wiped was around RM70 ~ RM100m, depending on how you count it.... guess what ? our side mis sell the product saying a min RM 100k to purchase this bond.It had me wondering for a while that it cant be all just insti buying this, but rather must be some individual and surely some unfortunate one were losing more than others... also a mere rm10k entry point surely quite some people kena... Guess the news is slowly coming out... Cross selling fund or insurance to FD uncle is surely quite profitable to the bankers..... |

|

|

May 13 2023, 09:34 PM May 13 2023, 09:34 PM

Show posts by this member only | IPv6 | Post

#101

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(plc255 @ May 13 2023, 04:35 PM) The 2 bond funds that got wiped was around RM70 ~ RM100m, depending on how you count it.... The institutions is just distributing the fund and they are not buying it 🤦♀️ hence no losses to them and even the fund house there are almost to none losses because they are only collecting management fee annually while the actual losers are the individuals who buying it at rm100k Min entry point 🤦♀️ so in fact losses are only probably a couple of hundred or about 1000+ because of the high entry point at rm100kIt had me wondering for a while that it cant be all just insti buying this, but rather must be some individual and surely some unfortunate one were losing more than others... also a mere rm10k entry point surely quite some people kena... Guess the news is slowly coming out... Cross selling fund or insurance to FD uncle is surely quite profitable to the bankers..... It will would have gain more drama if the entry price was as low as rm1000 then you will see more drama outside of the distributors or the banks 🤦♀️ AHAM actual wipe out is about 70% of the fund while 30% are still in actual money because they manage to liquidate some before the whole thing went south while the mandate was holding at least 15% in cash anytime |

|

|

May 14 2023, 09:01 PM May 14 2023, 09:01 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ May 13 2023, 09:34 PM) The institutions is just distributing the fund and they are not buying it 🤦♀️ hence no losses to them and even the fund house there are almost to none losses because they are only collecting management fee annually while the actual losers are the individuals who buying it at rm100k Min entry point 🤦♀️ so in fact losses are only probably a couple of hundred or about 1000+ because of the high entry point at rm100k what when (NAV date) did you see the fund still has 30% in value ? not supposed to be negative ?It will would have gain more drama if the entry price was as low as rm1000 then you will see more drama outside of the distributors or the banks 🤦♀️ AHAM actual wipe out is about 70% of the fund while 30% are still in actual money because they manage to liquidate some before the whole thing went south while the mandate was holding at least 15% in cash anytime |

|

|

May 15 2023, 12:00 AM May 15 2023, 12:00 AM

Show posts by this member only | IPv6 | Post

#103

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ May 14 2023, 09:01 PM) 1stly it is will never be negative 🤦♀️ because even if you lose 100% in bonds it will be zero at the lowest hence nil price 🤦♀️Check the mandate as they have the mandate it is 15% of cash at anytime while another 15% when they manage to sell off before the forced takeover by FINMA Go ask AHAM or check your statement during early March |

|

|

May 15 2023, 10:02 AM May 15 2023, 10:02 AM

|

Junior Member

263 posts Joined: Aug 2017 |

Since April suspension has been lifted, as per feedback will be negative due to settling liabilities (Didn't mention in detail as of what type of expenses). Also advancing funds to bring NAV to zero for now.

This post has been edited by csbong87: May 15 2023, 01:15 PM |

|

|

May 16 2023, 03:14 PM May 16 2023, 03:14 PM

|

Senior Member

3,790 posts Joined: Aug 2007 |

QUOTE(csbong87 @ May 15 2023, 10:02 AM) Since April suspension has been lifted, as per feedback will be negative due to settling liabilities (Didn't mention in detail as of what type of expenses). Also advancing funds to bring NAV to zero for now. Based on annual report FYE 31 Jan 2023 for both single bond fund 2 and 4, they were about 93%+/- invested remaining probably in FX forward/swap or deposits.Typically, the liabilities of the fund includes accrued management fee, trustee/custodian fee, bank charges, derivatives (FX forward/Swap), fees due to distributors, auditor etc... The fund may have defaulted but the fees/charges etc... still need to be paid unless waived by counterparty. I presume when you meant by "advancing funds", the fund manager is coughing out some money to bring the fund back to Zero NAV. I think this would be the right thing to do because a negative NAV may imply that the unit holders owe monies to the fund, whereas the deed has made clear that the liabilities of the unit holder is up until the amount invested. |

|

|

Aug 30 2023, 05:01 PM Aug 30 2023, 05:01 PM

|

Junior Member

96 posts Joined: Jun 2008 |

everyone got this?

3… 2… 1… AHAM PRS #MerdekaBonus Campaign is here! Grow your retirement savings! Grow your wealth! Be prepared for your golden years! By investing a minimum of RM1,000 into any of our Private Retirement Scheme ("PRS") funds, you will receive an additional 1.0% Free Units based on your investment amount. The maximum investment amount for this campaign is capped at RM10,000 per participant. Complement your retirement savings with AHAM PRS. |

|

|

Aug 30 2023, 05:14 PM Aug 30 2023, 05:14 PM

Show posts by this member only | IPv6 | Post

#107

|

All Stars

24,385 posts Joined: Feb 2011 |

QUOTE(holyleonard @ Aug 30 2023, 05:01 PM) everyone got this? Don't look at 1%. It's marketing. Look at overall funds return. Are AHAM fund returns acceptable to you and your risk level. If yes then put in your money. For me personally their return sucks so I dont bother with them. I prefer consistent 10%p.a Vs 1-3%p.a3… 2… 1… AHAM PRS #MerdekaBonus Campaign is here! Grow your retirement savings! Grow your wealth! Be prepared for your golden years! By investing a minimum of RM1,000 into any of our Private Retirement Scheme ("PRS") funds, you will receive an additional 1.0% Free Units based on your investment amount. The maximum investment amount for this campaign is capped at RM10,000 per participant. Complement your retirement savings with AHAM PRS. |

|

|

Aug 31 2023, 03:44 AM Aug 31 2023, 03:44 AM

Show posts by this member only | IPv6 | Post

#108

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(holyleonard @ Aug 30 2023, 05:01 PM) everyone got this? 1% is nothing when they already charged you sales charge 🤦♀️ look at the returns and then fees which you will be losing end with mediocre returns3… 2… 1… AHAM PRS #MerdekaBonus Campaign is here! Grow your retirement savings! Grow your wealth! Be prepared for your golden years! By investing a minimum of RM1,000 into any of our Private Retirement Scheme ("PRS") funds, you will receive an additional 1.0% Free Units based on your investment amount. The maximum investment amount for this campaign is capped at RM10,000 per participant. Complement your retirement savings with AHAM PRS. |

| Change to: |  0.0687sec 0.0687sec

0.41 0.41

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 07:48 PM |