Does anyone have HSBC Everyday Global Account Malaysia?

Recently I opened the this account and based on understanding there is multicurrency account (SGD, AUD, USD etc etc).

I login to my HSBC account and I can see a list of accounts (all same account number) but with different currency.

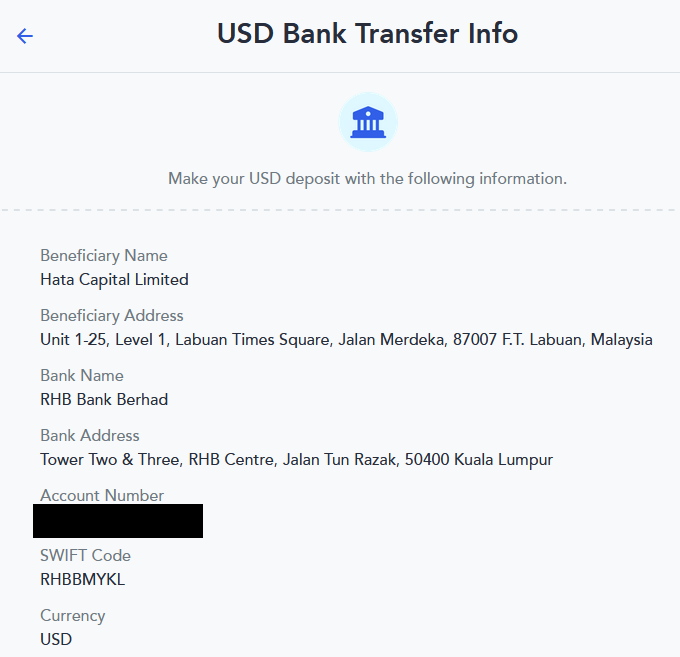

May I know how for example if I would like to receive money in different currency aside from RM?

For example, if I would like to receive SGD transfer from SG bank? Is that possible?

Or I need to receive it in RM and self transfer it to my internal SGD account number inside HSBC?

And if it is possible, how does one made the transfer?

If I have UOB SG banking, do I just transfer by selecting HSBC SG? or to choose HSBC MY?

Appreciate if anyone have this banking and did made any soft of multicurrencies transfer before.

Thanks

Dec 26 2022, 11:05 PM, updated 3y ago

Dec 26 2022, 11:05 PM, updated 3y ago

Quote

Quote

0.0152sec

0.0152sec

0.43

0.43

5 queries

5 queries

GZIP Disabled

GZIP Disabled