QUOTE(FSMOne Malaysia @ Dec 8 2022, 11:03 AM)

Bond investment may also provide regular stream of interest income and potentially grow your capital in the long term. Investor receives fixed-rate interest income (coupon), usually semi-annually, which remains the same despite how market interest rates might change.

Investors may be able to reap a potential long-term capital gain as bonds offer predictable repayment of principal at maturity. This is because bond prices often move in the opposite direction of market interest rates. Should market interest rates fall, there may be potential for capital gain from price appreciation.

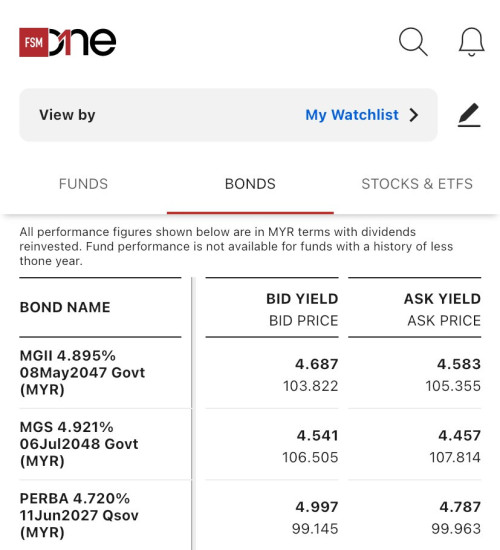

For example,

when Bank Negara continues to raise interest rates in the future, investors can find some gems in the bond pace, especially buying into those bonds where the price falls below 100.

Investors could enjoy the regular income stream + the capital appreciation if hold until maturity.

Besides, during interest rate hike environment, the issuer will offer higher coupon rate to attract new investor. In the end, investor will enjoy higher coupon rate when they buy into new bond during this period!

Transaction volume are low right? Difficult to sell later or have to sell at the lower price range?Investors may be able to reap a potential long-term capital gain as bonds offer predictable repayment of principal at maturity. This is because bond prices often move in the opposite direction of market interest rates. Should market interest rates fall, there may be potential for capital gain from price appreciation.

For example,

when Bank Negara continues to raise interest rates in the future, investors can find some gems in the bond pace, especially buying into those bonds where the price falls below 100.

Investors could enjoy the regular income stream + the capital appreciation if hold until maturity.

Besides, during interest rate hike environment, the issuer will offer higher coupon rate to attract new investor. In the end, investor will enjoy higher coupon rate when they buy into new bond during this period!

Dec 8 2022, 12:30 PM

Dec 8 2022, 12:30 PM

Quote

Quote

0.0135sec

0.0135sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled