Outline ·

[ Standard ] ·

Linear+

Investment Malaysia Bond, government or corporate bond?

|

FSMOne Malaysia

|

Dec 8 2022, 10:47 AM Dec 8 2022, 10:47 AM

|

Getting Started

|

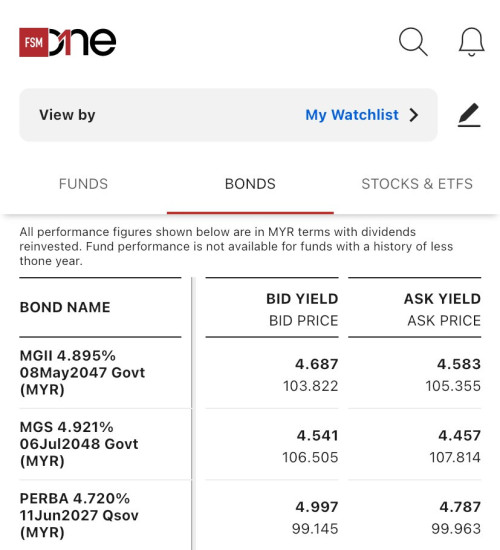

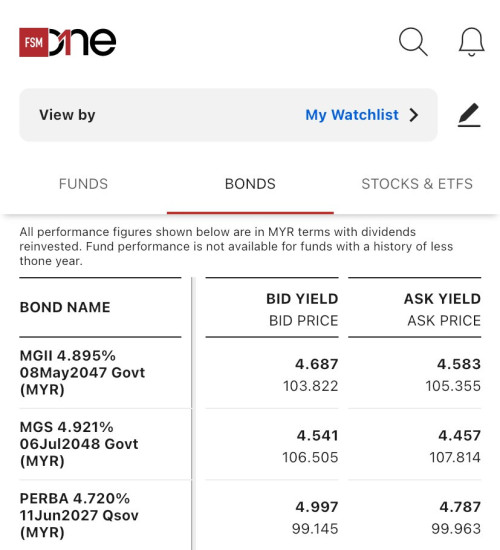

QUOTE(CommodoreAmiga @ Nov 17 2022, 03:09 PM) Yes, but your bond can take out or not? Interest rate going to be same by next year. Why bother with bond if same rates i can get with FDs? hi there  You can actually sell your bond anytime before it matures and the selling price is subject to market conditions. Similar to FD, bond investments may yield a stable interest income that is usually higher than the interest received from FD for a comparable tenure, with an added chance of capital appreciation. Furthermore, unlike FD, there are no penalties should the investors wish to redeem their investments. Bond price will not have significant drawdown unless it is downgraded by rating agency or the bond being default. Generally bond coupon payment is higher than FD rate in long run as bond is still well cushion by the fixed coupon payout annually (around 4% - 5% for Malaysia corporate bond). This post has been edited by FSMOne Malaysia: Dec 8 2022, 10:48 AM |

|

|

|

|

|

FSMOne Malaysia

|

Dec 8 2022, 11:03 AM Dec 8 2022, 11:03 AM

|

Getting Started

|

Bond investment may also provide regular stream of interest income and potentially grow your capital in the long term. Investor receives fixed-rate interest income (coupon), usually semi-annually, which remains the same despite how market interest rates might change.

Investors may be able to reap a potential long-term capital gain as bonds offer predictable repayment of principal at maturity. This is because bond prices often move in the opposite direction of market interest rates. Should market interest rates fall, there may be potential for capital gain from price appreciation.

For example,

when Bank Negara continues to raise interest rates in the future, investors can find some gems in the bond pace, especially buying into those bonds where the price falls below 100.

Investors could enjoy the regular income stream + the capital appreciation if hold until maturity.

Besides, during interest rate hike environment, the issuer will offer higher coupon rate to attract new investor. In the end, investor will enjoy higher coupon rate when they buy into new bond during this period!

This post has been edited by FSMOne Malaysia: Dec 8 2022, 11:05 AM

|

|

|

|

|

|

FSMOne Malaysia

|

Dec 9 2022, 08:58 AM Dec 9 2022, 08:58 AM

|

Getting Started

|

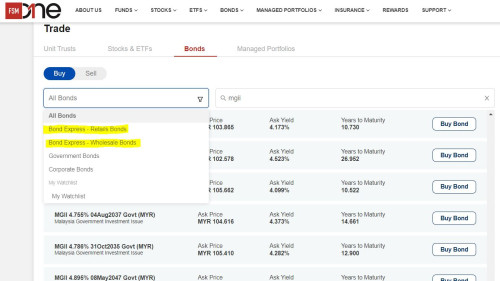

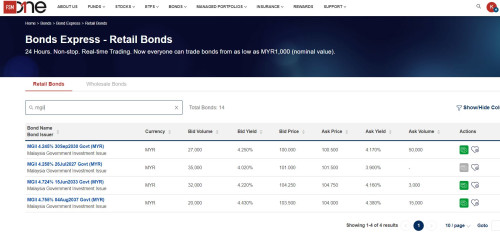

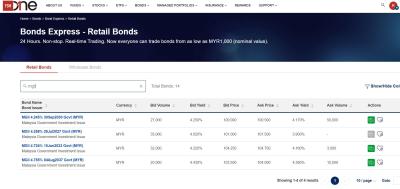

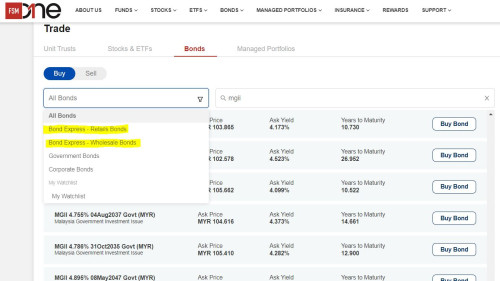

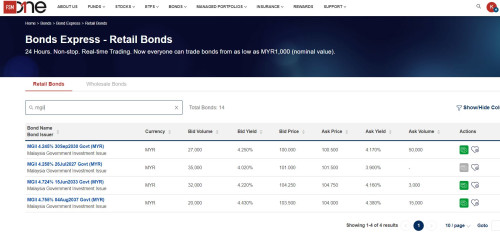

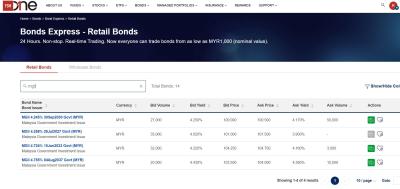

QUOTE(bcombat @ Dec 8 2022, 12:30 PM) Transaction volume are low right? Difficult to sell later or have to sell at the lower price range? FSMOne platform does have the bond Express platform, you can trade your odd lot bond on the Bond Express platform. The liquidity will vary depending on the offer price and bond rating at the point of selling. Generally, you are selling your odd lot bond to FSMOne, and the bond dealer will resale to other investors by increasing the “Ask Volume” in the bond express platform. You may refer to “Bid Volume” in the bond express platform to identify how much we are willing to buy back from investors. |

|

|

|

|

|

FSMOne Malaysia

|

Dec 9 2022, 02:37 PM Dec 9 2022, 02:37 PM

|

Getting Started

|

QUOTE(bcombat @ Dec 9 2022, 09:25 AM) Big spread between “bid” and “ask” pricing.  ahh not this page. you may navigate and select "bond express"  or here to view in bigger picture  the gap between bid and ask price in bond express is not as big   what special about FSMOne bond express is, you can trade bonds from as low as MYR1,000 (Retail Bonds) and RM5,000 for (Wholesale Bonds). Bond Express will be transacted on a real-time basis, so the trade will be completed on the same day. Feel free to visit our website at https://www.fsmone.com.my/bonds/bond-express/retail-bonds to browse through Bond Express for other bonds available on our platform as well This post has been edited by FSMOne Malaysia: Dec 9 2022, 02:48 PM Attached thumbnail(s)

|

|

|

|

|

Dec 8 2022, 10:47 AM

Dec 8 2022, 10:47 AM

Quote

Quote

0.0174sec

0.0174sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled