Property Sifus are back!, After long silence, they r back! Yes!

Property Sifus are back!, After long silence, they r back! Yes!

|

|

Oct 12 2022, 08:34 PM, updated 4y ago Oct 12 2022, 08:34 PM, updated 4y ago

Show posts by this member only | Post

#1

|

Junior Member

137 posts Joined: Feb 2006 |

|

|

|

|

|

|

Oct 12 2022, 08:40 PM Oct 12 2022, 08:40 PM

Show posts by this member only | Post

#2

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(jj2themax @ Oct 12 2022, 08:34 PM) Start to see Property sifu ads now. After hiding in the cave for so long, they r now back. Property bull run? Why you want to purposely start a thread for him or others ? Many here oredi know the damages they have done until mod has to issue a warning. Is the same old story ..... BBB ! Not a beneficial topic to talk. This post has been edited by mini orchard: Oct 12 2022, 08:47 PM |

|

|

Oct 12 2022, 09:01 PM Oct 12 2022, 09:01 PM

Show posts by this member only | IPv6 | Post

#3

|

Junior Member

662 posts Joined: Jun 2020 |

i can see it like a trend. property > money game > share market > forex > crypto > NFT > auciton > back to property again.

They want to earn money with talking only (course), buy or not buy still buyer decision. If ready want to learn some mindset and knowledge, can attend their free class as much, the you can realized what is the basically property investment. But my advice, dont be greedy and fully believe all guru at the property purchase decision. Thats all. |

|

|

Oct 12 2022, 09:04 PM Oct 12 2022, 09:04 PM

Show posts by this member only | IPv6 | Post

#4

|

All Stars

24,229 posts Joined: Mar 2007 From: Kuala Lumpur |

The only deal we are looking here is the "property sifu's" fat pockets from your "course fees".

|

|

|

Oct 12 2022, 09:05 PM Oct 12 2022, 09:05 PM

Show posts by this member only | IPv6 | Post

#5

|

Senior Member

1,773 posts Joined: Dec 2013 |

Compress loan some more

Later get burn and 14th floor n burden everyone else Just need to watch Iherg youtube. He said for now if can cover 70% of monthly installments already considered very good Want earn fast money dont do property |

|

|

Oct 12 2022, 09:07 PM Oct 12 2022, 09:07 PM

Show posts by this member only | Post

#6

|

Senior Member

9,052 posts Joined: Jan 2003 |

Stop the buying and the developers will be forced to throw prices to stay alive. Pretty sure their banks will also force them to get rid of dead stocks cheaply.

|

|

|

|

|

|

Oct 12 2022, 10:36 PM Oct 12 2022, 10:36 PM

Show posts by this member only | Post

#7

|

Senior Member

2,287 posts Joined: Jun 2007 From: Anno Domini Time Ultra: 1,000,000 Trans Am Attack! |

Everyone is a property sifu, until their so called "strategy" caused other people to burn. Nowadays 1 project already 800-1k to 2k units. What are the chances you rent out your unit and cover most of the expenses?

The differences between you and them is they have more money to burn than you. So don't be a hero. Be smart and be your own sifu instead. |

|

|

Oct 12 2022, 10:42 PM Oct 12 2022, 10:42 PM

Show posts by this member only | IPv6 | Post

#8

|

Junior Member

213 posts Joined: Dec 2021 |

QUOTE(mini orchard @ Oct 12 2022, 08:40 PM) Why you want to purposely start a thread for him or others ? Strongly agree…the number of victims speak for itselfMany here oredi know the damages they have done until mod has to issue a warning. Is the same old story ..... BBB ! Not a beneficial topic to talk. |

|

|

Oct 13 2022, 01:38 AM Oct 13 2022, 01:38 AM

Show posts by this member only | Post

#9

|

All Stars

21,458 posts Joined: Jul 2012 |

Poorperly game is not newly invented or discovered. If poorperly investment is as half as profitable or certainty as claimed by guru, most if not all da ma and da shu are already multi millionaire. Where got chance for strawberry generation.

For reasons, herd members end in slaughterhouse or over the cliff. This post has been edited by icemanfx: Oct 13 2022, 02:17 AM |

|

|

Oct 13 2022, 04:26 AM Oct 13 2022, 04:26 AM

|

Senior Member

2,834 posts Joined: Dec 2020 |

QUOTE(Aaron212 @ Oct 12 2022, 09:05 PM) Compress loan some more Well more often than not the projects that don’t need these scam artists are fine. Your DPC etc are cashflow positive. So there are projects available that are actually profitable. Later get burn and 14th floor n burden everyone else Just need to watch Iherg youtube. He said for now if can cover 70% of monthly installments already considered very good Want earn fast money dont do property But if your budget is limited don’t bother. The budget range of units unfortunately are the most susceptible to failing. If you buy units that can’t break even it’s not an investment, it’s charity because you’re paying for people to live in your house. This post has been edited by Cavatzu: Oct 13 2022, 04:49 AM |

|

|

Oct 13 2022, 09:43 AM Oct 13 2022, 09:43 AM

Show posts by this member only | IPv6 | Post

#11

|

Junior Member

662 posts Joined: Jun 2020 |

Property investment may need to looking at long term.

Break even + positive cash flow is investor's hope. Buying investment property (new nowadays) first 5y (after vp) Lossing below 25% is ok, just think it's your personal saving. House is your, tenant paid your interest and some part of principle. 6th to 10th year, either sell (if ready appreciate) or hold (if the rental can break even or cashflow) 11th to 15th year, if 6th to 10th can't performance well, give it another 5year. 16th to 20th, form here you properly already achieve positive cashflow. People buy for investments dsr can cover (some portion) by tenancy agreement, so the quota to buy second third property is still achievable. Only those greedy thinking property investment is fast rich schemes, playing compress loan, playing high Cashback, playing proxy, following guru bulk purchase a rural area project etc gg. Want immediate break even or positive CF property only subsale and auction property can do if ready do all the diligent. |

|

|

Oct 13 2022, 10:18 AM Oct 13 2022, 10:18 AM

|

Senior Member

1,745 posts Joined: Jan 2013 |

QUOTE(Aldo-Kirosu @ Oct 13 2022, 09:43 AM) Property investment may need to looking at long term. even now very very hard to find "good deal" for subsales and auction with positive cash flow already.Break even + positive cash flow is investor's hope. Buying investment property (new nowadays) first 5y (after vp) Lossing below 25% is ok, just think it's your personal saving. House is your, tenant paid your interest and some part of principle. 6th to 10th year, either sell (if ready appreciate) or hold (if the rental can break even or cashflow) 11th to 15th year, if 6th to 10th can't performance well, give it another 5year. 16th to 20th, form here you properly already achieve positive cashflow. People buy for investments dsr can cover (some portion) by tenancy agreement, so the quota to buy second third property is still achievable. Only those greedy thinking property investment is fast rich schemes, playing compress loan, playing high Cashback, playing proxy, following guru bulk purchase a rural area project etc gg. Want immediate break even or positive CF property only subsale and auction property can do if ready do all the diligent. subsales with positive cash flow - 90% is those older condo, got rental market but no much room for capital appreciation in future. we need to think twice how we sold to next buyer in future. auction with positive cash flow - unlikely, most of the owner unable to rent out/cover loan, that why kena auction. but still got some super good deal for sure, just very very competitive in bidding. i been participate for a couple of round d, and i cant outbid the others wealth investor everytime , zzzz. |

|

|

Oct 13 2022, 10:36 AM Oct 13 2022, 10:36 AM

|

Junior Member

137 posts Joined: Feb 2006 |

The opportunity now is probably farmland or agricultural land at outskirt areas, smaller towns. Land is always scarce. Food/agriculture is always a necessity, just look at the recent food crisis and soaring prices.

Since klang valley/city house prices are so competitive, perhaps looking towards outskirts or other states better prospects in terms of hedging and longterm investing. |

|

|

|

|

|

Oct 13 2022, 11:17 AM Oct 13 2022, 11:17 AM

Show posts by this member only | IPv6 | Post

#14

|

Junior Member

662 posts Joined: Jun 2020 |

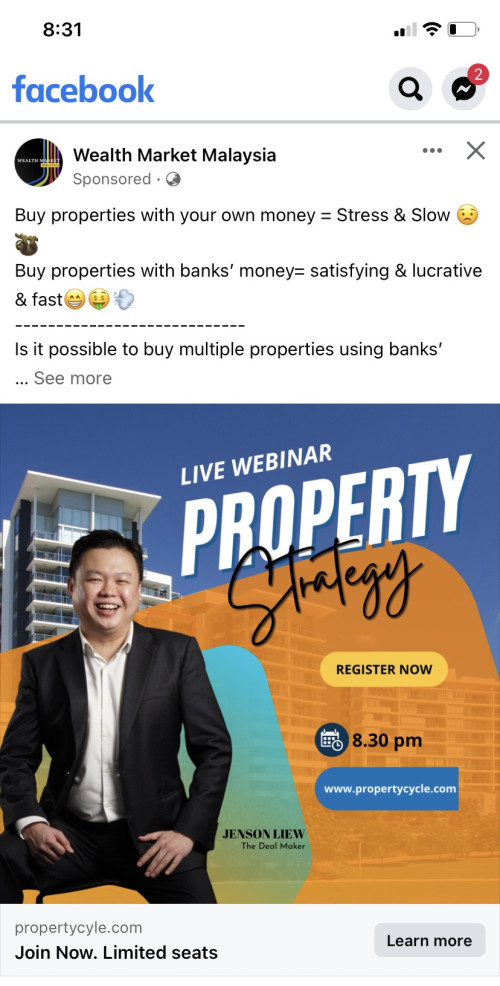

Haha now a day property sifu switch the market already, their course not only at property only, but also extended to business mode, talent, positive talk course as well. The guru with yellow sport car recently pop out at my fb.

Land investment highrise high return. My uncle buy a piece of land at Tanjung malim, 100k 2 or 3 acre 8year back, now the land value up to 400k+-. They have not a lot money to transform it to be new proper agriculture plantation business. So they a bit suffering to clean the land, built a wooden house, and plant some tree (but mostly failed). Own a piece a land but can't see the rental and use it now. Only next generation or few generation will be appreciated Thier effort I think. Land will locking a lot dsr and cashflow as well as it only 60% loan. |

|

|

Oct 13 2022, 12:21 PM Oct 13 2022, 12:21 PM

|

Senior Member

1,259 posts Joined: Jan 2018 |

No eye see Malaysian property market. Overseas is the way to go. But also in a way too late now that rm has been so devalued. But then again it could be even worse in 10 years time.

|

|

|

Oct 13 2022, 12:24 PM Oct 13 2022, 12:24 PM

|

Junior Member

148 posts Joined: Oct 2016 |

all tis so call guru are just developer engaged CON-sultant to clear their unsold units icemanfx liked this post

|

|

|

Oct 13 2022, 01:13 PM Oct 13 2022, 01:13 PM

|

Senior Member

2,834 posts Joined: Dec 2020 |

QUOTE(Aldo-Kirosu @ Oct 13 2022, 09:43 AM) Property investment may need to looking at long term. You say long term. Another pandemic or Thanos snap that wipes out half the population then you really have an oversupply situation.Break even + positive cash flow is investor's hope. Buying investment property (new nowadays) first 5y (after vp) Lossing below 25% is ok, just think it's your personal saving. House is your, tenant paid your interest and some part of principle. 6th to 10th year, either sell (if ready appreciate) or hold (if the rental can break even or cashflow) 11th to 15th year, if 6th to 10th can't performance well, give it another 5year. 16th to 20th, form here you properly already achieve positive cashflow. People buy for investments dsr can cover (some portion) by tenancy agreement, so the quota to buy second third property is still achievable. Only those greedy thinking property investment is fast rich schemes, playing compress loan, playing high Cashback, playing proxy, following guru bulk purchase a rural area project etc gg. Want immediate break even or positive CF property only subsale and auction property can do if ready do all the diligent. |

|

|

Oct 13 2022, 01:22 PM Oct 13 2022, 01:22 PM

|

Senior Member

2,287 posts Joined: Jun 2007 From: Anno Domini Time Ultra: 1,000,000 Trans Am Attack! |

QUOTE(Cavatzu @ Oct 13 2022, 01:13 PM) You say long term. Another pandemic or Thanos snap that wipes out half the population then you really have an oversupply situation. Oversupply already happening nowadays.No need wait for Thanos to come snap finger. Problem with majority now still overhang on the traditional way of investing "Buy house confirm up value geh" or "Buy house rent to people get positive cashflow" kind. Until they burn their ass and the money got locked for another 10-15 years to breakeven if they are lucky. Those so called plan are really depends on the amount of money you can burn for renovation (estimated 50-80k) and the time when there's no rental income, and also luck. Often times this cost already overlooked and hidden by those guru lar. Renovation cost also require 3-5 years to recover. And we want to talk about positive cashflow wor. Sell nasi lemak side by side also have better chance to grow your money more. |

|

|

Oct 13 2022, 01:36 PM Oct 13 2022, 01:36 PM

|

Senior Member

2,834 posts Joined: Dec 2020 |

QUOTE(temptation1314 @ Oct 13 2022, 01:22 PM) Oversupply already happening nowadays. Yea I rather do kfc business I think.No need wait for Thanos to come snap finger. Problem with majority now still overhang on the traditional way of investing "Buy house confirm up value geh" or "Buy house rent to people get positive cashflow" kind. Until they burn their ass and the money got locked for another 10-15 years to breakeven if they are lucky. Those so called plan are really depends on the amount of money you can burn for renovation (estimated 50-80k) and the time when there's no rental income, and also luck. Often times this cost already overlooked and hidden by those guru lar. Renovation cost also require 3-5 years to recover. And we want to talk about positive cashflow wor. Sell nasi lemak side by side also have better chance to grow your money more. The oversupply is in the undesirable areas mainly. Good areas are well supplied but prices need to come down to increase demand. Short of a major game changer like S’pore HSR things will continue to languish. |

|

|

Oct 13 2022, 07:52 PM Oct 13 2022, 07:52 PM

Show posts by this member only | IPv6 | Post

#20

|

Junior Member

662 posts Joined: Jun 2020 |

Yeah we cant predict any feature crisis, but if now we already start worrying feature things, then we just lost a lot opportunities. Choosing a right location and right price to in, will never been a bad choice to continue invest in property. Property investment is leverage loan to generate extra income and reserved the money value (appreciation value). If want doing KFC, its business, also need to choose a right location and a lot cash flow, selling nasi lemak not need lah haha. But honest speaking, If not investing property, we will not be here, how bad the condition and situation we will still talking property investment. Except someone think property investment died and thinking stock, nft, crypto, forex, etc etc is better choice than property investment. |

| Change to: |  0.0216sec 0.0216sec

0.51 0.51

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 01:23 AM |