sgd goes up due to them buying up their own currency,

how will be their short term outlook be?

continue go up or goes lower?

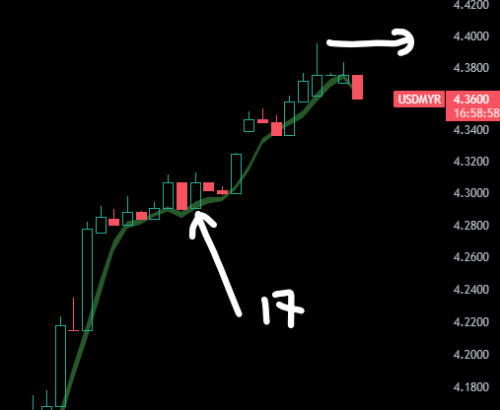

USD/MYR and SGD/MYR

USD/MYR and SGD/MYR

|

|

Aug 15 2023, 05:25 PM Aug 15 2023, 05:25 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

5,741 posts Joined: Apr 2019 |

sgd goes up due to them buying up their own currency,

how will be their short term outlook be? continue go up or goes lower? |

|

|

|

|

|

Sep 8 2023, 07:02 PM Sep 8 2023, 07:02 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(xander2k8 @ Sep 8 2023, 03:42 PM) BNM is tool less already 🤦♀️ trying intervene the market with reserves been drain now and they only left the tool OPR which will be stagnant for awhile RM will be head to 4 and 5 territory soon with SGD and USD anytime I believe sgd will head to 4.6Starting to shift my funds to sgd. Mark this post and recheck in the coming years. immobile liked this post

|

|

|

Sep 8 2023, 07:08 PM Sep 8 2023, 07:08 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

Oct 7 2023, 03:34 AM Oct 7 2023, 03:34 AM

Return to original view | IPv6 | Post

#4

|

Senior Member

5,741 posts Joined: Apr 2019 |

Our reserve is paltry as compared to Singapores reserve. This shows how much money the country has been squandered by certain individuals. Especially the vast natural resources

|

|

|

Apr 9 2024, 05:26 AM Apr 9 2024, 05:26 AM

Return to original view | IPv6 | Post

#5

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(AVFAN @ Apr 8 2024, 07:42 PM) now... BNM keeps saying RM is undervalued. Currency can only be strengthened if the currency is high in demand. Undervalued in what sense? What drives demand? is it possible that it is actually overvalued now?! i mean the huge subsidies been helping, no? if that is gone, like u said, no need economists to tell u what's gonna happen! or... the market has already partially factored in the "subsidy removed" scenario, hence the decline in last few months? so, can we guess the result when the whole subsidy removal thingy is done? or they might U-turn and keep the subsidies going, "kick the can down the road", as they say? pegging is not the answer. it will be costly and might lead to a total collapse in the end: https://www.freemalaysiatoday.com/category/...rotect-ringgit/ |

|

|

Aug 1 2024, 01:50 PM Aug 1 2024, 01:50 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

|

|

|

Aug 1 2024, 02:00 PM Aug 1 2024, 02:00 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Wedchar2912 @ Aug 1 2024, 01:53 PM) take heart... at least your portfolio is well diversified and not all your wealth is stuck in malaysia... yeah, the stuck ones in epf... now myr/ foreign exposure ratio: 40: 60 QUOTE(joeblow @ Aug 1 2024, 01:54 PM) May I know how you moved your usd? via rm30k each fintech or you have other ways to send high digits at low rates? wiseQUOTE(nexona88 @ Aug 1 2024, 01:56 PM) could have gotten rm8k more QUOTE(Medufsaid @ Aug 1 2024, 01:58 PM) yes Wedchar2912 liked this post

|

|

|

Aug 1 2024, 02:08 PM Aug 1 2024, 02:08 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

Aug 6 2024, 04:55 AM Aug 6 2024, 04:55 AM

Return to original view | IPv6 | Post

#9

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(boyboycute @ Aug 5 2024, 11:01 AM) Unker just wanna share very important message to those who like to TT to Singapork this is what i call accidental fame - one right guess, and one thinks he is very very good, resembling cathie woods, bring out milk bottle, infant, breastfeeding setori. When Unker started to roam the Unker, young fella probably still breast feeding. If only young fella listen to Unker last month, they won't be sitting in losses today. Now they lost the EPF dividend plus FX losses...Kesian https://forum.lowyat.net/index.php?showtopi...ost&p=109741680 zoom out long term, myr is horrible. from ratio of 1.1 to ratio of 3.50. 'kesian' CommodoreAmiga and Wedchar2912 liked this post

|

|

|

Sep 10 2024, 12:57 PM Sep 10 2024, 12:57 PM

Return to original view | Post

#10

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Ramjade @ Sep 10 2024, 12:07 PM) Come let me throw some cold water. It's very easy to outperform the EPF. Just buy s&p500 or qqq. 30 years dow the road you will get double or what EPF can give. Problem is most people don't want to wait 30 years. Conservatively 7%p.a for 30 years. Less conservative, would be 10%p.a for 30 years. not wrong at all.

-40% when it's red. that means you need 100% to return to normal level. i have both to balance my baskets.. EPF won't have negative, that is the beauty of it. This post has been edited by gashout: Sep 10 2024, 04:23 PM |

|

|

Sep 10 2024, 09:31 PM Sep 10 2024, 09:31 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Wedchar2912 @ Sep 10 2024, 07:45 PM) lol... which smart alec will just keep whatever converted in non interest bearing anything... only super old people will do that I think... like keeping money in some tin can. EPF past average is 6%. So every 12 years double the money. oo oo... in 1980s, lets convert 400K ringgit to GBP 100K and leave it there... then claim EPF dividend will surpass any FX gain? haha. (my bad... i just could not resist this example after your statement above). 1980 to 2024 is 44 years. Close to 48 years. We make it 4 cycles of doubling. 16x because 2x then 4x then 8x and 16x So 400k basically becomes 6.4 mil today's money. I think he's just trying to say the power of compounding the 8th wonder of the world. Forex exchange mmg cannot beat power of compounding. |

|

|

Sep 11 2024, 05:48 AM Sep 11 2024, 05:48 AM

Return to original view | IPv6 | Post

#12

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Wedchar2912 @ Sep 10 2024, 11:36 PM) makes no sense... comparing a passive investment scheme like EPF to handicapped long term FX holding position without even doing proper deployment of funds. just makes no sense to leave the funds there not invested. Yeah. I was following your 'just leave it there'.. I think you mean something else. |

|

|

Sep 11 2024, 05:49 AM Sep 11 2024, 05:49 AM

Return to original view | IPv6 | Post

#13

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(hksgmy @ Sep 11 2024, 12:00 AM) I’m getting between 4.8-5% risk free (but not tax free) on my AUD FD - ongoing for the past few years. The gravy train will end next year, but then I’ll just have to look for other interest bearing options to grow my holdings. Why will it end next year? Cause interest rate will drop? Or this special package won't be available anymore? |

|

|

|

|

|

Sep 11 2024, 11:49 AM Sep 11 2024, 11:49 AM

Return to original view | IPv6 | Post

#14

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(boyboycute @ Sep 11 2024, 11:08 AM) Thank you @gashout for getting Unker's point here. Unker look at return per unit of risk. When someone transfer to UK or SG, he is unlikely to park it in FD only. His choice would be corporate bond or the stock market. Both entails higher risk than EPF. While EPF may face inflation and Gov policy risk, it has very little cost and fees. i get you yes, compounding interest is a powerful tool. few get it. Kungfu here and there incurred charges, fees and costs. Not forgetting more white hair. BTW, Unker no longer have hair anymore. If u invest wrongly, you can kiss goodbye to your money. Over 30 years, while you Kungfu here, Tai chi there, doing split, Karate punch, Boxing hook etc....Unker sitting in Kopitiam kacau kopi and eat Char Kiuh Tiow, playing with grand children and blow water with neighbors. Then, by miracle, EPF's power of compounding surpassed your portfolio by a mile. Rule No 1 is Don't lose money. Rule No 2 is Compound Consistently. Both rules are very hard to achieve by individual investors, unless you're the next Warren B. so i have 40% in EPF(MYR), and 60% in other currencies, just to balance out everything. EPF is my sleep well mattress, rest is my theme park portfolio... Having said that, I am very excited for my 2^2 for my EPF portfolio when I retire... even if I stop contributing now. This post has been edited by gashout: Sep 11 2024, 11:59 AM |

|

|

Sep 11 2024, 12:22 PM Sep 11 2024, 12:22 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Cubalagi @ Sep 11 2024, 12:19 PM) Nice..quite close to mine. You are on the right track. Got to enjoy the fruits of your labor... Asians fail in that most of the times. At my planned retirement, just a few years from now, Im looking at about 50% EPF and 50% other financial assets (mix bonds, equities, gold and currencies). Still rough approximate depending on how the market will look like, any major career progress and spending pattern. (But nowadays Im more Yolo and not saving aggressively). I am learning to reward myself more now... It has to shift from a phase where we are in saving mode to start to enjoy life mode. Wedchar2912 liked this post

|

|

|

Sep 14 2024, 01:07 PM Sep 14 2024, 01:07 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

Sep 29 2024, 09:52 AM Sep 29 2024, 09:52 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Medufsaid @ Sep 28 2024, 07:13 PM) mod cherry gonna give us a lecture soonThis post has been edited by gashout: Sep 29 2024, 09:53 AM |

|

|

Oct 25 2024, 07:03 PM Oct 25 2024, 07:03 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

5,741 posts Joined: Apr 2019 |

Usd myr 4.33

Heng ah usd! |

|

|

Nov 6 2024, 12:51 PM Nov 6 2024, 12:51 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(dwRK @ Nov 4 2024, 01:11 PM) down she goes as anticipated... will myr continues to strengthen?... no idea but probably... heng ah. my 60% in usd rejoice at 4.39! if trading it... huat the way up liao... hopefully huat the way down also... take it one day at a time... good luck folks... des why must learn to filter the |

|

|

Nov 6 2024, 03:29 PM Nov 6 2024, 03:29 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(dwRK @ Nov 6 2024, 03:10 PM) i remember you mention something about being in cryptos... congrats!!! double win for you... :thumbsup: Yes. That's where most of my usd is at 😂Thanks! 🎉 dwRK liked this post

|

| Change to: |  0.0254sec 0.0254sec

0.68 0.68

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 10:45 AM |