2 years has passed.

If bought MLT and FLT at the time as your suggestion.

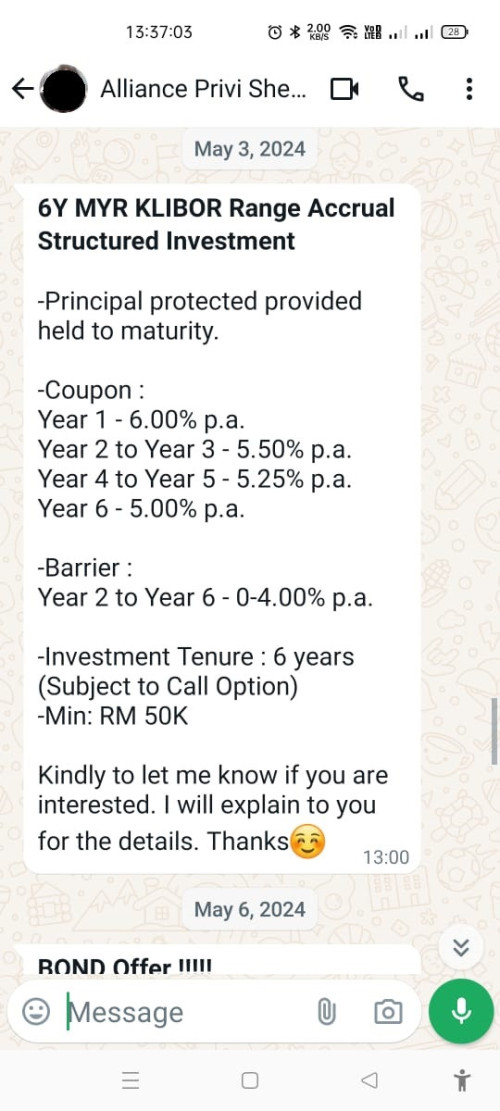

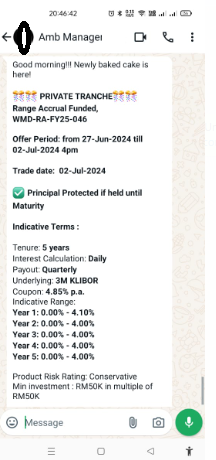

This structured product currently has a better return at the moment.

MLT was around 1.6x at time your posting

FLT was around 1.3x

Even collected 2 years dividend of MLT and FLT + SGD appreciation from 3.20 to current 3.48.

Both investment on MLT and FLT are losing out to a 11% of capital protected product.

MLT current price around 1.30

FLT around 0.95

Not mean to criticise, it was indeed a good suggestion based on interest rate environment at that time.

But things have changed due to interest rate hike afterwards.

From 2 years ago, suggestion changed from reit to bank shares....just indicated things can change over the time, due to unpredicted issues.

Fundamentally, there is no definitely right or wrong in investment.

Don't need to belittle other product, every product has its own merit and con, and serve different market segment needs and individual risk appetite.

This product is never a competitor to equities investment to start with, but a tool hedging on for die hard FD ers.

That's why we won't go to FD thread to say FD is worst, little return, eaten by inflation etc, should investing in xyz for better return, because FD has its purpose even it has the worst return.

Same with EPF, and many other products, you don't go to every thread to say ABC banks shares investment is bestest, others are nonsense. Because every product has its own purpose and intend and serve different individual needs.

We can't chase every penny out there. Even abc is the alpha investment, we also need to park some money in FD that has poor return. We can't say put in FD is silly as we don't know how future is unfolding.

Also, asset diversification may needed by some as their financial management and FD, structured product even insurance may part of their financial management.

Thanks. Actually I hold zero reits now. Once I realise that increment of negative-2%p.a for dividend and you will become the ATM to the reits somewhere down the road, not for me. Even if interest rates goes down to zero again (which it won't), I won't have any reits in my portfolio. I will not become an ATM machine.

I have restructured my portfolio now so that regardless of interest rate, I will be paid and every year they will increase their payment to me with minimum of 10%p.a.increment. My US, EU stocks payout ratio all less than 50%. Some payout like 20% only. Very sustainable going forward.

Jun 22 2022, 04:38 PM

Jun 22 2022, 04:38 PM

Quote

Quote

0.0245sec

0.0245sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled