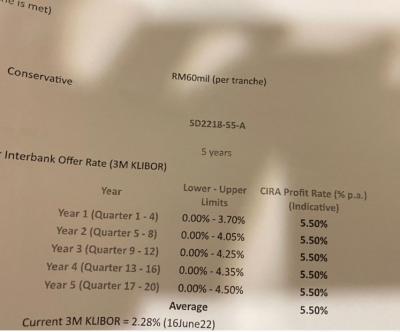

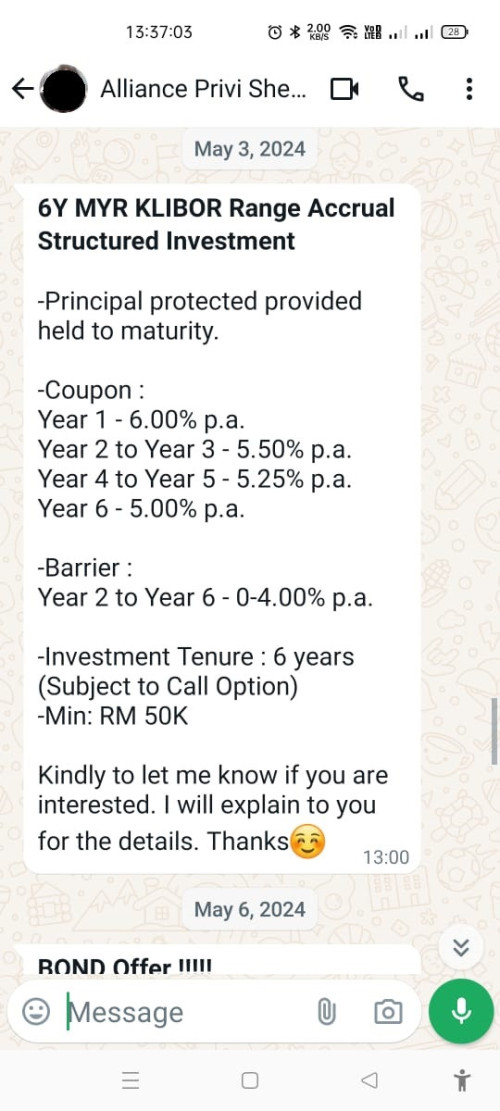

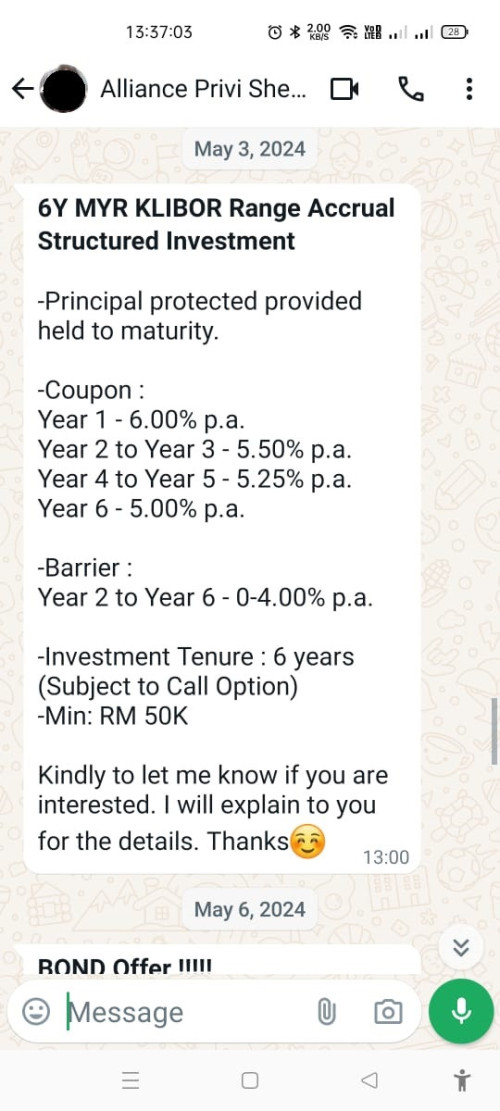

Capital guaranteed if hold 5 years

Get 5.5% as long as Klibor doesnt shoot beyond limit

Paid 3 monthly

Min RM65k only

Closing date Friday 24.6.22

Good deal if Klibor unlikely to shoot beyond those limits

What do you think?

Attached thumbnail(s)

CIMB Islamic product -5 years, Good rate 5.5%

|

|

Jun 22 2022, 02:43 PM, updated 2y ago Jun 22 2022, 02:43 PM, updated 2y ago

Show posts by this member only | IPv6 | Post

#1

|

Senior Member

5,875 posts Joined: Sep 2009 |

|

|

|

|

|

|

Jun 22 2022, 03:03 PM Jun 22 2022, 03:03 PM

Show posts by this member only | Post

#2

|

Senior Member

3,623 posts Joined: Apr 2019 |

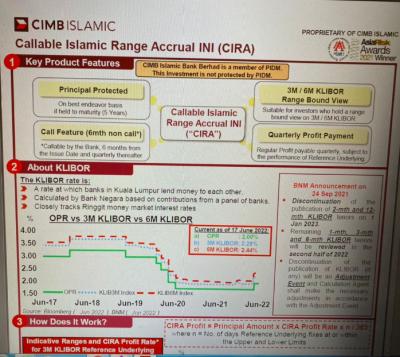

QUOTE(guy3288 @ Jun 22 2022, 02:43 PM) RM told me about this Callable Islamic Range Accrual (CIRA) klibor is highly correlated to OPR set by BNM. Essentially a one-to-one move. Capital guaranteed if hold 5 years Get 5.5% as long as Klibor doesnt shoot beyond limit Paid 3 monthly Min RM65k only Closing date Friday 24.6.22 Good deal if Klibor unlikely to shoot beyond those limits What do you think? the upper barrier is 4% thereabout, meaning your bet is essentially BNM will not hike rates by more than 1.75% from today. Decide if this is a view you are willing to take for the whole 5 years. If you have a choice, can consider depositing money into epf as EPF die die also will give 2.5% pa. This post has been edited by Wedchar2912: Jun 22 2022, 03:28 PM |

|

|

Jun 22 2022, 04:38 PM Jun 22 2022, 04:38 PM

Show posts by this member only | IPv6 | Post

#3

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(guy3288 @ Jun 22 2022, 02:43 PM) RM told me about this Callable Islamic Range Accrual (CIRA) Bro, mapletree logistics and Frasers logistics are yielding around that much. I rather go with them than this bank product.Capital guaranteed if hold 5 years Get 5.5% as long as Klibor doesnt shoot beyond limit Paid 3 monthly Min RM65k only Closing date Friday 24.6.22 Good deal if Klibor unlikely to shoot beyond those limits What do you think? You want debt free stuff for safer risk, trig plc and hicl plc I believed they have no debt. 5%p.a with increment of around 2% yearly. You are earning 5.5% in SGD Vs in RM and 5% in GBP Vs RM. Big difference. This post has been edited by Ramjade: Jun 22 2022, 04:44 PM LoTek and lovelyuser liked this post

|

|

|

Jun 22 2022, 05:30 PM Jun 22 2022, 05:30 PM

Show posts by this member only | Post

#4

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Suggest you to read these 4 pages on "retail structured products" before you proceed. Enjoy.  Modern_Portfolio_Management_Moving_Beyond_Modern_Portfolio_Theory_by_Petzel__Todd_E.__Pg._540_544_.pdf ( 93.17k )

Number of downloads: 289

Modern_Portfolio_Management_Moving_Beyond_Modern_Portfolio_Theory_by_Petzel__Todd_E.__Pg._540_544_.pdf ( 93.17k )

Number of downloads: 289From: Modern Portfolio Management: Moving Beyond Modern Portfolio Theory (Pg. 540-544) on2920 liked this post

|

|

|

Jun 22 2022, 08:35 PM Jun 22 2022, 08:35 PM

Show posts by this member only | IPv6 | Post

#5

|

Senior Member

5,875 posts Joined: Sep 2009 |

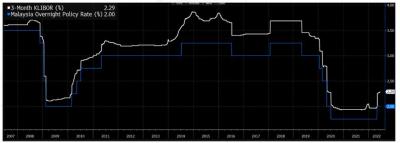

QUOTE(Wedchar2912 @ Jun 22 2022, 03:03 PM) klibor is highly correlated to OPR set by BNM. Essentially a one-to-one move. EPF quota used, SSPN also max out Ganjaran limitsthe upper barrier is 4% thereabout, meaning your bet is essentially BNM will not hike rates by more than 1.75% from today. Decide if this is a view you are willing to take for the whole 5 years. If you have a choice, can consider depositing money into epf as EPF die die also will give 2.5% pa. She showed me OPR and Klibor Chart past 15 yrs, look like never above 4% (FD rate in 2018 was 4.85% ) she told be safe wont exceed , and every year the limit moved up higher to 4.5% I was thinking if high chance can earn all 5 yrs at 5.5% want to put 500k If can earn only 3yrs and another 2 yrs Klibor exceed i got 0%, average 5yrs still got 16.5%/5 =3.3% me willing to gamble with her 65kx2 also QUOTE(Ramjade @ Jun 22 2022, 04:38 PM) Bro, mapletree logistics and Frasers logistics are yielding around that much. I rather go with them than this bank product. i have not opened the IBKR and Spore account yet, You want debt free stuff for safer risk, trig plc and hicl plc I believed they have no debt. 5%p.a with increment of around 2% yearly. You are earning 5.5% in SGD Vs in RM and 5% in GBP Vs RM. Big difference. no real push at my stage want easy meat only. QUOTE(TOS @ Jun 22 2022, 05:30 PM) Suggest you to read these 4 pages on "retail structured products" before you proceed. thanks, noted the riskEnjoy.  Modern_Portfolio_Management_Moving_Beyond_Modern_Portfolio_Theory_by_Petzel__Todd_E.__Pg._540_544_.pdf ( 93.17k )

Number of downloads: 289

Modern_Portfolio_Management_Moving_Beyond_Modern_Portfolio_Theory_by_Petzel__Todd_E.__Pg._540_544_.pdf ( 93.17k )

Number of downloads: 289From: Modern Portfolio Management: Moving Beyond Modern Portfolio Theory (Pg. 540-544) I kena before CIMB FRIND,ended got very low return. then i avoided FRNID past many yrs, now only reconsider this CIRA something similar since it seems past many yrs Klibor never exceed 4 % like a good bet it seems. This post has been edited by guy3288: Jun 22 2022, 08:37 PM Attached thumbnail(s)

|

|

|

Jun 23 2022, 12:39 AM Jun 23 2022, 12:39 AM

Show posts by this member only | IPv6 | Post

#6

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(guy3288 @ Jun 22 2022, 08:35 PM) Don't bet KLIBOR cannot go up. Why? US increasing interest rate like crazy so Malaysia will follow. They cannot just ignore US interest or else RM will become like shit. Although it is already shit.This post has been edited by Ramjade: Jun 23 2022, 12:45 AM |

|

|

|

|

|

Jun 23 2022, 02:16 AM Jun 23 2022, 02:16 AM

Show posts by this member only | IPv6 | Post

#7

|

Senior Member

5,875 posts Joined: Sep 2009 |

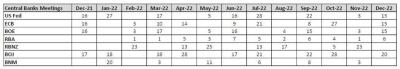

QUOTE(Ramjade @ Jun 23 2022, 12:39 AM) Don't bet KLIBOR cannot go up. Why? US increasing interest rate like crazy so Malaysia will follow. They cannot just ignore US interest or else RM will become like shit. Although it is already shit. 3 more Central bank meetings this year, she confidently said total increase OPR max 0.25 each time, max 0.75, so max OPR can go this year is 2.75, Klibor likely 3.1-3.2 still within limits She made further prediction next year also OPR would increase little 0.2 max x 3= 0.6 --->OPR3.36, Klibor 3.7, i may lose 1 quarter interest in May 2023, in July New Klibor limit 4.05 sets in, again i should get paid 5.5% then CIMB cant tahan paying 5.5%, likely call back Ismail Sabri dared not increase OPR too much, rakyat suffering, loan expensive business will collapse she sounded so confident i hantam lah. ggod thing about this is i collect interest 3 monthly and it is prorated from Central bank meeting date, calculated daily basis Attached thumbnail(s)

|

|

|

Jun 23 2022, 10:38 AM Jun 23 2022, 10:38 AM

Show posts by this member only | IPv6 | Post

#8

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(guy3288 @ Jun 23 2022, 02:16 AM) 3 more Central bank meetings this year, she confidently said total increase OPR max 0.25 each time, max 0.75, I am not talking now. You said product is 5 years long. I am saying klibor can go up to 5% in 5y time.so max OPR can go this year is 2.75, Klibor likely 3.1-3.2 still within limits She made further prediction next year also OPR would increase little 0.2 max x 3= 0.6 --->OPR3.36, Klibor 3.7, i may lose 1 quarter interest in May 2023, in July New Klibor limit 4.05 sets in, again i should get paid 5.5% then CIMB cant tahan paying 5.5%, likely call back Ismail Sabri dared not increase OPR too much, rakyat suffering, loan expensive business will collapse she sounded so confident i hantam lah. ggod thing about this is i collect interest 3 monthly and it is prorated from Central bank meeting date, calculated daily basis lovelyuser liked this post

|

|

|

Jun 23 2022, 11:01 AM Jun 23 2022, 11:01 AM

Show posts by this member only | Post

#9

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

It is suitable for the FD ers, who doesn't want to invest in other riskier asset. Instead of placing long term FD typically more than 1 years plus, that currently earns 2.6 to 2.8%, Klibor FRNID can earn extra interest. It is more like hedging tool against FD interest rate. Scenario 1 If OPR goes up too much, Klibor up beyond range, FRNID doesn't earn. But at the same times the rest of existing FD is going to earn much higher interest rate, that may compensate the FRNID. Scenario 2 While if interest rate doesn't go up too much, FRNID earns extra interest compared to merely placing FD long term. guy3288 liked this post

|

|

|

Jun 23 2022, 12:11 PM Jun 23 2022, 12:11 PM

|

Senior Member

3,623 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Jun 23 2022, 02:16 AM) 3 more Central bank meetings this year, she confidently said total increase OPR max 0.25 each time, max 0.75, what do you expect your RM to say? she works for the bank that is trying to sell you this product. so max OPR can go this year is 2.75, Klibor likely 3.1-3.2 still within limits She made further prediction next year also OPR would increase little 0.2 max x 3= 0.6 --->OPR3.36, Klibor 3.7, i may lose 1 quarter interest in May 2023, in July New Klibor limit 4.05 sets in, again i should get paid 5.5% then CIMB cant tahan paying 5.5%, likely call back Ismail Sabri dared not increase OPR too much, rakyat suffering, loan expensive business will collapse she sounded so confident i hantam lah. ggod thing about this is i collect interest 3 monthly and it is prorated from Central bank meeting date, calculated daily basis look how nicely she state that the hikes of 2023 are in quantum of 20 bps, not 25 bps. BNM traditionally hikes in quantum of 25 bps. The issuer, ie CIMB, will not call back this Range Accrual if rates are heading upwards. US Fed is forecasted to hike at least 1.5% for remainder of 2022, so you are really taking a bet on whether BNM wants a weak ringgit or not.... the bet is basically 5 years time worth of your money.... as of now, just worth around 20% of your 500K rm. lovelyuser liked this post

|

|

|

Jun 24 2022, 09:47 AM Jun 24 2022, 09:47 AM

Show posts by this member only | IPv6 | Post

#11

|

Senior Member

5,875 posts Joined: Sep 2009 |

QUOTE(Ramjade @ Jun 23 2022, 10:38 AM) I am not talking now. You said product is 5 years long. I am saying klibor can go up to 5% in 5y time. yeah 5yrs is long, we take risk everyday, but wont die lah this oneAny idea why her graph showed past 15 yrs Klibor not reaching 5%?no inflation kah ? US OPR not high meh those years? QUOTE(Wedchar2912 @ Jun 23 2022, 12:11 PM) what do you expect your RM to say? she works for the bank that is trying to sell you this product. my typo mistake, she was quite meticulous and thoroughlook how nicely she state that the hikes of 2023 are in quantum of 20 bps, not 25 bps. BNM traditionally hikes in quantum of 25 bps. The issuer, ie CIMB, will not call back this Range Accrual if rates are heading upwards. US Fed is forecasted to hike at least 1.5% for remainder of 2022, so you are really taking a bet on whether BNM wants a weak ringgit or not.... the bet is basically 5 years time worth of your money.... as of now, just worth around 20% of your 500K rm. i have other RMs so pushy i avoided out right this one good, can see one. even lend me RM20k today for my shortfall miscalculating KDI withdrawals.. end of day she make hers, i want to make mine, same same. dont understand your 5yrs time---worth 20% of RM500k meaning?can depreciate RM100 k, so much? Attached thumbnail(s)

|

|

|

Jun 24 2022, 10:54 AM Jun 24 2022, 10:54 AM

Show posts by this member only | IPv6 | Post

#12

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(guy3288 @ Jun 24 2022, 09:47 AM) yeah 5yrs is long, we take risk everyday, but wont die lah this one * Are willing to accept zero profit payment if the Reference Underlying is outside the specified ranges * Any idea why her graph showed past 15 yrs Klibor not reaching 5%?no inflation kah ? US OPR not high meh those years? my typo mistake, she was quite meticulous and thorough i have other RMs so pushy i avoided out right this one good, can see one. even lend me RM20k today for my shortfall miscalculating KDI withdrawals.. end of day she make hers, i want to make mine, same same. dont understand your 5yrs time---worth 20% of RM500k meaning?can depreciate RM100 k, so much? Does this mean getting back the principal amount without any interest at all ? Quarterly paid interest will be claw back as well? |

|

|

Jun 24 2022, 03:26 PM Jun 24 2022, 03:26 PM

Show posts by this member only | IPv6 | Post

#13

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(guy3288 @ Jun 24 2022, 09:47 AM) yeah 5yrs is long, we take risk everyday, but wont die lah this one US inflation have always been low. Only start last year have it bene high cause of massive printing. The last time inflation was this high in the US, it's like 30 years ago.Any idea why her graph showed past 15 yrs Klibor not reaching 5%?no inflation kah ? US OPR not high meh those years? my typo mistake, she was quite meticulous and thorough i have other RMs so pushy i avoided out right this one good, can see one. even lend me RM20k today for my shortfall miscalculating KDI withdrawals.. end of day she make hers, i want to make mine, same same. dont understand your 5yrs time---worth 20% of RM500k meaning?can depreciate RM100 k, so much? |

|

|

|

|

|

Jun 28 2022, 01:25 PM Jun 28 2022, 01:25 PM

Show posts by this member only | IPv6 | Post

#14

|

Senior Member

5,875 posts Joined: Sep 2009 |

QUOTE(no6 @ Jun 24 2022, 10:54 AM) * Are willing to accept zero profit payment if the Reference Underlying is outside the specified ranges * yeah that is the risk i take.Does this mean getting back the principal amount without any interest at all ? Quarterly paid interest will be claw back as well? claw back No. 3 monthly whatever pocketed in is yours. PS: Sold out in 1 day, late orders did not get it. no6 liked this post

|

|

|

Jul 6 2022, 06:12 PM Jul 6 2022, 06:12 PM

|

Senior Member

3,623 posts Joined: Apr 2019 |

|

|

|

Jul 6 2022, 09:15 PM Jul 6 2022, 09:15 PM

Show posts by this member only | IPv6 | Post

#16

|

Senior Member

5,875 posts Joined: Sep 2009 |

QUOTE(Wedchar2912 @ Jul 6 2022, 06:12 PM) i am sure the barriers are much better now if CIMB relaunch. surprisingly No! lower barriers maybe you can ask your RM again since you have not invested. coupon rate reduced ! that should mean something right? FD rate wont go up much......i guess i booked early luckily This post has been edited by guy3288: Jul 6 2022, 09:19 PM Attached thumbnail(s)

|

|

|

Jul 6 2022, 09:45 PM Jul 6 2022, 09:45 PM

|

Senior Member

3,623 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Jul 6 2022, 09:15 PM) surprisingly No! lower barriers need to ask for a refresh if you are still keen to invest, after today's OPR announcement by BNM. coupon rate reduced ! that should mean something right? FD rate wont go up much......i guess i booked early luckily hopefully u didn't buy into this version (or at least if you got in, it was the previous version with a slightly higher coupon rate). |

|

|

Jun 30 2024, 08:24 PM Jun 30 2024, 08:24 PM

|

Newbie

14 posts Joined: Sep 2014 |

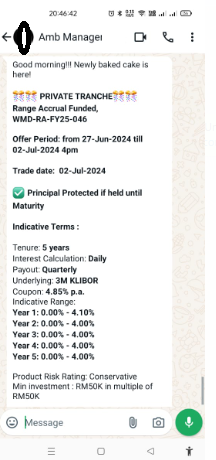

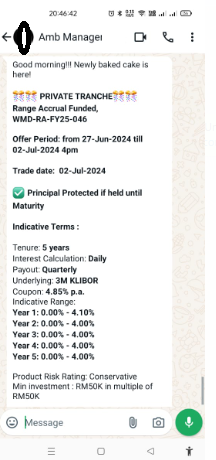

hi any views regarding this investment product given that market view now is there will be multiple rate cuts in the coming 1-2 years meaning klibor shld drop too hence chances of hitting above the mark set will be slimmer and bank will be a loser if keep issuing this product? so does this mean bank is likely to call n stop the product ? unless usa inflation bak again n rate continue hike then buyer of such products will lose..thanks..

|

|

|

Jun 30 2024, 09:04 PM Jun 30 2024, 09:04 PM

Show posts by this member only | IPv6 | Post

#19

|

Senior Member

5,875 posts Joined: Sep 2009 |

QUOTE(kenshi13 @ Jun 30 2024, 08:24 PM) hi any views regarding this investment product given that market view now is there will be multiple rate cuts in the coming 1-2 years meaning klibor shld drop too hence chances of hitting above the mark set will be slimmer and bank will be a loser if keep issuing this product? so does this mean bank is likely to call n stop the product ? unless usa inflation bak again n rate continue hike then buyer of such products will lose..thanks.. current klibor 3.59upper limit if only 4.0 is too close for comfort my CIRA was better upper limit higher but you cant win the bank My CIRA called back already..sigh.. yet RM kept bombarding me with their new tranches. the rate is getting lower and lower, but klibor upper limit remain.    |

|

|

Jun 30 2024, 09:29 PM Jun 30 2024, 09:29 PM

Show posts by this member only | IPv6 | Post

#20

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(kenshi13 @ Jun 30 2024, 08:24 PM) hi any views regarding this investment product given that market view now is there will be multiple rate cuts in the coming 1-2 years meaning klibor shld drop too hence chances of hitting above the mark set will be slimmer and bank will be a loser if keep issuing this product? so does this mean bank is likely to call n stop the product ? unless usa inflation bak again n rate continue hike then buyer of such products will lose..thanks.. QUOTE(guy3288 @ Jun 30 2024, 09:04 PM) current klibor 3.59 That's why I hold bank shares instead of all this nonsense thing. 5-6%p.a until infinity and increasing yearly too.upper limit if only 4.0 is too close for comfort my CIRA was better upper limit higher but you cant win the bank My CIRA called back already..sigh.. yet RM kept bombarding me with their new tranches. the rate is getting lower and lower, but klibor upper limit remain.    |

| Change to: |  0.0284sec 0.0284sec

0.29 0.29

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 02:59 AM |