Outline ·

[ Standard ] ·

Linear+

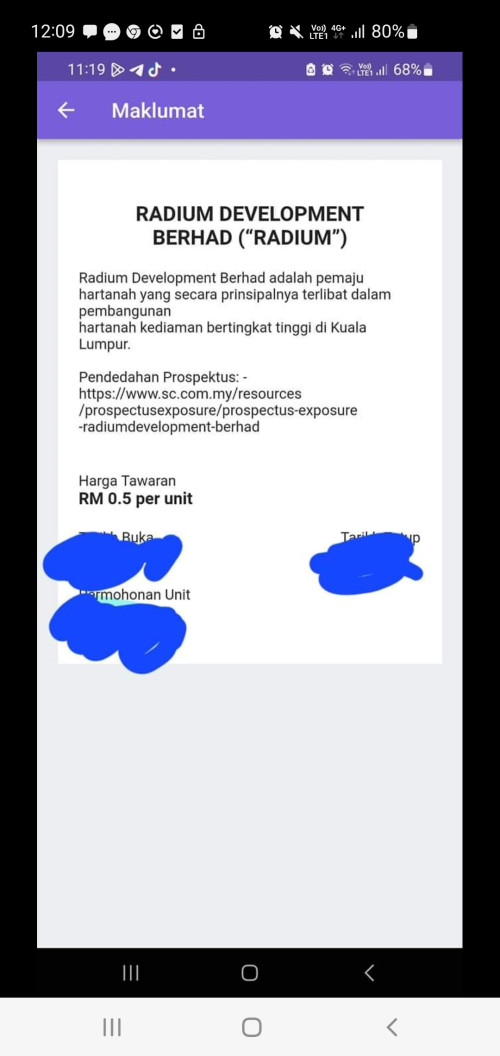

Radium Development Berhad (5313), Main Market

|

vorshre P

|

Mar 6 2023, 01:06 AM Mar 6 2023, 01:06 AM

|

New Member

|

QUOTE(xander2k8 @ Mar 5 2023, 03:02 PM) No need to wonder the problem 🤦♀️ it is just because of book keeping purposes that SC doesn’t approve To be listed most important is always is the books hence why company willing pay a starting million dollar to reputable IBs to secure the approval for listing Again please do read more and dont simply make stupid and misleading statements. Where on earth do you know that the books (financial statements) got problem?? It is now open for application for MITI investors, which means SC has approved and will be listed soon. |

|

|

|

|

|

xander2k8

|

Mar 6 2023, 01:23 AM Mar 6 2023, 01:23 AM

|

|

QUOTE(vorshre @ Mar 6 2023, 01:06 AM) Again please do read more and dont simply make stupid and misleading statements. Where on earth do you know that the books (financial statements) got problem?? It is now open for application for MITI investors, which means SC has approved and will be listed soon. Read it almost a year after the started process in the 1st place and only has been approved by SC earlier this year 🤦♀️ Even their IBs has been signed but no news yet because of the book keeping hence which is why the process delay 🤦♀️ The prospectuses published here have not been registered with the SC under Section 232 of the Capital Markets and Services Act 2007 and is solely for the purpose of seeking comments from the public. 🤦♀️ https://www.sc.com.my/resources/prospectus-...elopment-berhadIf it has been approved it won’t be under exposure 🤦♀️ This post has been edited by xander2k8: Mar 6 2023, 01:35 AM |

|

|

|

|

|

twim

|

Mar 7 2023, 08:55 AM Mar 7 2023, 08:55 AM

|

Getting Started

|

is this co. worth 1-2 billion upon listing ?

|

|

|

|

|

|

TSnexona88

|

Mar 7 2023, 09:32 AM Mar 7 2023, 09:32 AM

|

|

QUOTE(twim @ Mar 7 2023, 08:57 AM) hmmm looks like PE 20x based on 50c / share..ok kah for property developer ? It's 50/50.. Not so okay.. acceptable ☺️ |

|

|

|

|

|

privatequity

|

Mar 10 2023, 02:39 PM Mar 10 2023, 02:39 PM

|

|

QUOTE(nexona88 @ Mar 7 2023, 09:32 AM) It's 50/50.. Not so okay.. acceptable ☺️ I think SkyWorld better, at PE 10x. Bro can open new thread for upcoming ipo for DXN n SkyWorld? |

|

|

|

|

|

TSnexona88

|

Mar 10 2023, 02:52 PM Mar 10 2023, 02:52 PM

|

|

QUOTE(privatequity @ Mar 10 2023, 02:39 PM) I think SkyWorld better, at PE 10x. Bro can open new thread for upcoming ipo for DXN n SkyWorld? already open https://forum.lowyat.net/index.php?showtopic=5282515&hl=https://forum.lowyat.net/index.php?showtopic=5338689&hl= |

|

|

|

|

|

privatequity

|

Mar 10 2023, 03:05 PM Mar 10 2023, 03:05 PM

|

|

QUOTE(nexona88 @ Mar 10 2023, 02:52 PM) Amazing. |

|

|

|

|

|

earshore

|

Mar 25 2023, 10:03 AM Mar 25 2023, 10:03 AM

|

|

very tough market for property developers

|

|

|

|

|

|

kcp88

|

Mar 31 2023, 07:34 PM Mar 31 2023, 07:34 PM

|

New Member

|

QUOTE(xander2k8 @ Feb 27 2023, 02:09 PM) Stop preaching as they are well known for nice models but bad delivery in projects till defects still laying around for years 🤦♀️ Ppl around that Development knows about how unradiant upon delivery 👏 My own experience together with the Google reviews, I must say it's absolutely sensible for you to say this. This post has been edited by kcp88: Mar 31 2023, 07:35 PM |

|

|

|

|

|

xander2k8

|

Mar 31 2023, 08:29 PM Mar 31 2023, 08:29 PM

|

|

QUOTE(kcp88 @ Mar 31 2023, 07:34 PM) My own experience together with the Google reviews, I must say it's absolutely sensible for you to say this. How bad was your experience? Defects or major pains? |

|

|

|

|

|

abdhadijafar

|

Apr 4 2023, 06:07 AM Apr 4 2023, 06:07 AM

|

Getting Started

|

Selepas join iftar bersama Rhadium and Mplus harini, sedikit info yang telah dishare oleh para directors:

.

1) Company rhadium antara company yg bagus kerana profit growth yg meningkat tiap tahun dan PAT (Untung selepas cukai) yg tinggi around 100++ Milion utk tahun lepas, 2022

.

2) Projek2nya semua bernilai 300k-600k, iaitu mampu milik dan lokasi semua di lokasi yg prime, KL only (luar KL diorg tak buat), walking distance to LRT or MRT, seperti Vista Wirajaya, PV9

.

3) Kadar penjualan semua rumah²nya habis terjual - 100% take up even time covid kerana price point yg menarik utk projek² di KL

.

4) Future projects - antaranya pembinaan 1 hotel di KL, untuk menghasilkan sustainable income utk cover overhead company

.

5) IPO raised akan digunakan utk membeli tanah² lagi utk future projects

.

6) Kadar pinjaman yg sngt rendah, dan sngt berdisplin. Setiap kali settle project, full settlement akan dibuat utk settlekan pinjaman utk project berkenaan

7) Kadar dividen yg dijanjikan jugak sngt menarik, around 30% (tak ingt dari pada apa), yg mungkin akan menarik bnyk fund or trustees yg mengejar dividen..kita hold pun boleh makan dividen

.

8) No offer for sale

Prediction harga utk seunit rhadium IPO ialah dalam RM0.50++ (based on talk harini), dan prediction saya based on good performance and profit growth utk company rhadium, insyallah kenaikan 10-30% dari harga IPO (RM0.60-RM0.70) pada hari listing consider kepada sector dan comparison to previous IPO listing (Kitacon), tidak mustahil..apa kata anda?

This post has been edited by abdhadijafar: Apr 4 2023, 06:45 AM

|

|

|

|

|

|

twim

|

Apr 4 2023, 02:55 PM Apr 4 2023, 02:55 PM

|

Getting Started

|

Thanks for the insights datuk..

|

|

|

|

|

|

TSnexona88

|

Apr 4 2023, 04:51 PM Apr 4 2023, 04:51 PM

|

|

abdhadijafar Terima Kasih Boss atas maklumat terkini & panas dari ladang

|

|

|

|

|

|

R Investor P

|

Apr 5 2023, 12:45 PM Apr 5 2023, 12:45 PM

|

New Member

|

KUALA LUMPUR (April 3): Property developer Radium Development Bhd has inked an underwriting agreement with Malacca Securities Sdn Bhd and CIMB Investment Bank Bhd in conjunction with its upcoming initial public offering (IPO) on the Main Market of Bursa Malaysia Securities Bhd.

The IPO exercise involves a public issuance of 868 million new shares, representing 25% of its enlarged share capital.

Radium’s IPO is distinctive in that there is no offer-for-sale component, with all IPO proceeds to be channelled to the group.

The IPO proceeds will substantially be utilised for the acquisition of land bank and development expenditure, as well as hotel construction, demonstrating Radium’s commitment to accelerating its business growth.

Out of the 868 million new shares to be issued, 273 million shares will be made available to the Malaysian public via balloting, followed by 60 million shares to its eligible key senior management, employees of the group and business associates, including any other persons who have contributed to the success of the group.

A further 435 million shares will be offered by way of private placement to selected Bumiputera investors approved by the Ministry of International Trade and Industry, and the remaining 100 million shares for selected investors by way of private placement.

Malacca Securities is the principal adviser, managing underwriter and a joint placement agent for the IPO, while CIMB Investment Bank is a joint underwriter and joint placement agent.

Radium is slated to be listed on the Main Market in the second quarter of 2023.

|

|

|

|

|

|

abdhadijafar

|

Apr 12 2023, 03:51 PM Apr 12 2023, 03:51 PM

|

Getting Started

|

Info tambahan dari insider

1. Listing 31 may

2. Harga 50sen

3. 2.9 billion in 5years.. project in pipeline..

4. PAT 2022 around 100-110million (ni masih belum annouce lagi)

5. Akan ada special dividen

6. Mungkin akan ada cornerstones (foreign)

7. Final prospectus akan keluar 27 april

8. Private placement sudah habis

|

|

|

|

|

|

Baik

|

Apr 18 2023, 05:44 PM Apr 18 2023, 05:44 PM

|

|

Miti dah keluar ...100%? 🥵

Good luck and all the best.

PS: cctv mode

|

|

|

|

|

|

twim

|

Apr 19 2023, 05:55 AM Apr 19 2023, 05:55 AM

|

Getting Started

|

If MITI allocated 100000 shares but we take up 80000 shares will kena moratorium 6 months ?

|

|

|

|

|

|

Baik

|

Apr 19 2023, 07:51 AM Apr 19 2023, 07:51 AM

|

|

QUOTE(twim @ Apr 19 2023, 06:55 AM) If MITI allocated 100000 shares but we take up 80000 shares will kena moratorium 6 months ? Supposedly, either take all or take none (6 months ban). |

|

|

|

|

|

twim

|

Apr 19 2023, 08:38 AM Apr 19 2023, 08:38 AM

|

Getting Started

|

Tq bro.. Then I think I TOLAK la.. U taking ?

|

|

|

|

|

Mar 6 2023, 01:06 AM

Mar 6 2023, 01:06 AM

Quote

Quote

0.0286sec

0.0286sec

1.22

1.22

5 queries

5 queries

GZIP Disabled

GZIP Disabled