QUOTE(crador @ Mar 1 2022, 09:16 AM)

How was your life after the purchase?

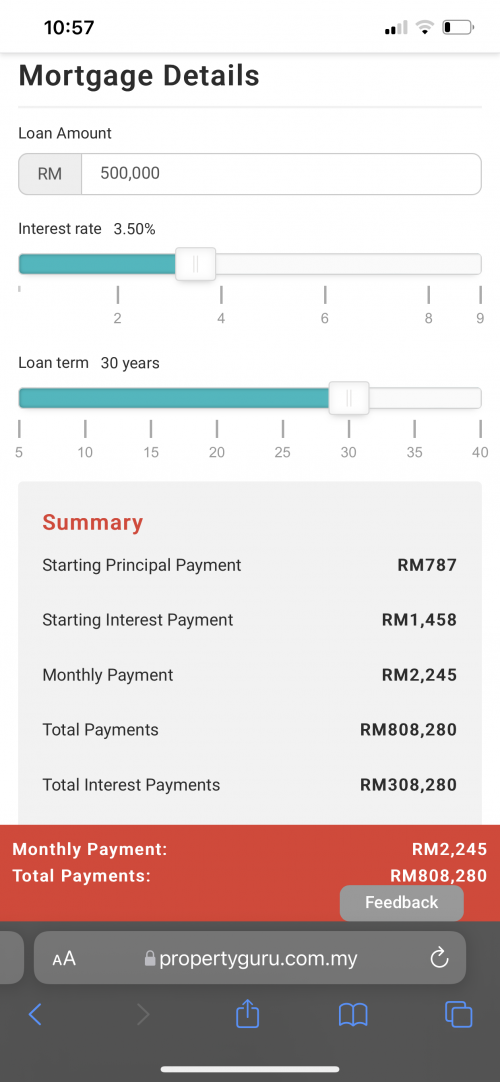

I think it must have been difficult. Because assuming he paid 50k dp, his 400k loan of 30 years tenure would be about RM1.9k monthly. At 3.7k gross or 3.3k nett, he wouldn't be able to save much, probably living with family, no car loans, no medical insurance, and no allowance for his family.

QUOTE(cy91 @ Feb 28 2022, 11:50 PM)

6735 nett also means 8.1k salary.. If follow this rule of thumbs how many ppl can afford property

Not many. Hence why many have joint names these days. And those who manage to with lesser salary, means they paid a higher down payment, have other sources of income (non-declared type

) or with family money. It is really not uncommon these days that youngsters have their family to finance their purchases these days.

I took a 100k loan in 2005 for a 265k condo, and I was earning just above RM3k then. I was fortunate to have some success with my investments since I started working in year 1992 and with about 50k assisted by family. At about RM950 installment per month, I really could not do much, could save but not much, and I was living with my family.

Have since paid back my mum the money.

Feb 28 2022, 10:05 PM, updated 4y ago

Feb 28 2022, 10:05 PM, updated 4y ago

Quote

Quote

0.1026sec

0.1026sec

0.82

0.82

5 queries

5 queries

GZIP Disabled

GZIP Disabled