QUOTE(Jessica JM. @ Mar 29 2022, 02:27 PM)

Same enquiry like previous post, what do you think?

I didn't know Islamic financing had no lock-in penalty, thanks for telling me. Doesn't that mean the rate is higher?

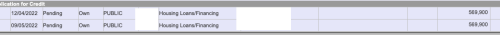

If I were you, I will go for conventional loan for house A and islamic loan for house B from 2 banks.I didn't know Islamic financing had no lock-in penalty, thanks for telling me. Doesn't that mean the rate is higher?

Then you will have another spare cash to buy a similar property and do it the same way, just pay RPGT if sell within 3 years.

The rate is pretty much the same. Go for islamic loan without lock-in.

But u haven't answered me where's house B located though. =)

Mar 29 2022, 07:18 PM

Mar 29 2022, 07:18 PM

Quote

Quote

0.0178sec

0.0178sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled