Is it possible?

Can you short shares in BSKL?, selling not buying

Can you short shares in BSKL?, selling not buying

|

|

Feb 17 2022, 04:39 PM, updated 4y ago Feb 17 2022, 04:39 PM, updated 4y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

119 posts Joined: Feb 2012 |

Is it possible?

|

|

|

|

|

|

Feb 17 2022, 05:02 PM Feb 17 2022, 05:02 PM

Show posts by this member only | Post

#2

|

Junior Member

383 posts Joined: Jul 2008 From: Penang |

|

|

|

Feb 18 2022, 05:45 AM Feb 18 2022, 05:45 AM

Show posts by this member only | Post

#3

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

Buy warrants instead

|

|

|

Feb 18 2022, 11:25 AM Feb 18 2022, 11:25 AM

Show posts by this member only | IPv6 | Post

#4

|

Junior Member

119 posts Joined: Feb 2012 |

|

|

|

Feb 18 2022, 11:27 AM Feb 18 2022, 11:27 AM

Show posts by this member only | IPv6 | Post

#5

|

Senior Member

3,501 posts Joined: Jan 2003 |

short FKLI futures (margin RM4,000 i think, but if you have RM40-80k, you no need to worry of the margin)

This post has been edited by Medufsaid: Feb 18 2022, 11:29 AM |

|

|

Feb 18 2022, 11:28 AM Feb 18 2022, 11:28 AM

Show posts by this member only | IPv6 | Post

#6

|

Junior Member

119 posts Joined: Feb 2012 |

QUOTE(pysh @ Feb 17 2022, 06:02 PM) I am using PB investment platform.Can't short or sell stocks I dont own. |

|

|

|

|

|

Feb 18 2022, 11:28 AM Feb 18 2022, 11:28 AM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

119 posts Joined: Feb 2012 |

|

|

|

Feb 18 2022, 11:30 AM Feb 18 2022, 11:30 AM

Show posts by this member only | IPv6 | Post

#8

|

Senior Member

3,501 posts Joined: Jan 2003 |

wanted to edit my post but you saw it already... ok here goes you can open a futures account with your broker. if you are afraid of leverage, you can just buy 0835EA counter, which is shorting the FBM KLCI index without leverage zib5 liked this post

|

|

|

Feb 18 2022, 11:37 AM Feb 18 2022, 11:37 AM

Show posts by this member only | IPv6 | Post

#9

|

Senior Member

4,503 posts Joined: Mar 2014 |

U find a broker that can offer u IDSS.However, that is only intra day shorting of the stocks. U have to close position by end of day The longer term shorting is called RSS, no broker offer that to normal retail. Otherwise, as mentioned by others, trade futures FKLI or find a broker that allows u to trade 0835EA. zib5 liked this post

|

|

|

Feb 18 2022, 11:47 AM Feb 18 2022, 11:47 AM

|

Junior Member

383 posts Joined: Jul 2008 From: Penang |

yea as per Cubalagi bro.. u need special brokers that can short

|

|

|

Feb 18 2022, 02:43 PM Feb 18 2022, 02:43 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

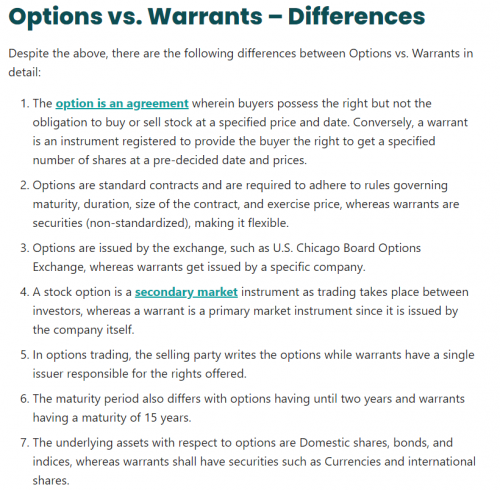

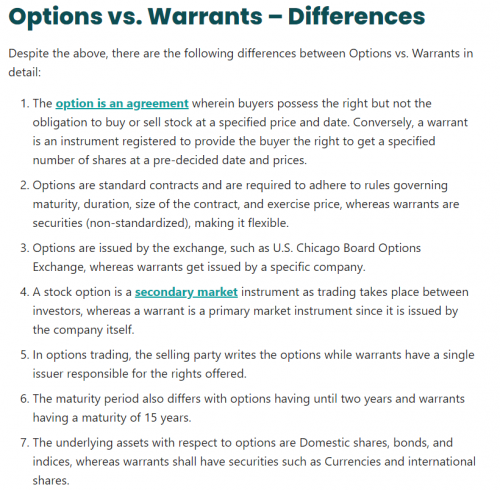

QUOTE(zib5 @ Feb 18 2022, 11:25 AM) Warrants are issued by companies, giving the holder the right but not the obligation to buy a security at a particular price.Companies often include warrants as part of share offerings to entice investors into buying the new security. Warrants tend to exaggerate the percentage change movement compared to the underlying share price. Types of Warrants There are two different types of warrants: call warrants and put warrants. A call warrant represents a specific number of shares that can be purchased from the issuer at a specific price, on or before a certain date. A put warrant represents a certain amount of equity that can be sold back to the issuer at a specified price, on or before a stated date. If you seriously wanna short the warrant is the best as it cheap and easy to get out because unlike 0835ea as the volume is low You need to which company you interested and put warrants in Bursa |

|

|

Feb 18 2022, 03:06 PM Feb 18 2022, 03:06 PM

Show posts by this member only | IPv6 | Post

#12

|

Junior Member

119 posts Joined: Feb 2012 |

QUOTE(xander83 @ Feb 18 2022, 03:43 PM) Warrants are issued by companies, giving the holder the right but not the obligation to buy a security at a particular price. sounds like options to meCompanies often include warrants as part of share offerings to entice investors into buying the new security. Warrants tend to exaggerate the percentage change movement compared to the underlying share price. Types of Warrants There are two different types of warrants: call warrants and put warrants. A call warrant represents a specific number of shares that can be purchased from the issuer at a specific price, on or before a certain date. A put warrant represents a certain amount of equity that can be sold back to the issuer at a specified price, on or before a stated date. If you seriously wanna short the warrant is the best as it cheap and easy to get out because unlike 0835ea as the volume is low You need to which company you interested and put warrants in Bursa |

|

|

Feb 18 2022, 03:06 PM Feb 18 2022, 03:06 PM

Show posts by this member only | IPv6 | Post

#13

|

Junior Member

119 posts Joined: Feb 2012 |

-deleted-

oops double post This post has been edited by zib5: Feb 18 2022, 03:07 PM |

|

|

|

|

|

Feb 18 2022, 03:15 PM Feb 18 2022, 03:15 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Feb 18 2022, 03:24 PM Feb 18 2022, 03:24 PM

Show posts by this member only | IPv6 | Post

#15

|

Senior Member

3,501 posts Joined: Jan 2003 |

QUOTE(xander83 @ Feb 18 2022, 03:15 PM) have you opened any positions in options before (FYI, i do. vanilla and synthetic options)? I don't see how if i sold an option that ITM, I can choose to not deliver if the holder wanted to exercise it.This post has been edited by Medufsaid: Feb 18 2022, 03:25 PM |

|

|

Feb 18 2022, 04:09 PM Feb 18 2022, 04:09 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Feb 20 2022, 02:43 PM Feb 20 2022, 02:43 PM

Show posts by this member only | IPv6 | Post

#17

|

Senior Member

3,501 posts Joined: Jan 2003 |

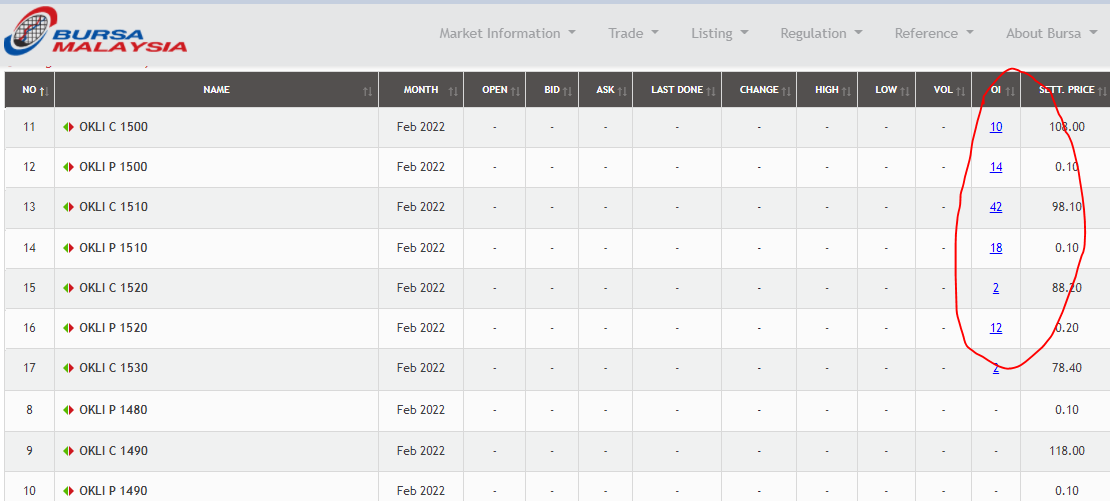

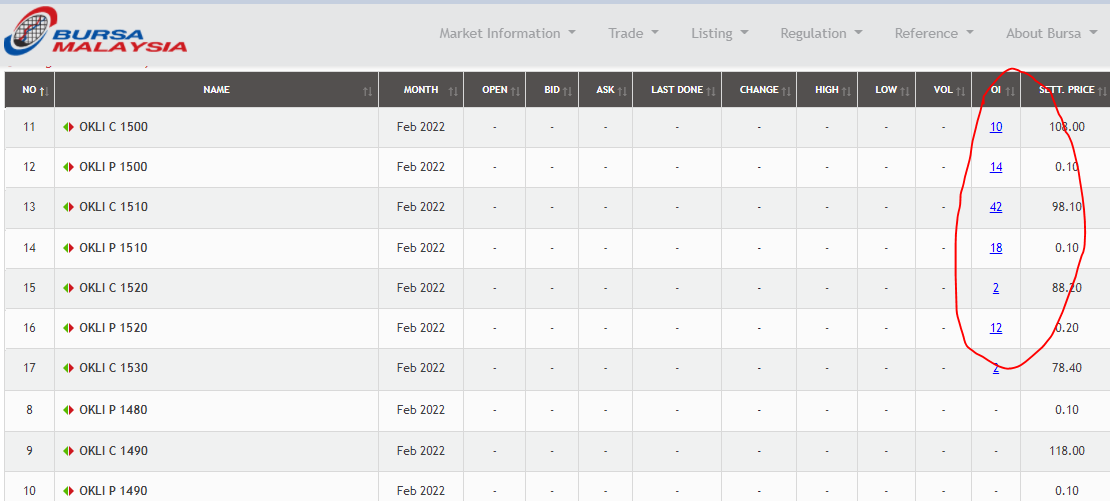

QUOTE(zib5 @ Feb 18 2022, 03:06 PM)  https://www.wallstreetmojo.com/options-vs-warrants based on above, and my fut/options trading experience, Warrants are issued by the parent company (so there's a fixed amount), while options are created by the Put/Call seller (number of options created can be viewed in the "open interest" column)  i think can ignore xander83 unless he can explain what he meant by binding This post has been edited by Medufsaid: Feb 20 2022, 02:48 PM |

|

|

Feb 21 2022, 04:15 PM Feb 21 2022, 04:15 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Medufsaid @ Feb 20 2022, 02:43 PM)  https://www.wallstreetmojo.com/options-vs-warrants based on above, and my fut/options trading experience, Warrants are issued by the parent company (so there's a fixed amount), while options are created by the Put/Call seller (number of options created can be viewed in the "open interest" column)  i think can ignore xander83 unless he can explain what he meant by binding You are wrong again as warrant is not issued by parent company unlike shares whereby only can be issue do by licensed issuers and in Malaysia there’s only 6 warrant issuers |

|

|

Feb 21 2022, 04:34 PM Feb 21 2022, 04:34 PM

|

Senior Member

3,501 posts Joined: Jan 2003 |

|

|

|

Feb 21 2022, 04:36 PM Feb 21 2022, 04:36 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

| Change to: |  0.0210sec 0.0210sec

0.38 0.38

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 11:45 AM |