Citibank Berhad

Hong Leong Bank Berhad (MYX: 5819)

The major requirement is your minimum income.

According to the 2011 BNM guidelines, the minimum income for a first-time applicant is RM24,000 annually.

Banks will require proof of income to qualify you as a credit card holder. Other than that, you must also have a valid identity card, employer letter of confirmation and other documents to support your application.

Not all banks have the same income requirement for the same card type.

For example, a Gold card by Bank A is offered to those with a monthly salary of RM3,000 and above, whereas Bank B opens to anyone earning a minimum of RM2,000 per month.

Income > MYR 2,000

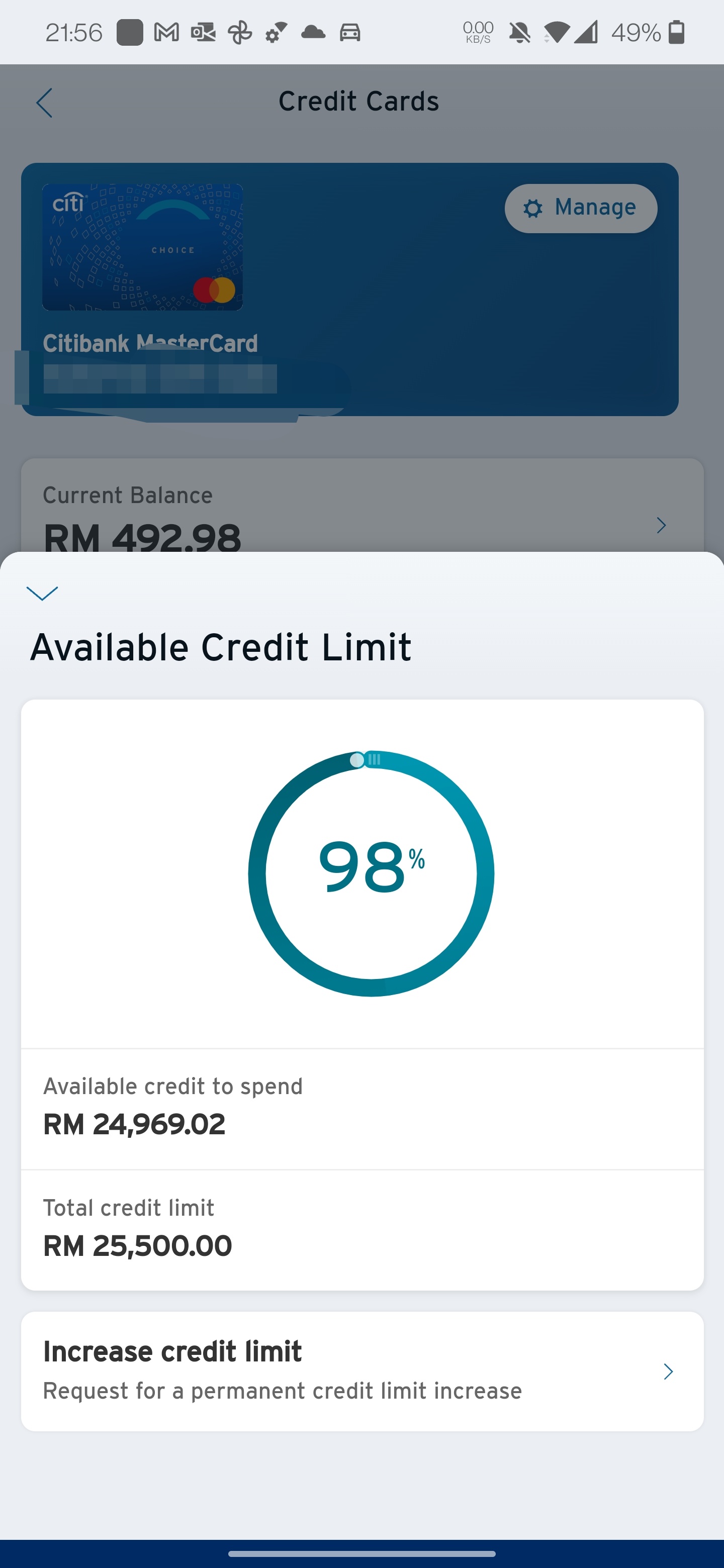

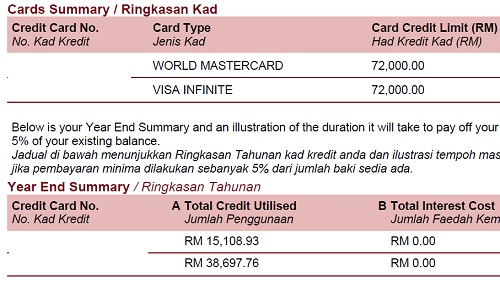

Your credit limit is determined by your annual income (can be non-employment income, e.g. rental income).

If your annual income is RM 30,000 or below, your credit limit is capped at 2X your monthly income.

If you earn RM30,000 to RM120,000 a year, your credit limit is up to 4X your monthly income.

There is no regulation on your credit limit if you earn RM120,000 or more a year.

How much is yours?

This post has been edited by plouffle0789: Jan 10 2022, 12:32 AM

Jan 9 2022, 09:23 PM, updated 4y ago

Jan 9 2022, 09:23 PM, updated 4y ago

Quote

Quote

0.0649sec

0.0649sec

1.06

1.06

6 queries

6 queries

GZIP Disabled

GZIP Disabled