QUOTE(TOS @ Dec 27 2021, 10:49 PM)

don't mislead people lah. Diversification is important, across industries/countries/companies.

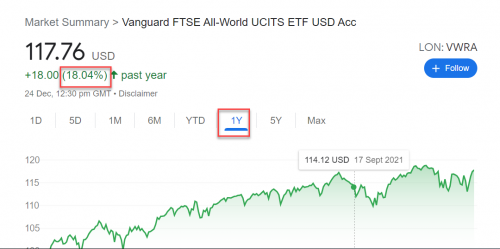

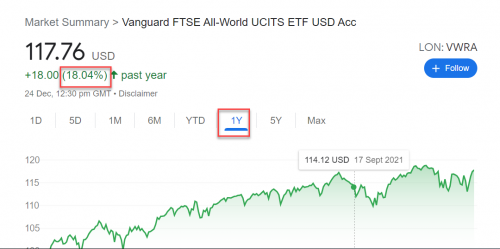

use IBKR, buy VWRA - best diversification as it has many large and medium size companies all across the world. Also it is Irish domiciled 15% WHT tax on dividends only instead of usual 30% tax. Hence also dividend investing for US stocks not that attractive due to 30% WHT tax. Better go for growth stocks.

comes to withdrawal speed, if use Stashaway also same thing when try to withdraw after sell, need +2 days or so.

heck even local Bursa after sell also need few days before can withdraw money into own bank after sell.

So i dont see why not 100% in IBKR. It can even be used to buy SG stocks there and all across the world. Just take note of the fees as different stock exchange different fees. Taxes might be different also.

why US stocks.. just google Amazon, Apple, Tesla, Meta, Alphabet stocks.. see how much they went up every year.

for ETFs go for CSPX, VWRA, SWRD etc irish domiciled.

or u can copy Stashaway's ETF selections by opening at account there.. choose the good ETFs and invest DIY yourself via IBKR.

I always see this before I invest.. people say past performance doesn't matter.. yeah right then just check Bursa stocks and tell me if past performance matters or not? Many people got fed up with Bursa's performance just check reddit, youtube etc forums else why foreign investors keep withdraw. US stocks and ETFs is the way. Some SG stocks or overseas stocks also not bad.

This post has been edited by Davidtcf: Dec 28 2021, 03:28 PM

This post has been edited by Davidtcf: Dec 28 2021, 03:28 PM

Dec 27 2021, 09:46 PM, updated 4y ago

Dec 27 2021, 09:46 PM, updated 4y ago

Quote

Quote

0.0198sec

0.0198sec

0.51

0.51

5 queries

5 queries

GZIP Disabled

GZIP Disabled