QUOTE(vinlyy @ Dec 23 2021, 09:55 PM)

Hi all bankers and sifus,

I’m with my girlfriend trying to get loan for my first house. We plan to buy double storey KL.

Property price: 900k second double storey

Loan:hope to get 90%

Credit card: clear off every month no outstanding

Age: 28(me) 25(she)

Year of our business: 2year plus

Net income:

Enterprise profit

Year 2019 - 99k - rm4200 monthly profit /person

Year 2020 -135k - rm5600 monthly profit/person

All sale and expenses got transaction in our account

We also got submit our income to LHDN for year 2019&2020

Monthly saving around 4k - 6k

Occupation: morning market hawker

-we operate our business under our partnership enterprise

-profit by sharing in business enterprise account

-ssm 2year ++

Commitment :

For me: ptptn rm250 /left 13 year

Every month clear no outstanding

She : no commitment

Marital status : single

Currently : rent house rm1500 per month

Is our profile able get a loan for our 1st house purchase? What would be the loan margin and loan tenure? How much we need to prepare in order to buy second hand double storey with price 900k?Thanks for the advice

It is big chance to get 90% loan?

Banks right now are still extremely conservative with lending, especially with self-owned business with F&B/retail/hawker as these are very dependent on human traffic (read: very susceptible to effects of pandemic and poor economic conditions) and consumer sentiment. With the likelihood of raised interest rates soon, they are likely to reduce the loan margin offered and/or offer higher interest rates. Chances are not high to get 90% for you and your GF's case, especially without a marriage cert I’m with my girlfriend trying to get loan for my first house. We plan to buy double storey KL.

Property price: 900k second double storey

Loan:hope to get 90%

Credit card: clear off every month no outstanding

Age: 28(me) 25(she)

Year of our business: 2year plus

Net income:

Enterprise profit

Year 2019 - 99k - rm4200 monthly profit /person

Year 2020 -135k - rm5600 monthly profit/person

All sale and expenses got transaction in our account

We also got submit our income to LHDN for year 2019&2020

Monthly saving around 4k - 6k

Occupation: morning market hawker

-we operate our business under our partnership enterprise

-profit by sharing in business enterprise account

-ssm 2year ++

Commitment :

For me: ptptn rm250 /left 13 year

Every month clear no outstanding

She : no commitment

Marital status : single

Currently : rent house rm1500 per month

Is our profile able get a loan for our 1st house purchase? What would be the loan margin and loan tenure? How much we need to prepare in order to buy second hand double storey with price 900k?Thanks for the advice

It is big chance to get 90% loan?

Assuming 90% loan without purchasing MRTA, at 30 years tenure with 3% interest rate (average lower rate that's offered by two of the lowest rates banks, Public Bank & Maybank, most other banks are higher), that'll be a little over RM3.4k/month repayment for house price of 900k.

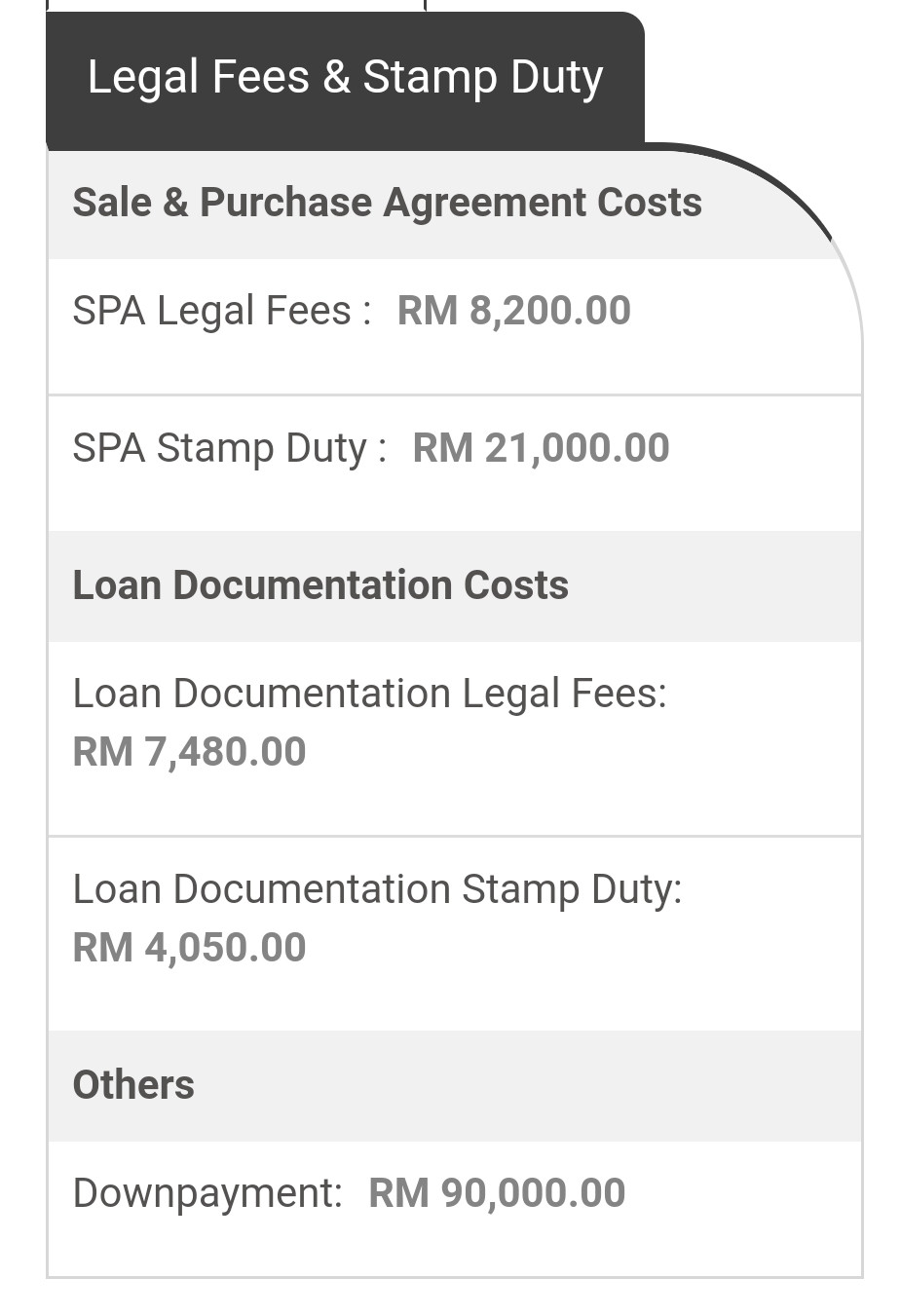

To be safe, best for you to prepare at least 20% of purchase price on hand, not just for downpayment but for potential renovations as well.

You should also enquire directly with bankers to get potential chances, as each bank have their own criteria and strictness. Some banks are notoriously strict unless you're longtime existing customer, some very cincai and happy to give approval. Each bank also have different rates. These kinds of policy super hard to get on online forum because considers p&c biz info.

Dec 28 2021, 11:05 PM

Dec 28 2021, 11:05 PM

Quote

Quote

0.0157sec

0.0157sec

0.59

0.59

6 queries

6 queries

GZIP Disabled

GZIP Disabled