QUOTE(kswee @ Dec 9 2021, 04:08 PM)

If I wanna subscribe instead of selling off the LR, how do I do it in Rakuten? Go to Buy, insert AirAsia LR and buy the amount based on the LR amount I have?

Airasia Loan Rights

|

|

Dec 10 2021, 06:00 AM Dec 10 2021, 06:00 AM

Return to original view | Post

#1

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

|

|

|

|

|

|

Dec 10 2021, 01:53 PM Dec 10 2021, 01:53 PM

Return to original view | Post

#2

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

|

|

|

Dec 10 2021, 03:36 PM Dec 10 2021, 03:36 PM

Return to original view | Post

#3

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

|

|

|

Dec 10 2021, 03:38 PM Dec 10 2021, 03:38 PM

Return to original view | Post

#4

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(spreeeee @ Dec 10 2021, 02:38 PM) totally noob on this. Yours if sell, too small to make a different. Just now I see… worth 0.05cent per rcuids if sell just got the huge envelope today, what can i do with the pink form? not many shares with aa though.. jz for fun when bought that time.. currently stated number of rcuid allocated = 166, and warrants = 83.. amount payable 124.50 Wanna join me and pay that 124.50? I just masuk 1k+ lol This post has been edited by MasBoleh!: Dec 10 2021, 03:39 PM |

|

|

Dec 10 2021, 05:02 PM Dec 10 2021, 05:02 PM

Return to original view | Post

#5

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(spreeeee @ Dec 10 2021, 05:01 PM) QUOTE The low-cost airline said trading for the rights will start from Dec 6, 2021, instead of Dec 3 as scheduled earlier. The prospectus and provisional allotment letter of offer, meanwhile, would be despatched on Dec 7, 2021, instead of the day before, it said in a filing with Bursa Malaysia on Thursday. AirAsia also changed the last day and time for acceptance, renunciation and payment to Dec 20 from Dec 17 as well as for the rights cessation quotation to Dec 13 from Dec 10. The last dates for sale and transfer of provisional allotments will be Dec 14 and Dec 20, respectively, compared to Dec 13 and Dec 17 previously. The entitlement date — Dec 2, 2021 — remains unchanged. https://www.theedgemarkets.com/article/aira...-public-holiday So today is not the last day? |

|

|

Jan 15 2022, 12:32 AM Jan 15 2022, 12:32 AM

Return to original view | Post

#6

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(Boon3 @ Jan 14 2022, 06:44 PM) This is why you have to discard all emotions and opinions and read the report as it is. Those details from the report you got, is it their financial report?No love/hate or fansi stuff. And discard all hero worship nonsense. Read the numbers as it is. The house of card was there for all to see...... |

|

|

|

|

|

Jan 15 2022, 09:40 AM Jan 15 2022, 09:40 AM

Return to original view | IPv6 | Post

#7

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

|

|

|

Jan 15 2022, 06:53 PM Jan 15 2022, 06:53 PM

Return to original view | Post

#8

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

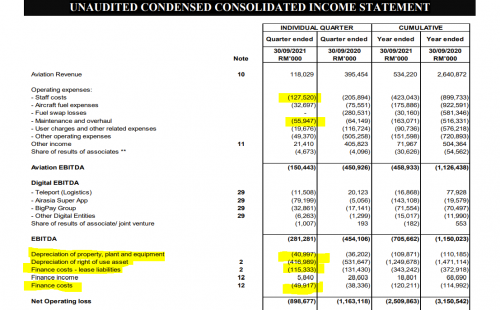

QUOTE(Boon3 @ Jan 15 2022, 09:53 AM) And yes... whenever you read anything (be it social media, your closest friend/relative, your bosses or even news media, it pays to verify what you have read ) I made the point that AA was built on debts... Well one can verify that statement by checking either the QR or the annual reports. Let's do it via the QR... Not the best but for simplicity sake, I just use each year 4th QR.... and my focus is on cash, total borrowings, capital commitment for new planes 2008 https://www.malaysiastock.biz/GetReport.asp...-Dec%202008.pdf Cash 593 million Total loans 6.69 Billion Capital commitment 24.86 billion ==>> Right from the start... net debt in loans is about 6 billion. Owe ppl 6 billion but wants to buy 24 billion worth of new planes... 2009 https://www.malaysiastock.biz/GetReport.asp...02009_FINAL.pdf Cash 747 million Total loans 7.593 Billion Capital commitment 24.6 billion ==> debts increased okay? ..... fast forward.... lazy sikit 2015 https://www.malaysiastock.biz/GetReport.asp...%2026%20Feb.pdf Cash 1.3 Billion Total loans 12.7 Billion Capital commitment 66.296 billion ===> see how the company gets deeper in debts? fast forward... 2017... https://www.malaysiastock.biz/GetReport.asp...Feb18_Final.pdf Cash 1.8 Billion Total loans 9.3 Billion Capital commitment 89.8 billion ===> company had started selling and leasing back its planes... fast forward lastest QR https://www.malaysiastock.biz/GetReport.asp...021%20Final.pdf Cash 400.7 million Total loans 1.2 Billion Capital commitment 97.3 billion Lease liabilities 13.9 Billion and there you have.... since 2008.... what really has AA achieved? when you line up the data, preferably in ur own worksheet, it's much easier to see what's happening.... and all this is the company own doing. and yes, on hedging... run thru the QRs the same way... you can see how AA took on way too much hedging risk (yes, business hedging is always good but whatever's good can turn bad if one over do it) and you can also see, throughout its history, go see how much hedging losses has AA suffered ..... QUOTE(icemanfx @ Jan 15 2022, 10:19 AM) Due to capital intensive and highly depreciated assets, it is normal for airlines to build on debts even well run airlines like sq. how debts is managed is another debts. I thought of this as well. QUOTE(Boon3 @ Jan 15 2022, 12:51 PM) You are welcome. The condensed income statement is useful too! https://www.malaysiastock.biz/GetReport.asp...021%20Final.pdf  As you can see, the big ticket items ... 1. Depreciation of right of use asset = 416m per quarter 2. Lease liabilities = 115m per quarter 3. Finance costs = 50m per quarter and yeah... staff cost ~ 120 million per quarter... Yea... if I do a simple rough count, that's close to 700m per quarter. and the Aviation revenue was only 118m.... even if Aviation revenue increases 3 fold, revenue will only be around 450 million... As you can see, it's a long way off now for AA to even register a profit.... and TIME is never a friend of a lousy business.... the leased airplanes will depreciate more as time passes..... the shelf live tioo....... yup...... AA will have to take in new planes in the future too, but how? Which sky will the money drop from? Borrow again? QUOTE(Boon3 @ Jan 15 2022, 01:11 PM) Here's an old posting of mine in 2016.... I thought is normal for Airlines to be built with debt, but from the figures, seems like AA has been overly expanded. TF may have made wrong judgements and overly confident================================================== http://www.theedgemarkets.com/my/article/a...imb-ib-research In his note to investors today, Yap said investors have generally been cautious on the potential orders, fearing that AirAsia is once again over-expanding. "Investors did not like the additional 100 orders which come at a list price of US$125.7 million each, as they come on top of the undelivered 304 A320neo orders," he said. :x 304 belum deliver... Order 100 lagi..... LOL How to write the word DIE ah? source: posting #83 ================================================== See how AA backorder of new airplanes got so big? AA went into a buying orgy during those years (and of course later we also found out about the Airbus bribery scandal) ..... Backorder of 304 airplanes undelivered... and AA went to order another 100 new ones.... !!!!! This is hole that AA dug itself. Covid only exposed it! |

|

|

Jan 15 2022, 07:24 PM Jan 15 2022, 07:24 PM

Return to original view | Post

#9

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(Boon3 @ Jan 15 2022, 07:18 PM) Most saw and look at AirAsia based on how big the company was growing. They see the new planes, the expansion and most ppl assumed that the company is doing good. So from your last sentence, I will assume that AA can still be saved even been laden with such a big debts. Hopefully can see them reboundBut all that was achieved was achieved via borrowing. Yup the house was built on debt. Hence, here we are. The house of debts has been terribly exposed. And the weakness is there and will continue to be there unless the management wakes up and address they key issue itself. |

| Change to: |  0.0792sec 0.0792sec

0.39 0.39

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 07:29 PM |