QUOTE(Asus W3V @ Jan 4 2022, 10:37 AM)

Yes but the conversion fee is 1.0.Airasia Loan Rights

Airasia Loan Rights

|

|

Jan 4 2022, 10:41 AM Jan 4 2022, 10:41 AM

Return to original view | IPv6 | Post

#21

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Asus W3V @ Jan 4 2022, 10:37 AM) Yes but the conversion fee is 1.0. Asus W3V liked this post

|

|

|

|

|

|

Jan 4 2022, 10:51 AM Jan 4 2022, 10:51 AM

Return to original view | IPv6 | Post

#22

|

All Stars

15,942 posts Joined: Jun 2008 |

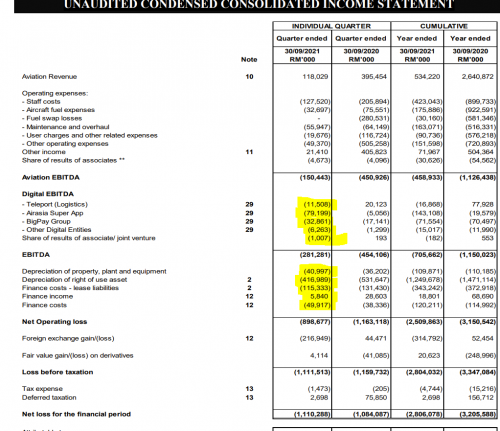

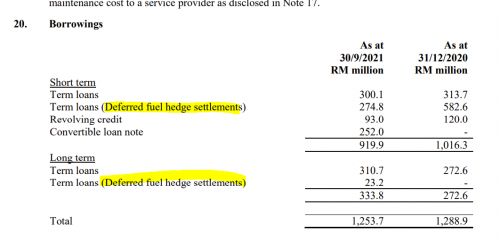

QUOTE(Avangelice @ Jan 4 2022, 10:05 AM) I have no idea why you are really hating on AA but my beliefs are I want exposure to airlines and its an industry controlled by MAS which is a government entity or its AA which to me its a discruptive company that challenges a status quo. Btw.. Put all feellings aside... no need talk love/hate. Pointless la. Second reason is if it can weather the mcos and covid Pandemic and delve it's hands in food delivery and banking. It is a resilient company. So covid, did huge damage on the sales revenue but let's look at the numbers.. what hurt AA really bad? Me? What I see was. 1. Excessive hedging which led to hundreds and hundreds of million in hedging losses. If not mistaken, close to 1 billion on hedging losses. 2. Leasing. 3. Debts. 3 issues which were horrendously managed. This post has been edited by Boon3: Jan 4 2022, 10:51 AM |

|

|

Jan 4 2022, 12:51 PM Jan 4 2022, 12:51 PM

Return to original view | Post

#23

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 4 2022, 01:30 PM Jan 4 2022, 01:30 PM

Return to original view | Post

#24

|

All Stars

15,942 posts Joined: Jun 2008 |

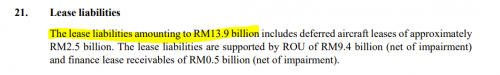

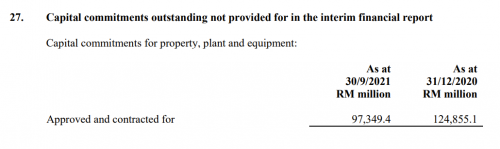

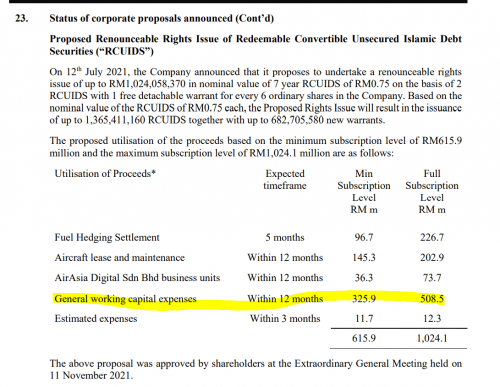

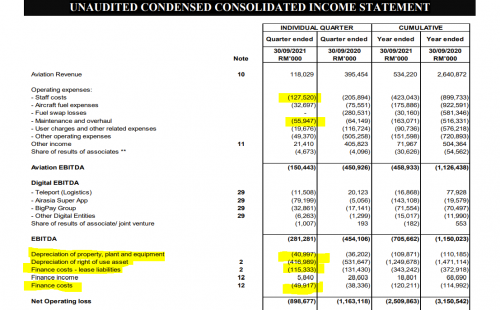

QUOTE(giftfre @ Jan 4 2022, 12:56 PM) Ya, It has 85 months lifetime before expired. Still have time to perform. Exactly!The only matter is whether AirAsia could survive or not? Fundamentals at this point is most crucial because the loan rights c/w warrants happened because it's a billion dollar fundraiser attempt to rescue AA. The last reporter QR...  yaa..... we can see clearly the superapp/digital/big pay are all losing money.... and yea... part of the money raised from the loans stock issue will be dumped into the digital business... The debts AA is carrying...  The lease burden ... 13.9 billion!!  The new planes on back order.... 97 billion!!  ( all of which I would argue that is all AA own gross mismanagement!! ) and this is where the money of the 1 billion loan stock issue will go to... (500 million goes for working expenses  how? Can AA survive based on these numbers?? |

|

|

Jan 4 2022, 02:15 PM Jan 4 2022, 02:15 PM

Return to original view | Post

#25

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 4 2022, 04:24 PM Jan 4 2022, 04:24 PM

Return to original view | Post

#26

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(giftfre @ Jan 4 2022, 04:16 PM) Yes, Ah Boon. from the technical data and current prospect, this stock can keep in cold storage, no eye see. For me, beside avoiding this stock, I would stress all this mess is from its own mismanagement.... Previous post, got member support AirAsia merely because keep faith in Mr Tony (some said he is sifu in pursuing people/ manipulate the biz). So my point is for this counter, we can only depend on how Tony and the team see the risk/ problem and turn into opportunity. Plz keep posting latest news about Tony and the team action plan and strategy. May be he still got Cable besar with current PM. Developing growth from engineering of debts is nothing but a house of debts and this is what AA is. And worst still, he gambled heavily and lost extremely heavy on hedging. The 100 billion worth of obligation to buy new airplanes (yeah, whatever happened to that bribery case?) is utterly insane. |

|

|

|

|

|

Jan 13 2022, 04:43 PM Jan 13 2022, 04:43 PM

Return to original view | Post

#27

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 14 2022, 07:45 AM Jan 14 2022, 07:45 AM

Return to original view | IPv6 | Post

#28

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Jan 4 2022, 01:51 PM) Strange thing is that the stock has a -0.81 NTA (based on latest quarter)...today is traded at 0.81!!! Nah...https://www.thestar.com.my/business/busines...39s-pn17-appeal Bursa so bad ah? Got give or no give chansi? |

|

|

Jan 14 2022, 11:01 AM Jan 14 2022, 11:01 AM

Return to original view | Post

#29

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Jan 14 2022, 10:45 AM) True that PN17 is not 100% dead.... but then...AA how la.... 1 billion rights issue... (amount correct?) Got that placement share... Dunno how many millions... Got that few hundred million loan... yes? And yet...... here we are... the overwhelming lubang is still there... |

|

|

Jan 14 2022, 06:44 PM Jan 14 2022, 06:44 PM

Return to original view | IPv6 | Post

#30

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(HumbleBF @ Jan 14 2022, 05:55 PM) I always wonder that this company, annual report always show negative figures, but people still supporting it. Now it just went from bad to worse..even during precovid the statements alrdy showing negative figures This is why you have to discard all emotions and opinions and read the report as it is. No love/hate or fansi stuff. And discard all hero worship nonsense. Read the numbers as it is. The house of card was there for all to see...... |

|

|

Jan 14 2022, 06:49 PM Jan 14 2022, 06:49 PM

Return to original view | IPv6 | Post

#31

|

All Stars

15,942 posts Joined: Jun 2008 |

Even now.... what's the future hurdles? 1. The lease liabilities, which runs over 10 billion currently. 2. The insane commitment to buy 100 billion worth of airplanes. 3. The depreciation of leased assets. Yup. It's leased planes has a age factor. 4. Can the shareholder trust the boss not to simply bet on its hedges? Last but not least covid wasn't the reason why the company is in such a hold. COVID only exposed its failings. dattebayo liked this post

|

|

|

Jan 15 2022, 06:10 AM Jan 15 2022, 06:10 AM

Return to original view | Post

#32

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(HumbleBF @ Jan 14 2022, 11:27 PM) Yeah...but one thing if AA close down, I'm sure all of sad la, as no more low cost flights lol. The engineering of debts can be seen from day one. I remembered I just briefly go through their AR a few years back and the highlights were all negative. I'm shocked at that time knowing that it is a famous airlines but not making any profits for years. Like what happened? Then I've just ignored this counter till now, the news of Pn17. Not surprised.. Anyway, the pn17 news is not new. Liabilities had been greater than its assets for quite some time. Yup. Bursa had given them a grace period since June 2020. |

|

|

Jan 15 2022, 06:11 AM Jan 15 2022, 06:11 AM

Return to original view | Post

#33

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 15 2022, 09:53 AM Jan 15 2022, 09:53 AM

Return to original view | Post

#34

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(MasBoleh! @ Jan 15 2022, 12:32 AM) And yes... whenever you read anything (be it social media, your closest friend/relative, your bosses or even news media, it pays to verify what you have read )I made the point that AA was built on debts... Well one can verify that statement by checking either the QR or the annual reports. Let's do it via the QR... Not the best but for simplicity sake, I just use each year 4th QR.... and my focus is on cash, total borrowings, capital commitment for new planes 2008 https://www.malaysiastock.biz/GetReport.asp...-Dec%202008.pdf Cash 593 million Total loans 6.69 Billion Capital commitment 24.86 billion ==>> Right from the start... net debt in loans is about 6 billion. Owe ppl 6 billion but wants to buy 24 billion worth of new planes... 2009 https://www.malaysiastock.biz/GetReport.asp...02009_FINAL.pdf Cash 747 million Total loans 7.593 Billion Capital commitment 24.6 billion ==> debts increased okay? ..... fast forward.... lazy sikit 2015 https://www.malaysiastock.biz/GetReport.asp...%2026%20Feb.pdf Cash 1.3 Billion Total loans 12.7 Billion Capital commitment 66.296 billion ===> see how the company gets deeper in debts? fast forward... 2017... https://www.malaysiastock.biz/GetReport.asp...Feb18_Final.pdf Cash 1.8 Billion Total loans 9.3 Billion Capital commitment 89.8 billion ===> company had started selling and leasing back its planes... fast forward lastest QR https://www.malaysiastock.biz/GetReport.asp...021%20Final.pdf Cash 400.7 million Total loans 1.2 Billion Capital commitment 97.3 billion Lease liabilities 13.9 Billion and there you have.... since 2008.... what really has AA achieved? when you line up the data, preferably in ur own worksheet, it's much easier to see what's happening.... and all this is the company own doing. and yes, on hedging... run thru the QRs the same way... you can see how AA took on way too much hedging risk (yes, business hedging is always good but whatever's good can turn bad if one over do it) and you can also see, throughout its history, go see how much hedging losses has AA suffered ..... |

|

|

Jan 15 2022, 12:51 PM Jan 15 2022, 12:51 PM

Return to original view | Post

#35

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(MasBoleh! @ Jan 15 2022, 09:40 AM) You are welcome.The condensed income statement is useful too! https://www.malaysiastock.biz/GetReport.asp...021%20Final.pdf  As you can see, the big ticket items ... 1. Depreciation of right of use asset = 416m per quarter 2. Lease liabilities = 115m per quarter 3. Finance costs = 50m per quarter and yeah... staff cost ~ 120 million per quarter... Yea... if I do a simple rough count, that's close to 700m per quarter. and the Aviation revenue was only 118m.... even if Aviation revenue increases 3 fold, revenue will only be around 450 million... As you can see, it's a long way off now for AA to even register a profit.... and TIME is never a friend of a lousy business.... the leased airplanes will depreciate more as time passes..... the shelf live tioo....... yup...... AA will have to take in new planes in the future too, but how? Which sky will the money drop from? Borrow again? This post has been edited by Boon3: Jan 15 2022, 12:52 PM |

|

|

Jan 15 2022, 01:11 PM Jan 15 2022, 01:11 PM

Return to original view | Post

#36

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(MasBoleh! @ Jan 15 2022, 09:40 AM) Here's an old posting of mine in 2016....================================================== http://www.theedgemarkets.com/my/article/a...imb-ib-research In his note to investors today, Yap said investors have generally been cautious on the potential orders, fearing that AirAsia is once again over-expanding. "Investors did not like the additional 100 orders which come at a list price of US$125.7 million each, as they come on top of the undelivered 304 A320neo orders," he said. :x 304 belum deliver... Order 100 lagi..... LOL How to write the word DIE ah? source: posting #83 ================================================== See how AA backorder of new airplanes got so big? AA went into a buying orgy during those years (and of course later we also found out about the Airbus bribery scandal) ..... Backorder of 304 airplanes undelivered... and AA went to order another 100 new ones.... !!!!! This is hole that AA dug itself. Covid only exposed it! |

|

|

Jan 15 2022, 05:39 PM Jan 15 2022, 05:39 PM

Return to original view | IPv6 | Post

#37

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(howyoulikethat @ Jan 15 2022, 04:47 PM) just curious, what do you mean by air asia business is sustainable and financially feasible post covid? Airlines has always been a lousy business. What's worst is an airlines with a lousy management. If A was sustainable, why on earth did it embark on a wholesale sales and leaseback program? |

|

|

Jan 15 2022, 06:32 PM Jan 15 2022, 06:32 PM

Return to original view | Post

#38

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(howyoulikethat @ Jan 15 2022, 05:43 PM) anyway, just for chatting sake... post#124, the posting with all the QR links... This part was the most important part..... 2015 https://www.malaysiastock.biz/GetReport.asp...%2026%20Feb.pdf Cash 1.3 Billion Total loans 12.7 Billion Capital commitment 66.296 billion =========== here's why.... Yes, the cash of 1.3 Billion vs 12.7 billion in loans showed how unstainable the company was... choking with the delivery of new air planes .... debts up to its neck...... how to take on new loans? survival was really an issue then!!! And ironically, 2015 was when AirAsia started embarking on its sale and leaseback of its airplanes...... rest really was history.... the weakness back then... so easy to spot in 2016 (my old postings are still out there .... somewhere... anyway.... the bottom line today is still the fact that liabilities is more than assets..... ie... INSOLVENCY!!! and not helping at all, air travel is still very much limited..... This post has been edited by Boon3: Jan 15 2022, 06:33 PM |

|

|

Jan 15 2022, 07:18 PM Jan 15 2022, 07:18 PM

Return to original view | Post

#39

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(MasBoleh! @ Jan 15 2022, 06:53 PM) I thought of this as well. Most saw and look at AirAsia based on how big the company was growing. They see the new planes, the expansion and most ppl assumed that the company is doing good.I thought is normal for Airlines to be built with debt, but from the figures, seems like AA has been overly expanded. TF may have made wrong judgements and overly confident But all that was achieved was achieved via borrowing. Yup the house was built on debt. Hence, here we are. The house of debts has been terribly exposed. And the weakness is there and will continue to be there unless the management wakes up and address they key issue itself. |

|

|

Jan 15 2022, 07:56 PM Jan 15 2022, 07:56 PM

Return to original view | Post

#40

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(MasBoleh! @ Jan 15 2022, 07:24 PM) So from your last sentence, I will assume that AA can still be saved even been laden with such a big debts. Hopefully can see them rebound 'And the weakness is there and will continue to be there unless the management wakes up and address they key issue itself.'Look the lease liabilities at 13.9 billion is way too insane. The back order of new planes at close to 100 billion, that's even worst. The leased air planes... is getting older by the day. This issue is huge! The company really needs to understand how to control it's hedging. During the early years, the company lost more than 500 million in hedging... and here we are.... the company recent hedging losses is even worst! Yup... can the company address all this? |

| Change to: |  0.0211sec 0.0211sec

1.81 1.81

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 07:37 AM |