Outline ·

[ Standard ] ·

Linear+

tax for oversea trading /dividend, its become more complicated

|

SUSTOS

|

Nov 16 2021, 08:57 PM Nov 16 2021, 08:57 PM

|

|

QUOTE(Ramjade @ Nov 16 2021, 08:55 PM) Thanks. I am not remitting my money back. All the more reasons for me not to bring my money back to Malaysia. elea88 now you can plan ahead. Me too. In fact I want to sell more ASNB funds and bring out to look for better opportunities.  |

|

|

|

|

|

SUSTOS

|

Nov 19 2021, 10:42 PM Nov 19 2021, 10:42 PM

|

|

https://www.sinchew.com.my/20211119/2022%e8...b7%9d%e7%a6%bb/ So if you remit back dividends there is a chance that you will be taxed. But he thinks capital gains not likely. He reminds everyone: Keep your documents! This post has been edited by TOS: Nov 19 2021, 10:43 PM

|

|

|

|

|

|

SUSTOS

|

Nov 20 2021, 08:44 AM Nov 20 2021, 08:44 AM

|

|

|

|

|

|

|

|

SUSTOS

|

Nov 22 2021, 01:02 PM Nov 22 2021, 01:02 PM

|

|

https://www.sinchew.com.my/?p=3435256Nothing new, just a Mandarin version of the LHDN press statement earlier.

|

|

|

|

|

|

SUSTOS

|

Nov 24 2021, 03:22 PM Nov 24 2021, 03:22 PM

|

|

https://www.thesundaily.my/home/malaysia-sh...trend-AL8591301QUOTE On the matter of taxation of foreign-sourced income introduced in the latest budget, he said that more detailed guidelines will be published prior to the implementation in 2022.

“There may be some exemptions considered in the future, but the main principle behind it is not to subject any income to double taxation, if you have been taxed in another jurisdiction and you can bring it here,” he said.

“As long as we don’t subject any income to additional taxation, the system is fair.”

|

|

|

|

|

|

SUSTOS

|

Nov 27 2021, 09:34 PM Nov 27 2021, 09:34 PM

|

|

|

|

|

|

|

|

SUSTOS

|

Nov 30 2021, 09:33 AM Nov 30 2021, 09:33 AM

|

|

2021/2022 Malaysia Tax Booklet by PwC https://www.pwc.com/my/en/publications/mtb.htmlThis post has been edited by TOS: Nov 30 2021, 09:33 AM |

|

|

|

|

|

SUSTOS

|

Dec 10 2021, 05:24 PM Dec 10 2021, 05:24 PM

|

|

|

|

|

|

|

|

SUSTOS

|

Dec 10 2021, 09:57 PM Dec 10 2021, 09:57 PM

|

|

QUOTE(Ramjade @ Dec 9 2021, 11:29 AM) https://drive.google.com/file/d/1c0rWG2PHbr...Ep4cnKNT9zuAa2gTOS, Hansel, prophetjul, tadashi987, elea88Govt goint to get access to bank account without notifying us before hand from my understanding. It is reported in Sinchew today: https://www.sinchew.com.my/20211210/%e6%97%...9d%a1%e6%96%87/ |

|

|

|

|

|

SUSTOS

|

Dec 13 2021, 09:34 PM Dec 13 2021, 09:34 PM

|

|

|

|

|

|

|

|

SUSTOS

|

Dec 15 2021, 02:45 PM Dec 15 2021, 02:45 PM

|

|

https://www.sinchew.com.my/20211215/2021%e8...bc%b4%e7%a8%8e/Finance bill 2021 passed. Deputy finance minister confirms that those who work in overseas like Singapore, if repatriate their income back to Malaysia, will need to pay tax in Malaysia. This post has been edited by TOS: Dec 15 2021, 02:48 PM

|

|

|

|

|

|

SUSTOS

|

Dec 15 2021, 03:39 PM Dec 15 2021, 03:39 PM

|

|

QUOTE(prophetjul @ Dec 15 2021, 03:33 PM) So similarly for those who work in UK, Aus, etc? No details given. I tried looking for news report on Google for the "past hour" and found nothing. But should be the case for "employment income". No details on tax on dividends/interests etc. Foreign pension fund savings like CPF repatriation still under consideration by MoF. |

|

|

|

|

|

SUSTOS

|

Dec 15 2021, 10:40 PM Dec 15 2021, 10:40 PM

|

|

QUOTE(Davidtcf @ Dec 15 2021, 08:32 PM) They will even check our bank accounts? Isn't that against bank privacy rules? Wah no privacy laws like that gov/LHDN can korek our bank accounts as they like. Even if put money in overseas, AEOI will ensure exchange of bank accounts information. So if they can know your foreign assets, there is no reason they can't know your own onshore assets.  Anyway, I will put less money in Malaysia, privacy reasons plus lack of investible assets. Hansel Can I hide my money in shares/brokerage accounts? I know they can check your money in foreign banks, but what if I hide them in my shares/bonds? Does the AEOI apply to brokers? |

|

|

|

|

|

SUSTOS

|

Dec 16 2021, 08:55 AM Dec 16 2021, 08:55 AM

|

|

Thanks everyone. Got your points.

|

|

|

|

|

|

SUSTOS

|

Dec 16 2021, 09:12 AM Dec 16 2021, 09:12 AM

|

|

QUOTE 15. Is income derived from outside Malaysia taxable? In general, income from employment should be taxable in the country where the services are performed regardless of the place where the contract is signed or where the remuneration is paid. However, from the Year of Assessment 2004, income received in Malaysia from outside Malaysia is tax exempt. Therefore, any income received by resident or non-resident taxpayers in Malaysia are taxable (Paragraph 28 (1), Schedule 6 of the Income Tax Act 1967). If you have worked abroad and the work carried out is related to the employment carried out in Malaysia, thus the employment income received will be taxable in Malaysia. Kindly log on to IRBM Official Portal, https://www.hasil.gov.my >> Legislation >> Public Ruling >> No.1/2011 – Taxation of Malaysian Employees Seconded Overseas for further information. This page is updated on Dec. 13. Can't remember if this is a new addition. This is the public ruling paper: https://phl.hasil.gov.my/pdf/pdfam/PR1_2011.pdf |

|

|

|

|

|

SUSTOS

|

Dec 16 2021, 09:46 AM Dec 16 2021, 09:46 AM

|

|

QUOTE(tadashi987 @ Dec 16 2021, 12:33 AM) Received this mail from phillipmutual, for our gauge on the impact of proposed Finance Bill 2021 to Investors investing in their Money Market Fund (MMF) DESCLAIMER: I do not know if the rule explained in the mail applied to other/all MMF or any other fund type beside MMF » Click to show Spoiler - click again to hide... « Dear Valued Investors,

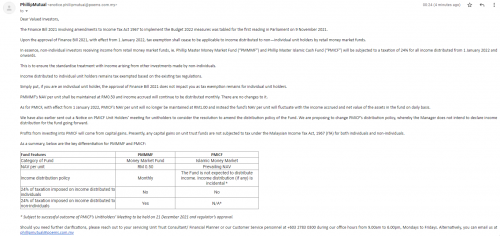

The Finance Bill 2021 involving amendments to Income Tax Act 1967 to implement the Budget 2022 measures was tabled for the first reading in Parliament on 9 November 2021.

Upon the approval of Finance Bill 2021, with effect from 1 January 2022, tax exemption shall cease to be applicable to income distributed to non—individual unit holders by retail money market funds.

In essence, non-individual investors receiving income from retail money market funds, ie. Phillip Master Money Market Fund (“PMMMF”) and Phillip Master Islamic Cash Fund (“PMICF”) will be subjected to a taxation of 24% for all income distributed from 1 January 2022 and onwards.

This is to ensure the standardise treatment with income arising from other investments made by non-individuals.

Income distributed to individual unit holders remains tax exempted based on the existing tax regulations.

Simply put, if you are an individual unit holder, the approval of Finance Bill 2021 does not impact you as tax exemption remains for individual unit holders.

PMMMF’s NAV per unit shall be maintained at RM0.50 and income accrued will continue to be distributed monthly. There are no changes to it.

As for PMICF, with effect from 1 January 2022, PMICF’s NAV per unit will no longer be maintained at RM1.00 and instead the fund’s NAV per unit will fluctuate with the income accrued and net value of the assets in the fund on daily basis.

We have also earlier sent out a Notice on PMICF Unit Holders’ meeting for unitholders to consider the resolution to amend the distribution policy of the Fund. We are proposing to change PMICF’s distribution policy, whereby the Manager does not intend to declare income distribution for the fund going forward.

Profits from investing into PMICF will come from capital gains. Presently, any capital gains on unit trust funds are not subjected to tax under the Malaysian Income Tax Act, 1967 (ITA) for both individuals and non-individuals.

As a summary, below are the key differentiation for PMMMF and PMICF:

[CHECK PICTURE]

* Subject to successful outcome of PMICF’s Unitholders’ Meeting to be held on 21 December 2021 and regulator’s approval.

Should you need further clarifications, please reach out to your servicing Unit Trust Consultant/ Financial Planner or our Customer Service personnel at +603 2783 0300 during our office hours from 9.00am to 6.00pm, Mondays to Fridays. Alternatively, you can email us at phillipmutual@poems.com.my

Thank you.

For and on behalf of

Phillip Mutual Berhad

They didn't say anything on foreign dividends/interests for mutual funds/UTs that hold foreign shares/bonds? |

|

|

|

|

|

SUSTOS

|

Dec 16 2021, 09:27 PM Dec 16 2021, 09:27 PM

|

|

QUOTE(Davidtcf @ Dec 16 2021, 09:41 AM) Confirm liao LHDN can check our bank accounts. And we won’t be informed about it: https://www.thestar.com.my/news/nation/2021...=smartech#closeStarting year 2022. They need "court order". If you can be informed of the "court order", I wonder why they need to amend the legislation, since asking the bank for details and asking court to approve via garnishee will still result in informing the person (owner of bank account). |

|

|

|

|

|

SUSTOS

|

Dec 20 2021, 03:44 PM Dec 20 2021, 03:44 PM

|

|

|

|

|

|

|

|

SUSTOS

|

Dec 21 2021, 03:25 PM Dec 21 2021, 03:25 PM

|

|

QUOTE(Hansel @ Dec 21 2021, 02:55 PM) Then,.. bros,.. you know what will happen ?? Then they will do a blanket taxation on ALL incoming remittances first,... see how much came from which source, then 'calibrate' at their end and refund the ones which are non-taxable. That's why,... my suggextion is,... if possible for individual investors,... don't move first for the first 6 months of next year. But for investors into foreign funds based in Msia,... no choice,... I currently invests in an Asia pacific equity fund on FSM, so based on what you say, I might be better off holding the individual stocks rather than the fund? The fund hold blue chip counters in Asia Pacific, but majority of them pays dividend. This post has been edited by TOS: Dec 21 2021, 05:27 PM |

|

|

|

|

|

SUSTOS

|

Dec 22 2021, 09:49 AM Dec 22 2021, 09:49 AM

|

|

QUOTE(prophetjul @ Dec 22 2021, 09:11 AM) My next bet on new tax income streams will be tax on EPF withdrawals above certain quantum. A bit like the US tax on 401k withdrawals. Imagine the millions involved with withdrawals. Makes me think really hard whether i should start to initiate withdrawing my savings there. QUOTE(dwRK @ Dec 22 2021, 09:45 AM) money put in 401k is before tax lah... so early withdrawal kena tax is only fair money in EPF is post tax... they won't double tax I would say PNB's ASNB will be taxed first before EPF, since EPF is for "retirement". ASNB on the other hand is just general investment vehicle, so is a more "legitimate" vehicle to tax. Even before PNB's ASNB would probably be local UT/mutual funds. When government desperate for money, everything can be taxed.  |

|

|

|

|

Nov 16 2021, 08:57 PM

Nov 16 2021, 08:57 PM

Quote

Quote

0.0407sec

0.0407sec

1.03

1.03

6 queries

6 queries

GZIP Disabled

GZIP Disabled