dropped to 0.86 liao.. more coming.

Senheng New Retail Berhad (5305), Main Market

Senheng New Retail Berhad (5305), Main Market

|

|

Jan 28 2022, 11:58 AM Jan 28 2022, 11:58 AM

Return to original view | Post

#21

|

Senior Member

3,520 posts Joined: Jan 2003 |

dropped to 0.86 liao.. more coming.

|

|

|

|

|

|

Jan 28 2022, 03:55 PM Jan 28 2022, 03:55 PM

Return to original view | Post

#22

|

Senior Member

3,520 posts Joined: Jan 2003 |

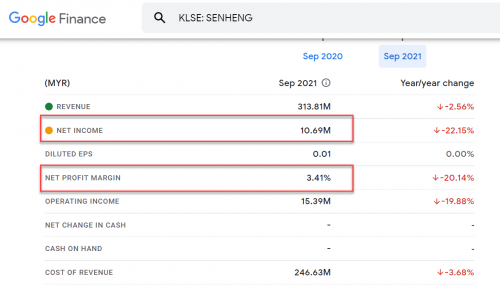

QUOTE(Boon3 @ Jan 28 2022, 03:24 PM) I wouldn't know but one thing I know in the stock market is, try to reason out by yourself, don't over complicate things by overthinking and mixing conspiracy theories.... esp those you hear from media/social media. It just doesn't help. yes see their net profit for 2021. High revenue but cost of doing biz is high also:One thing I would ask, for a company like SenHeng, a retailer in the electronics market, where profit margins are super thin, I would ask where do I see SenHeng in 5 times. Do I envision the company making much more money? If I don't, then why would others get excited over the stock?  and like others say here, they not alone in market selling electrical appliances, so many other Sdn. Bhd companies like HLK, Harvey Norman etc. https://www.investopedia.com/terms/u/underpricing.asp QUOTE Nevertheless, there are two opposing goals at play. The company's executives and early investors want to price the shares as high as possible in order to raise the most capital and reward themselves most lavishly. QUOTE An IPO can be underpriced if its sponsors are genuinely uncertain about the reception that the stock will receive. After all, in the worst case, the stock price will immediately climb to the price that investors consider that it's worth. Investors willing to take a risk on a new issue are rewarded. The company's executives are pleased. That is considerably better than the company's stock price falling on its first day and its IPO being blasted as a failure. ^they should price their IPO correctly or underprice, rather than overpricing. Those kena burnt already likely won't buy their stocks in the future or have a bad perception towards their company. |

|

|

Jan 28 2022, 04:07 PM Jan 28 2022, 04:07 PM

Return to original view | Post

#23

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(koja6049 @ Jan 28 2022, 04:00 PM) actually i don't even know what is suppose to be the "fair value" right now. If going by PE then at least need to be 0.4xx to be safe? yeah could fall down to around there.. thats why just now I fast2 sell after watched that youtube taikor talk about Senheng https://youtu.be/OMxxjBE8rFA?t=1000 This post has been edited by Davidtcf: Jan 28 2022, 04:07 PM koja6049 liked this post

|

|

|

Jan 28 2022, 05:08 PM Jan 28 2022, 05:08 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jan 28 2022, 04:32 PM) Like that also a youtube taikor meh? He's basically reading a news link only, which was an article posted on NST. https://www.nst.com.my/business/2022/01/765...but-early-trade Man, I would stay away from all those youtubers la.... He himself also investor/trader lai de if check his other videos. If ppl advise make sense then I will accept lor. If Senheng has good biz model, unique product or service then can consider to hold. What they selling also nothing unique. Profit margin also razor thin. Somemore price IPO so high. Fail la whoever advise them to set such a high price. Didnt think about impact of doing this? This post has been edited by Davidtcf: Jan 28 2022, 05:12 PM |

|

|

Jan 28 2022, 05:18 PM Jan 28 2022, 05:18 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

3,520 posts Joined: Jan 2003 |

Mr DIY could be bubble waiting to happen. At least their biz more unique. We dont see them having a strong competitor opening up so many branches like them.

Go in can buy so many cheap stuffs, some Mr DIY own brand. Profit margin sure higher also. Then Mr DIY PE ratio is at 50+. Senheng is at 120+. So you can see which is more overpriced. This post has been edited by Davidtcf: Jan 28 2022, 05:21 PM |

|

|

Jan 28 2022, 07:23 PM Jan 28 2022, 07:23 PM

Return to original view | Post

#26

|

Senior Member

3,520 posts Joined: Jan 2003 |

Mr DIY opened its first store in Spain. Asean market already opened many stores. Senheng can't do similar:

https://www.diyinternational.com/home/news/...-spain-opening/ Earlier Turkey: https://www.therakyatpost.com/news/malaysia...tore-in-europe/ This post has been edited by Davidtcf: Jan 28 2022, 07:24 PM |

|

|

|

|

|

Jan 31 2022, 11:09 PM Jan 31 2022, 11:09 PM

Return to original view | Post

#27

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(EvOliver @ Jan 30 2022, 02:07 PM) I sold mine already at 0.88. I think many here have sold them too to stop loss.I only bought 2000 stocks so losses not that big. Cant imagine what others would go through if they bought a lot more. |

|

|

Feb 1 2022, 11:38 PM Feb 1 2022, 11:38 PM

Return to original view | Post

#28

|

Senior Member

3,520 posts Joined: Jan 2003 |

It's really dumb of them to aim for short term insta profit. I bet many of their investors who got burnt is gonna boycott them for life after this. Some might even barged into their shop and give them a good scolding.

Hope in future no other malaysia companies overpriced their IPO. Bursa could have prevented this from happening also by placing some regulations. Pricing cannot above X% of fair price of stock for example. Based on the account books of the company currently. |

|

|

Feb 5 2022, 10:39 AM Feb 5 2022, 10:39 AM

Return to original view | Post

#29

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(hongie @ Feb 5 2022, 01:52 AM) saw it at Mplus broker.. maybe not accurate for that. still many say it's overpriced. Can check here too for their analysis: https://simplywall.st/stocks/my/retail/klse...l-berhad-shares eric.tangps liked this post

|

|

|

Feb 11 2022, 06:48 PM Feb 11 2022, 06:48 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

3,520 posts Joined: Jan 2003 |

Someone wrote this great article about Senheng IPO. A good read: https://klse.i3investor.com/m/blog/philip2/...Senheng_IPO.jsp BahBahBlack and buqiuren liked this post

|

|

|

May 17 2023, 04:45 PM May 17 2023, 04:45 PM

Return to original view | Post

#31

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

| Change to: |  0.0358sec 0.0358sec

0.65 0.65

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 03:29 PM |