QUOTE(encikbuta @ Jul 7 2021, 12:37 PM)

oh cool, another local non-banking platform beat FSM in the race to offer NYSE brokerage! am i missing something or does the fees doesn't seem all that bad? I'm interested to use this to buy and hold ETF for the long term:

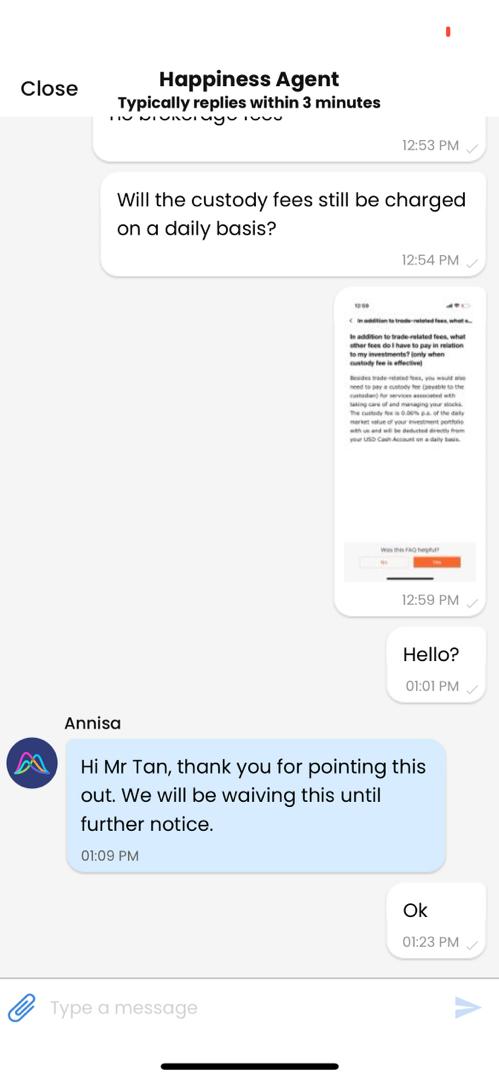

- 0.06% p.a. custodian fees - for RM100,000 total asset value, they will charge RM60 per annum only? not bad right?

- 0.40% for each trade (minimum USD5) - ok yea this one will hurt. so maybe what we can do is just gather about RM2000 before making a lumpsum trade? so i would get hit with about 1.25% trade fees only. Not too bad compared to mutual funds.

let me know if i got any fee or calculations wrong. this seems like a better route for people like me who are paranoid about opening overseas account to fund the more reputable brokers (tiger, moomoo, tsg ibkr, etc). anyway, i'm holding out to see if FSM can provide a more competitive rate when they finally allow overseas trading

There's more to hit. Since they are using Saxo is their backend, Saxo have bad exchange rate Vs IB. So you are losing money there too.

You are welcome to give free money to them. IBKR only charge USD 0.35/transaction Vs USD5 for this lousy platform. If you got no money for IBKR, TSG only charge USD1.50.

Both doesn't even have platform fees.

Tiger, Moomoo are regulated by MAS. Now compare MAS with SC who blindly ban TD.

FYI Ibkr is a super paranoid broker (super conservative) and they have very strong financial reserves. Keep in mind MIDF is using Saxo as their backend. A foreign broker

Akru a robo investor is using Ibkr as their backend.

Your choice. You like to give them free money. Be my guest. What I know is I don't even consider MIDF an option for overseas investing. Thumbs down for me. Highly not recommended.

Jul 7 2021, 09:40 AM, updated 5y ago

Jul 7 2021, 09:40 AM, updated 5y ago

Quote

Quote

0.0230sec

0.0230sec

0.52

0.52

5 queries

5 queries

GZIP Disabled

GZIP Disabled