QUOTE(ronnie @ Nov 21 2023, 09:56 PM)

RM1,000,000 / RM3000 = 334 saja meaning still possible to earn 12% if you are the balance 46xx users to contribute RM3k in PRS and dont forget you can also use my linkHAHAAH!!!

Investment Versa

|

|

Nov 21 2023, 10:02 PM Nov 21 2023, 10:02 PM

Return to original view | IPv6 | Post

#101

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(ronnie @ Nov 21 2023, 09:56 PM) RM1,000,000 / RM3000 = 334 saja meaning still possible to earn 12% if you are the balance 46xx users to contribute RM3k in PRS and dont forget you can also use my linkHAHAAH!!! |

|

|

|

|

|

Nov 23 2023, 05:34 PM Nov 23 2023, 05:34 PM

Return to original view | IPv6 | Post

#102

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(cybpsych @ Nov 23 2023, 04:41 PM) // Refer a Friend and Get RM50 Referral Reward Meaning those who have versa account won't get rm40Refer a Friend: Share your referral code to your friends who are new to Versa. Invest RM3,000: Your friend’s first cash in must be to any of PRS funds via Versa. Claim Your Rewards: Once their total balance in a PRS fund reaches RM3,000 within a calendar year, both of you will receive a RM40 reward each. This totals your referral reward to RM50 each! // Only when 1 new account with one existing account then get rm40 This post has been edited by virtualgay: Nov 23 2023, 05:35 PM |

|

|

Nov 24 2023, 11:56 AM Nov 24 2023, 11:56 AM

Return to original view | IPv6 | Post

#103

|

Senior Member

3,282 posts Joined: Apr 2008 |

|

|

|

Nov 24 2023, 01:27 PM Nov 24 2023, 01:27 PM

Return to original view | IPv6 | Post

#104

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(ronnie @ Nov 24 2023, 12:52 PM) NiceI old jor cannot take risk I have 5 years to fully utilities the tax rebate By 55 sure I will empty everything and move it to EPF Just celebrated my 20 years anniversary in my company Can't believe I never change job for 20 years I guess I am not a risk taker My advice to the young ones pls change job once in a while don't end up like me stuck in a company for 20 years |

|

|

Nov 24 2023, 03:47 PM Nov 24 2023, 03:47 PM

Return to original view | IPv6 | Post

#105

|

Senior Member

3,282 posts Joined: Apr 2008 |

My post got reported can let me know which post violated the rules? Please enlightened me so I can improve

|

|

|

Nov 27 2023, 03:15 PM Nov 27 2023, 03:15 PM

Return to original view | IPv6 | Post

#106

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(xander2k8 @ Nov 27 2023, 01:47 PM) I don’t think you understand what is network marketing 🤦♀️ which is why they rather give referrals which is more easier than finding new account openings as the strawberry generation loves it the 4.3% or close to it... this one super confusing if u were to count as i never able to count it correctlyTime weighted is skewed 🤦♀️ look actual returns over your own AUM 1. Minimum 100 otherwise full withdrawal is initiated 2. Annual fee and management fee are deducted from the returns automatically 3. Can’t remember but I think I didn’t get charged for it because beta user 4. Depending on which funds 🤦♀️ expect 3 to 5 working days depending on the fund with the exception of Versa Cash-I 5. Yes less than 4.3% because of rounding of units and price but quite close to it because of the rebates being credited 2 weeks later |

|

|

|

|

|

Nov 27 2023, 03:42 PM Nov 27 2023, 03:42 PM

Return to original view | Post

#107

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(xander2k8 @ Nov 27 2023, 03:18 PM) Not confusing 🤦♀️ if you know Can you show me your account or your figure?The problems is because rounding of units and rebates are being paid out 2 weeks later to smoothen it out to 4.3% With mine I have this issue where I add up all the rebates and all the reinvestment unit yes it does not equal to 4.3% or even 4.0% For me I will get reinvestment unit follow by 2 x rebates because I have PRS 26th Oct I get my reinvestment unit RM13.34 8th Nov I get 2 x rebates total RM4.04 23 Nov I get my reinvestment unit again RM13.53 Can I assume that if I add up 13.34 + 4.04 is equal to 6% for the month of October? Nov I yet to get my rebates so I wait and I will report back In total I have around 10150 right now in Versa Cash I trying my best to count and nothing make sense |

|

|

Nov 28 2023, 01:22 PM Nov 28 2023, 01:22 PM

Return to original view | Post

#108

|

Senior Member

3,282 posts Joined: Apr 2008 |

|

|

|

Nov 28 2023, 02:37 PM Nov 28 2023, 02:37 PM

Return to original view | IPv6 | Post

#109

|

Senior Member

3,282 posts Joined: Apr 2008 |

|

|

|

Nov 28 2023, 04:52 PM Nov 28 2023, 04:52 PM

Return to original view | IPv6 | Post

#110

|

Senior Member

3,282 posts Joined: Apr 2008 |

Yesterday was on a call with Versa to clarify how the 6% works and this was my assumption:

Oct Base return = 3.4% Versa Cash Promo Rate = 4.3% PRS Promo Rate = 6.0% This is how i understand it before i talk to them 6.0% = Base Rate + Versa Cash Promo Rate Rebate + PRS Promo Rate Rebate 6.0% = 3.40% + 0.90% + 1.70% *3.40% + 0.90% = 4.3% Versa Cash Promo Rate *1.70% = 6.0% PRS Promo Rate - 4.30% Total no matter how you count base on the above you will get 6% for the first RM10k But after speaking to them yesterday this is how they say they count: Base = 3.40% (Oct Base Return) Versa Cash Promo Rebate = 4.3% - 3.40% = 0.90% Versa PRS Promo Rebate = 6.0% - 3.40 = 2.60% Total Return in the month of October base on % = Base 3.40% + Versa Cash Rebate 0.90% + PRS Rebate 2.60% which brings us to 3.4+0.9+2.6 = 6.9% for the first 10k they also clarify that the payout of this 6% in Oct and Nov and 12% in Dec will end by 31st December meaning everything will go back to normal calculation by 1-Jan-2024 This post has been edited by virtualgay: Nov 28 2023, 04:54 PM |

|

|

Nov 28 2023, 05:38 PM Nov 28 2023, 05:38 PM

Return to original view | IPv6 | Post

#111

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(xander2k8 @ Nov 28 2023, 05:17 PM) See I told you to call them and get the answer which they have given you properly within a quick time 😂 and you getting more than 6% infact Quite crazy their promotionImagine 10k in December how much you will get Just assume Dec base rate is 3.4% So again it will be 3.4% + 0.90% = 4.3% 3.4% + 8.6% = 12% Total would be 3.4% + 0.9% + 8.6% = 12.9% 10000 x 12.9% / 365 x 31 days = RM109.56 Hope my calculations is correct |

|

|

Nov 28 2023, 08:41 PM Nov 28 2023, 08:41 PM

Return to original view | IPv6 | Post

#112

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(xander2k8 @ Nov 28 2023, 06:29 PM) Only good for time one off 🤦♀️ unless you are in taxable bracket and need for tax write off 50 years old uncle here that is why I invested into PRSDon’t bother 🤦♀️ let them realise the 100 extra is worse off within 10 years of terrible performance and worse case scenario losing money PRS 🤦♀️ with terrible asset allocation and long term performance 🤦♀️ which good for those who can withdraw within 5 years time span |

|

|

Nov 29 2023, 02:47 PM Nov 29 2023, 02:47 PM

Return to original view | IPv6 | Post

#113

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(xander2k8 @ Nov 29 2023, 12:56 AM) u ask me if i am 30 now i wont even put a single cent into PRS even if taxable income is 100kbase on 100k taxable income if you invest RM3k you can back tax saving of RM570 - (you are at 19%) tax bracket but if you are now 30 your 3000 inside PRS at most will only grow like 3.5% to 4.5% average per year for the period of 25 years it is as good as gone case maybe you die also you cannot withdraw because is like EFP so those young ones if u really believe in PRS then invest RM3k give it a try those old one, just do it if you are at 50 years old like me, few more months i am 51 then i have 4 more years left then i can take out my PRS bokbokchai liked this post

|

|

|

|

|

|

Nov 29 2023, 08:57 PM Nov 29 2023, 08:57 PM

Return to original view | IPv6 | Post

#114

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(bokbokchai @ Nov 29 2023, 05:01 PM) Omg I did the calculation and you were right. Thanks for the enlightenment. Guess I put into asnb and pay tax instead of putting into prs. I did have a PRS account and calculating around 3.5% annual interest after 10 years. If asnb consistently just give 4.5%. But investing the 3000 into asnb instead I will gain at least 5k even if I had to pay off higher tax. this is from experience and calculation and historical dataRather contribute that 3k into EPF since it’s giving also more return in comparison to PRS. my advice is if you are at least 48 to 50 then give PRS a go if u are 45 and have 10 more years before 55 better not la... from the tax saving we are talking about RM570 if 100k 570/3000 we are talking about 19% instant gain then you factor in lousy PRS gain of around 3.5% per year for my case my gain would be 3.5% x 4 (4 more years to withdrawal) + 19% (570) so in total i would gain around 19%+14% = 33% in 4 years then 34% / 4 years which give me 8.25% per year which is better than EPF and ASM I will continue to do it when i am 51, 52, 53, 54 then withdraw everything by 55 so basically the nearer to reitrement the better for you to invest in PRS dont think about PRS for now put into something like EPF, ASM, SSPN <- conservative type else put into bank stocks (MBB, HLB, PBB) which give good dividend yield This post has been edited by virtualgay: Nov 29 2023, 09:02 PM |

|

|

Nov 29 2023, 08:59 PM Nov 29 2023, 08:59 PM

Return to original view | IPv6 | Post

#115

|

Senior Member

3,282 posts Joined: Apr 2008 |

QUOTE(bokbokchai @ Nov 29 2023, 08:01 PM) you mean PRS was doing pretty good? I won't agree so thou cuz I did give at least 10 years time for it to prove itself. 10 years time got high and low, if i could invest in apple stock during that 10 years time, thing would have been different (if im young and ok for higher risk). PRS was never good, 10 years before and 10 years after it will be the sameit is not even risky at all |

|

|

Nov 30 2023, 09:38 AM Nov 30 2023, 09:38 AM

Return to original view | Post

#116

|

Senior Member

3,282 posts Joined: Apr 2008 |

|

|

|

Nov 30 2023, 10:01 AM Nov 30 2023, 10:01 AM

Return to original view | IPv6 | Post

#117

|

Senior Member

3,282 posts Joined: Apr 2008 |

|

|

|

Nov 30 2023, 10:23 AM Nov 30 2023, 10:23 AM

Return to original view | IPv6 | Post

#118

|

Senior Member

3,282 posts Joined: Apr 2008 |

|

|

|

Nov 30 2023, 05:09 PM Nov 30 2023, 05:09 PM

Return to original view | IPv6 | Post

#119

|

Senior Member

3,282 posts Joined: Apr 2008 |

|

|

|

Nov 30 2023, 05:26 PM Nov 30 2023, 05:26 PM

Return to original view | IPv6 | Post

#120

|

Senior Member

3,282 posts Joined: Apr 2008 |

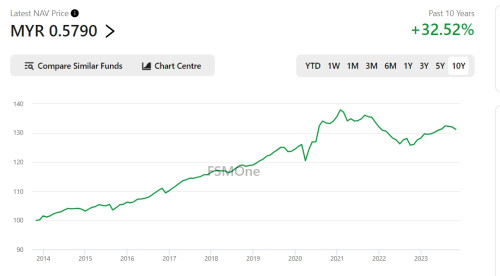

QUOTE(xander2k8 @ Nov 30 2023, 05:14 PM) Don’t expect much movement on it but you better pray 🤦♀️ they don’t lose money on buying wrong corporate bonds convertive fundSeems like the moderate fund outperformed growth funds for 10 year basis 🤦♀️ while YTD growth fund is negative  This post has been edited by virtualgay: Nov 30 2023, 05:26 PM |

| Change to: |  0.0984sec 0.0984sec

0.64 0.64

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 03:50 AM |