Outline ·

[ Standard ] ·

Linear+

CIMB Loan, Personal Express Cash, Need ur advise on how I can get it less

|

TSoracle02

|

Mar 24 2021, 02:17 PM, updated 5y ago Mar 24 2021, 02:17 PM, updated 5y ago

|

New Member

|

Hi everyone, I have a personal that I took in 2018 and the details are as below:

Loan Amount: RM 47,800

Interest Rate: 18.62%

Monthly Installment: RM 1,230

Loan Tenure: 5 years

Outstanding balance (as of today) : RM 39,030.79

I did opted for the 6 months moratorium and I've paid in total RM 28,294.27.

I have the money now to make a full settlement and I've called up the bank to ask if there's a rebate given. Feels so unfair to pay the balance interest rates for the upcoming year when I'm not even going to pay monthly anymore.

I've called them twice it's hard to speak with them. Can someone advise on how to go about this?

|

|

|

|

|

|

TSoracle02

|

Mar 24 2021, 04:38 PM Mar 24 2021, 04:38 PM

|

New Member

|

QUOTE(DragonReine @ Mar 24 2021, 02:39 PM) 1) Check if your agreement allows early settlement, might have additional charges for cancellation. 2) Unfortunately for you, because it's a personal loan, it's most likely calculated on Rule of 78 for interest payment. Since it was a 2018 loan and it's already year 3 of the 5 years tenure, you've already paid easily 80% of the total interest they charged to your loan. Any "rebate" from early settlement of personal/car loan is really just interest you will not be paying from your remaining instalments because you've settled loan early. That's why when you check now, the outstanding loan is still so high, because your previous instalments is used to pay mostly interest, not the loan itself. You may read about rule of 78 here: https://loanstreet.com.my/learning-centre/h...-the-rule-of-78If you want to see how much "rebate" you might get, you can calculate here: https://loanstreet.com.my/calculator/car-an...calculator.htmlI remember early settlement is allowed but I can't find the agreement I've signed. Yeah, that's right. The installments I've paid is mostly interest. |

|

|

|

|

|

TSoracle02

|

Mar 24 2021, 05:30 PM Mar 24 2021, 05:30 PM

|

New Member

|

QUOTE(zstan @ Mar 24 2021, 04:59 PM) that's how all the bank CEO's last year got fat paychecks and huge bonuses. unlikely they will give you any rebate. can try and call but not worth to pay lump sum. Haha yeah. That's the thing, I dont want to keep this loan. Such a burden and I've worked really hard to save up. |

|

|

|

|

|

TSoracle02

|

Mar 24 2021, 05:32 PM Mar 24 2021, 05:32 PM

|

New Member

|

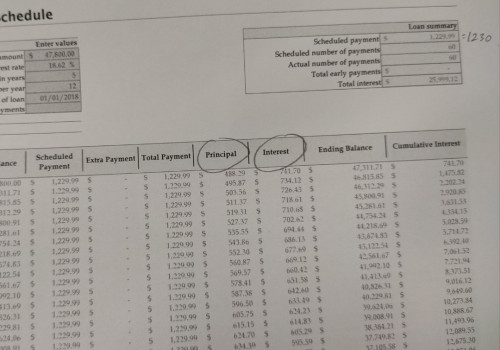

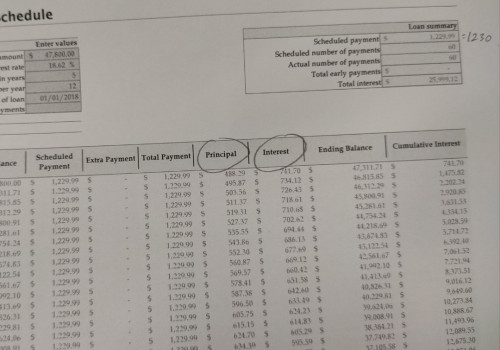

QUOTE(DragonReine @ Mar 24 2021, 02:53 PM) Visual illustration of Rule of 78/Sum of Digits method of interest calculation and payment, using the figures you gave. Anyone with later versions of Excel can input this into the Loan Amortization Schedule template workbook, it actually shows how the first half of a loan tenure, less than half of the instalment paid goes to pay the loan itself, majority of it is used to pay interest.  Oh yeah, that's right. Almost the same. |

|

|

|

|

|

TSoracle02

|

Mar 25 2021, 10:40 AM Mar 25 2021, 10:40 AM

|

New Member

|

QUOTE(Conslow2020 @ Mar 24 2021, 11:20 PM) Wow that interest rate is higher then some Ahlong lender interest what the shit I was desperate to get a loan quickly and that was the only offer I had. Sucks but I had no choice. Now can only cry  |

|

|

|

|

|

TSoracle02

|

Mar 25 2021, 10:42 AM Mar 25 2021, 10:42 AM

|

New Member

|

QUOTE(xander83 @ Mar 24 2021, 05:48 PM) With your current outstanding early settlement will save you at least rm2k easily Worse case you should lodge to BNM and try to get AKPK to help you on mediation because you have the right for early settlement with at least 3% rebate Hmm yeah, looks like it. Nice, thank you. I'm waiting for the agreement letter that I've signed, then I can try to do this. |

|

|

|

|

Mar 24 2021, 02:17 PM, updated 5y ago

Mar 24 2021, 02:17 PM, updated 5y ago

Quote

Quote

0.0171sec

0.0171sec

1.07

1.07

6 queries

6 queries

GZIP Disabled

GZIP Disabled