QUOTE(oracle02 @ Mar 24 2021, 02:17 PM)

Hi everyone, I have a personal that I took in 2018 and the details are as below:

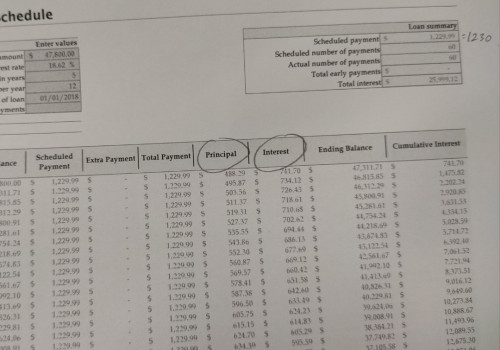

Loan Amount: RM 47,800

Interest Rate: 18.62%

Monthly Installment: RM 1,230

Loan Tenure: 5 years

Outstanding balance (as of today) : RM 39,030.79

I did opted for the 6 months moratorium and I've paid in total RM 28,294.27.

I have the money now to make a full settlement and I've called up the bank to ask if there's a rebate given. Feels so unfair to pay the balance interest rates for the upcoming year when I'm not even going to pay monthly anymore.

I've called them twice it's hard to speak with them. Can someone advise on how to go about this?

Interest rate 18.62% per annum? so high?

I dont know but i always believe the 1st level of borrowing should be from your credit card.

nowadays they provide a lot of those cash installment plan with 0% interest but upfront charge 2.88%, 3.88%, 4.99%.

in a way is they charge those interest Per year upfront. last time they offer me 1.5%/1.8%. i dont need it but i took it out anyway and put into an FD.

i still lose out the effective interest if i dont use it and keep it in FD. but it gives me the cashflow flexibility in the event i need cash

next is balance transfer which i think offers the same but at slightly higher interest rate.

after you exhaust the card, then only come personal loan. during my younger younger years, i took before. like you say no choice, need cash.

last resort is if loans all too high and you have property, then you can refinance and consolidate all your debts into the loan to lower down your interest rate.

if dont have property, final resort is to deal with AKPK.

Mar 24 2021, 02:17 PM, updated 5y ago

Mar 24 2021, 02:17 PM, updated 5y ago

Quote

Quote

0.5277sec

0.5277sec

0.65

0.65

5 queries

5 queries

GZIP Disabled

GZIP Disabled