next stop, 90$...

ARK Invest

ARK Invest

|

|

May 14 2021, 10:53 AM May 14 2021, 10:53 AM

Show posts by this member only | IPv6 | Post

#101

|

Junior Member

937 posts Joined: Apr 2020 |

next stop, 90$...

|

|

|

|

|

|

May 24 2021, 06:39 PM May 24 2021, 06:39 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

https://www.linkedin.com/pulse/cathie-woods...YRqRDryUw%3D%3D

Cathie Wood's Explanation for the Bitcoin Crash is Verifiably False QUOTE My intent is not to target Cathie Wood or the ARK team personally. I very much enjoy their work, think their analysts are incredibly unique thinkers, and have enjoyed learning from them over the years. But Cathie's commentary on bitcoin today is easily, verifiably false and demands a fact-check. Here is the explanation she gave my former Bloomberg colleague Carol Massar today on why bitcoin's dropping: "I think we're in a risk-off period, for all assets. If you look at the stock market, the more risky or more volatile parts of the stock market have come in dramatically since mid-February, and I think a lot of the concerns have been around inflation. Initially that was helping bitcoin, as bitcoin is a very important inflation hedge... but I think what's happening right now is because the stock market -- the highly volatile part of the stock market, the innovation part of the stock market -- has gone through such a correction, which has been inflamed by inflation fears, I think the correlation among volatile assets is going to 1 right now and that includes bitcoin." A risk-off period for all assets? Not even close. The Nasdaq has indeed been under some pressure, and inflation is certainly the talk of the town, but there is no broad de-risking happening in the market, according to the data so far. Cathie's arguing that bitcoin is down because investors are in a risk-off period of selling and that correlations across assets are rising. Such events do happen, and the Covid selloff in March last year was a perfect example. This market today is going through something very different: a steady, specific selection process of weeding out trades that investors don't think will work in a reflationary, growth-positive economic environment. There is no sign of widespread panic. A ton of stocks are at all-time highs. The stuff that's going down is the result of deliberate selection, not panic. Since it's been almost exactly a month since bitcoin and the Nasdaq's highs, I used 30-day correlations to assess the veracity of her statement, and there's just no truth to it. No unusually high correlation between bitcoin and the Nasdaq, the S&P 500, not to FANG, growth funds, chipmakers, not even to the ARKK fund itself! The 30-day correlation of bitcoin to all these things did go to 1 in March last year. Today, they're all between 0 and 0.5. It's not even true if you isolate the comparison to high-growth companies as she implies. In March last year, bitcoin's correlation to ARK hit 0.97. Today it's 0.6. Last year bitcoin's correlation to the SPDR growth fund hit 0.95; today's is 0.51. Its correlation To the Nasdaq: 0.94 vs 0.59 today. To the S&P 500: 0.97 vs 0.11. If selling gets severe, could we get a high-correlation selloff? For sure, but that won't explain why bitcoin's already been cut in half. It also doesn't matter what correlation length you pick. Since Cathie cited mid-February, let's look at a 90-day correlations between "innovation tech" (ARKK) and bitcoin:  It's gone way down, because ARKK started rolling over first and is actually stable the past few days as bitcoin crashed. Investors might be choosing to bail on innovation tech and bitcoin in the same general time frame of the past quarter, but it has nothing to do with a sudden high-correlation panic sale across markets. Nothing like that is happening. The best you can do is argue bitcoin is a higher-beta version of some specific risk assets in the growth category, but doing so invalidates the other part of her claim, that bitcoin is an inflation hedge. Here are the more important correlations. The correlation between value stocks and bitcoin, which did hit 0.97 during the Covid selloff, is currently at negative 0.2, its most inverse since the pandemic began. Bitcoin's correlation to Treasury prices is also rising, to .45, the highest since August. And most importantly, bitcoin's correlation to gold is negative 0.79, the most inverse ever. Investors are hating some things and loving others. It's a choice, not a forced liquidation. People are choosing which assets they think will thrive in the reflationary post-Covid economy that's emerging, and ARKK and bitcoin are not making the cut. It takes 30 seconds to run these charts. Why is she misleading investors? This post has been edited by zacknistelrooy: May 24 2021, 06:39 PM |

|

|

May 27 2021, 10:28 PM May 27 2021, 10:28 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

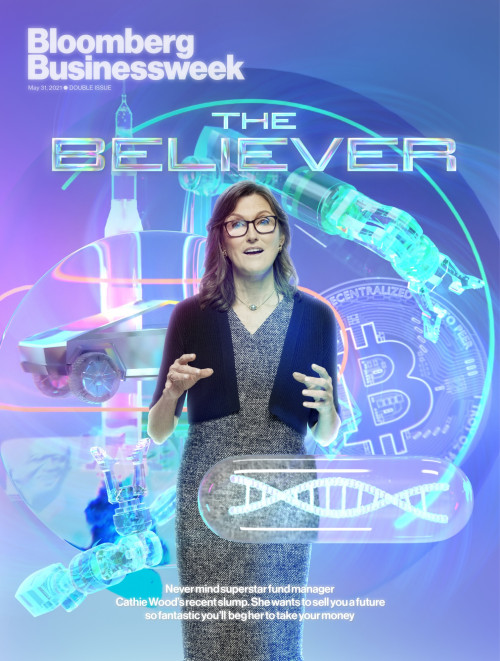

Cathie Wood’s Bad Spring Is Only a Blip When the Future Is So Magnificent

https://www.bloomberg.com/news/features/202...k-fund-stumbles  QUOTE The pandemic turned out to be the transformative crisis Wood had been predicting—at least for her investment returns. From its March 2020 low to its February 2021 peak, the ARK Innovation fund jumped more than 350%. Nonetheless, she underestimated the virus itself. “I do think there is a lot of hysteria out there around the coronavirus,” she said during her Bloomberg visit in March 2020. Echoing Trump, she compared Covid to the flu. A month later, she worried that the federal government’s stimulus law, the $2.2 trillion Cares Act, was too generous and might hold back the economic recovery by giving workers incentives not to work. Ironically, those stimulus checks would get credit for luring a generation of young people into stock trading. And when they signed up for Robinhood accounts, or logged onto Reddit or Twitter, and started seeing performance charts, they quickly learned about ARK. Wood’s profile soared. Her Twitter following multiplied 28-fold since late 2019; she surpassed 900,000 followers after an interaction with Elon Musk’s 56 million-follower account. From a global fan base, she acquired a range of nicknames including “Money Tree” in South Korea and “The Godmother” in Hong Kong. TikTok and Twitter are full of videos and memes celebrating her as a stockpicker and a female role model. “Wherever I go in the ETF world, Cathie comes up, Cathie is always in the conversation,” Balchunas says. Her willingness to err on the side of being too early, rather than too late, has clearly hit a FOMO nerve. “I want to be part of the next Apple,” says Mark LeClair, a 43-year-old ARK investor who works in software support near Houston. He says he’s not worried about temporary drops in her funds’ share prices. “Over the next 10 years, these innovators are going to dominate these spaces, and I think Cathie is on the right track.” The investing industry’s response to ARK’s success was, of course, to copy it. Giants including BlackRock, which manages $9 trillion, launched products built around themes such as robotics and self-driving cars. MSCI, one of the largest creators of the sort of indexes that Wood has spent years critiquing, collaborated with ARK on new ones inspired by her approach. Financial advisers, tasked with steering customers to prudent investments, struggle to handle the Wood phenomenon. Earlier this year, Leon LaBrecque, chief growth officer for Sequoia Financial Group, said clients couldn’t stop asking about her, even as her performance was beginning to falter. “Everybody wants to be with the rock star,” he said. He bought shares of the ARK Innovation ETF and ARK Genomic Revolution ETF for his own portfolio in 2019. After driving a Tesla and becoming fascinated by the car, he loved the idea of investing in an ARK fund and capturing some of the benefits of Tesla without shouldering 100% of the risk. In some ways, Wood reminded him of Tesla’s CEO. “She’s got that Musk confidence,” LaBrecque said. “You listen to her and you go, ‘Wow. Either she’s right or she really thinks she’s right.’ ” But LaBrecque sold his personal ARK positions this year, saying he’s uncertain whether the company can continue growing at the rate it did in 2020. He doesn’t recommend ARK funds to clients, though he will buy shares if they specifically request it. In 2020 and early 2021, Wood and her online defenders had an easy response to detractors: Look at her record. Her 2018 prediction that Tesla would hit $4,000 a share—which much of Wall Street found laughable—came true in early 2021. When Wood first bet on Bitcoin, in 2015, the cryptocurrency traded around $230. It peaked at over $63,000 in April. Since then, Tesla has tumbled back below her 2018 target, which would now be $800 a share adjusted for a 5-for-1 stock split. As an unforgiving market has pushed ARK’s flagship fund down a third from its peak, the skeptics have gotten louder. They were especially vociferous in March when ARK unveiled its new price target for Tesla, a 2025 “base case” of $3,000 a share, a fivefold increase. ARK was ridiculed for, among other things, saying Tesla could elbow into the car insurance industry, building a $23 billion business in a few years—an assertion, critics said, that showed the company just didn’t understand how insurers are regulated and how much capital they require. Equally baffling to many auto experts are ARK’s projections for electric vehicles, which suppose a tenfold increase in production in just a few years, and for Tesla’s creation of an autonomous taxi network, based on a technology—driverless cars—that doesn’t really exist yet. Wood says traditional auto analysts don’t understand Tesla, which she sees as a technology company far more than a carmaker. “Tesla has pulled together the right people with the right data with the right vision,” she says. As for her crypto enthusiasms, her company projects Bitcoin will become a sizable part of mainstream portfolios, including 401(k)s and pensions. In February, Wood said Bitcoin could even replace bonds in the traditional 60/40 stock-bond portfolio—in other words, investors en masse would swap the stability of bonds for a new, untested, and highly volatile asset. That seems like a stretch, even by 2021 standards. ARK has also made some policy changes that haven’t exactly allayed concerns about Wood’s appetite for risk. It used to impose a 20% limit on the amount of a company’s shares any ARK ETF could own. It scrapped that cap in late March, giving her the flexibility to make even bolder, more concentrated bets in the future. In the same filing, ARK said it may buy into special purpose acquisition companies, or SPACs, the blank-check companies that have also become a stock market craze in the past year. The Securities and Exchange Commission has warned investors about buying shares of SPACs backed by celebrities, including professional athletes, and Wood has said some SPACs “are going to end badly.” In March, though, the ARK Autonomous Technology & Robotics ETF (ticker ARKQ) bought shares of a SPAC backed by tennis star Serena Williams that merged with 3D-printing company Velo3D Inc. to take it public. As her returns dip, Wood has urged everyone to keep the faith. “I know there’s a lot of fear, uncertainty, and doubt evolving in the world out there,” she said in a video posted on a Friday after a particularly brutal week for her funds. Look on the bright side, she told her investors. Lower stock prices now mean even bigger returns later for companies like Tesla with—another favorite phrase—“exponential growth opportunities.” On Bloomberg TV, she said: “We keep our eye on the prize.” |

|

|

Jun 20 2021, 12:00 AM Jun 20 2021, 12:00 AM

|

Senior Member

1,033 posts Joined: Dec 2009 |

Jim Cramer says the ‘Ark Invest phenomenon’ appears to be over for now

https://www.cnbc.com/2021/06/18/jim-cramer-...er-for-now.html QUOTE CNBC’s Jim Cramer said Friday that Ark Invest’s stock-moving influence appears to be waning — at least for now. Ark Invest’s family of exchange-traded funds were some of the best performers on Wall Street last year, but have not fared well in 2021 as investors rotated away from high-growth stocks and into economic recovery plays. The “Mad Money” host said as the funds run by star money manager Cathie Wood’s firm struggled, the amount of outflows started to pick up. That has implications for the stocks that are components of the ETFs, Cramer said. “It seems pretty clear that the Ark Invest phenomenon is no longer in play,” Cramer said. “We’re not seeing major outflows here, but the era of Cathie Wood propping these stocks up with her own buying bazooka, I think, it appears to be over.” The opposite was true last year as investors started to notice how well Wood’s family of funds was performing, Cramer said, leading the firm to see a massive wave of inflows and new firepower to deploy into the market. Dunking by the media when these people were pushing the trend just a few months back...... |

|

|

Jun 20 2021, 12:53 PM Jun 20 2021, 12:53 PM

Show posts by this member only | IPv6 | Post

#105

|

Junior Member

937 posts Joined: Apr 2020 |

its ok arkk slowly back up....

|

|

|

Jun 24 2021, 01:01 AM Jun 24 2021, 01:01 AM

Show posts by this member only | IPv6 | Post

#106

|

Junior Member

338 posts Joined: Jun 2017 |

Bought some at 100usd during May (ARKK)..

Still good to hold? |

|

|

|

|

|

Jun 24 2021, 08:34 AM Jun 24 2021, 08:34 AM

Show posts by this member only | IPv6 | Post

#107

|

Junior Member

937 posts Joined: Apr 2020 |

up 20%..its up to you if you wanna sell...

|

|

|

Jun 24 2021, 02:16 PM Jun 24 2021, 02:16 PM

Show posts by this member only | IPv6 | Post

#108

|

Junior Member

338 posts Joined: Jun 2017 |

|

|

|

Jun 29 2021, 08:55 PM Jun 29 2021, 08:55 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

Cathie Wood’s Ark Invest to create a bitcoin ETF under the symbol ‘ARKB’

https://www.cnbc.com/2021/06/28/cathie-wood...itcoin-etf.html QUOTE Cathie Wood’s Ark Invest is creating a bitcoin exchange-traded fund, according to a filing with the Securities and Exchange Commission. Wood — a longtime bitcoin bull — has been buying up proxies for the digital asset in names such as Coinbase and Grayscale Bitcoin Trust. Now, the innovation investor is seeking to own the actual asset itself. The ETF’s investment objective is to track the performance of bitcoin, according to the SEC filing. The fund would trade under the ticker symbol “ARKB,” if approved by the SEC. Ark Invest is working in partnership with 21Shares to launch the ETF. “The market value of bitcoin is not related to any specific company, government or asset. The valuation of bitcoin depends on future expectations for the value of the Bitcoin network, the number of bitcoin transactions, and the overall usage of bitcoin as an asset. This means that a significant amount of the value of bitcoin is speculative, which could lead to increased volatility. Investors could experience significant gains, losses and/or volatility in the Trust’s holdings, depending on the valuation of bitcoin,” the S1 filing stated. The SEC last week again postponed a decision to approve the first bitcoin ETF. The latest action comes as SEC Chairman Gary Gensler has called for more regulation of cryptocurrency exchanges and greater investor protections. So far, there have been eight other bitcoin ETFs filed with the SEC. |

|

|

Jun 29 2021, 09:09 PM Jun 29 2021, 09:09 PM

|

Junior Member

297 posts Joined: Apr 2020 |

QUOTE(zacknistelrooy @ Jun 29 2021, 08:55 PM) Cathie Wood’s Ark Invest to create a bitcoin ETF under the symbol ‘ARKB’ This would aged wellhttps://www.cnbc.com/2021/06/28/cathie-wood...itcoin-etf.html |

|

|

Jun 29 2021, 10:02 PM Jun 29 2021, 10:02 PM

Show posts by this member only | IPv6 | Post

#111

|

Junior Member

338 posts Joined: Jun 2017 |

Wow arkk and coinbase flying to the moon

|

|

|

Jul 29 2021, 10:15 PM Jul 29 2021, 10:15 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

Cathie Wood’s ARK Innovation ETF Has Sold Nearly All Its Chinese Stocks

https://www.barrons.com/articles/cathie-woo...cks-51627500059 QUOTE ARK Invest’s Cathie Wood continued to exit Chinese stocks this week as Beijing’s crackdown on the tutoring industry caused sharp swings in the nation’s stocks market. According to the company’s website, ARK’s largest fund, the $22.4 billion ARK Innovation (ticker: ARKK), has exited nearly all its positions in Chinese stocks as of Wednesday, except for a $1 million holding in real estate services company KE Holdings (BEKE). This is down from an 8% allocation to China stocks in February, according to Morningstar data. ARK funds have been shedding Chinese stocks consistently over the past few weeks as Chinese regulators stepped up measures against the nation’s internet giants—including Alibaba Group Holding (BABA) and Didi Global (DIDI)—over antitrust and cybersecurity issues. On Tuesday, a number of Wood’s actively managed funds, again significantly reduced holdings in Chinese stocks, including internet giant Tencent (TCEHY) and healthcare software firm Ping An Healthcare and Technology (1833.HK), according to the firm’s public data on its trading activity. ARK ETFs also on Tuesday sold e-commerce-leaders Pinduoduo (PDD) and JD.com (JD), food-delivery app Meituan (3690.HK), online recruitment services KanZhun (KZ), and automaker BYD (BYDDY). In an investment seminar earlier this month, Wood said China’s tech sector might be facing a valuation reset. The $5.8 billion ARK Next Generation Internet (ARKW) now has just 2.7% of its assets invested in China, according to Morningstar data, while the $2.7 billion ARK Autonomous Technology & Robotics (ARKQ) and $3.7 billion ARK Fintech Innovation (ARKF) still have 18% and 12% of their portfolios in Chinese stocks, respectively. Wood’s flight from Chinese stocks has helped her funds avoid what could’ve been much larger damage. The iShares MSCI China ETF (MCHI) plunged 13% from last Thursday’s close to Tuesday’s close. All of ARK’s ETFs, on the other hand, declined less than 5% during the same period. The iShares MSCI China ETF bounced back nearly 6% in Wednesday trading, while ARK funds have gained around 2%. |

|

|

Jul 30 2021, 05:45 PM Jul 30 2021, 05:45 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

|

|

|

Jul 30 2021, 07:05 PM Jul 30 2021, 07:05 PM

|

Junior Member

338 posts Joined: Jun 2017 |

Cathie wood seems to prefer buy high sell low...

|

|

|

Aug 1 2021, 07:38 PM Aug 1 2021, 07:38 PM

|

Senior Member

3,904 posts Joined: Jul 2007 |

QUOTE(Msxxyy @ Jul 30 2021, 07:05 PM) soon you can profit from it the other way.Anti-Ark ETF to bet against Cathie Wood’s flagship fund This post has been edited by lamode: Aug 1 2021, 07:39 PM |

|

|

Aug 24 2021, 09:39 PM Aug 24 2021, 09:39 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

Aug 28 2021, 10:19 PM Aug 28 2021, 10:19 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

Aug 31 2021, 03:39 PM Aug 31 2021, 03:39 PM

|

Probation

18 posts Joined: May 2020 |

This is interesting and likely will reduce risk of investing to BTC. |

|

|

Sep 1 2021, 09:37 AM Sep 1 2021, 09:37 AM

Show posts by this member only | IPv6 | Post

#119

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Sep 9 2021, 08:33 PM Sep 9 2021, 08:33 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

Cathie Wood’s Ark cuts China positions ‘dramatically’

https://www.ft.com/content/4ddf4b5b-3267-41...04-8f4e77783a5c QUOTE Cathie Wood, the chief executive of Ark Invest and one of the world’s most closely watched investors, said her fund had significantly reduced its exposure to China, leaving only a portfolio of companies that were identifiably “currying favour” with Beijing. Ark’s sharp strategy shift, she told an audience of institutional fund managers on Thursday, was because the environment in China was “quite different” from the one that many global asset managers had poured funds into late last year. Chinese authorities were now focusing on social issues and social engineering at the expense of capital markets, she said. Anything deemed by Beijing as too profitable was at risk of being torpedoed. The Ark founder cited as a catalyst a series of numbing regulatory changes imposed over the course of a single weekend in July by the Chinese government on the country’s online education industry. That move, she said, suggested that the government’s quest for “common prosperity” had become its prevailing concern. The education directives banned for-profit companies from teaching school subjects, effectively wiping out the country’s multibillion-dollar listed tutoring sector overnight. The measures are part of a wider crackdown on the tech, entertainment and gaming sectors. Shares in Tencent and NetEase, China’s two leading online gaming companies, dropped sharply on Thursday, while the wider Hang Seng Tech index fell 4.7 per cent, after authorities instructed the groups to “break from the solitary focus of pursuing profit”. “We have not eliminated our positions but we have reduced our positioning in China dramatically and we have swapped some of our holders, which became losers, into companies that we know are courting the government with ‘common prosperity’,” said Wood. Ark’s sharply consolidated China portfolio of companies seeking the government’s favor included JD Logistics, which Wood said was building infrastructure in third- and fourth-tier cities on extremely low gross margins. Wood also noted e commerce platform Pinduoduo, which she said was investing heavily in the grocery sector and supply chains between farms and stores. “I think it’s basically investing for free to help the government,” she said, adding that certain companies appeared to be specifically “currying the government’s favor”. Wood’s comments, which were made during a Mizuho Securities investor conference, came against a debate among global investors over whether Chinese president Xi Jinping was rendering certain sectors in the equity markets of the world’s second-biggest economy in effect uninvestable because of the unpredictable regulatory risk hanging over them. Beijing’s recent interventions have hit Chinese businesses listed on US stock markets particularly hard, including the tutoring companies and ride-hailing group Didi Chuxing, whose shares tumbled after regulators launched an investigation into its data security shortly after its New York initial public offering. Wood argued that despite Ark’s recent portfolio reshuffle, she did not think China wanted to shut itself off from the rest of the world or to stop growing but was instead undergoing a “reset”. “We think they’ll reconsider some of these regulations with time and we won’t give up on China because they are so focused on innovation and they are so inherently entrepreneurial,” she said. BlackRock this week said it had attracted $1bn to its debut mutual fund in China, for which it gained approval this year. Financier George Soros criticized the move in The Wall Street Journal, calling it a “tragic mistake”. China has over recent years taken steps to liberalize its vast and strictly controlled capital markets, allowing foreign companies to fully own their mutual fund and securities businesses. Big international groups, which already have significant exposures to Chinese stocks, have sought to expand into the nascent asset management industry, with BlackRock this week saying its recently approved onshore business had brought in 110,000 clients for its first fund. |

| Change to: |  0.0260sec 0.0260sec

0.33 0.33

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 08:20 AM |