All of the below statement is personal observation and opinion of TS's and does not reflect the real workings of the world.

As the country grows, perhaps the wealth gap widens if this is not addressed carefully through policy and fiscal stimulus in the market, creating the gap disparity.

On the observation and hypothesis of young HKers, or NYC the young are more focused on themselves, in personal and career aspects.

One will get married but does not wish to conceive a child. Hence, the hard-earned money is used to pay rents, expenses, and self-care/self-improvement/self-wants.

It can be watches, clothes, home improvement, gadgets (let's not go into big houses or cars). These are not huge in purchase prices but slowly buying it will accumulate more commitment to pay them.

There are two options, if you save enough you buy it outright or bill it on the credit card and pay end of the month.

However, there is a third option, remain a young untapped market but a few start-up is doing it.

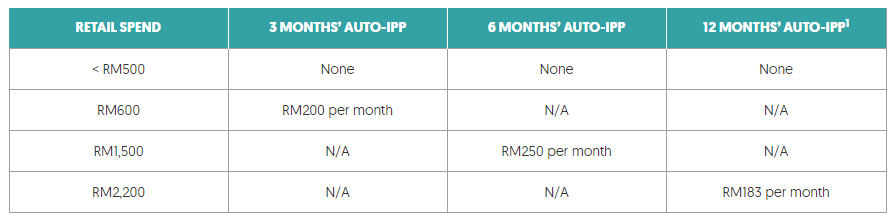

Split your payment into three months, interest free (yes we know about 12months ezpayment, but this is different).

This 'split your payment' can be used on smaller prices products, eg Nike sneakers RM750

Split 3

RM250 per month x 3

This is definitely more appealing for people to BUY IT outright since payment is only RM250, next month is next month's problem.

Come discuss if this untapped market needs to move faster in Malaysia because AU, EU, US, CHN is moving towards that era. Recently Paypal is offering this service as well to stay relevant in the money transfer industry.

Do you think this is healthy for the young or it is still inevitable that the wealth gap will widen with this form of payment?

This post has been edited by ClericKilla: Jan 13 2021, 11:58 AM

/k SPLIT PAYMENT TREND... DO YOU THINK IT WORKS?

Jan 13 2021, 11:56 AM, updated 5y ago

Jan 13 2021, 11:56 AM, updated 5y ago

Quote

Quote

0.0552sec

0.0552sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled