This is a discussion thread for sharing of investing ideas, philosophies, portfolio management, books, company information as well as evaluating companies.

WARNING : Information shared or discussed on this thread is NOT INVESTMENT ADVICE. You MUST do your own research before investing.

WHAT IS GROWTH STOCK INVESTING ?

According to The Motley Fool (fool.com) :

"Growth stocks are companies that increase their revenue and earnings faster than the average business in their industry or the market as a whole.

Often a growth company has developed an innovative product or service that is gaining share in existing markets, entering new markets, or even creating entirely new industries.

Businesses that can grow faster than average for long periods tend to be rewarded by the market, delivering handsome returns to shareholders in the process. And the faster they grow, the bigger the returns can be."

So Growth Stock investing is about holding the shares of companies that outperform the markets.

You can read the full article here :

https://www.fool.com/investing/stock-market.../growth-stocks/

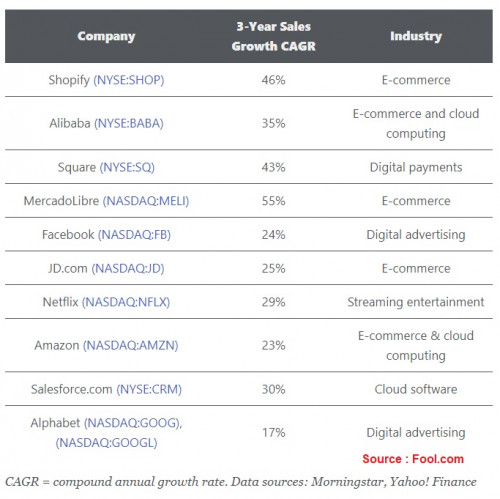

Some examples of growth stocks include (from fool.com) :

Dec 1 2020, 06:57 PM, updated 5y ago

Dec 1 2020, 06:57 PM, updated 5y ago

Quote

Quote

0.0264sec

0.0264sec

1.29

1.29

5 queries

5 queries

GZIP Disabled

GZIP Disabled