** note: Share buyback is noble and by itself, does benefit shareholders. Googleable. Pls do search and read **

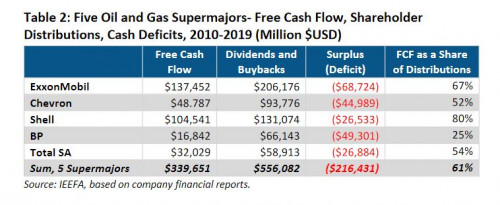

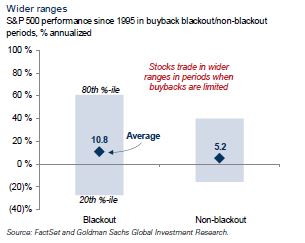

Yes, what if the buybacks is done wrongly? Or even abused?

QUOTE

The risk:

1. The share could still fall below the share buyback prices.

2. This is related to what you had posted. When a company buybacks a lot of shares, it depletes the cash at hand, which means whatever excess working money a company has is depleted just because the boss embarks on an aggressive buyback

1. The share could still fall below the share buyback prices.

2. This is related to what you had posted. When a company buybacks a lot of shares, it depletes the cash at hand, which means whatever excess working money a company has is depleted just because the boss embarks on an aggressive buyback

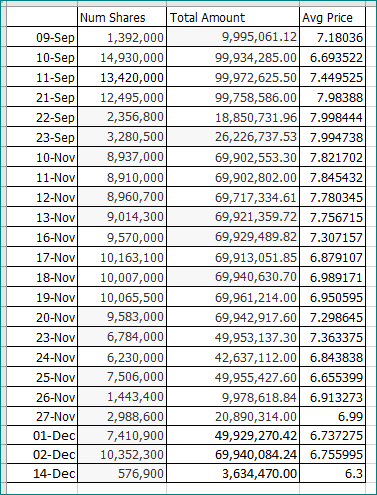

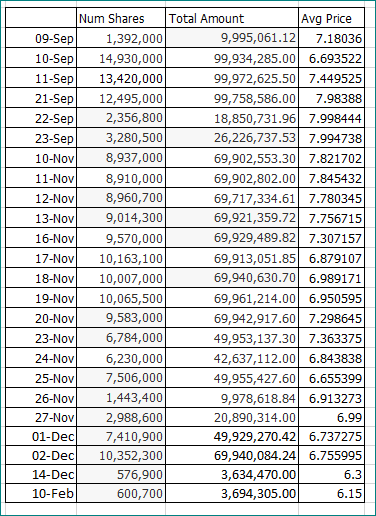

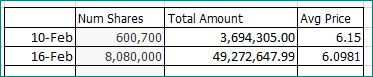

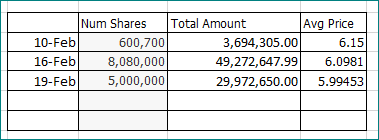

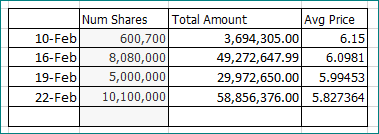

See we understand and know that TopGlove has bought a shit load of shares. Day in day out buyback, continuously for so many days already...

So it would be good that we tabulate out the number of shares they bought and the monetary value of the shares it bought....

Share buyback is nothing but buying shares. Examining Top Glove style of buying shares, if it good, we could learn from it, yes?

We could also see the buybacks from the theory of Dollar Average Cost buying? Does such buying really work?

But if the way of TopGlove buyback is bad, hey don't you think it is hell of a great idea to learn from TopGlove mistake? Yup, learning from our mistake is always the best but learning from other people's mistake(s) is heck a lot better. (some famous bugger did say this, yes?)

Notes:

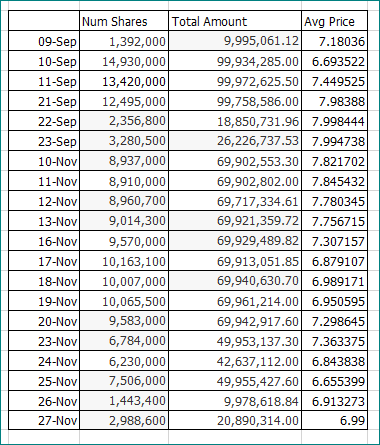

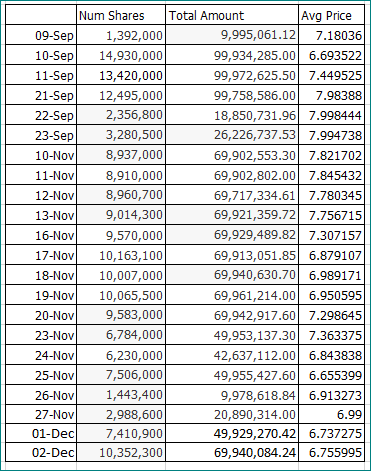

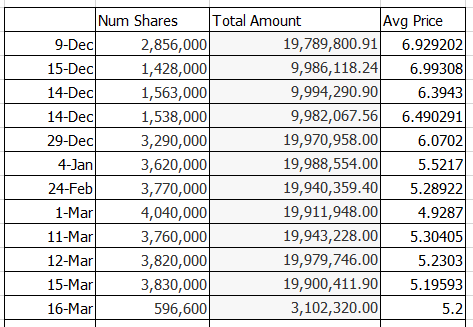

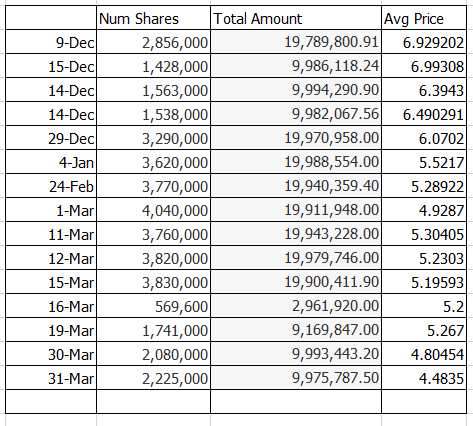

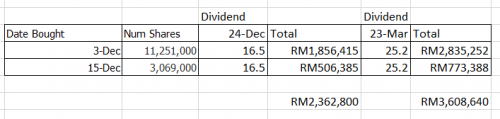

1. Table track buybacks since 9th Sep.

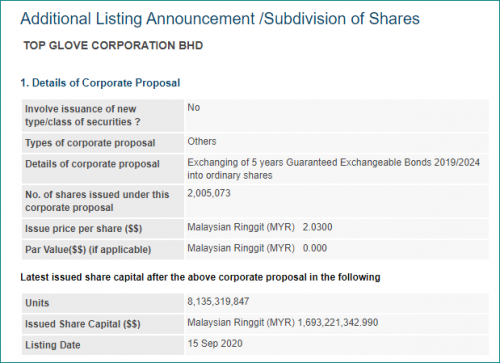

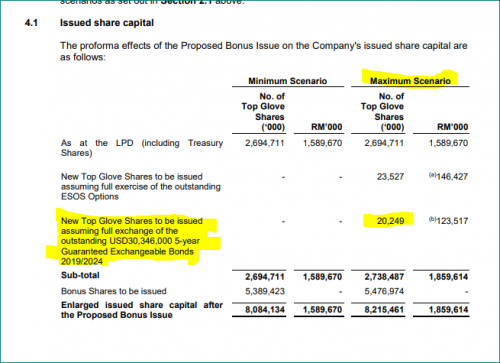

2. TopGlove did have existing Treasury shares, which was then credited with bonus shares arising from the recent bonus issue. Hence, the total shares purchased WILL be different than the total of Treasury shares.

3. I am human. I could make mistake. Do verify the numbers and yes, if could, do inform me and I will correct.

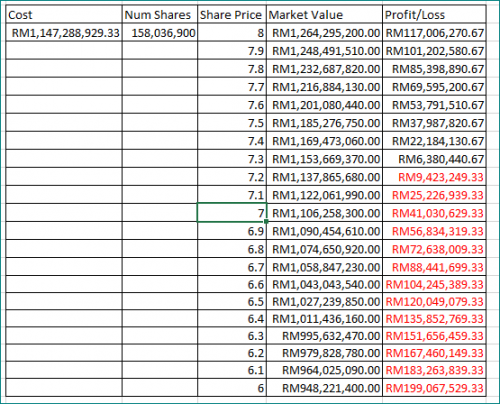

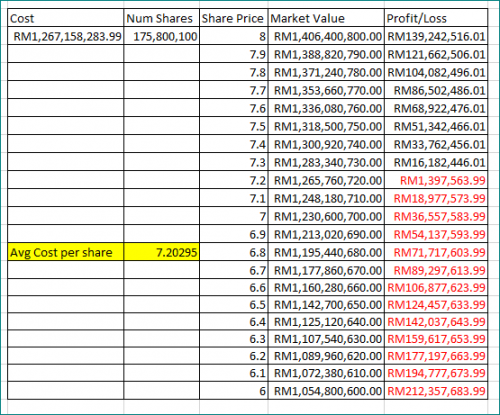

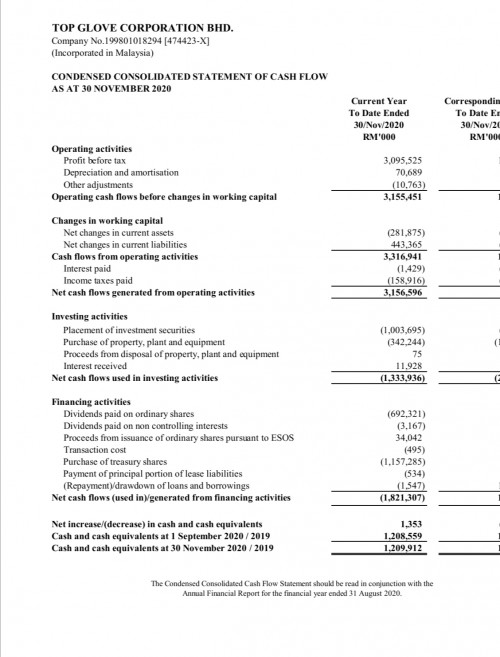

Total number shares bought during this period.... 158,036,900

Sum paid for these shares = RM1,147,288,926.33

Average price for these shares is ... 7.259627

Closing price of Top Glove on 27 Nov = 6.99

Marked to market, the total market value of these shares bought back is 1,1204,677,931.00

Current marked to market prices losses is 42,610,988.33

extended profit/loss calculations based on various assumed prices... see post #22

*** table will be updated once a week ***

*** link to the updated post will be edited into this posting ***

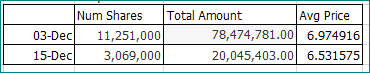

Link to updated table for week ending 4 Dec 2020 - post #32

Link to updated table for week ending 4 Dec 2020 - post #87

This post has been edited by Boon3: Dec 18 2020, 07:53 PM

Nov 28 2020, 09:06 AM, updated 5y ago

Nov 28 2020, 09:06 AM, updated 5y ago

Quote

Quote

0.1149sec

0.1149sec

0.60

0.60

5 queries

5 queries

GZIP Disabled

GZIP Disabled