QUOTE(Human Nature @ Oct 17 2022, 09:24 PM)

that was SST 1.0 instead of GSTCredit Cards Affin Duo Credit Card, great rewards for eWallet

Credit Cards Affin Duo Credit Card, great rewards for eWallet

|

|

Oct 18 2022, 09:54 AM Oct 18 2022, 09:54 AM

Return to original view | IPv6 | Post

#21

|

Senior Member

1,141 posts Joined: Oct 2018 |

|

|

|

|

|

|

Nov 3 2022, 12:22 PM Nov 3 2022, 12:22 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(Haloperidol @ Nov 3 2022, 12:07 PM) yes, must generate 3050 for first month first ---> and only obtained 50 cashback meh, there is RM 25 service tax...so RM 3025? next month need to go 3080 --> then get 80 QUOTE(cybpsych @ Nov 3 2022, 12:11 PM) but first statement maximum cash back RM 50 only |

|

|

Nov 7 2022, 05:38 PM Nov 7 2022, 05:38 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(beLIEve @ Nov 7 2022, 01:05 PM) My case was different. I already met their requirements, still required to change, and kept failing to change. Apparently, must use uppercase and lowercase, not just either one, plus the number and special char. +1, was compelled to change the password despite meeting the requirement, unless uppercase AND lowercase is mandatoryEdit : Got OTP at the place you input new pass. need to wait for the OTP cooldown if not meeting the requirement |

|

|

Dec 5 2022, 05:49 PM Dec 5 2022, 05:49 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(tan_aniki @ Dec 5 2022, 12:01 PM) markup with 10%: the GST is still 6% As you can see the final price has increased (RM1924.22 - RM1676.57) / RM1676.57 = 14.77% and we although we pay RM98.03 - RM111.11 = -RM13.08, we still pay more than 6% from the original rate. This is because every level they markup and charge 6% and the final price markup again and GST again, although the middle GST all reimburse back to them but the final price is hefty and GST is more than 6% 88.73/1,478.89 108.92/1815.3  law of economics it would be of out of their mind to get something at 1,387.16 when other distributor is selling at 1,295.56, maintaining 10% margin legislation feel free to report the unethical businessman **************************************** y r we even discussing this in a credit card thread This post has been edited by 1mr3tard3d: Dec 5 2022, 05:58 PM |

|

|

Dec 30 2022, 10:20 AM Dec 30 2022, 10:20 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(underscore_lee @ Dec 29 2022, 10:07 PM) why not checking the official website for latest and detailed information instead?QUOTE(underscore_lee @ Dec 29 2022, 10:07 PM) I see it says "minimum 12 swipes on retail transaction per year" to get free annual fee waiver. If we do TNG top-up, is it considered retail transaction already? Is buying items on Shopee or Lazada considered retail transaction? Or still need to go brick & mortar shops.  QUOTE(underscore_lee @ Dec 29 2022, 10:07 PM) I'm thinking to use this credit card to: you may get cash back above RM 50- Top up RM2000 TNG credit, get 3% cashback = RM50 max (then use TNG app to transfer back to my M2U via DuitNow) - Auto-Billing for my Maxis Postpaid bills (RM600+), get 3% cashback = RM18 Does this mean per month I can get RM68 cashback? Or is it RM50 max across all categories? but 1) previous balance must be RM 3,000 or above AND 2) other spending category in addition to ewallet so you will probably only receive RM 50 as your previous balance is below RM 3,000 (RM 2,000 + RM 600 - RM 50) » Click to show Spoiler - click again to hide... « warning from TNG and possible blocking from reloading with credit card in the future |

|

|

Jan 5 2023, 02:30 AM Jan 5 2023, 02:30 AM

Return to original view | IPv6 | Post

#26

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(justanovice @ Jan 4 2023, 10:09 PM) Can’t believe i missed out on this nice card. for duo+, that applies to transaction RM 250 or belowQuestion: can i apply both duo and duo+, or I should do duo first ? As I know sometimes bank will approve the higher tier card and neglect the lower tier one. since it was reported that wave + pin would not be considered as contactless for this card QUOTE(MystiqueLife @ Jan 4 2023, 11:37 PM) cash back for totally different categories justanovice liked this post

|

|

|

|

|

|

Jan 5 2023, 03:29 PM Jan 5 2023, 03:29 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(vincent_5451 @ Jan 5 2023, 11:54 AM) What if i reload RM1667 to ewallet, then RM260 to autobilling insurance, then RM300 to online shopping, then RM860 to other ewallet to fulfill the total bill of RM3080 outstanding amount? if u r new to bank, could apply forAlso will get back only RM50 cashback? If so then i feel that my autobilling of RM260 that i transferred from my other credit card to this Affin duo is useless already. cash on call > RM 5,160 or balance transfer > RM 10,320 to increase your statement balance for 6 - 12 months easy instalment would be viable too i wouldn't consider the transfer of autobilling as useless unless the other credit card provides cash back alternatively, just reload ewallet RM 1,407/1,107 |

|

|

Jan 6 2023, 12:20 AM Jan 6 2023, 12:20 AM

Return to original view | IPv6 | Post

#28

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(johnc3 @ Jan 5 2023, 07:52 PM) if you have late payment perhaps? was suggesting him to attain RM 50 cash back instead of RM 66.80 presuming his ewallet reload is for maxing out cash back instead of actual usage since his recurring is RM 260 (RM 1,667 - RM 260) or inclusive of online spending (RM 1,667 - RM 260 - RM 300) QUOTE(joice11 @ Jan 5 2023, 10:42 PM) just received my duo card, so just to confirm is it the sst rm25 calcurate to the statement bal for next month, right? so for 1st month i need to spend RM3025 to get RM50 cash back right? why do you need RM 3,000 balance to get RM 50 cash back for next month? yes, the RM 25 sst will be contributed towards the statement balance assuming RM 50 cash rebate is your only credit transaction, no early payment or cancelled transaction, etc |

|

|

Jan 18 2023, 03:28 PM Jan 18 2023, 03:28 PM

Return to original view | IPv6 | Post

#29

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(eddydo @ Jan 18 2023, 03:08 PM) If i paid my bill before statement date, previous balance becomes rm0, means this month cb is capped at 50? quite confusing sentencepresume paying current month statement (yet to be issued), statement balance = RM 0 has no effect on current month cb but the cb cap for the following month will be restricted to RM 50 This post has been edited by 1mr3tard3d: Jan 18 2023, 03:30 PM |

|

|

Feb 20 2023, 10:43 AM Feb 20 2023, 10:43 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

1,141 posts Joined: Oct 2018 |

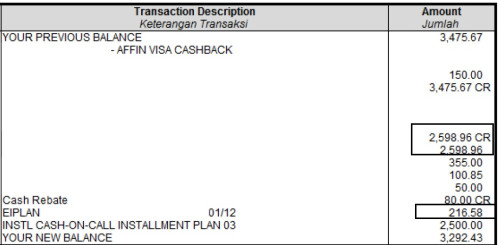

QUOTE(Human Nature @ Feb 19 2023, 03:18 PM) If i do the 12 months Eiplan, how will it affect the cashback? the cash back will be credited based on the transaction instead of the instalmentLets say RM2000. Will the statement show (-)RM2000 hence affecting the next month's statement balance? Will the RM2000 still get cashback for the month? the eiplan will only credit RM 166.67 to statement balance  |

|

|

Mar 14 2023, 11:05 AM Mar 14 2023, 11:05 AM

Return to original view | IPv6 | Post

#31

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(owj @ Mar 14 2023, 10:40 AM) If I changed RM2400 TnG transaction to EIP 12 months, then the statement balance will not take into account of RM2400 swiped this month but rather RM200 only. Am I correct? yes, the understanding on the statement balance is correctQUOTE(owj @ Mar 14 2023, 10:40 AM) no, the cash back is based on the transaction instead of the EIP amounti.e. RM 30 in the month you reload TNG but no cash back on the EIP instalment |

|

|

Mar 15 2023, 02:45 PM Mar 15 2023, 02:45 PM

Return to original view | IPv6 | Post

#32

|

Senior Member

1,141 posts Joined: Oct 2018 |

|

|

|

Jul 6 2023, 02:19 PM Jul 6 2023, 02:19 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(joice11 @ Jul 6 2023, 01:01 PM) mean if my montly spend is around RM3200, then i take BT fr Public bk RM9500 to pay affin. then for 3 months i would get any cash back or just the 1st month? you would still get cash back based on eligible spending for each monthbut the maximum would be RM 30 in the following month your Public Bank BT deduct the balance because your previous balance will become negative? This post has been edited by 1mr3tard3d: Jul 6 2023, 02:24 PM |

|

|

|

|

|

Aug 14 2023, 11:03 AM Aug 14 2023, 11:03 AM

Return to original view | IPv6 | Post

#34

|

Senior Member

1,141 posts Joined: Oct 2018 |

|

|

|

Sep 20 2023, 10:29 AM Sep 20 2023, 10:29 AM

Return to original view | IPv6 | Post

#35

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(guailow83 @ Sep 20 2023, 10:22 AM) but i guess i will do nothing until they start charging annual fee as they may change policy from time to time won't be a problem if the fees are shown in the statement RM 75 is still manageable in my opinion |

|

|

Oct 30 2023, 03:54 PM Oct 30 2023, 03:54 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(whycanot323 @ Oct 30 2023, 03:49 PM) just came to know existing of Duo+, a replacement for my dead public quantum, checking am i correct for below after i read the website? i believe u r referring to RM 250 instead of RM 150use Affin Duo+ Visa for retail shopping with paywave, even more than rm150 , wave then key in password also valid for 3% right? but i m afraid no |

|

|

Oct 31 2023, 09:27 AM Oct 31 2023, 09:27 AM

Return to original view | IPv6 | Post

#37

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(cybpsych @ Sep 15 2023, 05:36 PM) QUOTE(cybpsych @ Oct 30 2023, 03:57 PM) waiting for your update but i would still be holding pb quantum, 1% difference vs 2 cards, additional issuing bank, additional credit limit |

|

|

Nov 10 2023, 10:35 AM Nov 10 2023, 10:35 AM

Return to original view | IPv6 | Post

#38

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(MGM @ Nov 9 2023, 03:26 PM) Is the TnG ewallet auto-debit considered as online or ewallet transaction for Affin Duo Visa to qualify for cb? QUOTE(Human Nature @ Nov 9 2023, 05:06 PM) his concern is probably whether it falls within the RM 30 cap i suppose Affin would only pick up the reload into TNG e-wallet rather than what u spent (TNG auto-debit)? This post has been edited by 1mr3tard3d: Nov 10 2023, 10:49 AM MGM liked this post

|

|

|

Dec 14 2023, 10:42 AM Dec 14 2023, 10:42 AM

Return to original view | IPv6 | Post

#39

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(CoffeeDude @ Dec 9 2023, 01:58 PM) I did an online transaction (buy flight tickets) and then converted it to EIP 12 months installments. your online transaction will be eligible for cash back for that monthDoes this online transaction still count for the cash back? but your statement balance will be reduced EIP |

|

|

Apr 12 2024, 11:29 AM Apr 12 2024, 11:29 AM

Return to original view | IPv6 | Post

#40

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(kem3399 @ Apr 10 2024, 02:59 PM) I looking for affin duo+ and just applied duo+ together with duo through pledge conventional FD for RM10000 last month. have not encountered cc pledged with fdThey gv me suggestion pledge islamic FD but need RM12000 for duo+. So total is RM22000 for 2 pairs cc... I just curious that the amount would be that high for both pairs cc? but i think it's associated with the credit limit available so perhaps request for lower credit limit? could utilise the new-to-bank promotion, cash-on-call it is strange though that they asked u to pledge FD in Affin Islamic for Duo+ i know there are Duo & Duo-i, but don't know if there is a Duo+-i QUOTE(kem3399 @ Apr 10 2024, 10:52 PM) hmm.. I never try use BT b4. It look like abit risky for me since I got other cc need to manage. Afraid lack of control and miscalculation 😅 i m sorry, y do u need duo+ then?These r what I planning: 1000 ewallet 354 insurance auto debit 70 TNB the balance 1626 I will topup ewallet again coz I got other better CB cc for online spending. So I only can earn rm42++ monthly unless my other cc online CB fully utilise then I will use affin duo balance 243 maximising RM 50 cash back is not essential, RM 30 should do fine however, BT/cash-on-call would be helpful to hit the statement balance BT is deferring/prepaying/consolidating the payment of other credit cards amount, so u just focus on one account BUT make sure that u r comfortable with the instalment amount QUOTE(kem3399 @ Apr 11 2024, 12:13 PM) I hv no choice coz this is the fastest way to get 2 credit cards in short period. My income not that high plus I just get cc in January so the chance to get approve for new cc application very low. y do u need to get 2 credit cards in short period? |

| Change to: |  0.2091sec 0.2091sec

0.69 0.69

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 11:38 PM |